Important decisions made at the 43rd GST council meeting

- Recommend that the GST rate on Diethylcarbmazine (DEC) pills be reduced from 12 percent to 5%.

- Clarified that services provided to government entities in the form of rope-way construction are subject to the 18% GST rate.

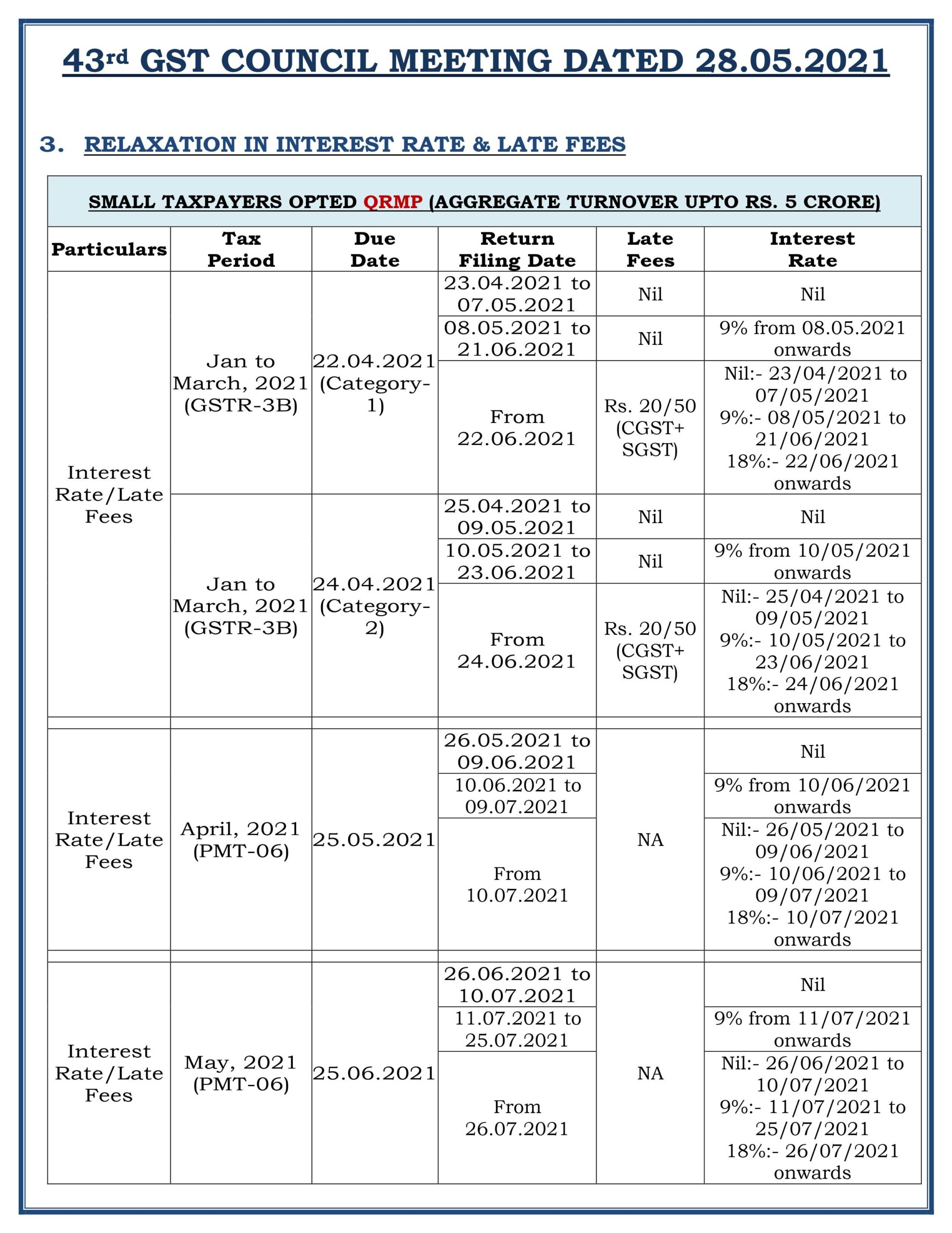

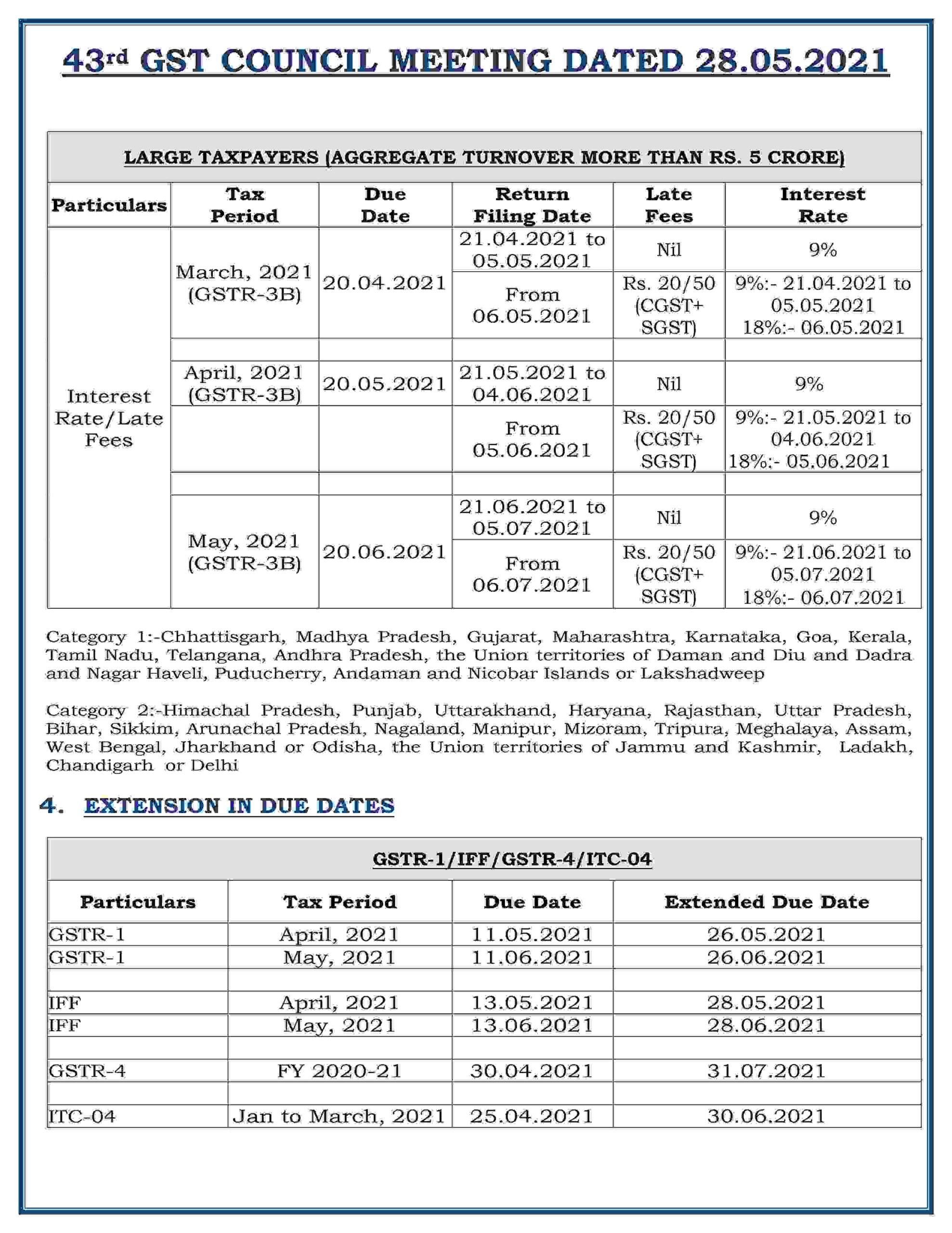

Know about relaxation in filing of GSTR 3B for the month from Mar’2021 to May’2021

| SN | Tax Period | Turnover (AAT) |

Due Date for filing | First 15 days from Due Date | Next 15 Days | Next 15 Days | Next 15 Days | From 61st Day Onwards | Waiver of Late Fee Till |

| 1 | Mar’21 | >5 Cr | 20/4

|

9% | 18% | 18% | 18% | 18% | 5/05 |

| <=5 Cr | Nil | 9% | 9% | 9% | 18% | 20/06 | |||

| 2 | Apr’21 | >5 Cr | 20/5

|

9% | 18% | 18% | 18% | 18% | 04/06 |

| <=5 Cr | Nil | 9% | 9% | 18% | 18% | 05/07 | |||

| 3 | May’21 | >5 Cr | 20/6

|

9% | 18% | 18% | 18% | 18% | 05/07 |

| <=5 Cr | Nil | 9% | 18% | 18% | 18% | 20/07 |

- Clarified that services provided by the government to its undertakings/ Public Sector Undertaking (PSU)s in the form of loan guarantees are exempt from GST.

