INCOME TAX UPDATE NOV 17, 2015

INCOME TAX UPDATE NOV 17, 2015

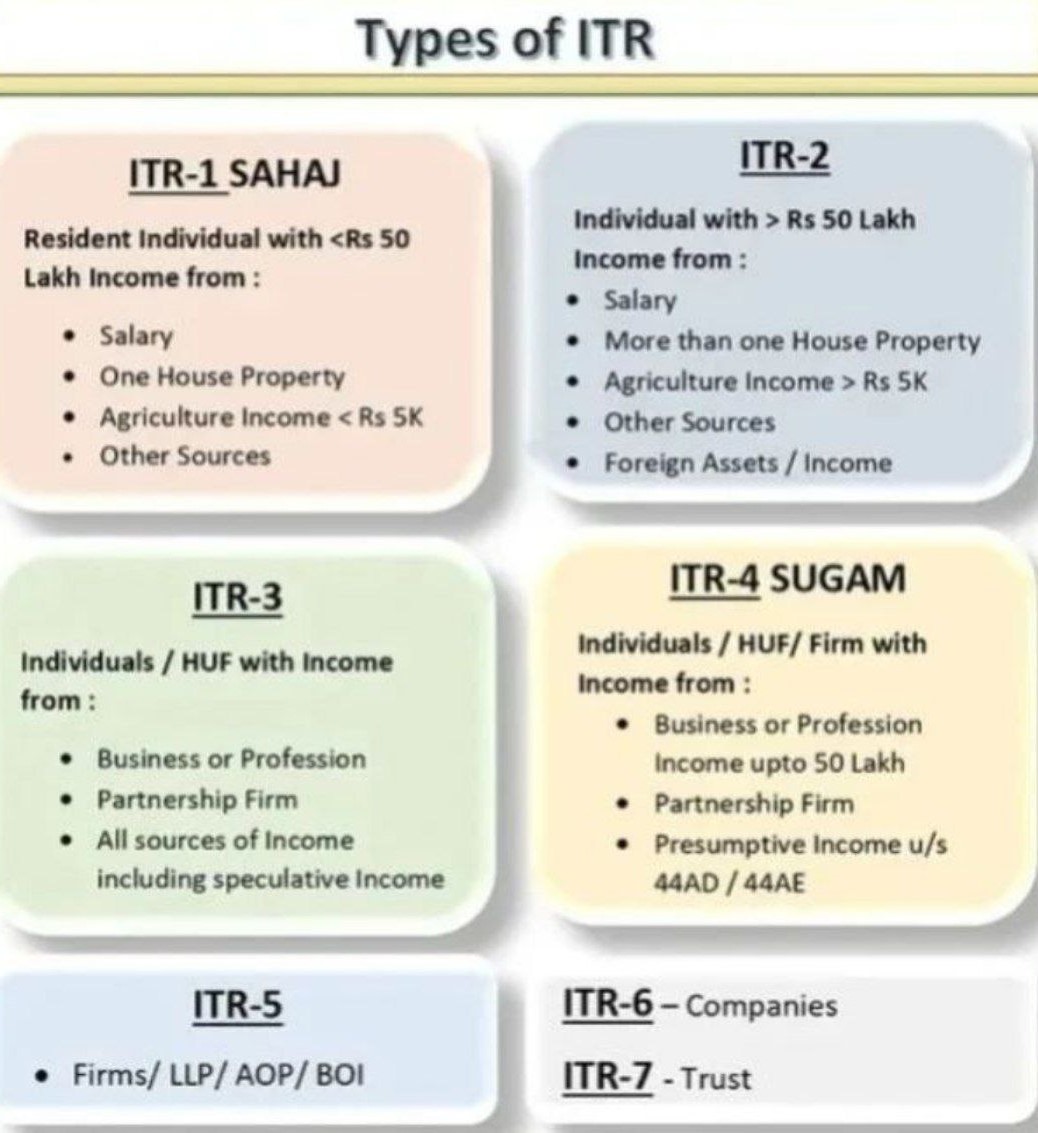

INCOME TAX ACT- Kind of ITR

SECTION 9

INCOME – DEEMED TO ACCRUE OR ARISE IN INDIA

Royalty/Fees for technical services : Where assessee-company engaged a company registered in USA, for review of design of cranes but it could not be discerned from records whether suggestions given by U.S. company would bring brought any major change or improvisation in design of crane, matter should be reconsidered afresh – [2015] 375 (Mumbai – Trib.)

SECTION 50B

CAPITAL GAINS – SLUMP SALE, COST OF ACQUISITION IN CASE OF

Where assessee had sold tea estate and assigned values to every movable property transferred to buyer, it could not be said that transfer was slump sales only for the reason that the tea estate was transferred to buyer as a going concern. – [2015] 149 (Kolkata – Trib.)

