Overview on collapse of Yes Bank

Table of Contents

Complete Understanding on collapse of Yes Bank

BRIEF INTRODUCTION

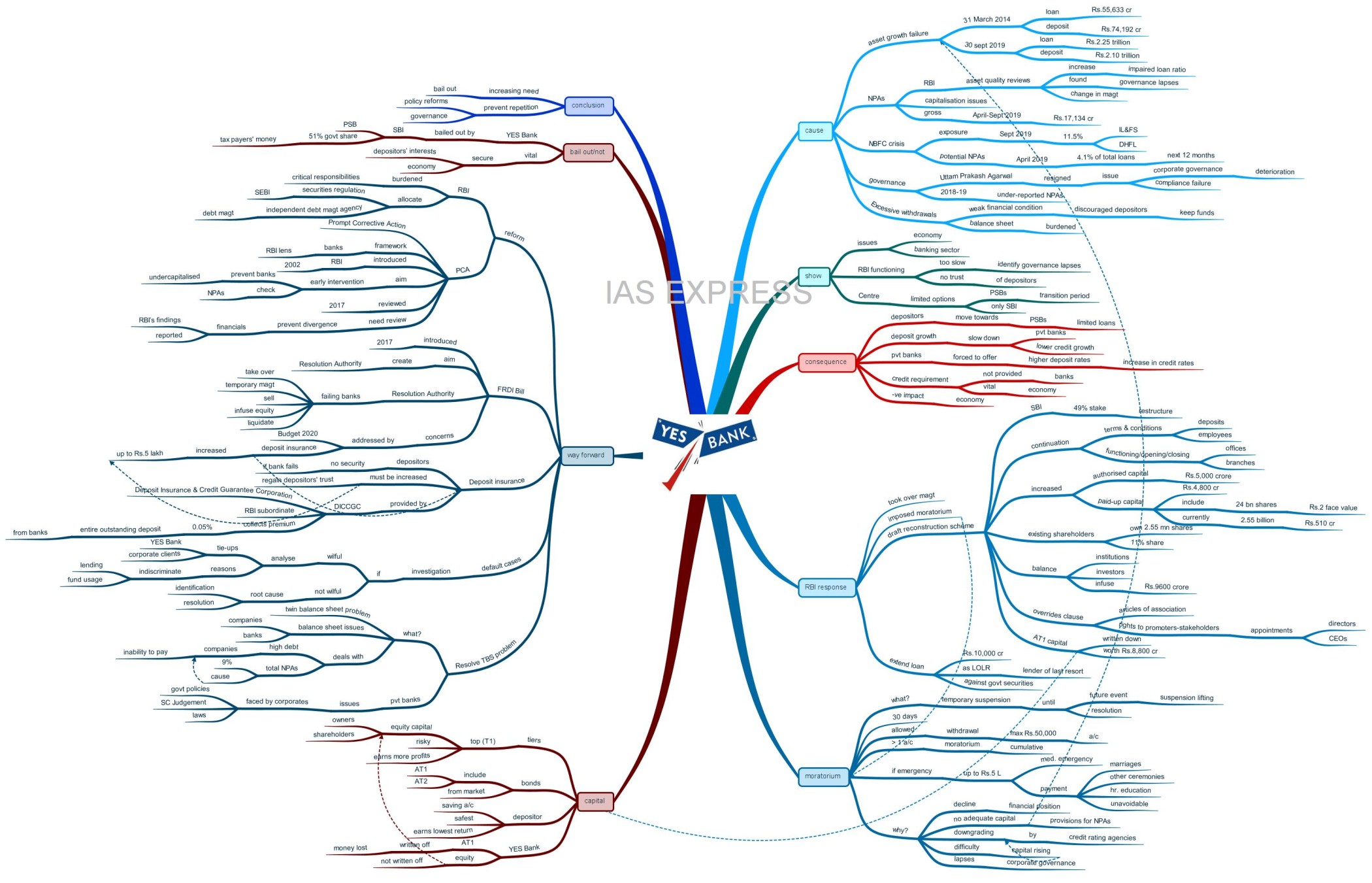

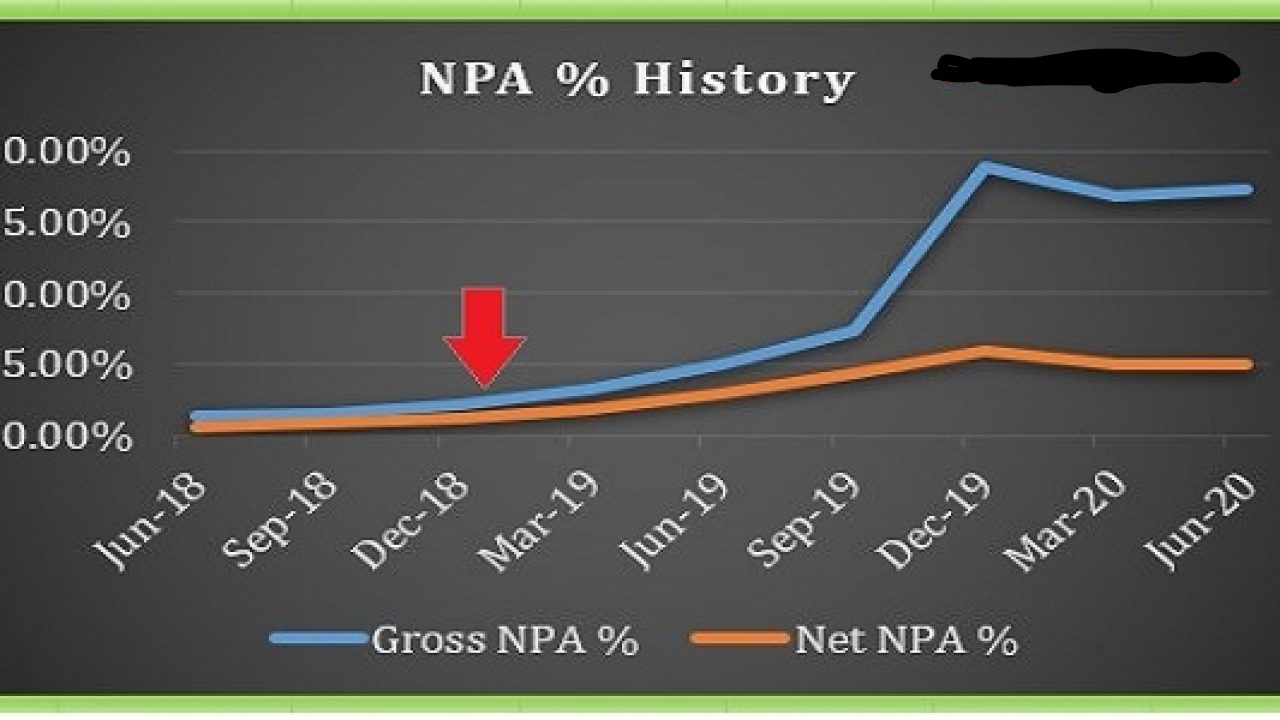

YES Bank has joined the growing list of financial institutions like IL&FS, DHFL, PMC bank that have come under the cloud for serious non-governance/compliance issues. a continual decline within the asset quality of 1 of the foremost popular retail banks of recent times, prompted RBI to come up with a series of measures to keep up stability within the financial sector.

PROPOSED REVIVAL PLAN

On 5th March 2020, YES Bank was placed under a moratorium by the RBI, which resulted in change of control of bank for 30 days, in order to come up with a revival plan for the collapse of YES bank. RBI is in discussion with SBI and LIC Housing Finance to take an investment stake within the bank and revive the bank with a new Board of Directors in place.

MORATORIUM

Moratorium means the conventional operations of the banks are suspended temporarily for a month. So, what can the moratorium and the revival mean for various stakeholders of Yes Bank.

IMPLICATIONS FOR DEPOSITORS

- Depositors aren’t allowed to withdraw over ₹50,000/- from their account till 4th April 2020.

- The limit applies to all accounts within the name of an individual across savings, current and time deposits.

- RBI allows for withdrawal of up to ₹5 lakh for depositors for specific cases like payment of medical bills,education expenses, etc. However, the method to access this amount is yet to be clarified in a more detailed RBI order detailed order on this issue.

- The limit to withdraw money could also be worrisome for depositors who have one account with Yes Bank and hence, their savings could also be stuck within the account till the time the bank decides to lift up the moratorium.

- A moratorium on current account transactions may make it difficult for small traders and businessmen to hold their daily business, especially so if they don’t have another current account. Small traders and businessmen should immediately inform their counter parties to prevent any due cheque payments in Yes Bank.

