GST Registration of sole proprietorship in India

Table of Contents

GST Registration of sole proprietorship in India

- Under the current GST regime, anyone who provides products or services must register for the Goods and Service Tax (GST). So, if your business has an annual revenue of more than Rs. 20 lakh, you must register with the Goods and Service Tax Network (GSTN).

- Once you have registered for GST, you will be given a special Goods and Service Tax Identification Number (GSTIN). Once your registration is complete, the Central Government will issue you a state-by-state 15-digit number.

- The fact that you will receive a legal identification as a supplier is one of many benefits of GST registration. By claiming an input tax credit, you can receive GST from customers who buy products and services from you.

What Situation GST Registration of sole proprietorship/Individual is needed?

- During the Financial Year supplier who supply the taxable goods or services and have a sale/received/turnover then Goods and services Tax registration if the business turnover exceeds INR 20 lakh or above. However in case special category states i.e. Himachal Pradesh, Uttarakhand, Jammu and Kashmir & North eastern states, the annual turnover limit is INR 10 lakh.

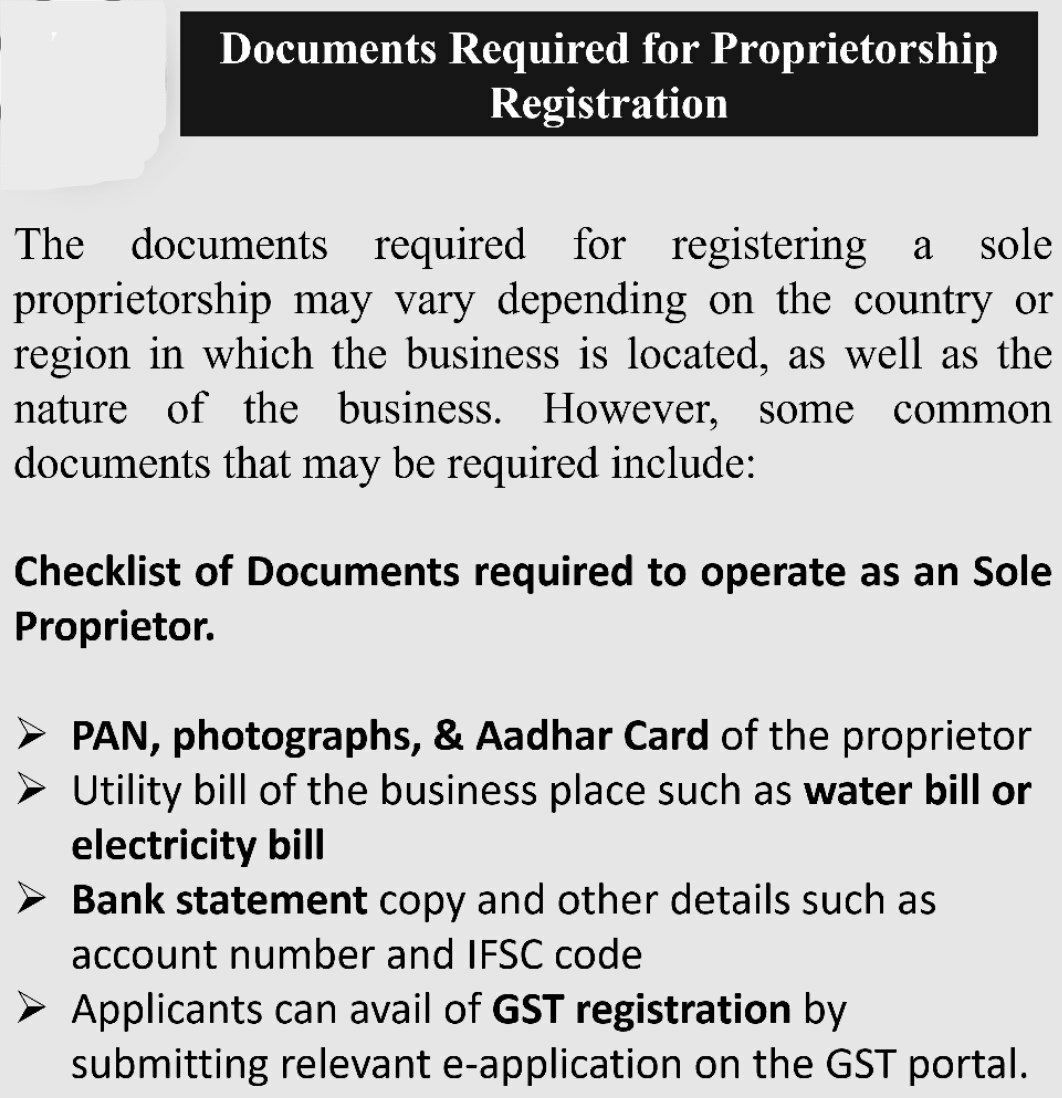

Information & Documents needed for GST Registration of sole proprietorship.

