GST Registration For One Person Company in India

Table of Contents

GST Registration For One Person Company in India

- A single person is the owner and operator of One Person Company. OPC Company’s director is distinct from the company. Many One Person Company Companies moved to or registered for One Person Company GST Registration when the GST was implemented on July 1, 2017. Online GST registration has finished. Submission of physical documents is not required.

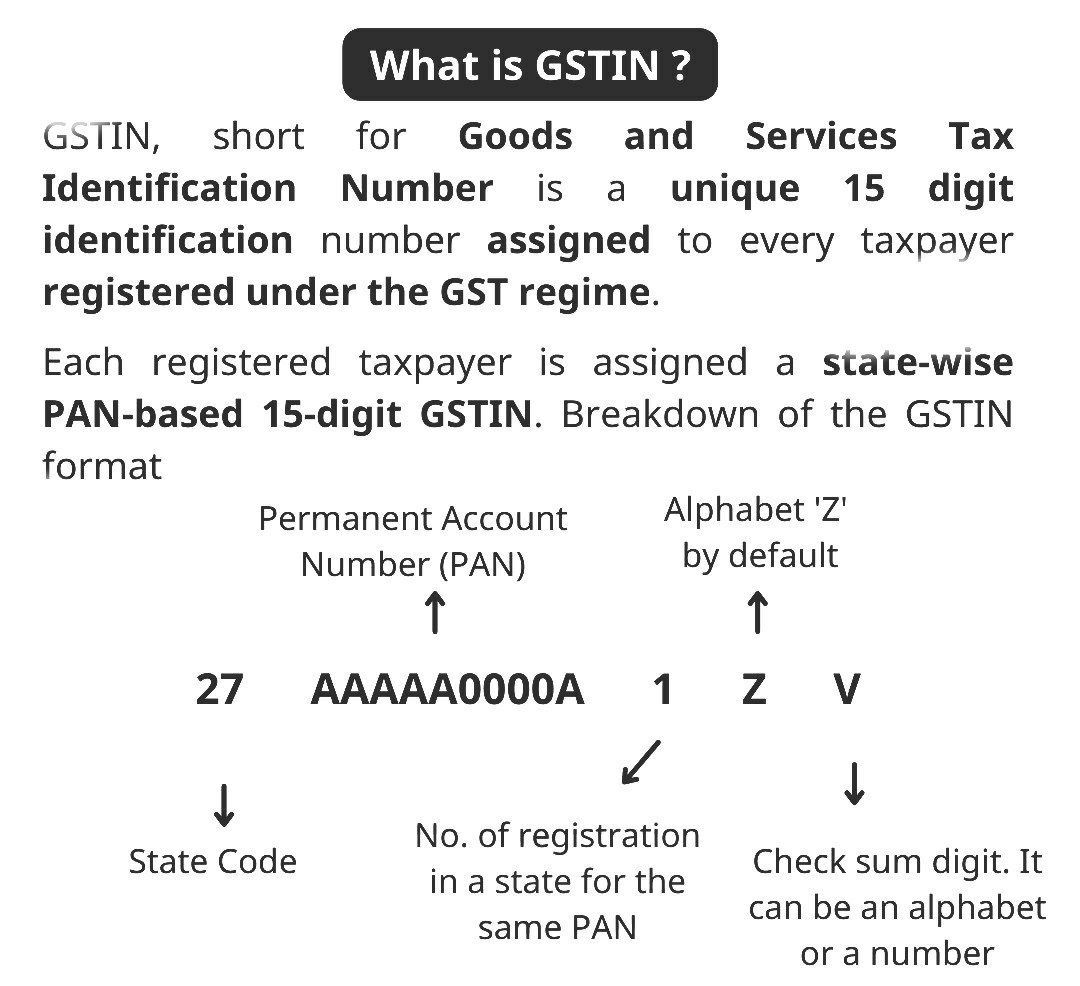

- One Person Companies must present scanned copies of their documentation while registering for GST. Based on a company’s PAN number, the GST Number is a unique 12-digit number.

