List of codes NOT eligible for section 44AD

Table of Contents

List of Professions or Businesses, which cannot Opt for Presumptive Taxation Schemes U/s 44AD

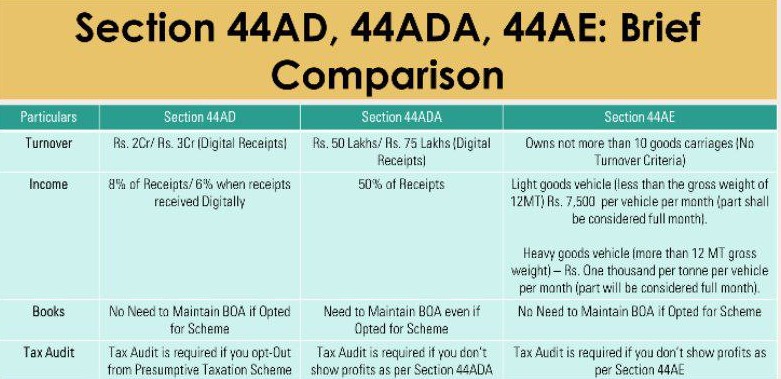

Section 44AD is applicable to any Hindu Undivided Family (HUF), resident individual or partnership firm (excluding LLPs) engaged in eligible business, with total turnover or gross receipts not exceeding INR 2 Crores in a financial year.

From FY 2016-17 onwards, professionals are not covered under Section 44AD. They fall under Section 44ADA if their gross receipts do not exceed Rs. 50 lakhs. Under Section 44ADA, 50% of the total gross receipts are deemed to be the income of the professional.

List of codes NOT eligible for section 44AD (Codes related to nature of business)

The presumptive taxation plan u/s 44AD of the Income Tax Act 1961 applies to any resident individual, resident Hindu Undivided Family, or resident Partnership Firm (excluding Limited liability partnerships) with a gross receipts or total turnover of less than INR 2 Crore. But, Following businesses are excluded from subscribing into the presumptive taxation plan u/s 44AD scheme:

- Business earning income from commission or brokerage

- Agency business

- Business of plying, hiring, or leasing of goods

Moreover that, additionally below list of professions/ businesses / business codes cannot opt for the presumptive taxation scheme u/s 44AD for filling of ITR

Computer and Related Services:

- Maintenance & repair of office, accounting and computing machinery: 14008

- Data Processing: 14003

- Other IT enabled services: 14005

- Software development: 14001

- Database activity and distribution of electronic content: 14004

- Other software consultancy: 14002

- BPO services: 14006

Health Care Services:

- Nursing homes: 18003

- Pathological laboratories: 18005

- Diagnostic centres: 18004

- Speciality and super speciality hospitals: 18002

- Dental Practice: 18011

- General hospitals: 18001

- Ayurveda Practice: 18012

- Medical clinics: 18010

- Medical education: 18017

- Practice of alternative medicine: 18019

- Unani Practice: 18013

- Homeopathy Practice: 18014

- Medical research: 18018

- Nurses or physiotherapists or other para-medical Practitioners: 18015

- Veterinary hospitals and practice: 18016

- Other healthcare services: 18020

Professions:

- Accounting, book-keeping and auditing profession: 16002

- Interior decoration: 16008

- Business & management consultancy activity: 16013

- Legal profession: 16001

- Engineering and technical consultancy: 16005

- Photography profession: 16009

- Fashion designing profession: 16007

- Tax consultancy profession: 16003

- Architectural profession: 16004

Culture and Sport:

- Literary activity: 20011

- Individual artists (excluding authors): 20010

- Other cultural activities: 20012

Others:

