Regulations & Rules for IT Companies & I/E in Dubai

Table of Contents

Company formation in Dubai related Regulatory Requirements

Dubai allows IT companies including those engaged in software development, IT services, hardware trading, import/export of IT equipment, and tech-enabled services to operate under two broad regimes:

Mainland vs. Free Zone: Regulatory Differences in company formation in Dubai

Dubai Mainland (DED – Department of Economy & Tourism)

- Regulated by: Dubai Economic Department (DED)

- Ownership: 100% foreign ownership permitted (no local sponsor required for most IT & trading activities).

- Business Scope: Allowed to trade anywhere in UAE, take government contracts.

- Licensing:

- IT Services License (Professional)

- Commercial / Trading License (for import/export of IT hardware)

Office space mandatory, Registration with Dubai Chamber, Import–export via UAE Customs (Federal Customs Authority) & Compliance with UAE Corporate Tax Law (9%) and VAT (5%)

Free Zones (More flexibility) Dubai Company

A Free Zone company offers significantly higher operational flexibility. It is ideal if you intend to operate from the UAE or cater to both local and international markets. Key advantages include Ability to conduct international business, and in many Free Zones, business within the UAE (subject to certain conditions)

- Eligibility to apply for UAE residence visas for owners and employees

- Ability to open corporate bank accounts in UAE banks

- Lower setup cost and simplified procedures compared to mainland setups

Benefits

- 100% foreign ownership

- 0% corporate tax on Free Zone–qualified income

- No customs duties for free-zone internal trade

- Fast incorporation (3–7 days)

- No office required in some zones (Flexi-Desk available)

Offshore Company in Dubai

An offshore company is designed for conducting business outside the UAE. It cannot generate revenue, sign contracts, or conduct commercial activities within the UAE mainland or any Free Zone. Key points include:

- No UAE commercial activity permitted

- Not eligible for UAE residence visas (no visa quota is issued for offshore structures)

- VAT is not applicable, as all services are rendered outside the UAE

- Corporate bank account opening is allowed, subject to each bank’s compliance and due-diligence requirements

- Suitable for holding companies, international consulting, global trading, or asset-holding activities conducted entirely outside the UAE

Licenses Required for IT + Import–Export Activities

IT Services / Software Development :

Typical approved activities like IT consulting, Software development, Cloud services, Cybersecurity services, Data analytics & AI services & Web & app development. License Types

-

-

- Mainland: Professional License – IT Services

- Free Zone: IT / Consultancy / Software License

-

Import & Export of IT Goods : If you want to trade hardware, like Laptops, servers, Cybersecurity equipment, Routers, switches, IoT devices, Mobile phones, accessories, IT peripherals, Chips, components.

Regulations & Rules for IT Companies & Import–Export in Dubai

License Required : Commercial Trading License (IT Equipment)

Mandatory License Required : Customs Registration (Importer/Exporter Code) : Issued by Dubai Customs once you have Trade license, Establishment card, E-sign card & customs account

Customs, Warehousing, and Logistics Rules

Importing goods into Free Zone

- Goods enter free zone duty-free

- No VAT applicable inside the Free Zone

- If goods later enter the mainland → 5% Customs Duty + 5% VAT

Importing directly into Mainland

- 5% customs duty

- 5% VAT

- Classification under HS Code required,

- Invoicing in line with FTA VAT compliance

Warehousing regulations

- JAFZA, DWC, DMCC offer bonded warehouses. Warehousing regulations required for dubai is require Warehouse lease, Warehouse code activation & Annual inspection & audits

Additional Approvals (Depending on Goods)

Most IT-related items do not require special approvals. But these items do:

| IT Equipment Type | Required Approval |

| Telecommunication devices (routers, radio equipment, access points) | TRA (Telecom Regulatory Authority) |

| Drones / sensors | GCAA approval |

| High-grade encrypted devices | May require security approval |

| Crypto mining equipment | Only in specific Free Zones; DMCC has crypto-friendly regulations |

Visa & Employment Regulations

- Both Mainland & Free Zone entities can issue visas to employees. Visa quota depends on office size like Flexi desk: 1–3 visas & Larger office/warehouse: proportional visa quota

