Understand the Tax Treatment of Inherited Property

Table of Contents

Taxation Applies Only on Sale of Inherited Assets

Current Position in India on Inherited Assets

- India does not have inheritance tax (estate duty was abolished in 1985).Hence, there is no tax liability at the time of inheritance. India does not levy inheritance tax. Assets received through inheritance are not taxable under the Income Tax Act, 1961. When you inherit a property (through will, succession, or gift from specified relatives), there is no tax at the time of inheritance.

- No tax on inheritance. Tax applies only when sold. Gains are taxed based on asset type and holding period.Tax arises only when the inherited asset is sold or generates income (rent, dividends, etc.). Movable Assets (e.g., shares, gold, mutual funds)

- In case taxpayer sell the inherited asset, capital gains tax will apply. If the inherited asset generates income (rent, interest, dividends, etc.), such income is taxable in your hands. So, while inheritance itself is tax-free, future income or sale proceeds from the inherited asset are not exempt.

- There is no inheritance tax in India. Assets passed on to legal heirs are not taxed at the time of inheritance. Tax arises only on subsequent sale or income generated from those assets.

- Any life insurance payout received by the nominee on the death of the insured is fully tax-exempt under Section 10(10D) of the Income Tax Act, subject to prescribed conditions.

- if the heir decides to sell inherited assets (shares, property, etc.), capital gains tax applies. The original owner’s cost and holding period are considered for calculating tax.

- currently there is no inheritance or estate tax in India. Inherited property or assets are tax-free at the time of transfer.

- Since India does not levy inheritance tax, there is nothing to avoid at present. However, you must pay taxes on income earned from inherited assets (like rent, dividends, or capital gains on sale).

- Unlike many countries around the world that levy an inheritance or estate tax, India currently has no inheritance tax. This means that if you inherit property or assets from a deceased individual, you are not liable to pay tax at the time of inheritance. However, tax arises later in two situations:

Why the Government May Reintroduce Inheritance Tax

- Wealth Inequality: Over 40% of India’s wealth is held by the richest 1%, compared to a global average of 7%.

- International Precedent: Countries like Japan levy inheritance tax as high as 55%.

- Revenue Generation: Estate duty could bring additional funds for public spending.

- Redistribution: May help reduce wealth concentration across generations.

Tax arises on sale : When you sell the inherited property, you must pay capital gains tax on the profit. When you sell an older inherited property, tax saving on entire sale is usually subject to capital gains tax.

Capital Gain = Sale Consideration – Indexed Cost of Acquisition – Expenses on transfer

Challenges if Reintroduced

- Impact on Family Businesses: Many Indian firms are family-run; estate duty could disrupt succession planning.

- Capital Flight: Wealthy individuals may shift residency or businesses abroad to escape taxation.

- Double Taxation Concern: Assets inherited may already have been subject to income tax or wealth tax during the lifetime of the deceased.

- Administrative Burden: Valuation disputes, compliance complexity, and enforcement would be significant hurdles.

Ownership Methods & Legal Implications on Inherited Assets

- Will of Succession : Legal heir inherits as per the will.

- Nomination : Nominee becomes the rightful owner.

- Joint Ownership : Surviving owner gets full control.

Types:

- Tenants in Common: Shares passed to legal heirs.

- Joint Tenancy: Equal shares; survivor inherits.

- Tenancy by Entirety: Between spouses; requires mutual consent to sell.

Immovable Property (e.g., land, house)

- Capital Gains Tax applies only when the property is sold.

- Holding period includes the time held by the original owner.

- If held for more than 24 months, it’s considered long-term capital gain (LTCG).

Step-Up Cost (Fair Market Value as on 1st April 2001)

For properties acquired before 1st April 2001, you can take the Fair Market Value (FMV) as on 1st April 2001 (restricted to stamp duty value) as the Cost of Acquisition. This usually reduces the taxable gain significantly.

Apply Indexation

- Indexation allows you to adjust the cost of acquisition and improvement for inflation.

- Indexed cost = Cost × (CII of year of sale ÷ CII of 2001-02).

- This helps bring down the capital gain substantially.

Deduct Eligible Expenses

- Brokerage/commission paid for sale.

- Legal expenses for transfer.

- Cost of improvements (renovations, extensions, etc.) after inheritance or even by the original owner (if documented).

Capital Gains Exemptions (Sections 54 to 54F)

You can claim exemptions by reinvesting the gains:

- Section 54: Reinvest capital gain in a residential property (in India).

- Must purchase within 1 year before or 2 years after sale, or construct within 3 years.

