Overview on Maharashtra Amnesty Scheme 2023 by GST Dept

Table of Contents

Maharashtra Amnesty Scheme 2023 for Maharashtra GST Dept announced

As part of Maharashtra Budget announcements, the Maharashtra govt on March 9 announced a ‘Amnesty scheme ‘ known as ‘Maharashtra Amnesty Scheme of Arrears of Tax, Interest, Penalty or Late Fee , In Budget speech, it is important to note, This New Amnesty Scheme, i.e Maharashtra Amnesty Scheme 2023 is applicable on difference taxes levied by Goods and services Dept before introduction of Goods and services Act

the Maharashtra State BJP Cell of Chartered Accountants (CA) presented the state government with a proposal for a GST Amnesty scheme On March 4, 2023 that would forgive tax, interest, and penalty , The proposal states that the government will beneficial because the Maharashtra government will significantly benefit financially from the extension of the MVAT amnesty scheme through July 31, 2023.

-

In case the matter related to arrears of interest, late fee, penalty details are as under:

-

- In case arrears of interest, late fee, penalty up to 2 lacs full waiver

- In case arrears of interest, late fee, penalty INR 2 to 50 lacs per statutory order 80% waiver

- As per the Terms & conditions of the above said scheme will be explained in apocopate Scheme documents, The Current period of duration of this New Amnesty Scheme Maharashtra Amnesty Scheme 2023 will be from 1st May, 2023 to 31 Oct, 2023.

-

In case of matter related to women Business enterprises details are as under :

-

- In case the matter related to women Business enterprises , the professional tax limit increased from Rs 10,000/- to Rs 25,000/- .

- Most probably this will cover Professional Tax too. New Amnesty Scheme, 2023 is called ‘Maharashtra Amnesty Scheme 2023 for of Arrears of Tax, Interest, Penalty or Late Fee.

- Women who make up to Rs 25,000 per month would not be subject to professional tax, as per the Maharashtra Budget.

- Previously, women were required to pay professional tax if their monthly income exceeded Rs 10,000. Women will still be eligible for a 1% stamp duty discount when purchasing real estate. But, the 15-year restriction prohibiting her from selling a home to a male buyer will be removed.

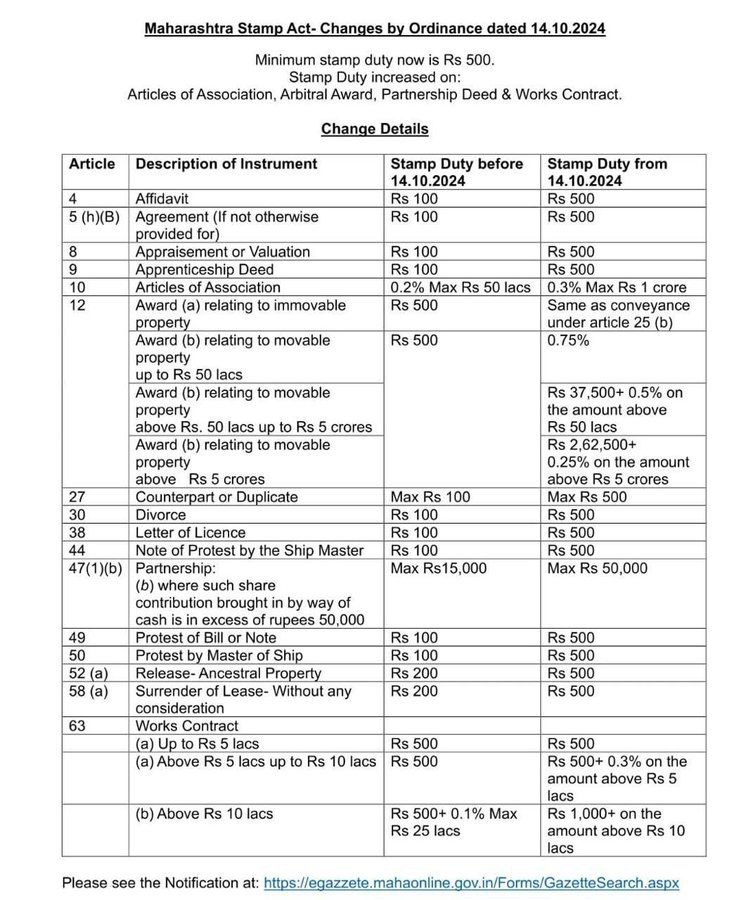

Changes in Maharashtra Stamp Act

Minimum Value of Stamp Paper required for Various Documents will be Rs.500 now

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.