ITR Forms for FY 2022-23 -Types & Applicability

Table of Contents

NEW ITR FORMS FOR FY 2022-23 – TYPES & APPLICABILITY

BRIEF INTRODUCTION

Where offline ITRs were filed, greater importance be given on the type of ITR form applicable based on the source and quantum of the income of the taxpayer. However, with the advancement of technology, all these manual works is now done with the help of software’s and thus, would not require application of knowledge.

Even though everything is online, the taxpayer is required to have a basic knowledge of all the ITR forms, in order to proceed with their ITR filing.

INCOME TAX RETURN

Income Tax Return is a statement, forming the structure of a taxpayer’s income. It basically describes the quantum of income and their sources, and the said information is furnished with the government, so that they can easily gather the details of income of all the taxpayers and can collect taxes accordingly.

ITR FORMS

Where a taxpayer is required to file their ITR, the same can be done by filing the ITR forms, made available on the IT portal. Specific forms have been prescribed, based on the source and quantum of income. The taxpayer is required to identify the applicable form and furnish the information in the said identified form.

TYPES OF ITR AND THEIR APPLICABILITY

-

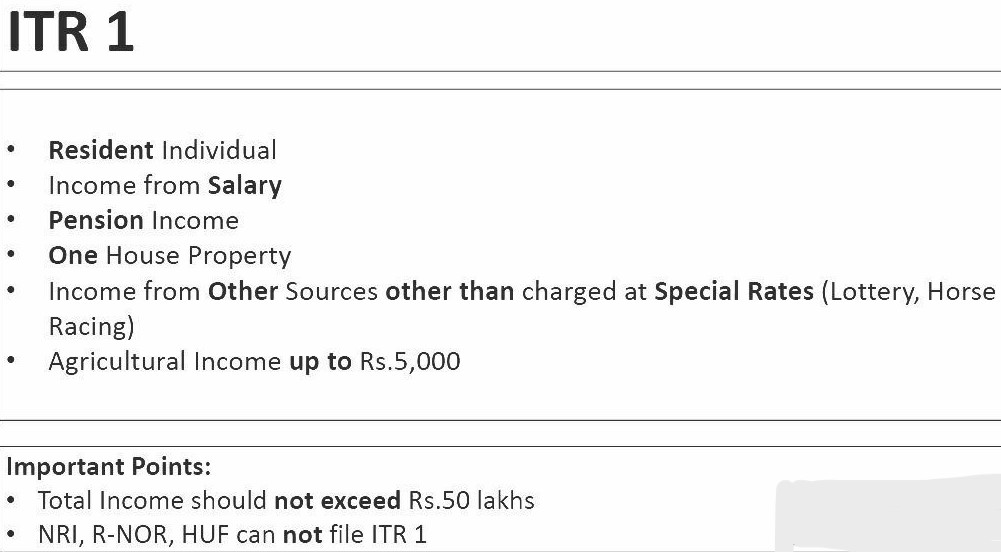

ITR 1

This form is applicable to individuals who are residents and have total income of up to Rs 50 lakh constituting of Income from Salary, one house property, income from other sources (including family pension and interest income), and income from agricultural activities maximum up to Rs 5000. This ITR form does not apply to a Director in a company or made investment in unlisted equity shares or even in cases where TDS got subtracted as per section 194N where the ESOP taxation aspect has been deferred under new relaxation.