Banking Compliance

- Opening a UAE corporate bank account requires Passport & visa copies, Trade license, Lease agreement, Business plan & KYC disclosures (source of funds, expected transactions)

- Banks may conduct Video verification, On-site inspection (mandatory for some banks)

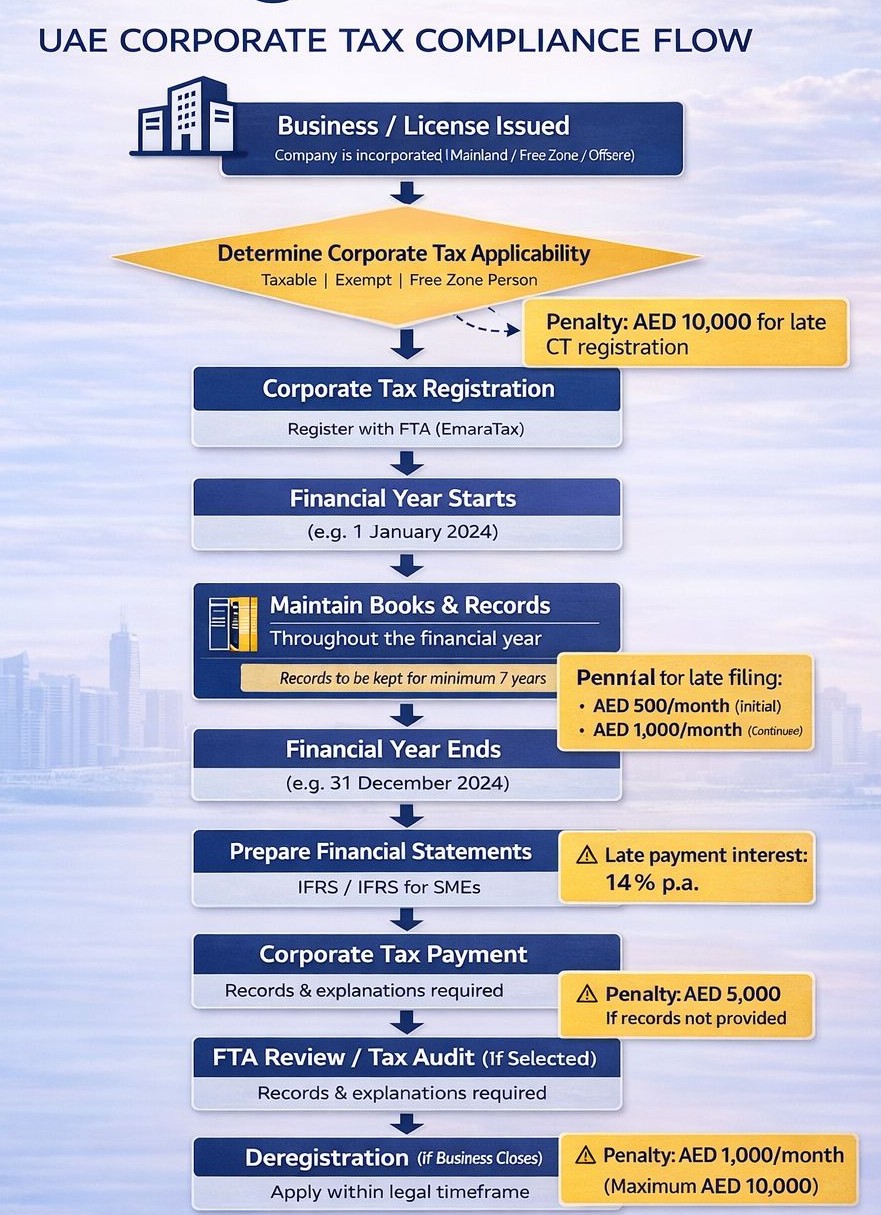

Corporate Tax, VAT & ESR Compliance in Dubai

Corporate Tax

-

- Free Zones: 0% tax for qualifying income (export-oriented activity)

- Mainland: 9% corporate tax on profits > AED 375,000

VAT

-

- Mandatory if annual turnover > AED 375,000

- Export of services: 0% VAT (conditions apply)

Economic Substance Regulations (ESR) : Applicable if you perform Headquarters business, Distribution & service centre business, IP-related business

Documents Required to Set Up Company

The exact requirements vary depending on whether the business is set up in a Free Zone or on the Dubai Mainland, as well as the structure (individual or corporate shareholder). However, the following list covers the standard documents commonly required for IT and import–export companies.

