GST E-Invoices Limit dropped from Rs 10 Cr to 5 Cr 1.08.2023

Table of Contents

Limit for GST E-Invoices for Firms dropped to Rs 10 crore Sales as of Oct. 1, 2022

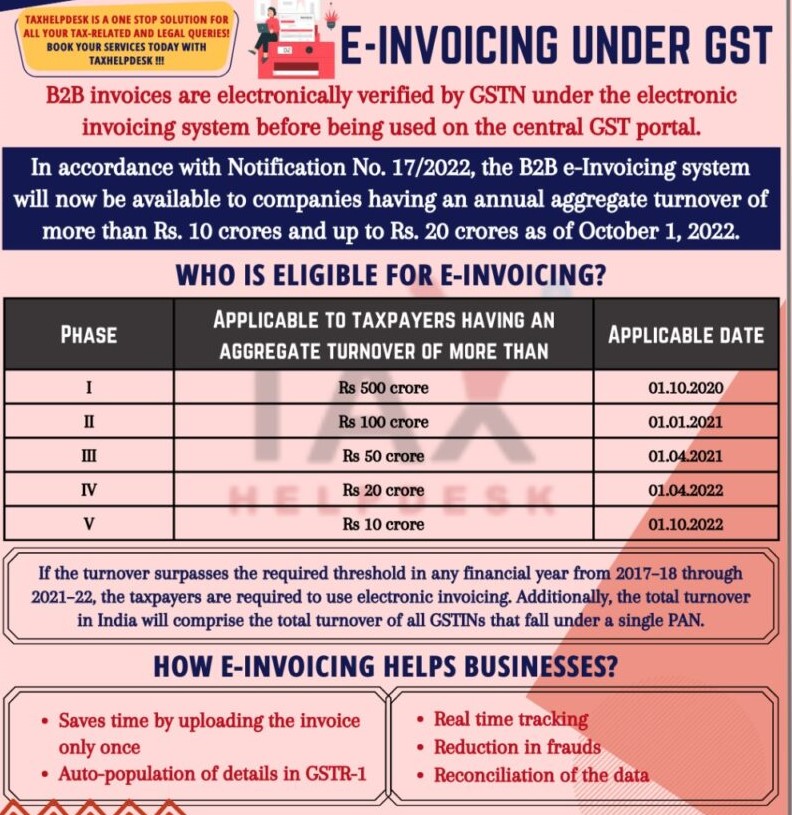

Every registered Businesses who has an annual turnover more than Rs. 10 Crores it is required to send an electronic invoice as of October 1, 2022. Presently for e-invoice is mandatory for the firms with yearly turnover of Rs. 20 Crores but the rule is amended on 1st of August 2022. From 1st of October 2022 the business is required to issue an E-Invoice must upload a json file containing their tax invoice in (IRP) Invoice Registration Portal in accordance with the E-Invoice schema in INV-01. They must then wait for the IRP to get back a digitally signed json file along with an IRN and QR Code.

All B2B invoices are electronically validated by the Goods and Service Tax Network (GSTN) under the newly adopted electronic invoicing (e-invoicing) system under GST. The creation of invoices via the GST site is not what e-invoicing is about. This is incorrect. Each dealer must produce invoices using his generally accepted accounting software.

E-invoicing is actually the process of uploading information from a previously created invoice to the GST portal and creating an IRN (Invoice Reference Number) for that invoice. E-invoicing is based on the premise that invoices should only be registered once on the GST site so that it can be utilised for several different things.

Some brief about E-Invoicing:

- Electronic Invoice is introduced in the 37th meeting of the GST Council held on 20th September 2019.

- When E-invoicing was introduced, it was only applicable on the firms with annual turnover of Rs. 500 crores.

- After while it was dropped to 100 crores, then 20 crore and currently it comes to 10 crore.

- Officials and Experts says that may be the annual turnover may drop to 5 crores in the coming year.

Reasons Behind the continuous drop in Threshold limit of the company for E-Invoicing:

- The higher tax authorities are getting easy in investigating the authenticity of Input Tax Credit in different sectors and find the revenue leakage.

- Tax admiration declares that Rs 35000 crore of ITC fraud, alone in the last fiscal year 2020-21 in which fake Invoice racket had arrested.

- This reduction in the threshold of the Business which increases the scope of the E-Invoicing the main motive behind this is Tax manipulation.

- The GST council has given the sufficient time gap i.e. 31st of October, so that all the companies can prepare their administration and systems to accept the E-Invoicing compliances.

In summary

Compulsory E-Invoicing for businesses having a Turnover of 10 Cr or more from 1st Oct. 2022

- The Goods and Service Tax (“GST”) has long been considering electronic invoices, or “E-invoicing,” and the GST Council has chosen to implement the e-invoicing ‘ device beginning on January 1, 2020, on a voluntary basis.

- However, commencing on October 1, 2020, taxpayers with a turnover of more than 500 crore will be required to generate mandatory e-invoices under the GST. From April 1, 2021, taxpayers with a turnover of 10 crore will also be required to do so. E-invoicing will be required starting on October 1, 2022, for companies with a turnover of 10 crores or more in any financial year commencing in 2017–18.

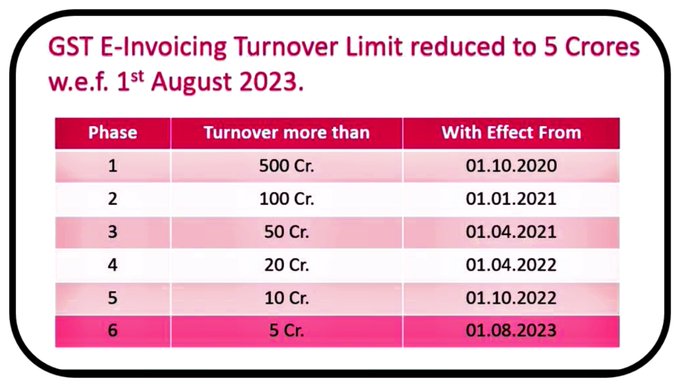

Compulsory E-Invoicing for businesses having a Turnover of 5 Cr or more from 1st Oct. 2022

- The government has decided to reduce the e-invoice limit from Rs. 10 Crores to Rs. 5 Crores from 1st August 2023. This means that any taxpayer who has an aggregate turnover exceeding Rs. 5 Crores in any financial year from 2017-18 to 2022-23 will be required to generate e-invoices from 1st August 2023 onwards. In simpler terms, businesses with turnover above Rs. 5 Crores will be required to generate electronic invoices for their transactions. This move is aimed at promoting digital transactions and reducing the scope for tax evasion.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.