- Only on Long-Term Capital Gain.

- Section 54EC: Invest up to INR 50 lakh in Capital Gains Bonds (NHAI/REC/IRFC) within 6 months of sale. Lock-in: 5 years.

- Section 54F: If you sell a property other than a house (e.g., land) and invest entire net sale consideration in a residential house.

Capital Gains Account Scheme (CGAS)

If you can’t reinvest immediately, deposit the gains in a Capital Gains Account Scheme before the due date of ITR filing (usually 31st July). You can later use it to buy or construct a property and still claim exemption.

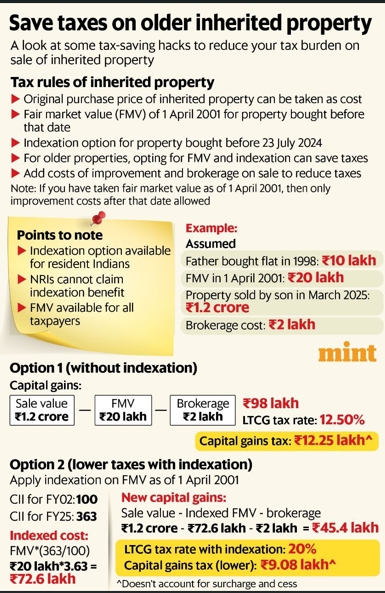

Example Comparison

Property Details:

- Bought by father in 1998 for INR 10 lakh

- FMV on 1 April 2001: INR 20 lakh

- Sold by son in March 2025 for INR 1.2 crore

- Brokerage: INR 2 lakh

Option 1: Without Indexation

- Capital Gains = INR 1.2 crore − INR 20 lakh − INR 2 lakh = INR 98 lakh

- LTCG Tax @12.5% = INR 12.25 lakh

Option 2: With Indexation

- CII for FY 2001–02 = 100

- CII for FY 2024–25 = 363

- Indexed FMV = INR 20 lakh × (363/100) = INR 72.6 lakh

- Capital Gains = INR 1.2 crore − INR 72.6 lakh − INR 2 lakh = INR 45.4 lakh

- LTCG Tax @20% = INR 9.08 lakh

Tax Saved: INR 3.17 lakh (excluding surcharge and cess)

Tax on Subsequent Sale of Inherited Property :

Once you inherit a property, you become its legal owner. If you later sell it, the capital gain or loss will accrue to you as the heir.

Holding Period : For capital gains classification:

- The holding period of the deceased is also counted along with your own.

- If the total holding period exceeds 24 months, the gain is treated as Long-Term Capital Gain (LTCG); otherwise, it is Short-Term Capital Gain (STCG).

Example

Mr. Sri Ram inherited a property from his father in 2019. His father purchased it for INR 28,000 on 11 Nov 2004, and it was sold for INR 3,80,000 on 20 Sep 2024.

- Since the combined holding period (father + heir) exceeds 24 months, it is LTCG.

- LTCG is taxable at 12.5% without indexation or 20% with indexation (plus surcharge & cess).

- The cost of acquisition will be the cost incurred by the original owner (i.e., INR 28,000).

