Tax benefits decoded : Old vs new tax regimes for FY 2025–26

Table of Contents

Income Tax benefits decoded comparison of the old vs new income tax regimes for FY 2025–26

“Tax benefits decoded” offers a detailed comparison of the old vs new income tax regimes for FY 2025–26, helping taxpayers evaluate which regime is more beneficial based on their deductions and exemptions.

Rebate under Section 87A for the FY 2025–26

-

Old Regime : Full tax rebate up to income of INR 5 lakh.

-

New Regime : Full tax rebate up to income of INR 7 lakh.

Deductions & Exemptions for the FY 2025-26

Old Regime : Major deductions/exemptions allowed:

-

80C (PF, LIC, ELSS, PPF, Housing Loan Principal, etc.) – up to INR 1.5 lakh

-

80D – Medical Insurance

-

HRA exemption

-

LTA exemption

-

Standard Deduction for Salaried – INR 50,000

-

Home Loan Interest (Section 24(b)) – up to INR 2 lakh (self-occupied)

-

Many other deductions available.

New Regime : Most deductions/exemptions not allowed, except:

-

NPS Employer Contribution – 80CCD(2)

-

Standard Deduction – INR 50,000 (introduced from Budget 2023)

-

Family Pension Deduction – INR 15,000

Key Allowances Comparison: Old vs New Regime

| Allowance | Old Regime | New Regime | Cap / Notes | Documents Required |

| HRA | Yes | No | Per formula, max 50% of basic | Rent receipt, rental agreement, landlord’s PAN |

| Home loan interest | Yes | No | ₹2 lakh for self-occupied property | Interest certificate |

| LTA | Yes | No | 2 trips in 4 years | Travel tickets and boarding pass |

| Car lease | Yes | No | — | Lease agreement |

| Car fuel/maintenance | Yes | No | Taxable ₹1,800–2,400 (personal use) | Fuel bills, maintenance bills |

| Driver salary | Yes | No | ₹900/month perquisite (personal use) | Salary slips, driver employment agreement |

| Telephone | Yes | No | — | Post-paid bills in employee’s name |

| Meal card | Yes | No | ₹50 per meal | Usage statement |

| NPS | Yes | Yes | Old: 10% of basic (employee + employer), New: 14% of basic (employer only) | Transaction statement |

Note: Some benefits like HRA and home loan interest are conditionally available in the new regime.

Simplicity vs Tax Saving

-

Old Regime – Useful for those with high investments in tax-saving instruments (80C, 80D, Home Loan, HRA).

-

New Regime – Simpler, lower rates, but fewer exemptions. Beneficial for those with fewer investments/deductions.

-

Which is Better : If deductions (80C + 80D + HRA + Housing Loan Interest etc.) are more than INR 3–3.5 lakh, the Old Regime usually results in lower tax. If deductions are less than INR 3 lakh, the New Regime is generally better.

Regime Comparison Table – Breakeven Analysis (FY 2025–26)

| Gross Salary | Breakeven Deduction | Tax Under Both Regimes |

| INR 7 lakh | INR 1.5 lakh | 0 under both regimes |

| INR 8 lakh | INR 2.5 lakh | 0 under both regimes |

| INR 10 lakh | INR 4.5 lakh | INR 81,900 |

| INR 14 lakh | INR 5.18 lakh | INR 81,900 |

| INR 16 lakh | INR 5.68 lakh | INR 1,13,100 |

| INR 20 lakh | INR 7.08 lakh | INR 1,92,400 |

| INR 24 lakh | INR 7.87 lakh | INR 2,92,500 |

| INR 25 lakh | INR 8 lakh | ₹3,09,000 |

| INR 30 lakh | INR 8 lakh | INR 4,75,800 |

| ₹50 lakh | ₹8 lakh | INR 10,99,800 |

| INR 1 crore | INR 8 lakh | INR 29,25,780 |

| INR 1.5 crore | INR 8 lakh | INR 48,52,700 |

| INR 2 crore | INR 8 lakh | INR 66,46,770 |

| INR 2.5 crore | INR 8 lakh | INR 91,74,750 |

| INR 5 crore | INR 8 lakh | INR 1,89,24,750 |

How to Choose the Best Regime?

- If deductions + exemptions > breakeven → Opt for Old Regime ✅

- If deductions + exemptions ≤ breakeven → Opt for New Regime ✅

Illustrative Example: Gross Salary = ₹40 lakh and Deductions Claimed = ₹12.5 lakh

| Category | Amount (₹) |

| HRA | 10,00,000 |

| PPF/ELSS (80C) | 1,50,000 |

| NPS (80CCD) | 50,000 |

| Medical (80D*) | 50,000 |

| Total | 12,50,000 |

- Since ₹12.5 lakh > ₹8 lakh breakeven for ₹40 lakh salary → Old Regime is better

- Breakeven thresholds already include common deductions. So only additional benefits like HRA, home loan, etc., should be used to evaluate the better option.

