Income Tax Audit Applicability & Application in India

Table of Contents

An Overview Income Tax Audit

- A tax audit may only be undertaken by a Chartered Accountant or a partnership of Chartered Accountants. If the latter is used, the name of the signatory who signed the report on behalf of the company must be included in the audit report. When registering at the e-filing site, the signatory must enter his or her membership number.

- The Statutory Auditor can also conduct tax audits. It is crucial to know that the number of tax audit reports that Chartered Accountants can file is limited. A Chartered Accountant is only allowed to conduct 60 tax audits each year. In the event of a corporation, the tax audit limit will apply to each of the partners.

Who is required to undergo a tax audit?

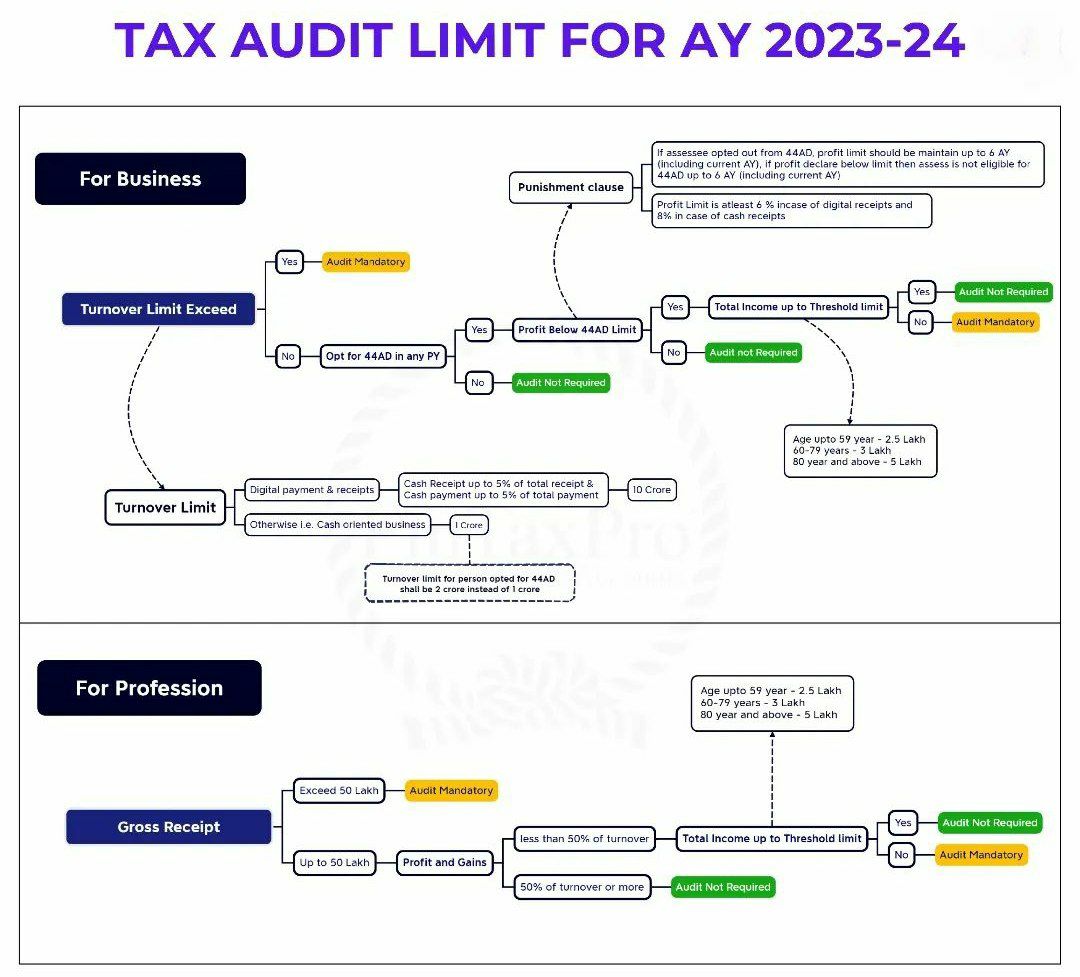

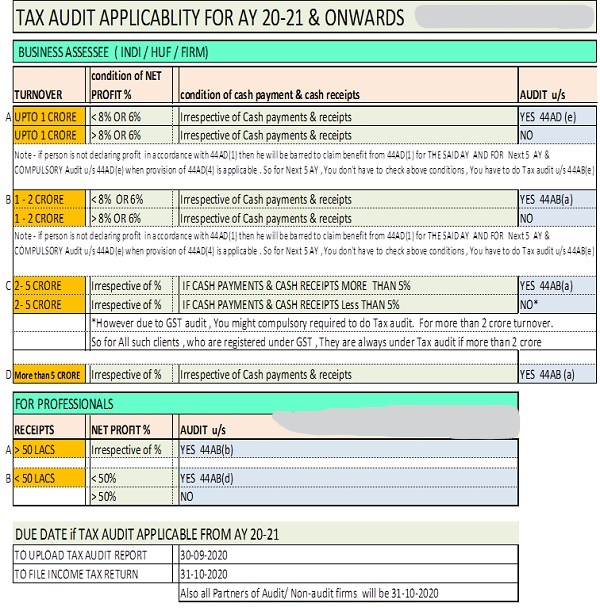

NOTE: The Rs 1 Crore threshold limit for a tax audit is planned to be enhanced to Rs 5 crore with effect from AY 2020-21 (FY 2019-20) provided the taxpayer’s cash receipts are restricted to 5% of gross receipts or turnover and cash payments are limited to 5% of aggregate payments. The following are the many types of taxpayers:

| Nature of Business or Profession | Category of Taxpayer | When audit is Mandatory? |

| Any Professions (Specified or Non-specified) | Any | When the gross receipts exceeds Rs. 50 lakhs during the relevant previous year. |

| Business | Bothe Payment and Receipt in case does not exceed 5% of the Total Receipts and Payments respectively. | If the previous year’s total sales, turnover, or gross receipts from the business exceeded Rs. 5 Crore. |

| Business | Either payment or receipt in cash exceeds 5% of the total receipts and payment respectively | If the previous year’s total sales, turnover, or gross receipts from business exceeded Rs. 1 crore. |

| Business eligible for Presumptive Tax Scheme under Section 44AD |

HUF or Resident Individual | If an assessee’s income exceeds the maximum exemption level and he has chosen for the plan in any of the previous five years but does not do so in the current year. |

| Business eligible for Presumptive Tax Scheme under Section 44AD |

Resident Partnership Firm | The taxpayer has chosen for the plan in any of the previous five years but does not do so in the current year. |

| Profession eligible for Presumptive Tax Scheme under Section 44ADA |

Resident Assessee | The taxpayer contends that his professional earnings are less than those calculated under Section 44ADA, and that his overall income exceeds the maximum exemption limit. |

| Business eligible for Presumptive Tax Scheme un- derSection44AE |

Any Assessee involved in the transportation, employment, or leasing of commodities | The taxpayer contends that his company earnings are less than the profit determined under Section 44AE. |

| Business eligible for Presumptive Tax Scheme un- der Section 44BB |

Non-resident assessee engaged in exploration of mineral oil | The taxpayer contends that his company earnings are less than the profit determined under Section 44BB. |

| Business eligible for Presumptive Tax Scheme under Section 44BBB |

Foreign Co. engaged in civil construction | Taxpayer contends that his profits from business are lower than the profit computed under Section 44BBB |

The purpose of a tax audit

The primary goals of a tax audit are as follows: • Proper bookkeeping without fraud activities, and verification of the same by an auditor.

- For reporting anomalies discovered thorough review of the books of accounts.

- For reporting different information such as tax depreciation, compliance with income tax law provisions, and so forth.

- Auditing simplifies the computation of taxes and deductions.

- The primary responsibility is to check the information provided in the taxpayer’s income tax return about income, taxes, and deductions.

Appointment of Tax Auditors in a Firm

- The Board of Directors is in charge of appointing tax auditors in a company. The Board may also transfer this authority to another officer, such as the CEO or CFO. Auditors in a partnership or sole proprietorship can be appointed by a partner, sole proprietor, or a person approved by the assessee. Furthermore, a taxpayer may engage two or more chartered accountants as joint auditors to conduct the tax audit. If all of the joint auditors agree with the findings, the audit report must be signed by all of them. In the event of disagreements, the auditors must state their views independently in a separate report.

Letter of Appointment for Tax Audit

- Before proceeding with the tax audit, the tax auditor must acquire a letter of appointment from the concerned assessee. The appointment letter must be officially signed by the person authorized to sign the income tax return. The auditor’s compensation must be included in the letter.

- In addition, the appointment letter should state that no other auditor has been entrusted with the duty for the current fiscal year, and it may provide information on the prior auditor. The latter is given in order to promote communication between the newly appointed auditor and his predecessor.

Tax Auditor’s Removal

- Management has the authority to fire a tax auditor if the auditor has delayed the submission of the report to the point that it is no longer feasible to submit the audit report before the stated due date. A tax auditor cannot be fired because he provided an adverse audit report or because the assesee is concerned that the tax auditor would give an unfavorable audit report. If a Chartered Accountant is dismissed on unjust grounds, the Institute of Chartered Accountants of India (ICAI)-established Ethical Standards Board has the authority to intervene.

Accounts audited in compliance with any other legislation

- If a taxpayer is required to have his books of accounts audited under another legislation, such as statutory audits of corporations under company law requirements, the person is not obligated to undertake his audit again for taxes purposes. The taxpayer just has to receive the audit report required by income tax legislation before the return’s due date.

Penalty for failing to complete a tax audit

Penalty for non-filing or late submission of a tax audit report

- If a taxpayer is obligated to have a tax audit performed but fails to do so, the following penalties may be imposed:

- 5 percent of all sales, revenue, or gross revenues

- 150,000 rupees

- If a taxpayer who is obligated to have his or her accounts audited fails to do so, a penalty may be imposed under Section 271B of the Income Tax Act. The penalty for failing to complete a tax audit is 0.5 percent of the turnover or gross revenues, up to Rs.1, 50,000.

However, if there is a justifiable explanation for such failure, no penalty under section 271B shall be imposed. So far, Tribunals/Courts have accepted the following legitimate causes:

- Natural Disasters

- The Tax Auditor’s Resignation and the Resultant Delay

- Long-term labour issues, such as strikes and lockouts

- Accounts lost due to circumstances beyond the Assessors’ control

- The partner in charge of the accounts’ physical incapacity or death

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.