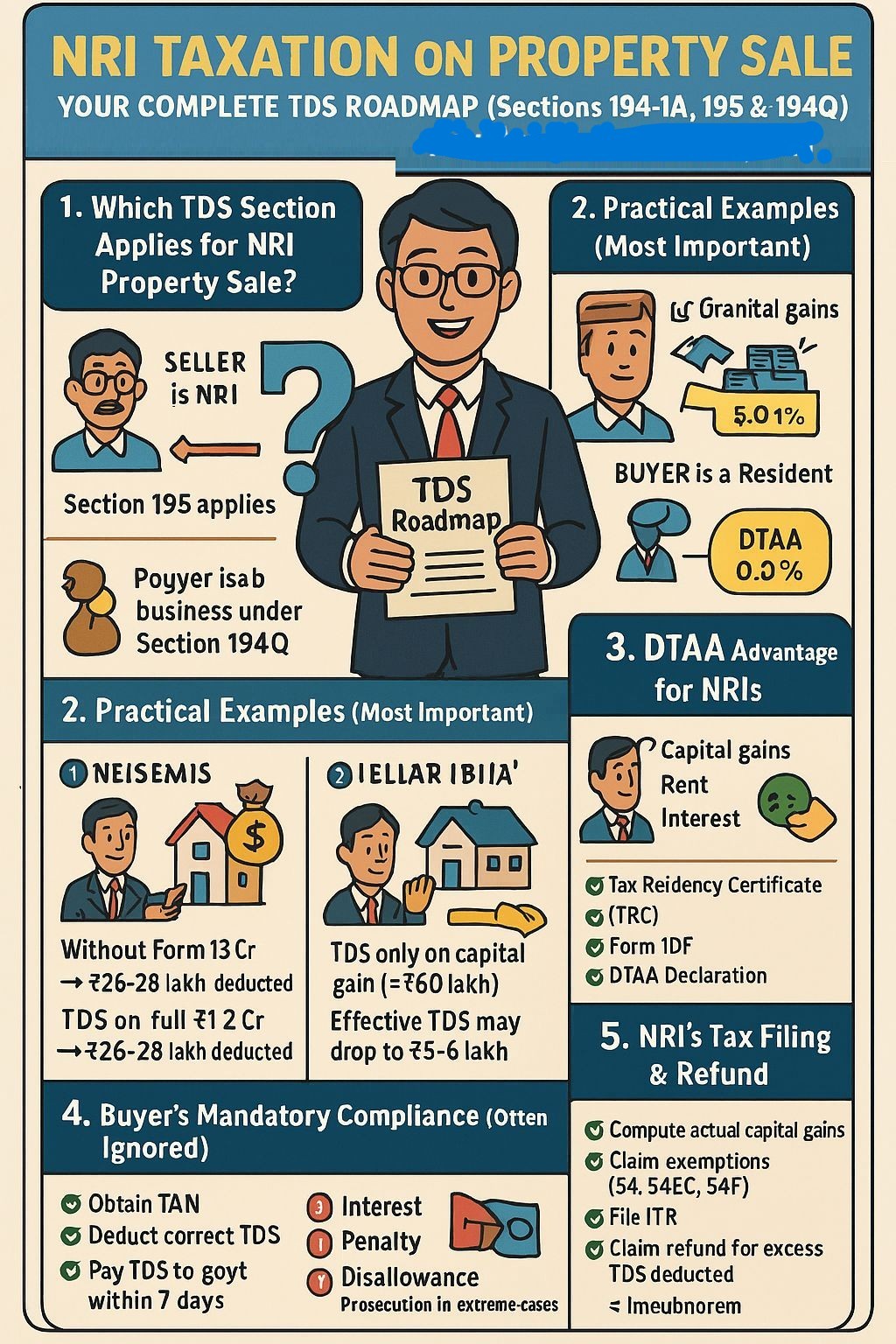

Summary for NRIs & buyers to understand TDS obligations & avoid heavy TDS/Penalties

NRI Taxation on Property Sale in India

Sale of immovable property by a Non-Resident Indian attracts strict TDS provisions, and mistakes often lead to huge excess deductions, penalties, and litigation. Here is complete TDS Roadmap on Sections 194-IA, 195 & 194Q, This roadmap explains who deducts, under which section, how much, and how to optimise legally.

Which TDS Section Applies?

Seller is NRI

- Section 195 applies (NOT 194-IA) : this TDS to be deducted by buyer, This TDS applies irrespective of sale value, and deduction is on amount payable to NRI

- Section 194Q applies : Buyer is carrying on business & transaction exceeds INR 50 Cr : then Section 194Q may also trigger, However, Section 195 overrides, Buyer must ensure correct section usage.

- Section 194-IA (1% TDS) is applicable ONLY when seller is Resident, in case Wrong application = default + penalties

DTAA Advantage for NRIs

NRIs can avail Double Taxation Avoidance Agreement benefits on Capital Gains, Rental Income, Interest Income. Following are mandatory Documents like Tax Residency Certificate, Form 10F, & Double Taxation Avoidance Agreement Self-Declaration. Double Taxation Avoidance Agreement may reduce tax rates or avoid double taxation abroad, but TDS in India must still comply with Section 195 unless reduced via Form 13. Form 13 is the single most important planning tool in NRI property sales.

