TDS TCS Rate Chart for FY 2024–25 and FY 2025–26

Table of Contents

TDS TCS Rate Chart for FY 2024–25 and FY 2025–26

TDS Deduction (FY 2024–25)

- Interest on Deposits (194A): 10%

- Commission (194H): 5%

- Rent (194I):

- 10% (for land/building)

- 2% (for plant/machinery)

- Professional/Technical Fees (194J): 10%

- Job work, labor contract, advertisement, etc. (194C):

- 1% for Individual/HUF

- 2% for others

- Salary (192B): Slab rates applicable

- Purchase of Goods (194Q): 0.1% (only if turnover > ₹10 Cr)

Important Cut-offs: (Applicable till 31-03-2025)

- Commission: ₹15,000

- Rent: ₹2,40,000

- Professional Fees: ₹30,000

- Job Work: ₹30,000 per single bill or ₹1 lakh aggregate

TCS Collection (FY 2024–25)

- On Scrap Sales (206C): 1%

- On Sale of Goods (> ₹10 Cr turnover) (206C(1H)): 0.1%

- Note: TCS on sale of goods is removed from 01-04-2025.

Payment Due Date:

- TDS/TCS to be deposited by 7th of the next month

- For March, deposit by 30th April.

TDS Deduction (FY 2025–26)

- Rates are same as FY 24-25 except a few changes in limits:

- Commission: ₹20,000

- Professional Fees/Technical Charges: ₹50,000 (each)

- New Addition:

- Partner Interest and Remuneration (194O): 10% (for Firms/LLPs)

TCS Collection (FY 2025–26)

- On Scrap Sales (206C): 1% (no change)

- On Sale of Goods (206C(1H)): Removed from 01-04-2025.

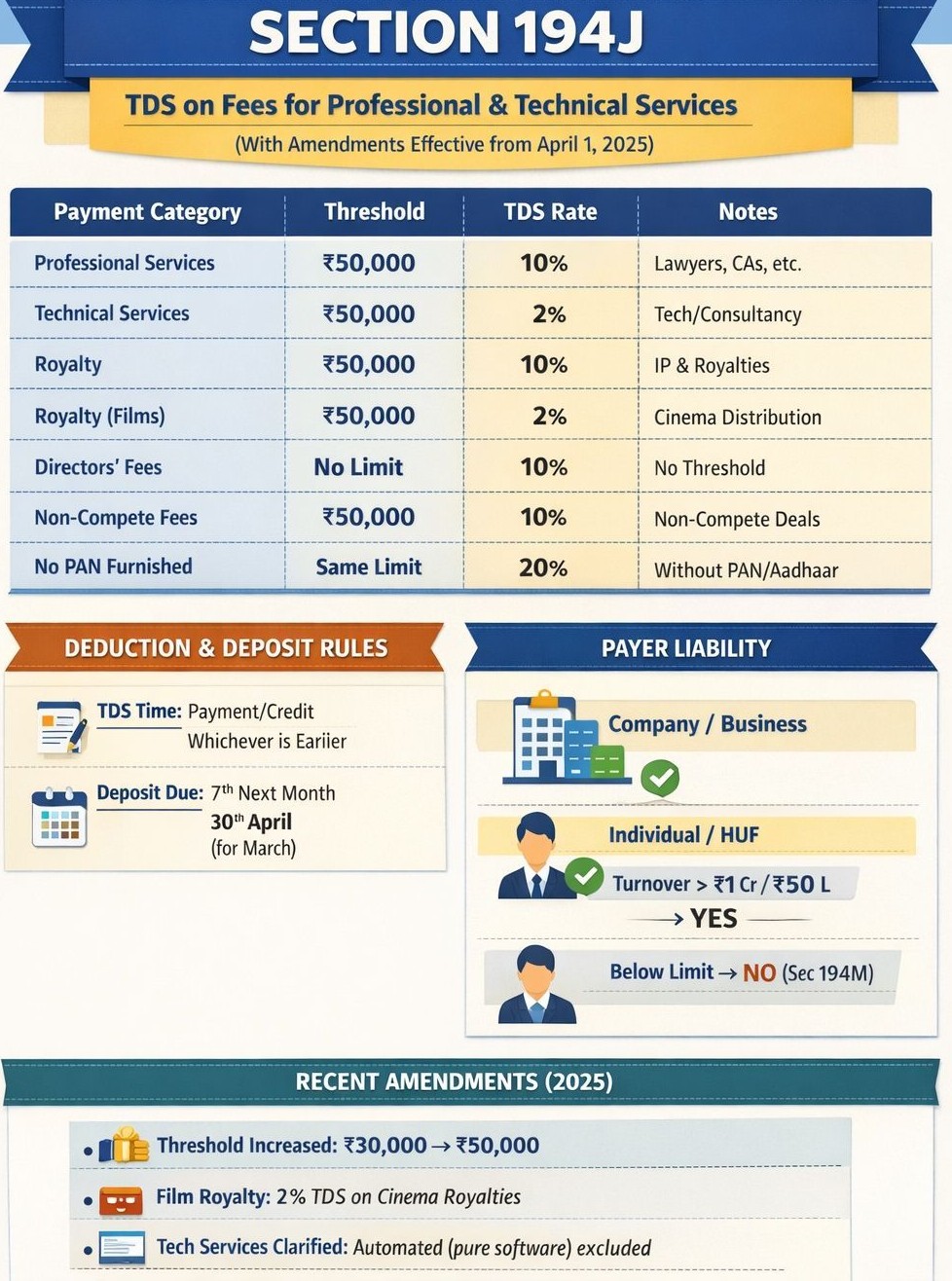

Section 194J – TDS on Professional & Technical Payments

Nature of Payments Covered under section 194J

- Professional fees (legal, medical, engineering, accounting, consultancy, etc.)

- Fees for technical services (other than professional services)

- Royalty

- Director’s fees/remuneration

- Non-compete fees

TDS Rates under section 194J

| Nature of Payment | Rate |

|---|---|

| Professional fees | 10% |

| Director’s fees/remuneration | 10% |

| Non-compete fees | 10% |

| Fees for technical services (other than professional) | 2% |

| Royalty (other than cinematographic film royalty) | 10% |

| Royalty for sale/distribution/exhibition of films | 2% |

| PAN not furnished (Sec 206AA) | 20% |

Threshold under section 194J

- ₹50,000 per financial year per payee

- Not applicable to Director’s fees (TDS from first rupee)

Who Must Deduct section 194J?

- Company / Firm / LLP / Trust / Business Entity

- Individual / HUF only if:

- Business turnover > ₹1 crore, or

- Professional receipts > ₹50 lakh (preceding FY – Sec 44AB)

Timing of section 194J

- Deduct at earlier of credit or payment, including year-end provisions.

Deposit & Reporting under section 194J

- Deposit: By 7th of next month

- Return: Form 26Q

- Certificate: Form 16A

- Credit reflected in Form 26AS / AIS

- Review agreements to classify professional vs technical services correctly.

- Director’s sitting fees & commission always attract TDS.

- Year-end provisions without TDS → high risk of notices & disallowance

Consequences of Non-Compliance under section 194J

- Interest u/s 201(1A):

- 1% per month—for non-deduction

- 1.5% per month – for non-payment after deduction

- Expense Disallowance u/s 40(a)(ia):

- 30% of expenditure disallowed if TDS not deducted/deposited

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.