Documents Required – If the shareholding is by Individuals:

For Individuals: at STAGE 1.: Application Forms, Professional & Experience Certificate (Profile of Company Shareholders/Directors/Manager), Passport Copy and Utility Bills (as Address Proof) of Shareholders/Directors/Manager. Certificate of Good Standing (to be issued by your existing bankers) & Business Plan- Passport copy, Passport-size photo, Residence visa copy (if applicable), Address proof, Mobile & email ID.

STAGE 2 (After Initial Approvals are obtained). MOA & AOA typed and signed, to submit 2 full sets, Service Agreement, It is mandatory to obtain a P.O. Box upon the completion of the registration of the company. Additional documents may be required by the Authorities on a case-to-case basis.

For Corporate Shareholder: if the shareholding is by a corporate body (not individuals), i.e., you are setting up the subsidiary of the parent company, the following additional documents are required:

- The parent company MoA /AoA are required, should be attested and legalized by UAE embassy in country of origin, then authenticated from the Ministry of Foreign affairs, UAE.

- Board Resolution by the Parent Holding Company resolving to set up the Subsidiary in Dubai-UAE Free Zone and Appointing the Director/Manager (required to be attested and legalized by UAE embassy in country of origin, then authenticated from the Ministry of Foreign affairs, UAE), Certificate of incorporation, Memorandum & Articles, Board Resolution, UBO declaration.

Free Zone–specific documents: Following are the documents required for new license.

- Trade Name (At least 3 name choice)

- Business Activity

- Passport copies of the shareholders.

- Passport size photograph.

- Proof of Address: Rental agreement (issued within the last 12 months)

- Business plan, Application form, Lease agreement (Flexi-desk or office) (Any one of the following (must be recent):

- Utility bill (less than 3 months old),

- Bank statement (less than 3 months old),

Note: If the document is not in English or Latin script (e.g., Russian, Japanese), a certified English translation is required)

Basic Identification Documents (All Structures)

- Passport copies of all shareholders, directors, and managers

- Passport-size photographs of key persons

- Proof of residential address (any one) like Utility bill, Bank statement, Tenancy contract

- UAE entry stamp or visa page (if applicable)

Company Formation Documents

Trade Name & License Applications

-

- Trade Name Reservation Certificate

- Initial Approval Certificate (by Free Zone Authority or DED – for Mainland)

- Application Form for License (IT services / trading / import–export)

- Constitutional Documents

-

- Memorandum of Association (MOA)

- Articles of Association (AOA) (not always required in Free Zones)

- Shareholders’ Resolution (for corporate entities or special structures)

Address / Office – Related Documents

Mainland Companies

-

- Ejari-registered Tenancy Contract (mandatory physical office or flexi-desk)

- Location map (sometimes requested by DED)

Free Zone Companies

-

- Lease Agreement / Flexi-desk Agreement

- Office/Facility Allocation Letter (issued by the Free Zone Authority)

Documents Related to Shareholders & Managers

If Shareholders/Managers Already Residing in UAE

- Emirates ID copy

- UAE Residence Visa copy

- NOC from current UAE sponsor (if employed under another company)

If Shareholders Are Corporate Entities

- Certificate of Incorporation

- Board Resolution authorizing company setup

- Memorandum & Articles of the parent company

- Certificate of Incumbency / Good Standing

- UBO (Ultimate Beneficial Owner) Declaration

Business Activity–Specific Documents

For IT / Software / Tech Activities

- Business Plan including:

- Proposed services (software development, IT consulting, cloud, etc.)