- Salary account holders who received their salary on 1st of March, won’t be ready to spend over ₹50,000 from their accounts. Salary account holders should immediately inform their employers to shift their accountsto a different bank.

- Deposit insurance is on the market only up to ₹5,00,000 of deposits ofan individual across all accounts of the bank. RBI has though assured to safeguard the interests of depositors.

- Depositors of Yes Bank can withdraw the money using the bank’s debit card and from its ATM. However, during the moratorium withdrawal of deposits through cheque, RTGS, NEFT, online facilities and demand draft has been suspended.

- Depositors are allowed to issue order instructions on any cheques issued from their Yes Bank Accounts.

IMPLICATIONS FOR BORROWERS

- Yes Bank borrowers should still repay their EMIs regularly to avoid any delay or default in repayment. this can be extremely important to scale back any adverse impact on their credit score.

- Home loan Borrowers of Yes Bank must bear in mind that the bank might not be ready to make the tranche payment for builders. it’s advisable they clarify with the bank, if they’d make their committed disbursement to the builders. they must also try and arrange for extra funds to avoid a neglect any committed home loan payments.

- Gold Loan Borrowers of Yes Bank should be ready to repay their loan and dispose of their pledged Gold because the moratorium is merely on withdrawal of deposits from the bank.

- Personal loan Borrowers of Yes Bank have little to stress as they will continue with their regular EMI repayments to bank and make sure that there’s no delay or default in payments.

- Yes Bank customers with a safety locker deposit for his or her gold and jewellery can still operate their lockers because the bank continues with its regular working hours. they’re liberated to withdraw their jewelry from the lockers.

Even as the moratorium is for a month, what has to be seen is that the final draft of revival plan. it’s expected that RBI will relax the conditions to withdraw the money from deposit accounts in an exceedingly gradual manner to avoid a run down on the bank.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.