Buyer’s Mandatory Compliance (Most Ignored Area)

In case of purchase of immovable property from an NRI, the buyer becomes an “assessee in default” if TDS obligations under Section 195 are not complied with. Buyer is mandatorily required to

- Obtain TAN (Tax Deduction Account Number)

- Deduct TDS correctly under Section 195 on the amount payable to the NRI

- Deposit the TDS with the Government within 7 days from the end of the month in which deduction is made

- File TDS Return in Form 27Q within the prescribed due date

- Issue TDS Certificate (Form 16A) to the NRI seller within the statutory timeline

Consequences of Non-Compliance: Buyer is treated as assessee in default, Interest, late fees, penalties and prosecution may be initiated & Buyer ignorance of law is not a valid defence under the Income-tax Act, 1961

Consequences of Failure:

-

-

Interest applicable @ 1% per month for non-deduction & Intrest @ 1.5% per month for non-payment after deduction

-

Late-fee & Penalties

-

Section 234E – INR 200 per day for delay in filing TDS return (subject to TDS amount)

-

Section 271H – Penalty ranging from ₹10,000 to ₹1,00,000 for failure to file or incorrect filing of TDS returns

-

-

Disallowance of Expenditure : Under Section 40(a)(i), where the buyer claims the payment as a business expense

-

Prosecution in Extreme Cases : Under Section 276B for wilful failure to deposit TDS & Failure by the buyer to deduct or deposit TDS correctly under Section 195 may result in:

-

Buyer’s ignorance or misunderstanding of law is not a valid defence under the Income-tax Act, 1961. then The buyer is treated as an “assessee in default” for TDS non-compliance.

-

NRI’s ITR Filing & Refund Strategy

- After sale, NRI must Compute Actual Capital Gain also taken care the Indexed Cost along with Improvement cost on property which is going to sale. they can also claim Sale expenses like commission etc.

- Claim Exemptions (if eligible) then they can claim section 54 – Residential reinvestment, Section 54EC – Bonds (₹50 lakh cap) & Section 54F – Investment in house

- NRI must file ITR in India and also can claim refund of excess TDS, NRI can claim mandatory if TDS > actual tax. in case excess TDS without Form 13 = long refund cycle

- In this reference following key Takeaways (At a Glance)

-

Section 194-IA does not apply to NRI sellers

-

Section 195 applies on gross consideration

-

Form 13 can save 70–80% of TDS

-

Buyer carries heavy legal responsibility

-

DTAA + exemptions + Form 13 = optimal tax outcome

-

- NRI property transactions are high-risk, high-value and compliance-heavy. A single mistake can cost lakhs in excess TDS or penalties.

Double Taxation Relief for NRIs

If you are an NRI and selling inherited property in India , then follow the Basic Tax-Saving Tips for NRI :

- NRIs can inherit property in India. No inheritance tax in India only capital gains tax applies on sale of inherited property. However, if they sell the inherited property, capital gains tax applies, and TDS may be deducted. They can also use DTAA provisions to avoid double taxation.

- Use Fair Market Value as of 1 April 2001 for older properties.

- For very old properties, always get a registered valuer’s report to maximize FMV as on 01.04.2001, which lowers your taxable gain.

Key Tax Rules for Inherited Property

- Cost of Acquisition: You can use the original purchase price or the Fair Market Value (FMV) as of 1 April 2001 (if the property was bought before that date).

- Indexation Benefit: Available for properties bought before 23 July 2024. Helps adjust the FMV for inflation, reducing taxable capital gains. Only resident Indians can claim indexation; NRIs cannot.

- Additional Deductions: You can add costs of improvement and brokerage on sale to reduce taxable gains. If FMV of 1 April 2001 is used, only improvements after that date are allowed.

- Apply indexation to reduce taxable gains. Include brokerage and improvement costs. Resident Indians benefit more due to indexation. Tax applies only on sale. & No indexation benefit for NRIs.

- TDS at 20%+ applies on sale proceeds.

- Apply for a Lower/Nil TDS certificate (Form 13) before the sale to avoid excess deduction.

- Claim Section 54 exemption by reinvesting in another residential property.

- Use Capital Gains Account Scheme if reinvestment is pending.

- Taxpayers use DTAA benefits to claim tax credits in their resident country.

Future Possibility: If estate duty is reintroduced, it could alter how inheritance is taxed, but would require careful policy design to avoid hurting family businesses and causing double taxation.

Buying Property in Your Wife’s Name? Think Twice Before Calling It a Tax Hack

It might sound smart Then Lower stamp duty; Fewer registration hassles & Bonus points for being thoughtful. But here’s the twist U/s 64 of the Income Tax Act, if you buy a property in your spouse’s name (and she didn’t pay for it from her own income), the “clubbing provisions” kick in. That means Any rental income, capital gains, or profit from that property will be added back to your income and taxed in your hands. So while you may save a small percentage in stamp duty today, the long-term tax cost can be much higher. Always plan smart Short-term savings shouldn’t turn into long-term tax pain. When it comes to real estate and family ownership, structure matters as much as sentiment.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.