All about the Interest on home loan is allowed U/s 24b

Table of Contents

Who can claim deduction U/s 24B of the Income Tax Act?

- Income tax deduction can be claimed for 2 or more housing loans. The deduction U/s 24B can also be claimed for 2 or more houses. For claiming deduction U/s 24B, Person must be the owner of the house property & also loan should be in his claimant name.

What is exclusions/Inclusions in Interest U/s 24B of the Income Tax Act?

- The said Interest will includes prepayment charges, service fees, brokerage, commission etc.

- penalty on unpaid interest/ Interest shall not be allowed as deduction.

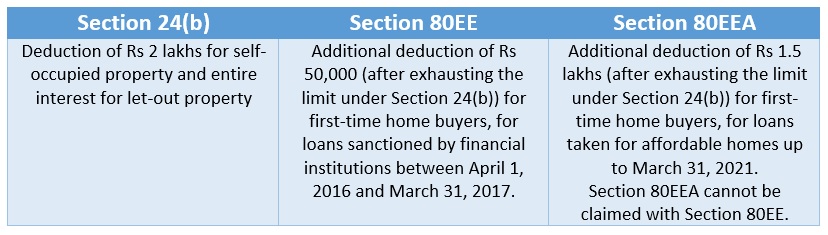

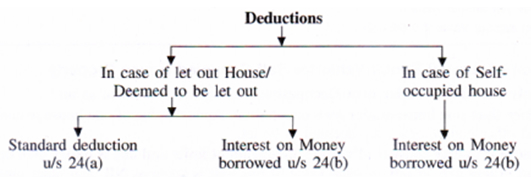

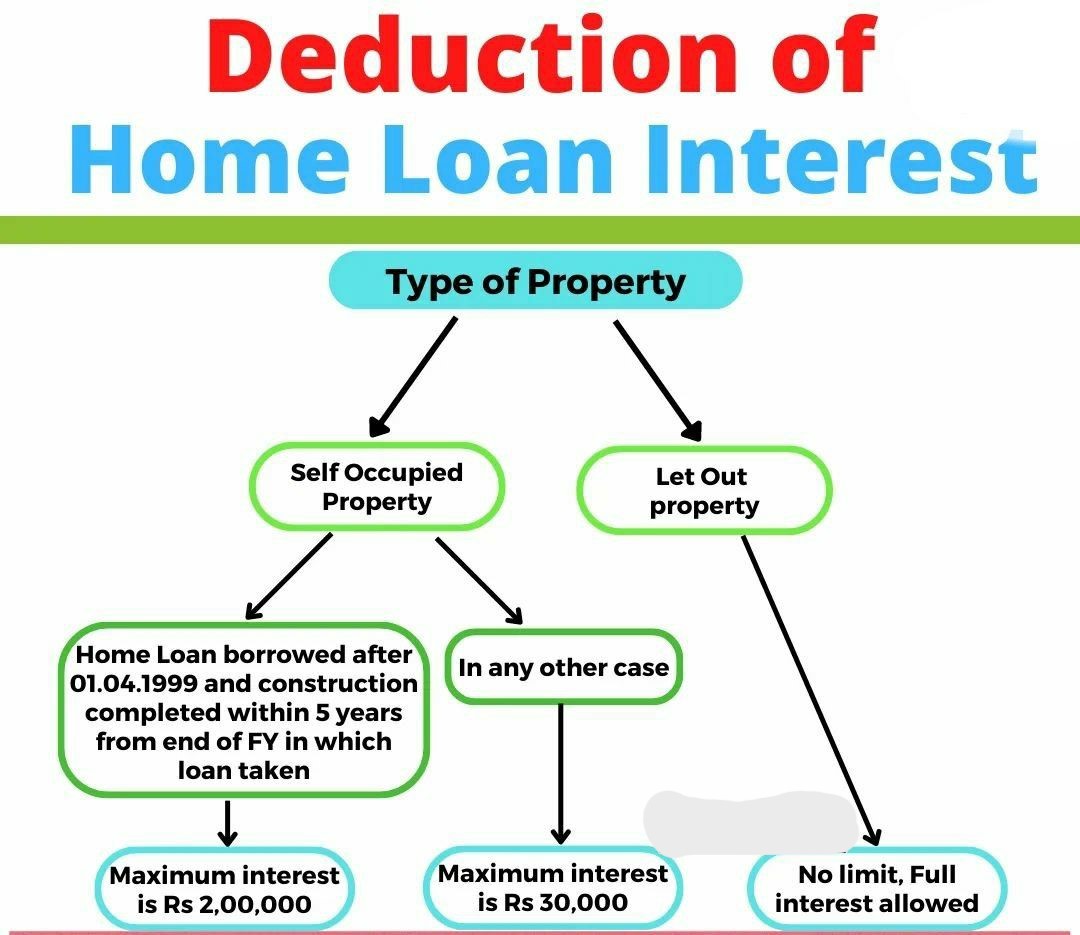

What is maximum Deduction Limit U/s 24B of the Income Tax Act?

- The maximum deduction limit on the interest of a loan is INR 2,00,000/- It is applicable for both self-occupied housing property or rental house property. Individuals owning 2 self-occupied housing properties can claim a deduction on the interest U/s 24B of the Income Tax Act.

- if a person owns two or more house property, then the total deduction for that person remains the same.

- Self-occupied House (SOP) – INR 2,00,000/-

- In deemed to be Let Out/ let out property – INR 2,00,000/-

- This is to be noted that income deduction u/s 24b Limits of deduction are applicable assessee wise & it is not property wise.

Whether the interest on capital of partners can be allowed as a deduction U/S 24(b)?

- Home loan interest may be deducted from taxable income under Section 24(b) of the Income Tax Act. Such a loan should be obtained for the acquisition, building, repair, or reconstruction of real estate for homes.

- According to decision of CIT v. Sane & Doshi Enterprises [ITA NO. 1477 OF 2009], interest paid on partners’ capital used to build property from which rental income is derived is allowable as a deduction.

- If all of the interest paid on the partners’ capital was related to the property that the assessee rented out but that was built or bought with the partners’ contributions, the deduction for interest on partners’ capital may be allowed as per Under section 24(b) under income tax Act.