-

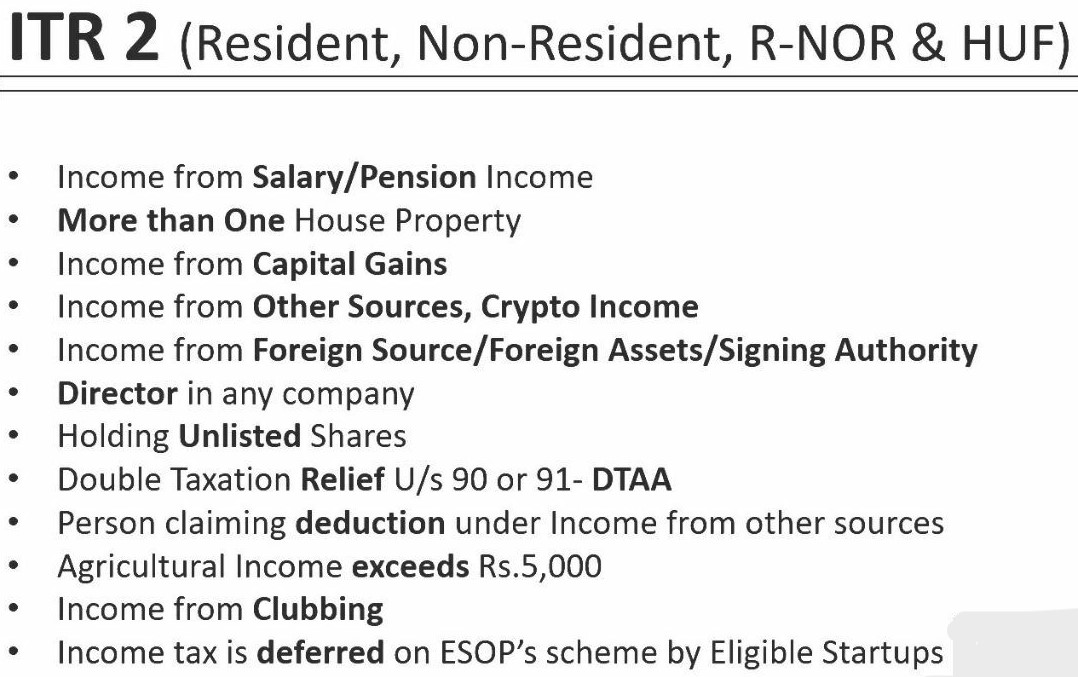

ITR 2

It is applicable to Individuals and HUFs having income from different sources except from business or professional income. Thus, an individual or HUF, not eligible to file Sahaj ITR 1, can file ITR-2. Therefore, any director of a company, as well as anyone who owns unlisted equity shares of a company, will be required to file ITR-2 returns. Also, individuals having more than one house property should also file an ITR-2 income tax return.

-

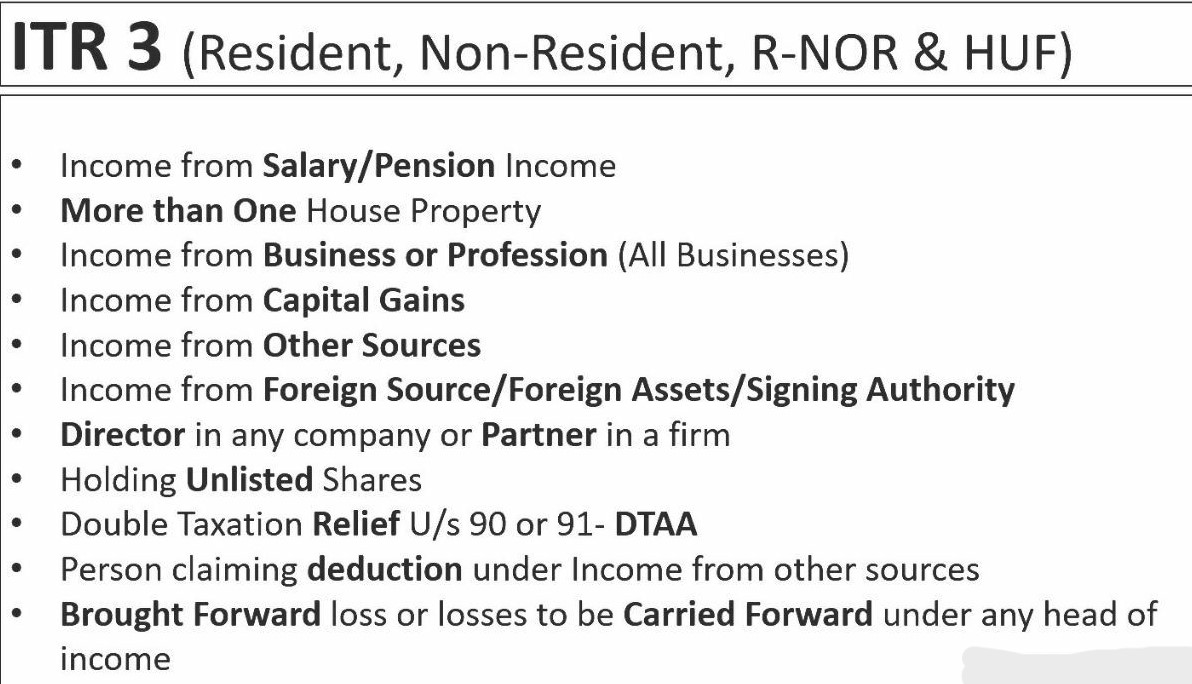

ITR 3

It is to be filed by persons having income from a business or profession. Thus, the eligible source of income for ITR 3 are –

-

- Running a business or profession whether subject to audit or not.

