What is a Hindu Undivided Family (HUF)?

Table of Contents

What is a Hindu Undivided Family (HUF)?

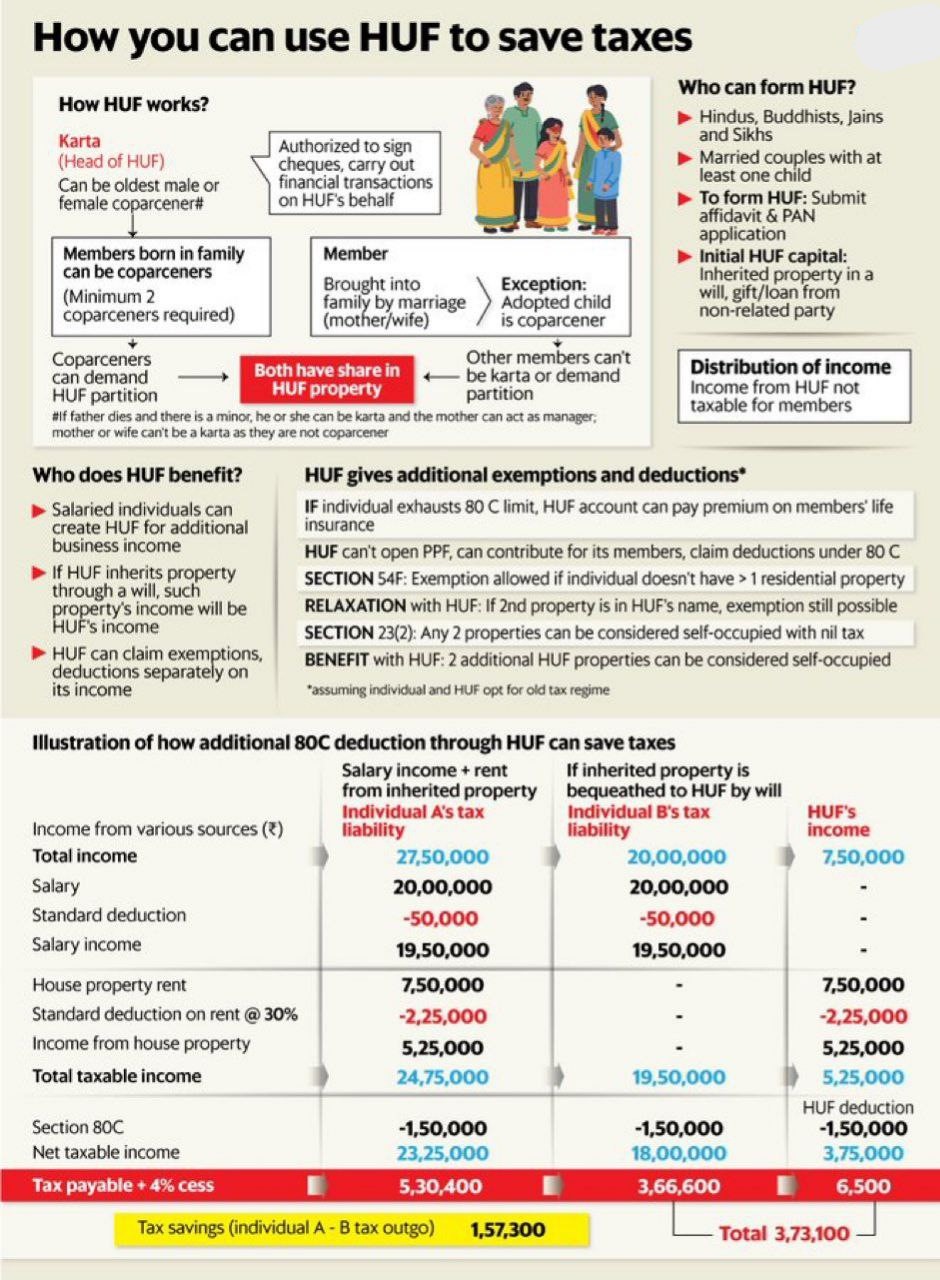

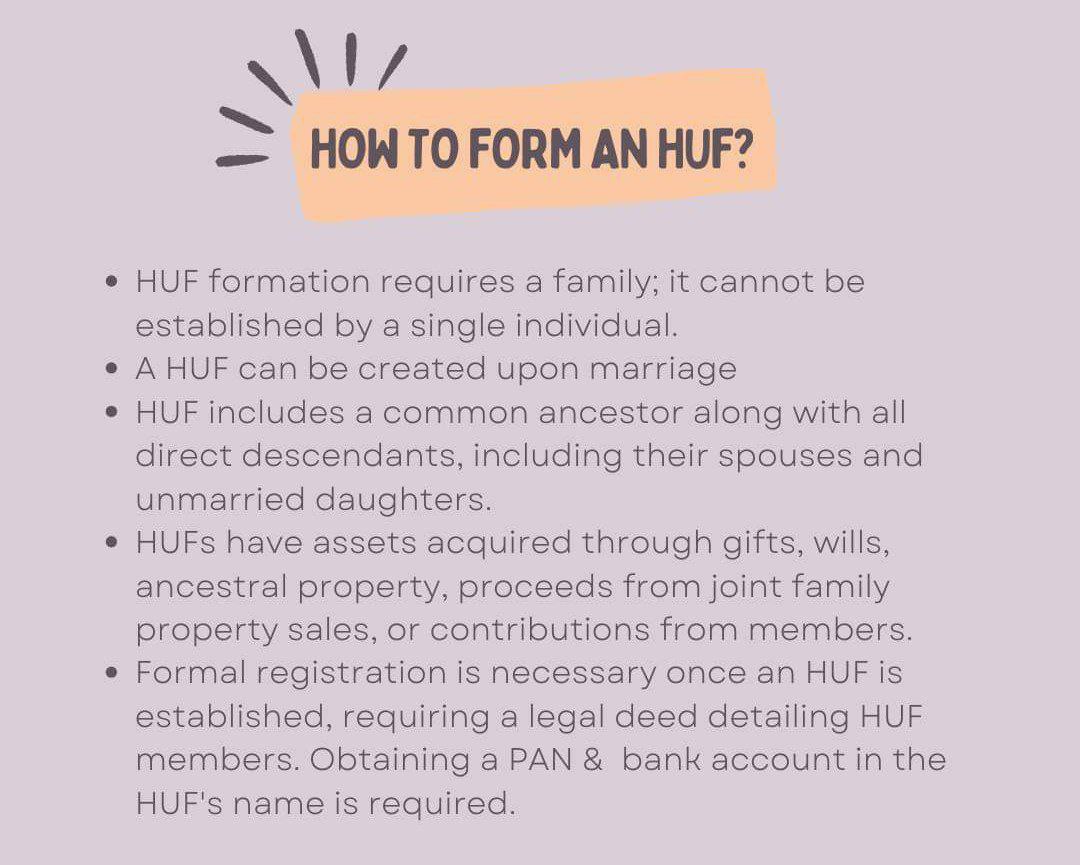

A Hindu Undivided Family is a distinct legal and tax entity recognized under Indian tax laws. It consists of members related by blood, members related by marriage, and a Karta (head of the HUF). A Hindu Undivided Family can earn income, own assets, file its own income tax return, and Be taxed independently of its members. Following are the benefits of Hindu Undivided Family

· Separate Tax Entity: Hindu Undivided Family is taxed separately from its members and Allows division of income within the family structure

· Independent PAN & Bank Account: Hindu Undivided Family has its own PAN and Operates through a separate bank account, ensuring clarity and compliance

· Income Sources for Hindu Undivided Family: A Hindu Undivided Family can earn income from family-owned businesses, rental income from ancestral property, investments made from HUF funds, and gifts received by Hindu Undivided Family (subject to conditions). This reduces the individual tax burden of family members.

How Hindu Undivided Family Taxation Works:

· Hindu Undivided Family is taxed exactly like an individual. Hindu Undivided Family Taxation Works Eligible for Basic exemption limit, Deductions under Chapter VI-A (80C, 80D, etc.) and Choice between old and new tax regime

· Income up to INR 7 lakhs is tax-free only under the new tax regime due to rebate U/S 87A, subject to conditions. This benefit applies separately to Hindu Undivided Family as well.