Following documents, we needed under Goods and services Tax Act while registering under GST

- PAN CARD of Applicants

- Partnership deed or Certificate of Incorporation in case company.

- DSC – Digital Signature

- Business Address proof in the form of rent, electricity bill, or for an SEZ, or rent agreement or an issued document by the Govt

- Partners or Promoters – Voter ID’s, Aadhaar cards or PAN cards.

- Firm, A Company or Bank account statement an individual & canceled cheque.

Advantage of GST registering for individuals

- The supplier has the legal right to collect tax from the purchasers. The recipient or purchaser of the goods or services can receive a credit for the taxes that have been paid.

- A provider of goods or services may be considered or recognized legally.

- Eligible to get a various other privileges & benefits under the GST Law.

- Due to the supply or both by the businesses, input of goods or services with accurate accounting of taxes paid can be used for GST practitioner registration in India.

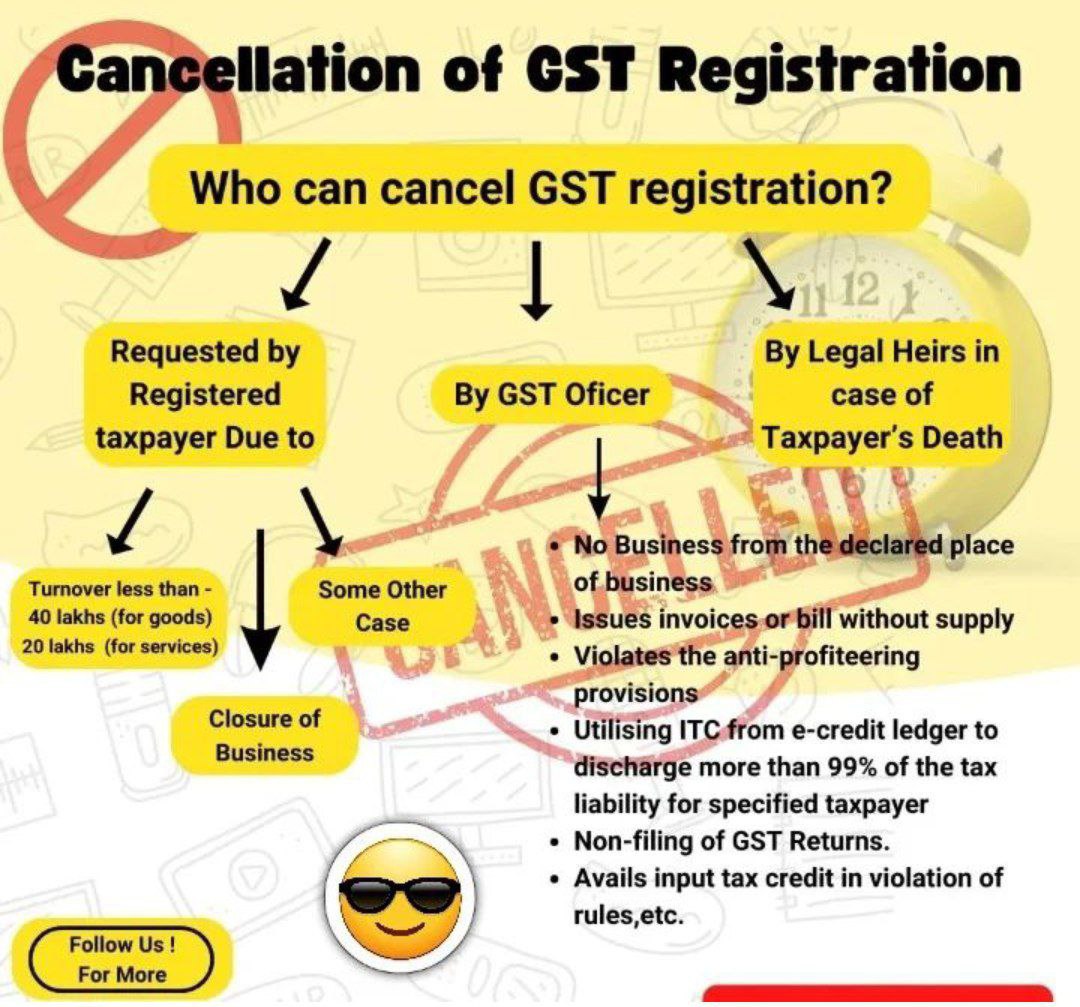

What are the implication or penalty for not registering under GST?

- For failing to pay tax or making inadequate payments, an offender must pay a penalty equal to 10% of the amount of tax owed, with a minimum payment of Rs. 10,000.

-

When the offender has intentionally avoided paying taxes, the penalty will be equal to 100% of the tax amount owing.