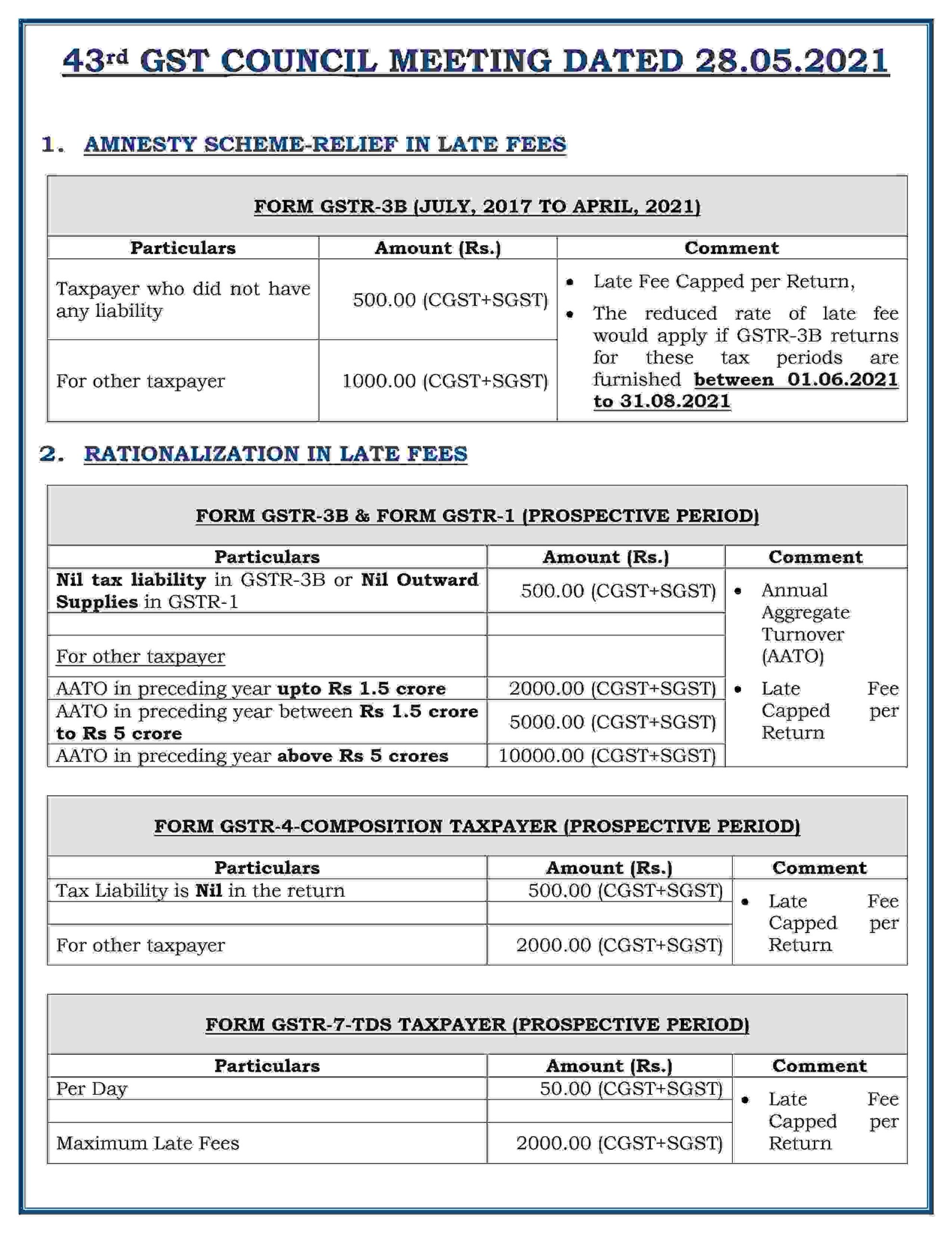

- Late Fee Reduced for non-filing of GSTR-3B of GSTR-3B from July 2017 to April 2021 as under:-

(a) For Nil return filling (no tax liability) – INR 500/- per return

(b) For other taxpayers -INR 1000/- per return

In the Above Reduced late fee applicable only when GSTR-3B will be filed between 1st June 2021 to 31st August 2021

(5) Maximum late costs recommended by committee for late filing of GSTR-1 and GSTR-3B

(a) For Nil return (no tax liability) – Maximum Rs 500/- per return

(b) For other taxpayers

(i) When Annual Turnover less than INR 1.5 CR in previous year – INR 2k per return maximum

(ii) When Annual Turnover between INR 1.5 CR to INR 5 Cr in previous year – INR 5k per return maximum

(iii) When Annual Turnover more than 5 crore in previous year – INR 10k per return maximum

(6) The deadline for reporting GSTR-1/IFF for May 2021 has been extended from June 11 to 26 June.