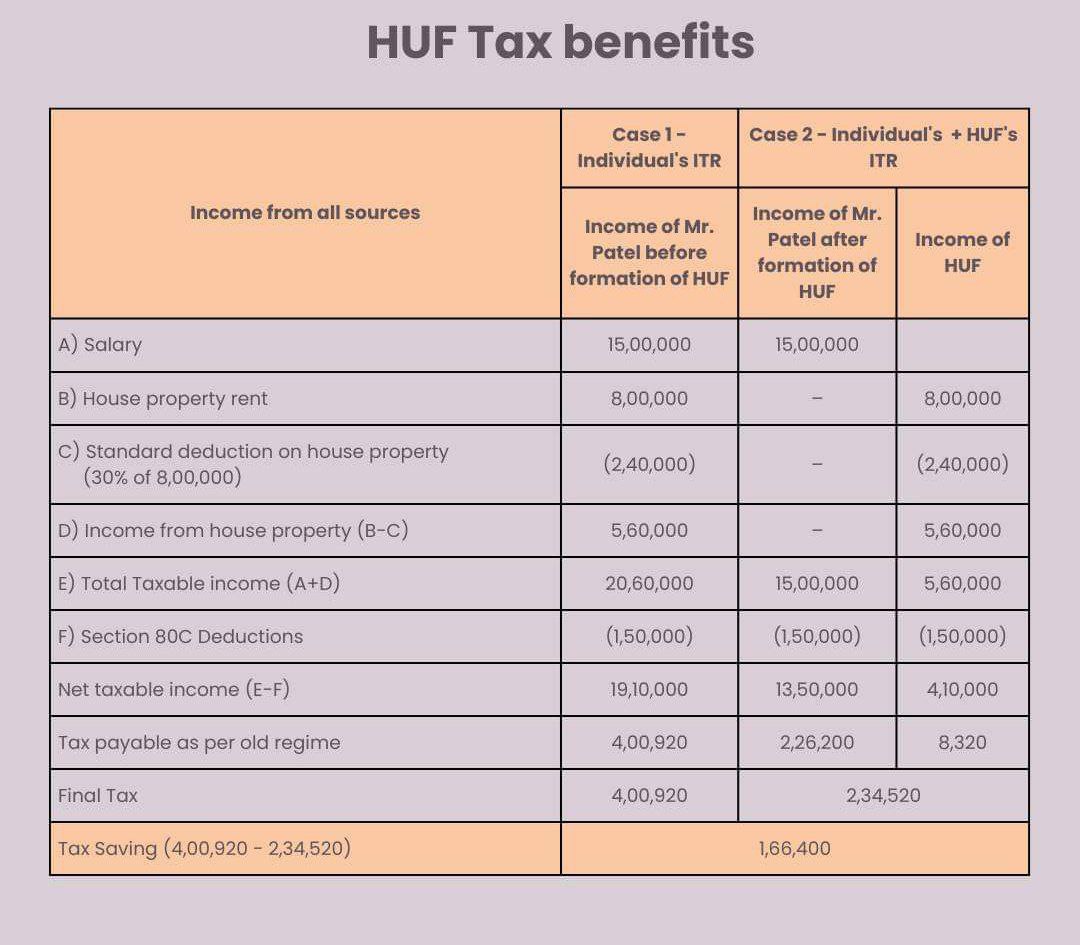

Tax Saving Opportunity Using Hindu Undivided Family

· By creating an Hindu Undivided Family, income can be legitimately split, overall family tax outflow can be reduced, additional exemption limits can be available for Hindu Undivided Family, and Hindu Undivided Family deductions become available.

· Personal income cannot be arbitrarily transferred to Hindu Undivided Family. Income must arise from ancestral property, Hindu undivided family-owned assets, and businesses run with Hindu undivided family capital. Improper transfers can attract clubbing provisions.

Additional exemption limits & additional deductions to be claimed by HUF, legitimate income splitting within the family, and long-term wealth structuring. But remember, personal income cannot be simply diverted to HUF. Income must arise from HUF assets or capital.

· Individual = Simple taxation

· HUF = Strategic tax planning.

· Used wisely, HUF can significantly reduce overall family tax outflow—but only with proper structuring and professional guidance.

HUF Makes Sense to incorporate only when Ancestral property exists. Family business using common capital, High-income individual looking for legitimate tax optimization and Long-term family wealth planning

HUF tax planning may not help much when taxpayers have Only salary income, No ancestral or HUF assets and Improper transfers (risk of clubbing & litigation)

Key Tax Planning Advantage of HUF—Practical Examples Where Hindu Undivided Family Helps

· Rental income from ancestral property

· Family business profits allocated to Hindu Undivided Family

· Investments made from gifts received by Hindu Undivided Family

· Multiple taxpayers within the same family group

A Hindu Undivided Family is a powerful and legitimate tax planning tool when used correctly. It allows families to optimize tax liability, create long-term wealth, and ensure structured financial planning across generations. However, careful structuring and compliance are essential. Hindu Undivided Family can help you save taxes—but only when set up and operated as per law.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.