GST functionality to validate IRN/Search IRN via document No

GSTN has enabled functionality to validate IRN or search Invoice Reference Number (IRN) from document No.

- The Goods and Service Tax Network has been implemented a useful function that users allows to get the access Invoice Reference Number even if it was not started recorded for credit note, debit note or an invoice,.

- Above Goods and Service Tax New search Functionality has enable to check & find Invoice Reference Number using Document No.

- So it can be say that in case GST Taxpayer have forgotten to preserve Invoice Reference Number, then they should not be panic; Goods and Service Tax Network has made this simple to locate and instant check & find Invoice Reference Number using Document No it.

- All the GST invoice being issued by GST supplier to his recipient required contain the IRN.

- GST officers can check & verify genuineness of said transaction via using IRN via GST portal as well as an offline app.

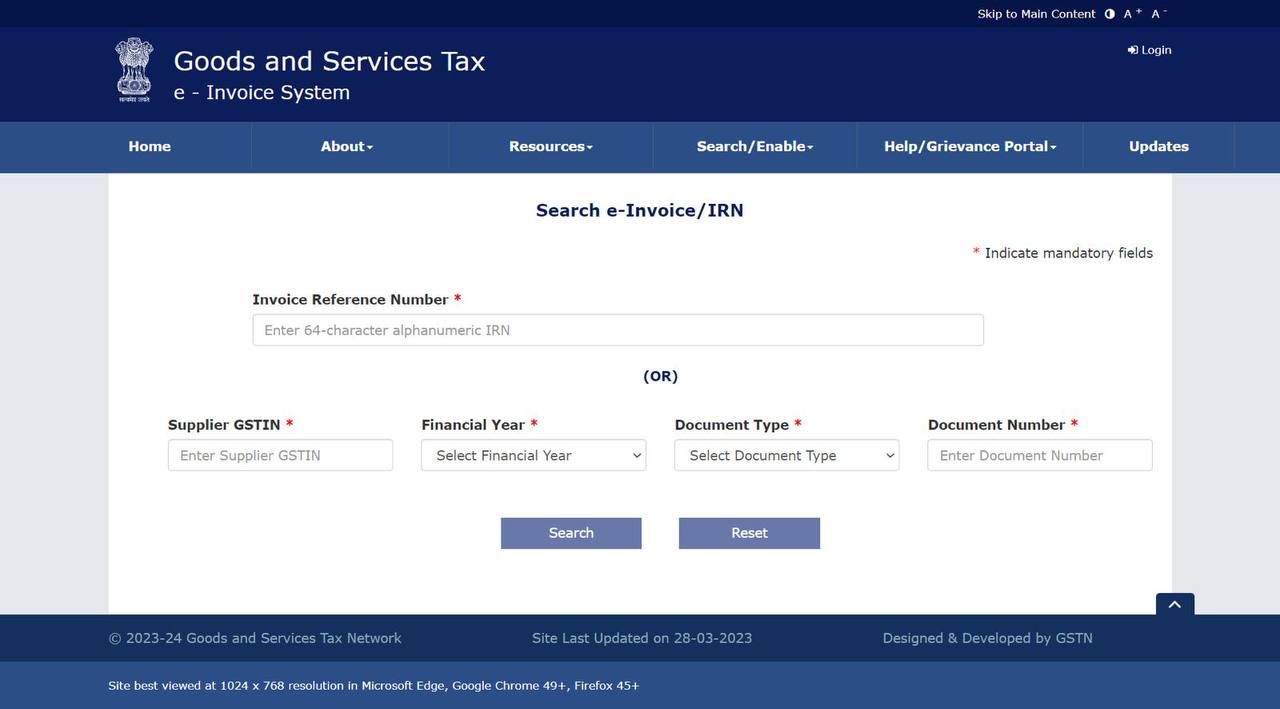

How to access functionality validate IRN/Search IRN via document No

Step to access above functionality, it is quite simply via use below steps as mention here under:

- You can Start via visiting the Goods and Service Tax Network Dashboard.

- thereafter you reached GSTN Dashboard, you needed to look for the option to search for or enable features. To continue, click on that.

- Above step will direct you to Search Invoice Reference Number’s page & than you can directly search Invoice Reference Number through the document No.

You can get access the respective link here under : Link

https://einvoice.gst.gov.in/einvoice/search-irn

- You may useful above link to verify the genuineness of E-invoice bcoz otherwise ITC can be rejected.

- By implementing this user-friendly solution, GSTN wants to provide a smooth experience to individuals who may have accidentally neglected preserving the vital IRN.

- With a few clicks, you can obtain the IRN for any document, ensuring that you retain accurate records and comply with GST specifications.

- IRP’s hash will become the e-invoice’s IRN (Invoice Reference Number). This must be unique to each invoice and act as the taxpayer’s unique identity in the GST System for the whole financial year.

For more details on GST relating topics & Accounting area, please contact India Financial Consultancy Corporation Pvt Ltd, a team of expert & professionals CA CS in Delhi.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.