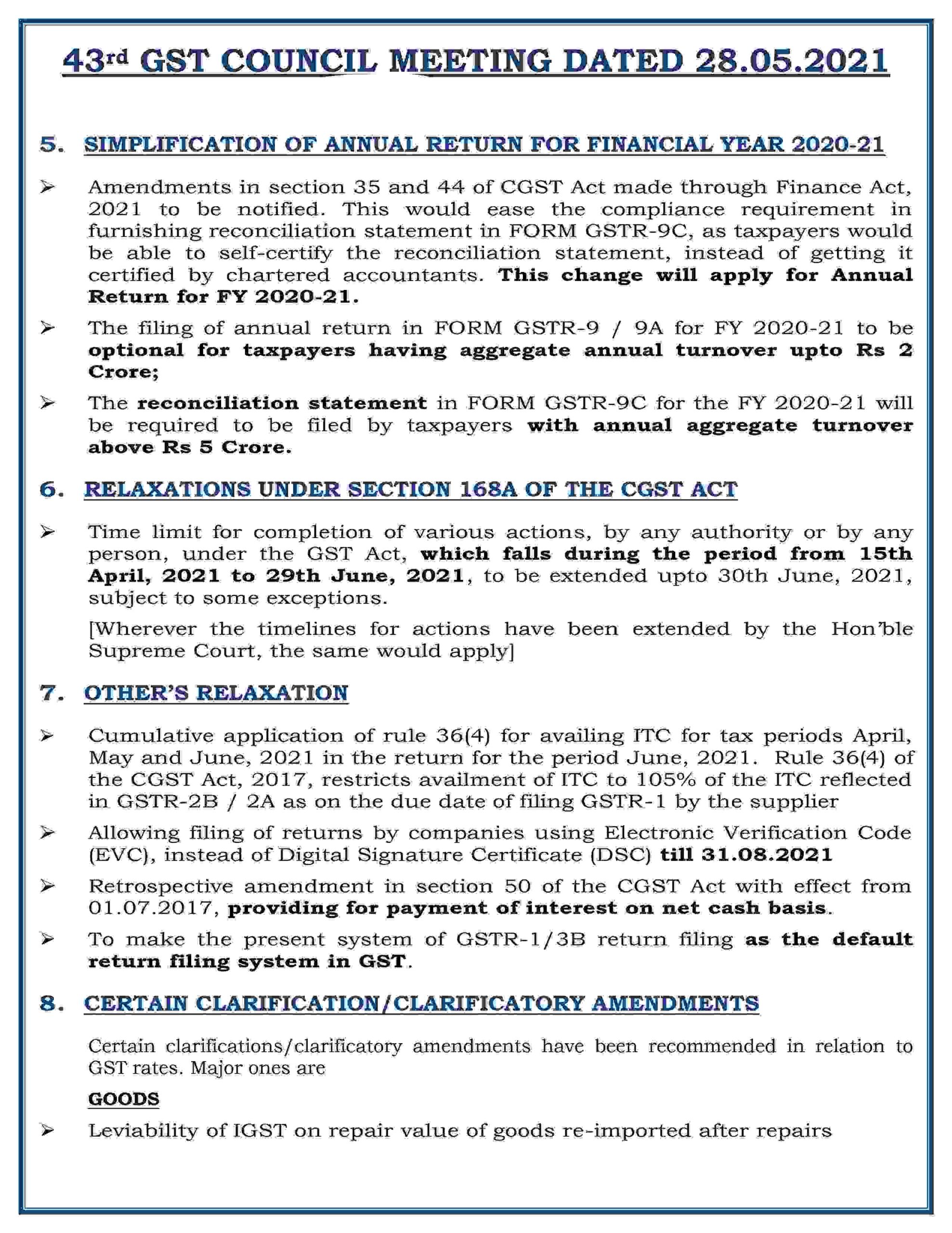

(7) Allowing companies to file returns using OTP rather than DSC until August 31, 2021.

(8) The deadline for reporting GSTR-4 (composition dealers) for FY 2020-21 has been extended to July 31, 2021.

(9) The deadline for completing different activities under the GST Act, which falls between April 15th and June 29th, 2021, has been extended until June 30th, 2021, subject to specified exceptions.

(10) GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for the fiscal year 2020-21

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.