TDS u/s 194Q on payments made to Kachha Arahitia

Table of Contents

Tax Deducted at Source under section 194Q on payments made to Kachha Arahitia

Meaning of Kachha Arahitia

- A kachha arahtia enters into a privity contract. in order for his constituent and the third party to be held responsible for one another, moreover that A kachha arhatia acts only as an agent of his constituent and never acts as a principal.

- On the other hand, Pacca Arhtia makes himself answerable under the contract to both his constituents and the third party. A pacca arhatia, on the other hand, is entitled to substitute his own goods towards the contract made for the constituent and buy the constituent’s goods on his personal account & so kachha arahtia acts as a principal as regards his constituent.

Tax Deducted at Source u/s 194Q on payments made to Kachha Arahitia

- Kachha Arahitia are involved in selling crops on behalf of farmers. Kachha Arahitia are agents for an unnamed principal. The Kachha Arahitia remuneration consists solely of commission & Kachha Arahitia is not interested in P&L made by his constituent. The Kachha Arahitia does not have any dominion over the goods.

- Tax Deducted at Source under section 194Q is deducted by the purchasers from Kachha Arahitias. Buyer in such cases is treating kachha Arahitias as a seller so covering transaction under section 194Q for the purposes of Tax Deducted at Source. Sale transaction by the Kachha Arahitia is not part of his business receipts/ turnover.

- The Centralized Processing Centreof the Income Tax department (CPC) while processing the returns of Kachha Arahitia raises the objection that the sales/ turnover is not declared in the gross receipts.

- Central Board of Direct Taxes in its circular: No 452 (1986) had clarified in Para 4 of circular that so far as Kachha Arahitias are concerned the turnover does not include the sales effected on behalf of principals & only commission (gross) has to be considered for the purpose of Income tax section 44AB.

- So some clarification is required on this issue from the Central Board of Direct Taxes , on whether Tax Deducted at Source required to be deducted on the transaction of sale via Kachha Arahitias.

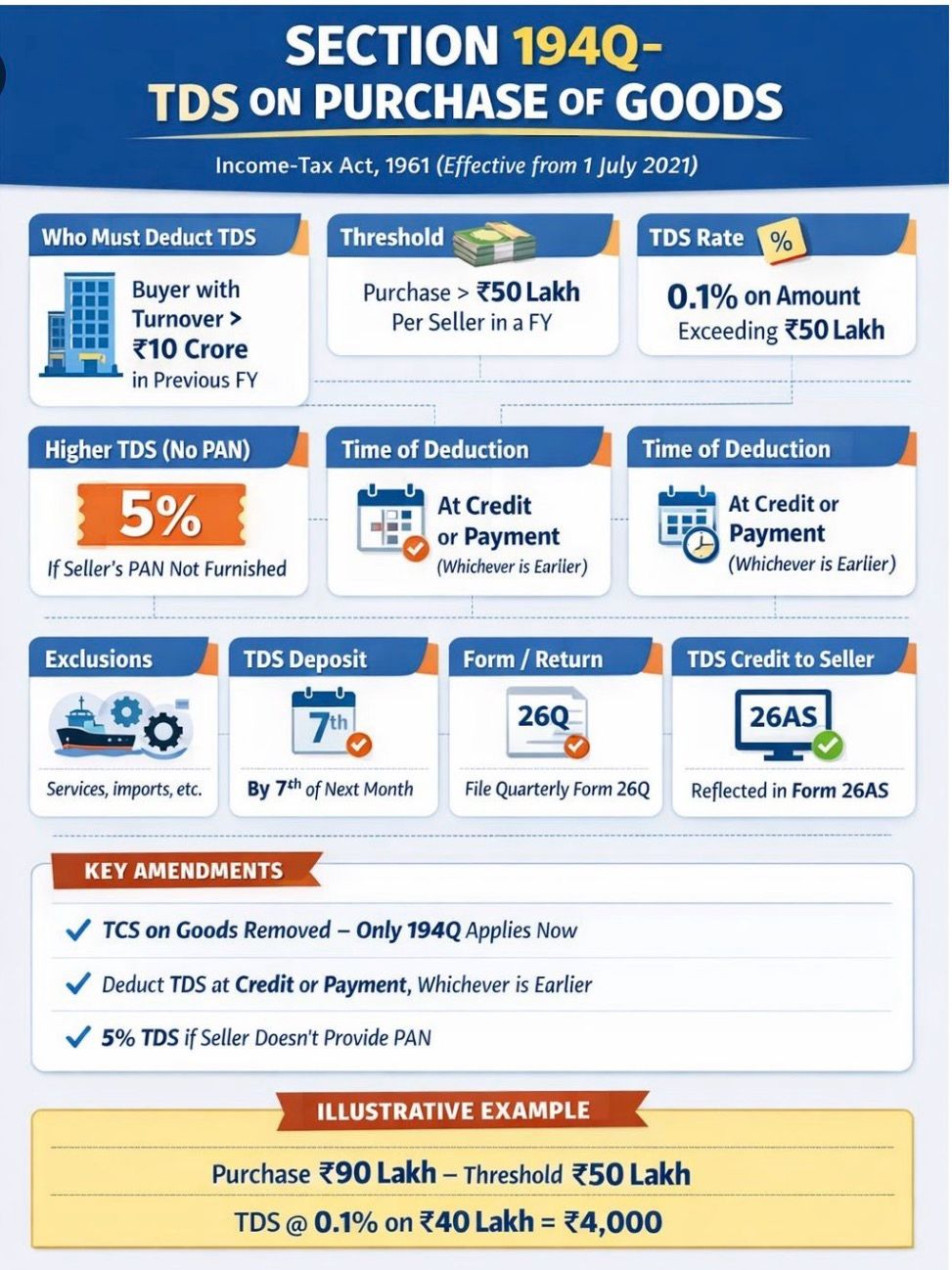

Summary of Section 194Q – TDS on Purchase of Goods

Applicability

- Who? Buyer with turnover > INR 10 crore in the preceding FY, and the buyer is responsible for deduction, deposit, return filing, and issuing certificates.

- Transaction Type: Purchase of goods from a resident seller.

- Threshold: TDS applies when aggregate purchases exceed INR 50 lakh per seller in a financial year.

Rate of TDS

- 0.1% on the amount exceeding INR 50 lakh.

- 5% if seller does not furnish PAN (Sec 206AA).

Time of Deduction :

At the earlier of credit or payment, including advance payments.

Effective Date :

Applicable on purchases on or after 1 July 2021.

Key Exclusions

- Non-resident sellers.

- Transactions already covered under other TDS provisions.

- Services, imports, electricity, and similar items.

Deposit & Reporting

- Deposit: By 7th of next month.

- Quarterly Return: Form 26Q.

- Credit: Reflected in seller’s Form 26AS.

- TDS Certificate: Form 16A.

CBDT Clarification

- Section 194Q overrides Section 206C(1H).

- If 194Q applies → TCS under 206C(1H) NOT applicable.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.