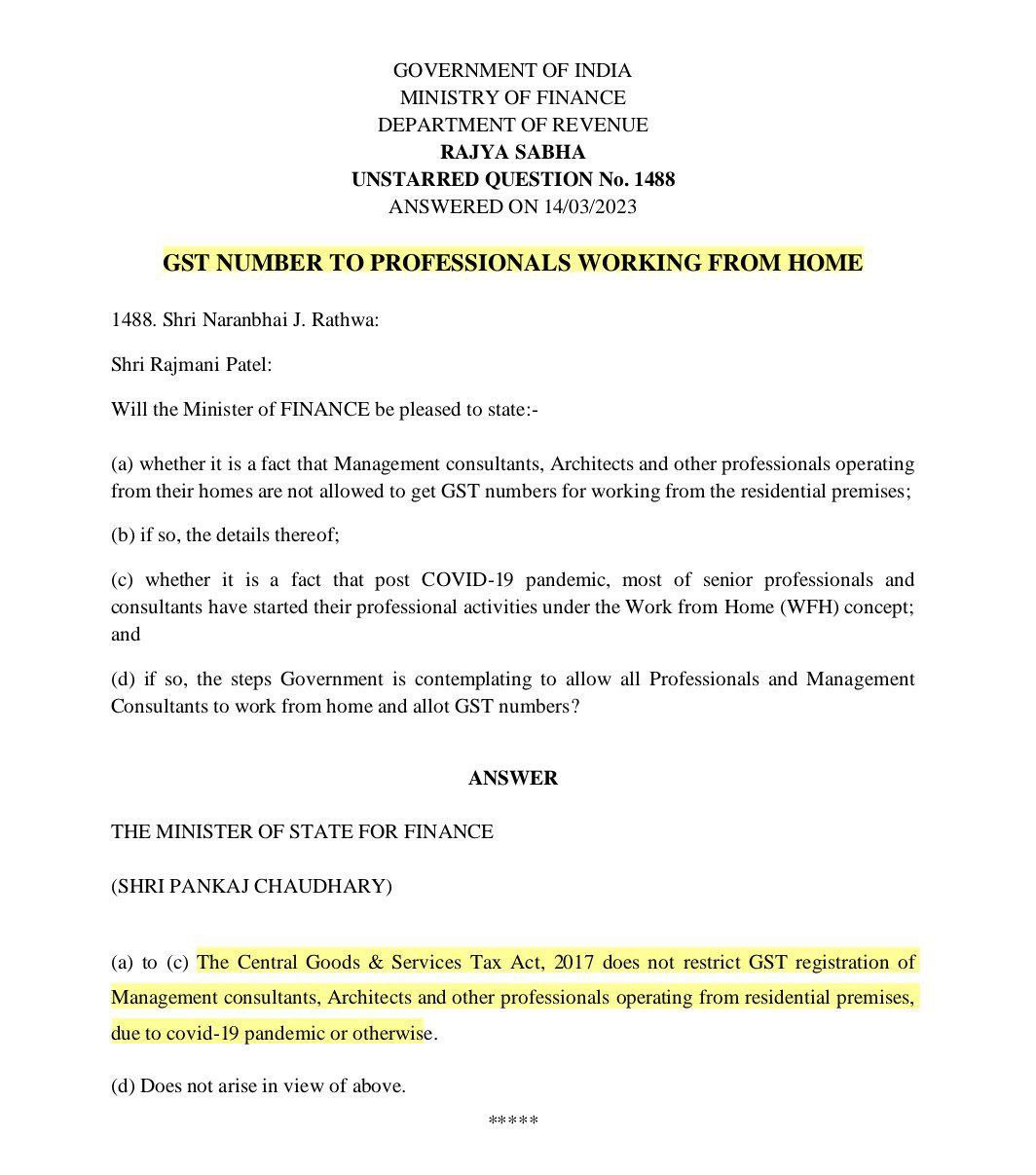

GST Registration allowed For Professional on Residential Address

GST- Forms for GST Registration, Amendment & Cancellation

| Name of GST Form | Download Form in PDF Format | Description of Form |

| Form 1 for GST Registration | GST REG- 01 | Application of Registration u/s 19(1) GST Act, 2017 |

| Form 2 for GST Registration | GST REG- 02 | Acknowledgement for GST Registration |

| Form 3 for GST Registration | GST REG- 03 | Notice for Seeking Additional information/ Clarification/documents relating to application |

| Form 4 for GST Registration | GST REG- 04 | Filing of Clarification/additional information/document |

| Form 5 for GST Registration | GST REG- 05 | Order for rejection of application of Registration / Amendment / Cancellation / Revocation of Cancellation |

| Form 6 for GST Registration | GST REG- 06 | Registration Certificate |

| Form 7 for GST Registration | GST REG- 07 | Application for Registration as TDS (u/s 51) or TCS (u/s 52) of the GST Act, 2017 |

| Form 8 for GST Registration | GST REG- 08 | Order of Cancellation of Application for Registration as TDS or TCS |

| Form 9 for GST Registration | GST REG- 09 | Application for Registration of Non Resident Taxable Person |

| Form 10 for GST Registration | GST REG- 10 | Application for registration of person supplying OIDAR services from a place o/s India to a person in India, other than a registered person |

| Form 11 for GST Registration | GST REG- 11 | Extension of registration period by casual/ non-resident taxable person. |

| Form 12 for GST Registration | GST REG- 12 | Order of Grant of Temporary Registration/ Suo Moto Registration |

| Form 13 for GST Registration | GST REG- 13 | Application for grant of Unique Identity Number (UIN) to UN Bodies/Embassies/others |

| Form 14 for GST Registration | GST REG- 14 | Application for Amendment in Registration Particulars |