- Market scope (UAE / GCC / international)

- Shareholding structure

- Office and manpower requirements

For Import–Export / Trading Activities

-

- Product list & HS Codes

- Warehouse lease agreement (if applicable)

- Customs Import–Export Code Registration documents

- Approval from TRA (for telecom equipment, routers, radio devices)

- GCAA Approvals (for drones or specific electronics)

Compliance and Regulatory Documents

-

- UBO Declaration Form (mandatory across UAE)

- Anti–Money Laundering (AML) Compliance Form

- Specimen signatures of shareholders/managers

- Board Resolution appointing a manager (if required)

- Data protection / cybersecurity declarations (in certain tech Free Zones)

Optional or Scenario-Based Documents

-

- Power of Attorney (POA) if someone signs on behalf of a shareholder

- Audited financial statements (for corporate shareholders)

- Translation & Notarization (for documents issued outside UAE)

- Legalization at UAE Embassy for foreign company documents

Additional Document Requirements: Government and Immigration authorities may request additional documents during the review or approval stages, depending on the applicant’s profile and compliance requirements.

Timeline Overview

| Process Stage | Estimated Time |

| Immigration Pre-Approval, Compliance & KYC | 2–3 working days |

| Company Setup & Trade License Issuance | 3–5 working days |

| Immigration Card Application (for visa purposes) | 5 working days |

| Entry Visa Application | 3–5 working days |

| Change of Status | Upon entry into the UAE (additional cost applies for in-UAE processing) |

| Medical Test & Emirates ID Biometrics | 3 working days (physical presence required) |

| Residency Visa Approval & Stamping | 5–8 working days (physical presence required) |

The above timelines reflect average processing times provided by known Free Zone and UAE Immigration authorities. Actual timelines may vary depending on documentation, applicant profile, compliance checks, and submission completeness. Processing begins only after all required documents are received.

Timeline & Cost (Approx.)

| Type | Time | Cost (Approx.) |

| Mainland IT License | 5–10 days | AED 12,000–18,000 |

| Free Zone IT License (no visa) | 1–3 days | AED 10,000–14,000 |

| A Free Zone with Trading + Visa Quota | 5–7 days | AED 18,000–25,000 |

| Customs Import–Export Code | 1–2 days | AED 500–1,000 |

| Warehouse setup | 2–4 weeks | AED 20,000+ |

UAE Free Zone Comparison Chart

| Feature | Meydan Free Zone (Dubai) | IFZA (Dubai) | SHAMS (Sharjah Media City) | Ajman Media City (AMC) |

| Why Choose This Zone? | Prestige & High Bankability – Prime Dubai address ideal for established or reputation-focused firms. | Best Overall Value in Dubai – Affordable Dubai presence with strong scalability. | Unbeatable Low-Cost Entry & Visa Quota – Lowest setup cost for service/creative licenses with high visa allowance. | Maximum Cost Efficiency & Speed – Fastest, cheapest, and simplest remote setup experience. |

| Location & Prestige | Elite Tier – Located in the Meydan Hotel district, offering a prestigious address preferred by banks. | High Tier – Recognized jurisdiction providing strong Dubai-based corporate identity. | Mid Tier – Strategically near Dubai–Sharjah border; cost-effective and functional. | Economy Tier – Focused on affordability rather than branding or prestige. |

| Ideal Client Profile | Businesses prioritizing a high-prestige Dubai address and stronger bank confidence (typically 1–2 visas). | Firms wanting a Dubai identity with good pricing and scalable visa options. | Entrepreneurs seeking the absolute lowest entry cost with maximum visa quotas. | Cost-focused clients needing the cheapest and fastest remote registration. |

| Estimated 1-Visa Setup Cost | Higher – Approx. AED 20,600 | Mid-Range – Approx. AED 17,700 – 21,500 | Lower – Approx. AED 13,800 – 14,900 | Lowest – Often below AED 12,000 |

| Visa Flexibility / Quota | Excellent – High quota even with Flexi-Desk (up to 4 visas). | Excellent – Flexible packages with strong scalability. | Exceptional – Very high visa allowances on the most economical packages. | High – Competitive visa pricing and generous allotments. |

| Bank Account Facilitation | Superior – Strongest acceptance from UAE banks due to location and reputation. | Very Good – Well-recognized with strong banking relationships. | Good – Smooth overall, but may require additional KYC. | Good – Fast setup supports quicker banking applications. |

| License Setup Time | ~2 Days – Very fast. | 2–4 Working Days | 3–5 Working Days | 1–3 Working Days – Often the fastest. |

| Resident Visa Processing | Fast: 5–7 working days | Fast: 5–7 working days | Varies based on application workload | Fastest: 1–3 working days |