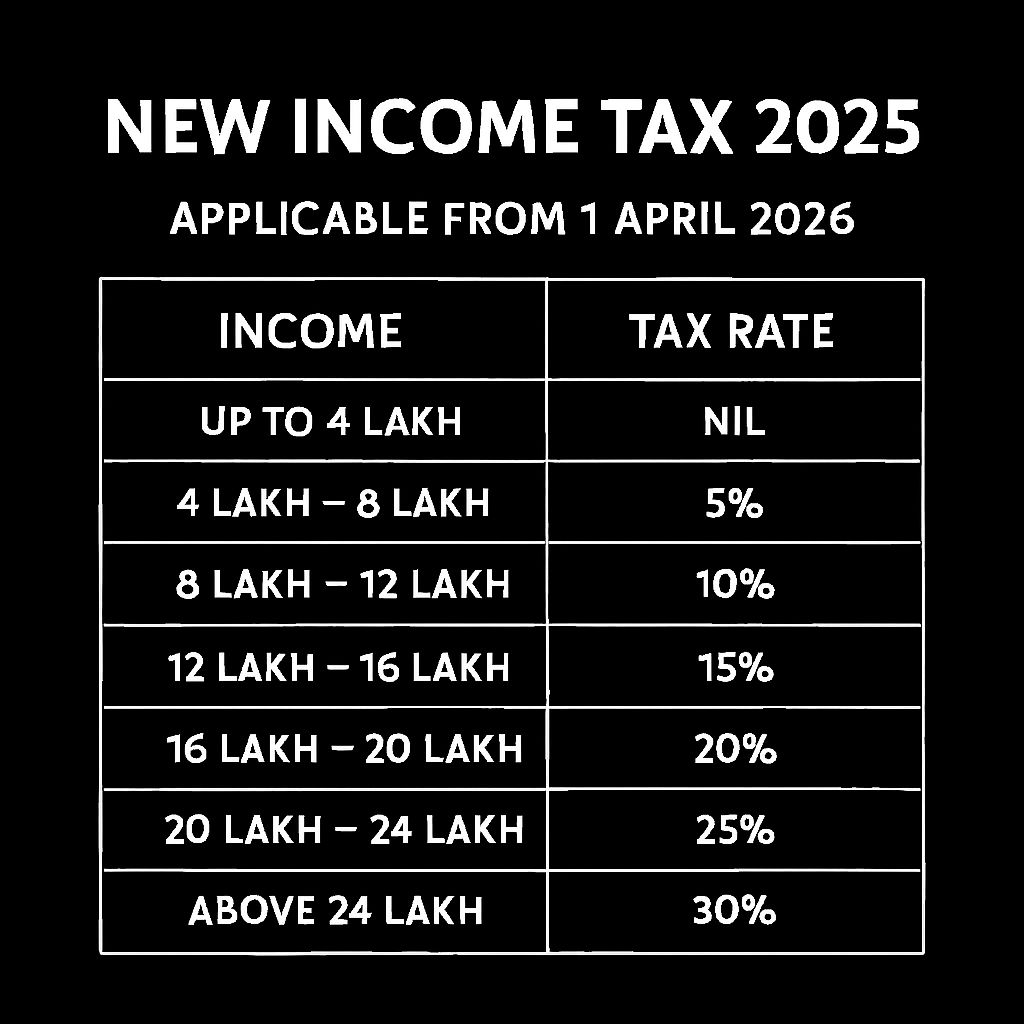

New Income Tax Law 2025 (Effective from 1 April 2026)

- India is gearing up to replace the Income-tax Act, 1961 with an all-new law designed to simplify, modernize, and make taxation more transparent. Details of key highlights are mentioned here under

- Simplified Structure : Sections reduced: 819 ➝ 536 & Chapters reduced: 47 ➝ 23 & Assessment Year” & “Previous Year” merged into a single Tax Year.

- New Tax Slabs (Financial Year 2025–26) – Default Regime

- Up to INR 4 lakh – Nil

- INR 4–8 lakh – 5%

- INR 8–12 lakh – 10%

- INR 12–16 lakh – 15%

- INR 16–20 lakh – 20%

- INR 20–24 lakh – 25%

- Above INR 24 lakh – 30%

- Higher Rebate (Section 87A Income-tax Act, 1961) : Rebate increased to INR 60,000 & Income up to INR 12 lakh effectively tax-free

- Compliance & Refunds : Refunds allowed even for belated returns & Tax deduction at sources correction window shortened from 6 years to 2 years

- Pension & Gratuity : Clear deductions for family members receiving commuted pension or gratuity

- Charitable Trusts : Capital gains can be reinvested & Relaxed norms for anonymous donations

- Faceless Assessments : More digital, minimal human interface & Aimed at reducing corruption & increasing transparency

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.