| Form 15 for GST Registration | GST REG- 15 | Approval of Amendment relating to registration particulars |

| Form 16 for GST Registration | GST REG- 16 | Application for Cancellation of Registration |

| Form 17 for GST Registration | GST REG- 17 | Show Cause Notice for Cancellation of Registration |

| Form 18 for GST Registration | GST REG- 18 | Reply to the Show Cause Notice issued for cancellation for registration |

| Form 19 for GST Registration | GST REG- 19 | Order for Cancellation of Registration |

| Form 20 for GST Registration | GST REG- 20 | Order for dropping the proceedings for cancellation of registration |

| Form 21 for GST Registration | GST REG- 21 | Application for Revocation of Cancellation of Registration |

| Form 22 for GST Registration | GST REG- 22 | Approval for revocation of cancellation of registration |

| Form 23 for GST Registration | GST REG- 23 | Issuance of Show Cause Notice against the application for revocation of cancellation of registration |

| Form 24 for GST Registration | GST REG- 24 | Reply to the notice for rejection of application for revocation of cancellation of registration |

| Form 25 for GST Registration | GST REG- 25 | Certificate of Provisional Registration |

| Form 26 for GST Registration | GST REG- 26 | Application for Enrolment of Existing Taxpayer |

| Form 27 for GST Registration | GST REG- 27 | Show Cause Notice for cancellation of provisional registration |

| Form 28 for GST Registration | GST REG- 28 | Order for cancellation of provisional registration |

| Form 29 for GST Registration | GST REG- 29 | Application for Cancellation of registration of Migrated Taxpayers |

| Form 30 for GST Registration | GST REG- 30 | Form for Field Visit Report |

| Form 31 for GST Registration | GST REG- 31 | Suspension and Notice for cancellation of registration |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.