When Failure to get accounts audited

Table of Contents

What happen when Failure to get accounts audited

Section 271B of the Income Tax Act mandates a penalty for failure to comply with the audit requirements under Section 44AB. However, Section 273B provides relief by allowing the penalty to be waived if the assessee can prove a reasonable cause for such failure. While Section 271B prescribes penalties for non-compliance with the audit requirements, Section 273B serves as a safeguard for taxpayers who face genuine difficulties. If any of the situations mentioned above (or similar ones) apply, the assessee can potentially avoid the penalty by demonstrating reasonable cause. However, the proof and explanation must be convincing enough for the tax authorities.

Penalty under Section 271B : If a person fails to:

-

- Get their accounts audited as required under Section 44AB, or

- Furnish the audit report within the prescribed time,

The Assessing Officer may impose a penalty, which is:

-

- 0.5% of the total sales, turnover, or gross receipts, or

- ₹1.5 lakh, whichever is lower.

Relief under Section 273B: Reasonable Cause

However, under Section 273B, no penalty will be imposed if the person can prove a reasonable cause for their failure. The onus is on the assessee to demonstrate that such failure occurred due to circumstances beyond their control.

Commonly Accepted “Reasonable Cause” Instances :

Tribunals and courts have accepted various situations as valid reasons for non-compliance, including:

- Death or incapacitation of a key person (such as a partner in charge of accounts).

- Failure of the official e-filing portal of the Tax Dept during the filing process.

- Labour disruptions, such as long-term strikes or lockouts.

- Bona fide misinterpretation of the term “turnover” or audit requirement, often based on expert advice.

- Seizure of accounts by authorities, leading to their unavailability.

- Natural calamities or public unrest, making compliance impossible.

- Resignation of the tax auditor leading to unavoidable delays.

- Loss of financial records due to unforeseen events like fire or theft.

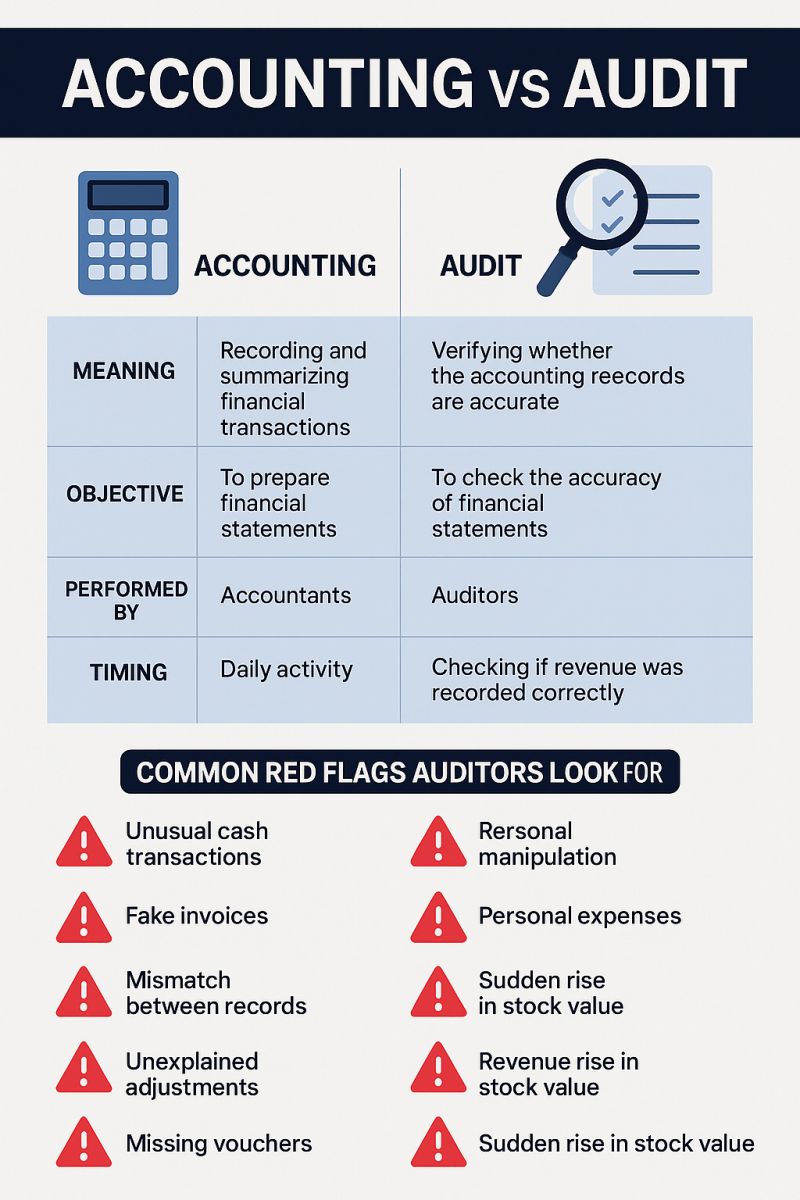

Accounting vs Audit — Key Differences

Accounting vs. Audit—Key Differences

| Basis of Difference | Accounting | Audit |

|---|---|---|

| Meaning | The process of recording, classifying, and summarizing all financial transactions to prepare financial statements. | The process of examining and verifying the accuracy and fairness of financial statements prepared by the accountant. |

| Objective | To determine the profit or loss of a business and show its financial position at the end of the period. | To ensure the truthfulness, accuracy, and reliability of the financial statements. |

| Nature of Work | Creation of financial records. | Examination of financial records. |

| Timing | Done daily and continuously throughout the accounting year. | Conducted after the accounting process is completed. |

| Performed By | Accountants or bookkeepers. | Auditors (internal or external, qualified professionals). |

| Focus Area | Recording and presentation of transactions in compliance with accounting standards. | Checking compliance, detecting errors, frauds, and providing an independent opinion. |

| Reports Prepared | Financial Statements – Balance Sheet, Profit & Loss Account, Cash Flow Statement, etc. | Audit Report – opinion on the fairness of financial statements. |

| Legal Requirement | Mandatory for all entities to maintain proper books of accounts. | Statutory audit is mandatory only for specified entities (as per Companies Act, Income Tax Act, etc.). |

| Period Covered | Continuous process throughout the year. | Periodic process, usually annual. |

| End Product | Financial Statements. | Auditor’s Report. |

Accounting is about preparing the picture of a company’s financial position. Audit is about reviewing that picture to ensure it’s true and fair.

Common Red Flags Auditors Look For

- Unusual cash transactions without proper documentation.

- Fake invoices or duplicate entries.

- Mismatch between bank statements and books.

- Unexplained adjustments or round figures.

- Missing vouchers or unauthorized payments.

- Manipulated revenue recognition near year-end.

- Personal expenses booked as business expenses.

- Sudden spike in debtors or inventory without justification.

About IFCCL

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.