Overview on Creative Professionals Guide to Bookkeeping

Table of Contents

Creative Professionals Guide to Bookkeeping: Basics of Bookkeeping

- Due to the rise in internet users, creative workers are in high demand across a variety of businesses. Their range of interacting with various businesses and the amount of money they trade are constantly expanding.

- One of the most important accounting tasks for every organisation that keeps track of financial transactions is bookkeeping. Although the fundamentals of bookkeeping for creative professionals remain the same, they need to take a different approach.

- The majority of creative workers frequently overlook bookkeeping tasks, which further impedes their accounting process.

- We offer bookkeeping assistance for creative workers, whether you are doing it on your own or working as a bookkeeper for other creative individuals. This will aid in improving the quality of your bookkeeping and helping you create accurate financial accounts for your company.

How do creative professionals handle your books?

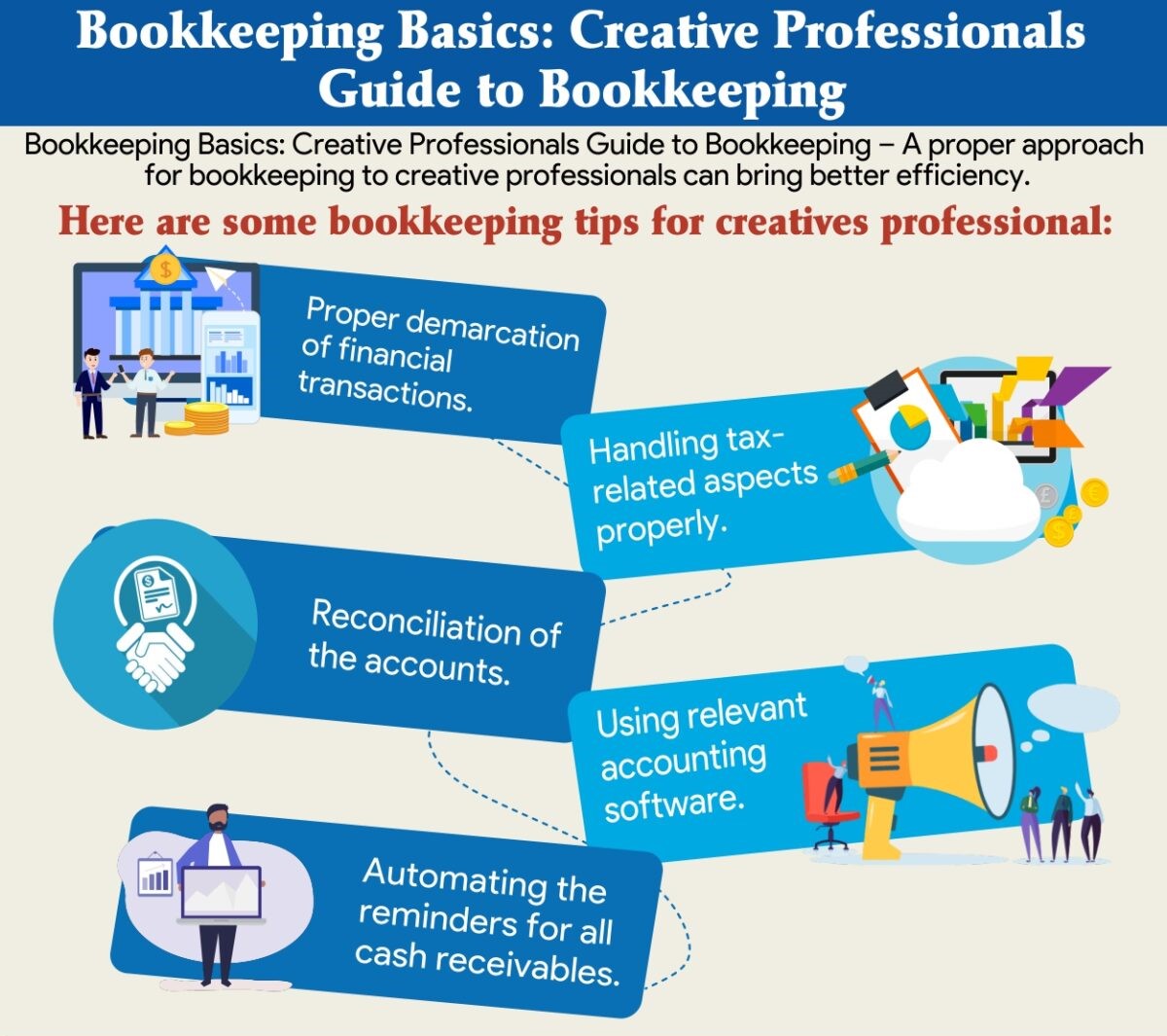

- If bookkeeping is not managed effectively, it can have an impact on your accounting and ultimately cost you more money. Some basics of bookkeeping for creative professionals are as continues to follow:

Describe your financial transactions properly.

- Basic financial transactions for creative professionals and other firms are typically the same.

- For creative professions, there are some unique financial transactions and expenses that must be accurately recorded.

- Having greater financial understanding of their company would be beneficial. Also, this will make it easier to manage the other accounting tasks correctly.

Tax Management

- Tax-related issues for creative professionals are generally comparable.

- Nonetheless, there may be some adjustments made in this case regarding tax treatment.

- So, in order to handle taxes, creative professionals need to have a solid understanding of tax law.

Reconciliation of the accounts

- Like in any other industry, reconciliation is crucial for creative workers.

- It is crucial to spot fraud and thoroughly examine financial transactions.

- It will be beneficial to improve the calibre and accuracy of the accounting activities by doing a proper reconciliation.

Accounting software adoption

- To manage bookkeeping and accounting tasks, the majority of organisations now use accounting software.

- For creative professions, using accounting software helps speed up bookkeeping.

- Also, they can use the programme to increase accuracy while lowering the cost of bookkeeping tasks

- Accounting tools like Tally Freshbooks, Xero, Quickbooks SAP and others can make bookkeeping and accounting for creative professionals simpler.

Automating cash receivables reminders

- Creative workers experience the same challenges with accounts receivable as any other business.

- It can take a lot of time and effort to remind each company to pay your invoices.

- So, you must use automated methods such as SMS, emails, and others to send reminders for cash receivables.

- This could contribute to enhancing the company’s cash flow.

Final View Points

- These are some essential bookkeeping tips for creative professionals that can raise the quality of their bookkeeping.

- Finding bookkeepers with knowledge in managing the bookkeeping needs of creative workers is very challenging.

So, you can hire professional that are skilled in managing the bookkeeping for creative workers to manage it for you. You can accomplish great bookkeeping for your company with the aid of this.

We Experts in:

- Strategic CFO Support

- Payroll

- Financial Reporting / Financial Statement/Financial Modeling

- Bookkeeping

- Accounts Payable / Accounts Receivable

- Management Accounts

- Taxation

- Accounting

- Compliance & Reporting

IFCCL offers freelance bookkeeping services for professionals in the creative industries. They have a group of skilled workers that are knowledgeable about how to efficiently and properly handle bookkeeping for creatives. They have all the necessary accounting equipment to manage the bookkeeping for creative professions. IFCCL is a well-known organisation that offers accounting services globally. Let’s set up a time to chat or call for further steps if this is something you are looking for!!,

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.