Other matter

- In case the partnership firm has constructed the godown from borrowed capital on which the interest has been paid to partners like outside parties, So it will be allowable deduction Under section 24(b) under income tax act

Comparison between Section 80C & Section 24B

- Interest on home loan is allowed U/s 24b while principal on home loan is allowed U/s 80C. Difference between 80C and section 24b is mention below:-

| Particulars about the Deduction | Section 80C | Section 24b |

| Income Tax Deduction allowed only for | Principal only | Interest only |

| Tax Deduction Basis | Cash Basis | Accrual Basis |

| Deduction Amount | INR 1,50,000 (From AY 2015-16) | Self-occupied property: INR 2,00,000 (From AY 2015-16) Other than Self-occupied property: No limit |

| Loan Purpose | Construction of a new House Property/ Purchase of a new House Property | Construction/ Purchase/ Repair/ Renewal/ Reconstruction of a Residential House Property. |

| Eligibility for claiming Tax deduction | NIL | Construction/ Purchase should be completed within Three years |

| Restriction on Sale of Property | Tax Deduction claimed would be reversed if Property sold within 5 years from the end of financial year in which such property is acquired by him. | NIL |

| Deduction during construction period | No deduction is available for the principal repayment during the construction/acquisition period. | Interest paid during the construction/acquisition period shall be allowed in 5 equal instalments from the last day of preceding Financial Year in which the construction is completed |

Position of House rent allowance with Interest Deduction

- House rent allowance U/s 10(13A) & interest deduction can be availed simultaneously even if house property is in same city in which you resides on rented property.

- Income tax form 12BB is to be submitted with employer, if you want your employer to take deduction under this section into consideration & thus deduct lower Tax deduction at source

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.