The income tax bill 2025 has been withdrawn

Table of Contents

The income tax bill 2025 has been withdrawn- A Pause Before the Big Tax Rewrite

The Bill was introduced in the Lok Sabha on 13 February 2025 and referred the same day to the Select Committee for examination. The Committee submitted its report on 21 July 2025, and the Government accepted almost all of its recommendations. This apprehension is misplaced. The new bill to be introduced will incorporate all the changes suggested by the Select Committee and accepted by the Government.

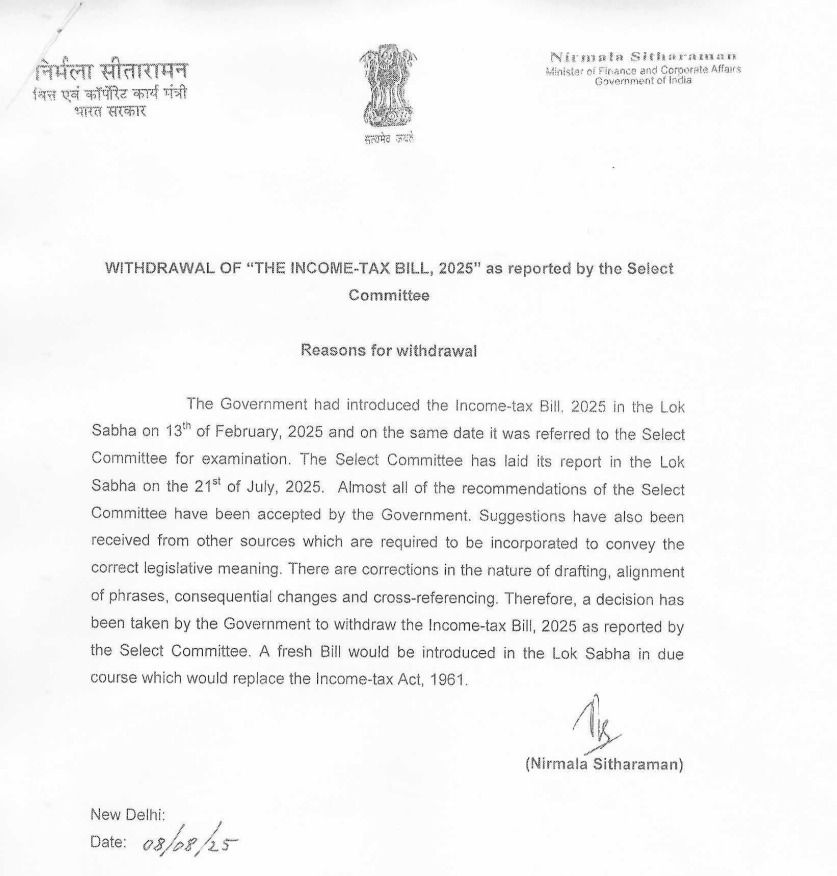

In a significant move, the Government of India has withdrawn the much-anticipated Income-tax Bill, 2025, which was set to overhaul the Income-tax Act, 1961. Finance Minister Nirmala Sitharaman informed Parliament that the withdrawal was necessary to incorporate crucial corrections, refinements, and technical adjustments arising from extensive feedback and suggestions on the draft bill.

A lot of apprehension is being expressed on social media about the withdrawal of the Income-tax Bill, 2025, which was introduced in the Lok Sabha in February 2025 by the Hon’ble Finance Minister Nirmala Sitharaman informed Parliament. It is being presumed by some that a completely new bill will be brought, ignoring the earlier bill and rendering the extensive work already done over the past months futile.

Why Was the Bill Withdrawn?

According to the official statement, numerous recommendations and representations were received from stakeholders — including tax professionals, industry bodies, legal experts, and lawmakers — pointing out structural inconsistencies in the draft.

These were not cosmetic edits but substantive changes necessary for legislative clarity and smooth implementation.

In the words of the Finance Minister: “There are corrections in the nature of drafting, alignment of phrases, consequential changes and cross-referencing.”

Such refinements are essential in a law as far-reaching and complex as income tax legislation, where any ambiguity can cause large-scale confusion, litigation, and compliance challenges.

The Importance of Legislative Precision

Tax laws impact millions of individuals and businesses daily. Cross-referencing errors or unclear drafting can undermine compliance, distort interpretations, and erode trust in the system.

The new bill was expected to replace the six-decade-old Income-tax Act, 1961, which has endured over a thousand amendments and countless judicial interpretations. Given its significance, it cannot afford to replicate the very complexity and clutter it aims to replace.

Clarification on Withdrawal of the Income-tax Bill, 2025

Why the earlier Bill was withdrawn: This is a normal parliamentary procedure when a bill already introduced requires numerous amendments. Once a bill is introduced in either House of Parliament, it becomes the “property” of that House. If amendments are needed, the member who introduced the bill (in this case, the Finance Minister) must move each amendment individually.

Additional suggestions from other sources needed to be included for better legislative clarity, along with corrections in drafting, phrase alignment, consequential changes, and cross-referencing. Because of these changes, the Government decided to withdraw the 2025 Bill and will introduce a fresh Bill in the Lok Sabha in due course to replace the Income-tax Act, 1961. This means the complete overhaul of India’s income tax law is postponed, and the new version is likely to be more refined after incorporating all feedback.

For each amendment, three separate motions must be moved:

- Seeking the Speaker’s approval to move the amendment.

- The Speaker placing the motion before the House to decide whether the amendment may be moved.

- Upon approval, the amendment is moved, debated, and, if agreed, incorporated into the bill.

When there are only a few amendments, this process is workable. But when, as in the case of the Income-tax Bill, 2025, there are numerous amendments (arising from the Select Committee’s recommendations and other inputs), this process would be extremely time-consuming.

Implications for Stakeholders

For taxpayers, professionals, and industry players preparing for a new tax regime, this means a delay — but potentially a more robust law. The government’s decision reflects an understanding that tax legislation must be future-ready, fair, and free from ambiguity. From a governance standpoint, this move signals maturity and responsiveness to feedback, prioritising legislative quality over speed.

Parliamentary convention in such cases is to withdraw the earlier bill and reintroduce it with all the accepted amendments already incorporated. This streamlines the process, allowing Parliament to consider and pass the bill more efficiently.

The bill to be introduced will not be entirely new. It will be the same Income-tax Bill, 2025, with all the accepted recommendations and amendments incorporated. All the hard work done over the last six months, and the valuable suggestions received, will be fully reflected in the revised bill that the Hon’ble Finance Minister will be introducing on Monday.

What’s Next on Withdrawal of the Income-tax Bill, 2025

The Finance Minister has assured that a fresh, refined bill will be introduced in the Lok Sabha “in due course.” While no specific timeline is set, it is expected that the revised draft will:

-

Incorporate all accepted recommendations from the Select Committee.

-

Address stakeholder concerns in detail.

-

Possibly undergo broader consultation before being tabled again.

Conclusion: A Welcome Pause, Not a Step Back

There is no cause for concern — the withdrawal is purely procedural and will actually make it easier for the new Income-tax Bill to be debated and passed. The withdrawal of the Income-tax Bill, 2025, is not a retreat from reform but a prudent pause. By reintroducing the bill with corrections already incorporated, the government avoids a cumbersome amendment process in Parliament while ensuring that the final law stands on strong technical and legal footing. Until the fresh bill is introduced, the Income-tax Act, 1961 continues to govern — perhaps showing its age, but still holding the fort.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.