Suitable for IT services, consultancy, import–export, e-commerce, software development, and global service operation Some popular IT & trading-oriented Free Zones:

- Dubai Silicon Oasis (DSO) – IT companies, development centres

- A Dubai Internet City (DIC) – Software, IT consulting, cloud, media tech

- Dubai Multi Commodities Centre (DMCC) – Trading & import–export

- Jebel Ali Free Zone (JAFZA) – Large imports/exports, warehousing

- Meydan Free Zone / IFZA – Low-cost, service-oriented licenses

Restrictions : In the free trade zone export freely, but local UAE trading requires Local distributor, or Paying 5% customs duty upon import into mainland & Sometimes a mainland branch for larger operations

Which Jurisdiction/Zone Is Most Suitable for an IT + Import/Export Business in Dubai?

Choosing between Mainland and Free Zone depends on whether your operations will focus on UAE domestic market, international markets, or a mix of both (IT + trading + warehousing + services). Below is a clear evaluation.

Mainland (Best for Local Market Operations & Diversified Activities)

Mainland is the preferred choice if your IT company intends to serve UAE customers directly, operate physical facilities, or expand into multiple business verticals. Following are main key Advantages for mainland area.

- Full UAE market access: You can trade, sell, and provide services anywhere in the UAE without restrictions.

- Freedom to open multiple offices/branches across Dubai or other Emirates.

- Broader activity choices — Combines IT services + trading + import/export + warehousing + onshore supply.

- Eligibility for government tenders — Required if you plan to work with UAE ministries, public-sector companies, smart-city projects, etc.

- Higher visa & workforce flexibility — Visa quotas grow based on office size, beneficial for scaling teams.

- More established local credibility for B2B operations, logistics, and retail distribution.

Ideal for clint If Clint will sell to UAE customers (corporate, retail, government), Clint expect to have a warehouse, showroom, or tech support centre. Clint want long-term freedom to add activities (software, hardware, trading, consulting). Clint want multiple visas and a growing team in UAE.

For Free Zone (Best for International / Export-Focused Businesses)

Free Zones are excellent for light operations, digital services, and companies that primarily target global markets, not domestic UAE customers. Key Limitations like Restricted access to UAE mainland market. Clints cannot directly trade or serve mainland clients. & A local distributor, commercial agent, or mainland branch is required for UAE domestic sales.

- Activity restrictions like Activities must fit within the Free Zone’s approved list.

- Visa limitations like Tied to the size of Flexi-desk or office package.

- Government tender access limited like Generally not eligible for local tenders.

- Domestic presence constraints like Cannot have mainland retail outlets or warehouses without extra licensing.

Ideal for You If Clints will mostly serve international clients. Clints want a low-cost setup for IT services or software development. Clints will import goods into the Free Zone and re-export them abroad. & Clints don’t require a large physical presence inside UAE.

Which is the Most Suitable Option for IT + Import/Export?

Once Choose Mainland if your business will:

- Import IT hardware and sell within UAE

- Provide IT services directly to local companies

- Bid for government or semi-government IT projects

- Build a domestic presence (office, support centre, warehouse)

- Plan future diversification (IT + consulting + trading + cybersecurity + retail)

In case you Choose Free Zone if your business will:

- Primarily export goods outside UAE

- Run software development or IT consulting for overseas clients

- Operate with minimal staff (1–3 visas)

- Prefer lower upfront cost and simpler compliance

- Use a Free Zone warehouse for transit, re-export, or bonded storage

Best Zones for IT + Import/Export (If Free Zone Chosen)

| Purpose | Recommended Zone |

| IT/software services | Dubai Internet City (DIC), DSO, IFZA, Meydan |

| Import/export + tech trading | JAFZA, DMCC, Dubai South (DWC) |

| Low-cost IT consulting | Meydan Free Zone, IFZA |

Dubai Taxation

UAE introduced a corporate tax of 9% on taxable profits exceeding AED 375,000, with profits up to this threshold taxed at 0%. , With Additional Threshold, if Revenue is not more than 3 million AED, then no Tax needs to be paid.