- General Commission Agent: 9005

- Film artist: 16020

- Medical profession: 16019

- Secretarial activities: 16018

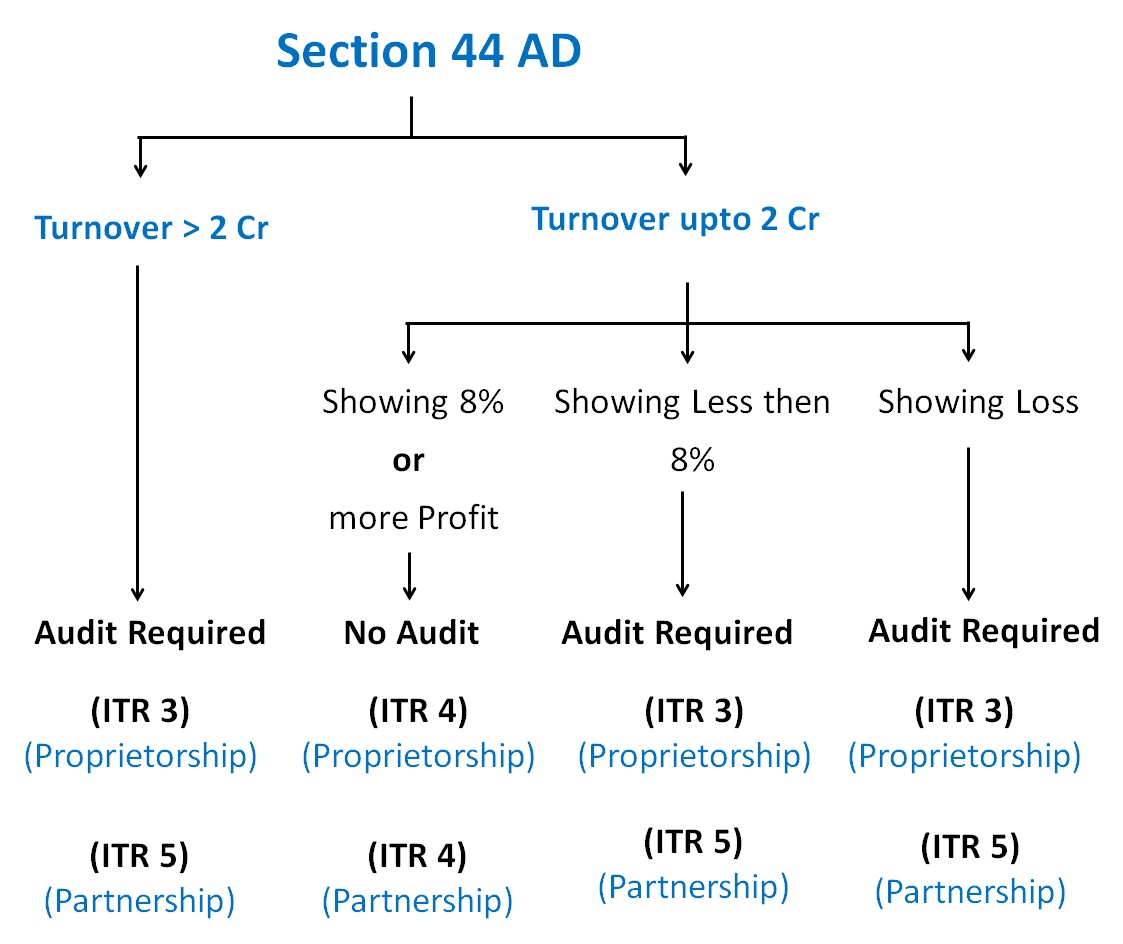

Tax Rate and Audit Requirement

- Assessees can declare income at 8% or more of the total turnover/gross receipts.

- If the declared income is less than 8%, books of accounts must be maintained, and they need to be audited by a Chartered Accountant.

- Assessees opting for Section 44AD are not required to pay advance tax. If income is derived from commissions and exceeds Rs. 10,000, advance tax must be paid.

Allowance and Disallowances

- Disallowances: Assessees opting for Section 44AD cannot claim deductions under Sections 30 to 38, including depreciation. Assessees cannot claim separate deductions for depreciation. The written down value (WDV) of assets will be calculated as if depreciation has been allowed and claimed under Section 32.

- Allowances: No disallowance will be made under Sections 40, 40A, or 43B. In case of a partnership firm, additional deductions can be claimed for salaries and interest paid to partners under Section 40(b), but only up to the specified limits.

Section 44AD vs Section 44ADA

Among the most misunderstood presumptive taxation provisions in India. Why do people choose the wrong section?

Section 44AD – For Businesses

Applies to traders, manufacturers, shop owners, and those with a turnover up to ₹2 Crore and a presumptive income:

-

8% of turnover (cash receipts)

-

6% of turnover (digital receipts)

Section 44ADA – For Professionals

Applies to CA, doctors, lawyers, architects, consultants, freelancers, designers, etc. Gross receipts up to INR 75 Lakhs, Presumptive income @ 50% The BIG Mistake Professionals wrongly opting for 44AD, business owners trying to use 44ADA. This can trigger scrutiny, rejection of return, or penalties later. One Rule to Remember

Business = 44 AD

Profession = 44ADA

Tax planning isn’t about shortcuts. It’s about choosing the right section at the right time.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.