MSMEs may Apply for a Business Loan

Table of Contents

MSMEs may Apply for a Business Loan

- Access to Business Loans is a vital component of any successful business. However, MSMEs may face some difficulty in securing the funding they need in time. But small businesses can apply for an Micro small and medium-sized enterprises Business Loan to help them reach their goals.

- This post will provide you with seven handy tips that will enable you to easily and swiftly obtain a business loan. Discover the various loan options that are available and how to file a successful application.

What are MSMEs, How can an MSME Business Loan help in grow?

- Micro small and medium-sized enterprises is a term used to describe businesses that are either independently owned or part of a larger corporate group and have fewer than 250 employees.

- MSME play a Important role in the country development and are considered one of the important sectors of the economy. They are also seen as engines of economic growth, as they offer an important source of employment to an otherwise untapped segment of the workforce. Moreover, they provide services and goods at a lower cost than larger corporate, allowing them to compete in the market. They also serve as a big source of innovation & new ideas, particularly in rural areas.

- Hence, Strong financial assistance ought to be provided to these companies in the form of financial products like business loans. They have a wide range of features and benefits designed specifically to meet the demands of micro, small, and medium-sized businesses.

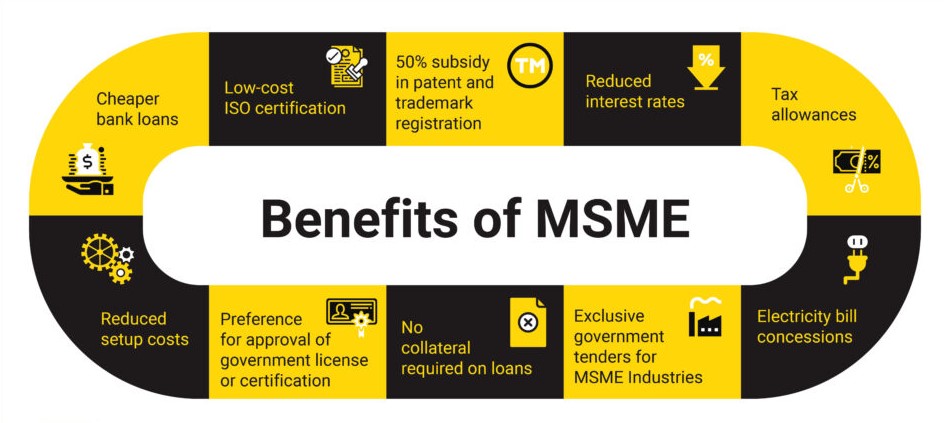

Benefits of Getting an MSME Business Loan

For companies that are looking for financing, business loans include a variety of features and advantages. Some of the top ones are:

- Working Capital Boost – Business loans can also give business owners access to more capital to support them reach their company objective faster.

- Attractive Interest Rates – Competitive interest rates can support businesses save money in the financing costs long run.

- Flexible & Favorable Terms – Favorable terms & Conditions, including long repayment terms, flexible repayment schedules, low fixed interest rates, & make business loans an attractive option for organizations.

- No or lessor Collateral needs – Few Non-Banking Financial Companies also give without collateral Business Loans, which means you are not needed to put any asset as security against the loan.

- Increased Loan Amount – businesses can access huge capital amount than they would be able to with other financing options, Like personal loans or as credit cards,

Moreover, Various other incentive are associated with above kind of loans, like than as – TDS deductions for interest payments & potential for increased credit ratings due to timely loan repayments.

Finally, business loans can be a valuable resource for businesses seeking to increase their capital and accomplish their objectives.

Most Ureses 7 ways where MSMEs Can file applications for a Business Loan

Following are the different ways via which Micro small and medium-sized enterprises can avail of a Business Loan

- Normal Nationalized or Pvt sector Bank Loans – MSMEs may take Normal Nationalized or Pvt sector bank offline route & File application for a MSMEs Business Loan at any above bank as per our choice. But, this could involve lengthy paperwork and long lines.

- Govt Loans – Several govt loans have been introduced to help Micro small and medium-sized enterprises Some of them include the the Credit Guarantee Trust Fund for MSE Enterprises (CGT MSE), Pradhan Mantri Mudra Yojana (PMMY), & more.

- Angel Investors – Angel investors can support Micro small and medium-sized enterprises to meet financial requirement for different business operations.

- Microfinance Institutions – Non-banking financial Institutions or Microfinance institutions provide small-size Business Loans to MSMEs as per their particular needs.

- Crowdfunding – Few crowdfunding portal can support Micro small and medium-sized enterprises find the required funding to fulfil different business needs.

- Non-banking financial Institutions/ Non-Banking Financial Companies (NBFCs) – Getting a Business Loan via an NBFC is an excellent way to finance business needs. Not only is the Business loan process faster, but the eligibility criteria are simple as well. It also involves small Documents when you may file online application.

- Credit Unions – Micro small and medium-sized enterprises can also apply for financial help from credit unions, which are non-profit & formed as cooperative financial institutions.

Process of application for an MSME Business Loan with an Non-bank financial company

We have to follow the steps stated below to apply for a Micro small and medium-sized enterprises Business Loan online:

Phase-1: initially go to lender’s website.

Phase-2: Select on ‘Apply Now’

Phase-3: Next option like needed KYC information & upload all the required documents

Phase-4: After the above we needed to wait for application assessment & verification.

Phase-5: Next we receive loan approval confirmation from dept,

Phase-6: Than Authorities Authorize disbursal of Micro small and medium-sized enterprises Business Loan

Conclusion

- Financial institutions like banks and other lending institutions Normally provide Micro small and medium-sized enterprises Business Loans. They can be utilised for many things, including growing operations, buying equipment, hiring additional employees, and more. These loans have the advantage of quick funding access, which enables small enterprises to seize opportunities as they present themselves.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.