- Income from all other sources like salary, house property, capital gain and other sources, be also included.

-

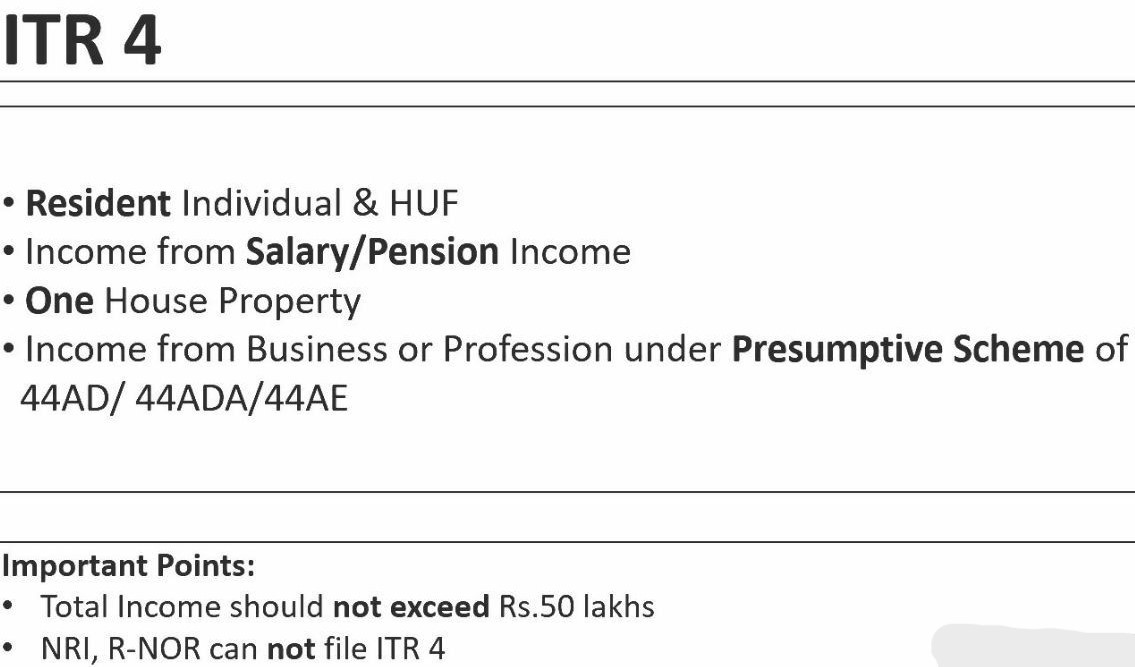

ITR 4

It is applied to Individuals, HUFs, and Firms, excluding LLPs, who are residents and have total income up to Rs.50 lakh. Such income constitutes income from business and profession, subject to computation under sections 44AD, 44ADA, or 44AE. Apart from business or profession, it includes income from one house property with single ownership, interest Income, Family Pension, and agricultural income up to Rs.5,000.

-

ITR 5

This form is to be filed by Firms, LLPs, Association of Persons, Body of Individuals, Artificial Juridical Person, legal heirs of deceased and insolvent person, trust and investment-based funds.

-

ITR 6

Such form is required to be filed by companies not eligible for an exemption under Section 11. It is to be noted that exemption under section 11 is provided to companies that receive income from property held for charitable or religious purposes. Such a return be filed electronically and authorized with the assigned digital signature.

-

ITR 7

It is to be filed by trusts, political parties, charitable institutions etc. receiving exempt income under the Act. Also, where the individuals and companies, fall under section 139(4A), section 139 (4B), section 139 (4C), or section 139 4D, they can also file ITR-7 form. One of the required aspects of this form is that, the taxes deducted, collected, or paid by or on their behalf, must match with their Tax Credit Statement Form 26AS. This form is divided into two parts with a total of 23 schedules.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.