SECTION 92C

TRANSFER PRICING – COMPUTATION OF ARM’S LENGTH PRICE

Comparables and adjustments – AMP expenses : Where assessee challenged demand made on account of T.P. adjustment on basis of Tribunal’s decision, but High Court had disallowed said decision, assessee had good prima facie case for stay on said demand – [2015] 63 (Mumbai – Trib.)

SECTION 222

COLLECTION AND RECOVERY OF TAX – CERTIFICATE PROCEEDINGS

Attachment : Where Assessing Officer raised huge tax demand upon assessee and in meantime bank account including cash credit account of assessee had been attached by income tax authorities, in view of decision of Madras High Court in case of K.M. Adam v. ITO [1958] 33 ITR 26, cash credit account of assessee could not be attached and it was entitled to be discharged – [2015] 38 (Calcutta)

SECTION 271(1)(c)

PENALTY – FOR CONCEALMENT OF INCOME

Revised return, effect of filing : Admission of income by assessee in revised return cannot give jurisdiction to Assessing Officer to levy penalty under section 271(1)(c) – [2015] 40 (Calcutta)

SECTION 276

OFFENCES AND PROSECUTION

High Court upheld criminal proceedings initiated against an assessee under Section 276(c) for non-payment of tax. The Court sets aside the contention of assessee that prosecution proceedings could not be initiated when no notice of demand under section 156 was furnished. The High Court held that separate notice of demand was not required if intimation under section 143(1) regarding tax payable by assessee was furnished. – [2015] 150 (Andhra Pradesh)

COMPANIES ACT

SECTION 3

PROHIBITION OF AGREEMENTS – ANTI-COMPETITIVE AGREEMENTS

Where opposite parties i.e. Jet Airways, Indigo and Spice Jet had acted in a concerted manner in fixing and revising fuel surcharge (FSC) rates for transporting cargo, conduct of OPs was anti – competitive and penalty was to be imposed upon them – [2015] 147 (CCI)

SERVICE TAX

SECTION 65(3)

TAXABLE SERVICES – ADVERTISING AGENCY’S SERVICES

Media costs incurred for advertisement campaign undertook outside India cannot be included in value advertisement agency services and cannot, therefore, be taxed in hands of advertising agency – [2015] 31 (Mumbai – CESTAT)

SECTION 65(68)

TAXABLE SERVICES – MANPOWER RECRUITMENT OR SUPPLY AGENCY’S SERVICES – STAY ORDER

Where Tribunal had found that employees deputed by foreign group company were actually appointed by assessee in India and only a portion of their salary was paid to employees by foreign group company and reimbursed on actual basis, same would not, prima facie, amount to manpower supply services – [2015] 33 (Andhra Pradesh)

CUSTOMS ACT

SECTION 113

CONFISCATION – SMUGGLING/ILLEGAL EXPORT

Since ‘illegal export’ is preceded by an ‘attempt towards illegal export’, confiscation under section 113 and penalty under section 114 are attracted against ‘attempt of illegal export’ even after goods have been actually exported – [2015] 34 (Madras)

CST & VAT

SECTION 5 OF CENTRAL SALES TAX ACT, 1956

SALE – SALE PRECEDING EXPORT

As per SEZ Act, Sales to SEZ unit is regarded as taxable sales unless any specific exemption in respect thereof is provided under CST Act or under the respective state legislation. In the instant case, it was held by the High Court that sale of sandalwood from Kerala to SEZ unit in Madras does not qualify to be export sales under Kerala VAT as no specific exemption has been provided either under Kerala VAT Act or under CST Act. –[2015] 148 (Kerala)

STATUTES

DIRECT TAX LAWS

Section 90 of the Income-tax Act, 1961 – Double Taxation Agreement – Agreement for Avoidance of Double Taxation and Prevention of Fiscal Evasion with Foreign Countries – Kuwait – Protocol amending said Agreement – PRESS RELEASE, DATED 18-11-2015

CORPORATE LAWS

Companies (Management and Administration) Third Amendment Rules, 2015 – Substitution of Form MGT-7 –NOTIFICATION [F.NO.01/34/2013-CL-V-PART-I], DATED 16-11-2015

INDIRECT TAX LAWS (ST./EX./CUS. & (CST & VAT)

Delhi Value Added Tax (Amendment) Rules, 2015 – Amendment in Forms DVAT-16, DVAT-30, DVAT-31 and insertion of Annexure IE – NOTIFICATION NO.F.3(20)/FIN(REV-I)/2015-2016/DSVI/906, DATED 12-11-2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact:info@caindelhiindia.com or call at 011-23343333

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.