Considering your plan to engage in IT services along with import–export of IT-related goods, we suggest the following:

- If your core business focuses on exports, international clients, or overseas operations, and you do not intend to sell directly to UAE-based customers, then a Free Zone setup remains a very good option. It offers ease of setup, lower operating costs, and flexibility for global business.

- However, if you expect to supply products or services within the UAE, or if you may require warehousing, local logistics, physical operations, or direct UAE market access, then a Mainland setup would be more suitable. It provides broader market access and allows you to expand locally without restrictions.

- Additionally, Mainland licensing gives you wider freedom in choosing business activities and managing the workforce, which is beneficial as your business grows, diversifies, or scales beyond export/trading activities.

Business Setup in dubai

Business Setup in Dubai refers to the complete process of establishing a company in Dubai or anywhere in the UAE. It includes all legal, administrative, and regulatory steps required to start operating a business. it means registering your company so you can legally do business in Dubai or from Dubai. Business Setup Includes Business setup usually covers the following:

- Choosing the Company Structure like Mainland company, Free Zone company or Offshore company

- Getting the Business License like This is the official permission from UAE authorities to run your business (e.g., IT services, trading, consulting).

- Registering the Company Name like Selecting and approving your trade name.

- Preparing Legal Documents like MOA/AOA, application forms, approvals from authorities, etc.

- Immigration & Visa Processing like Investor visa, Employee visa, Family visa

- Bank Account Opening like Corporate bank account for business transactions.

- Office / Address Setup like Flexi-desk, Shared desk or Office space (if required)

- Compliance & Tax Registration like UAE corporate tax, VAT registration (if applicable), Accounting and reporting services.

Why Dubai Is Popular for Business Setup

-

100% foreign ownership

-

No income tax

-

0% corporate tax for qualifying Free Zone income

-

World-class banking system

-

Easy international business operations

-

Strategic location between Europe, Asia, and Africa

-

Strong infrastructure and business-friendly regulations

-

Business Setup in Dubai = process of legally creating a company, obtaining a license, arranging visas, and opening a bank account to start doing business in Dubai or globally.

Basic question used to ask regarding Business Setup in dubai are like Business Advisory, Bank Account, Visa Services

| Sr. No. | Question | Options | Select/Comments (A, B, C, D) |

|

|

Purpose of Setting up the Company in UAE

(Please share the existing website/profile) |

|

|

| 2 | Activity of the Business

(A brief business plan will help us to understand the business activity) |

|

|

| 3 | Geographical area of Business Operations

(5% Customs duty will apply for sales in the mainland) |

|

|

| 4 | Preferred Company Setup Location/jurisdiction

( It may affect tax & Compliances) |

|

|

| 5 | Preferred Emirate and Premium Location |

|

|

| 6 | Total Number of Visas Required

(For opening a bank account in UAE, Investors must have a UAE Visa) |

|

|

| 7 | Facility Requirements

(Visas are linked with space and to availing tax benefits) |

|

|

| 8 | Nationalities of the shareholders | List all nationalities of shareholders/UBO | |

| 9 | Business Start Date |

|

Other Services Post Incorporations compliance required in dubai like Audit, Accounting/Bookkeeping, Bank Finance, Corporate tax, VAT Services, Anti-Money Laundering, UBO services, ESR.

Best Zone for Exact Plan to setting up company in Dabai

we are handling business setups in the company, we are providing company formation in the UAE, including all related compliance requirements. We have reviewed your requirements, and based on your business plan, If You Tell Me Your Specific Plan, we can Suggest the Best Structure, Share the following and I can recommend the best matching jurisdiction/zone + cost estimate:

- IT services planned (software dev, IT consulting, cloud, cybersecurity, etc.), Only software development or IT hardware import/export, in case Import/export products (hardware, electronics, components)

- Whether you plan to sell inside UAE or only export or Only online services?,

- Opening warehouse plan or client needed Share your model and I’ll rewarehouse?

- Whether warehouse space is required- Opening warehouse?

- Need visas or not? Number of visas needed?

- Prefer lowest-cost or long-term expansion?

- Best Free Zone services?

- option + estimated total cost.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.