- The company’s membership can expand (not mandatory). Please read the guidelines below for a straightforward registration of a one-person company. One Person Companies stand out from the competition because they just need one employee.

GST Registration Applicability for One Person Company

OPC GST Registration is compulsory irrespective of annual turnover, a OPC Company must exist if it conducts business supplying goods or services outside of the state. For ease of understanding, GST Registration Applicability can be divided into 5 Categories.

1. Turnover Criteria

- One Person Company Companies who sell goods or services & have annual sales totaling more than Rs. 20 Lac for Services and Rs. 40 Lac for Goods are needed to register under the GST.

2. Supply Outside state

- One Person Company GST Registration compulsory Regardless of annual turnover, a OPC company must exist if it conducts business supplying goods or services outside of the state. As an illustration, if an OPC registered in Maharashtra supplies goods to Punjab, GST registration is required.

3. Existing VAT / Service Tax / Excise registration

- Current/Existing only one Companies that have already registered for VAT, service tax, or excise must also register for GST. Provisional ID and password for GST Migration were first supplied by the GST Department.

4. E-commerce Seller

- OPC Companies who provide products or services through e-commerce platforms are compulsory required to register for GST. For instance, OPC Company needs to apply registration of GST for work contracts in India. if they provide goods on e-commerce platforms like Flipkart, Paytm, Amazon, etc.

5. Casual Person

- A casual taxable person is a person without a occasionally place of business who occasionally engages in the supply of goods or services. A temporary food stand or a shop selling pyrotechnics that is put up for the Diwali festival is an example of a casual taxable person.

List of Documents required for OPC GST Registration

Below documents list needed for One Person Company GST Registration.

- Copy of One Person Company Certificate

- Mobile No and Email ID of authorized person

- PAN & Address Proof of Director of OPC

- AOA & MOA of One Person Company

- Bank details- a copy of canceled cheque or bank statement

- Copy of PAN Card of One Person Company

- Address Proof of Company Own office – Copy of electricity bill/landline bill/ water bill/ municipal khata copy/ property tax receipt and in case of Rented office – Rent agreement and No objection certificate (NOC) from the owne

- Board Resolution for Appoint Authorized Person

Sample copy of Resolution:

RESOLVED THAT the Board of Directors do hereby appoint <Name>, <Designation> of the ____ OPC Company as Authorised Signatory for registration of the Company on the Goods and Service Tax (GST) System Portal and to sign and submit various document electronically and/or physically and to make applications, communications, representations, modifications or alterations on behalf of the Company before the Central GST and/or the concerned State GST authorities as and when required.

GST Registration Process of for OPC :

Any Firm or Companies or One Person Company or person selling or buying of goods or giving services have to GST Register themselves under GST to avail the privilege of input tax credit.

Online GST Registration can be made on the website of Goods and Services Tax or apply via www.carajput.com wherein a Temporary Reference Number (TRN) for the application is generated.

- First of all we needed make the Login at GST Portal.

- Submission Form Part-A (E-mail, Mobile Number, PAN).

- GST Portal verifies your detail via E-mail/ OTP.

- Then we needed to upload the needed documents.

- Access & fill in Part B using received number.

- Next Step is we get the ARN No (Application Reference No)

- Finally GST authorized Officer initiate verifying Company documents.

- GST authorized Officer have option to accepts or either rejects or our application within 7 working days in what ever the applicable position with them after proper verification.

- In case of any further clarifications or documents or proofs needed, we must give the same.

- Lastly After all whole clarifications process GSTN registration No shall be allotted to us.

As registration under GST is a online procedure now, Rajput Jain & Associates can make apply your GST registration No for your One Person Company from whole across India via India Financial Consulting Corporation Pvt Ltd.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.