Increase in use of AI in Account, Audit, Tax filling & Asst.

Artificial intelligence use in Accounting, Auditing, Income tax filling & Assessment

- Income tax Taxpayer Key data & information like No of payments on the tax bill, the Bank Account No, discount on the tax bill, & Other data can be extracted effortlessly and with accuracy by Artificial Intelligence enabled robots. Which help in taxation related matter,

- Artificial Intelligence may not be poised to replace accountants, But an Accountants can leverage accounting automation software, Docyt, to work more efficiently. Spend less time on tedious manual tasks, data entry & more time honing your financial and strategic expertise. The future of accounting is Artificial Intelligence powered accounting software.

- It’s critical to recognize that Artificial Intelligence is a rapidly developing field, making it more challenging to anticipate precisely how it will impact certain businesses in the long-term. But, based on what we know so far, it’s unlikely that, it seems unlikely that Artificial Intelligence would ever completely replace tax professionals.

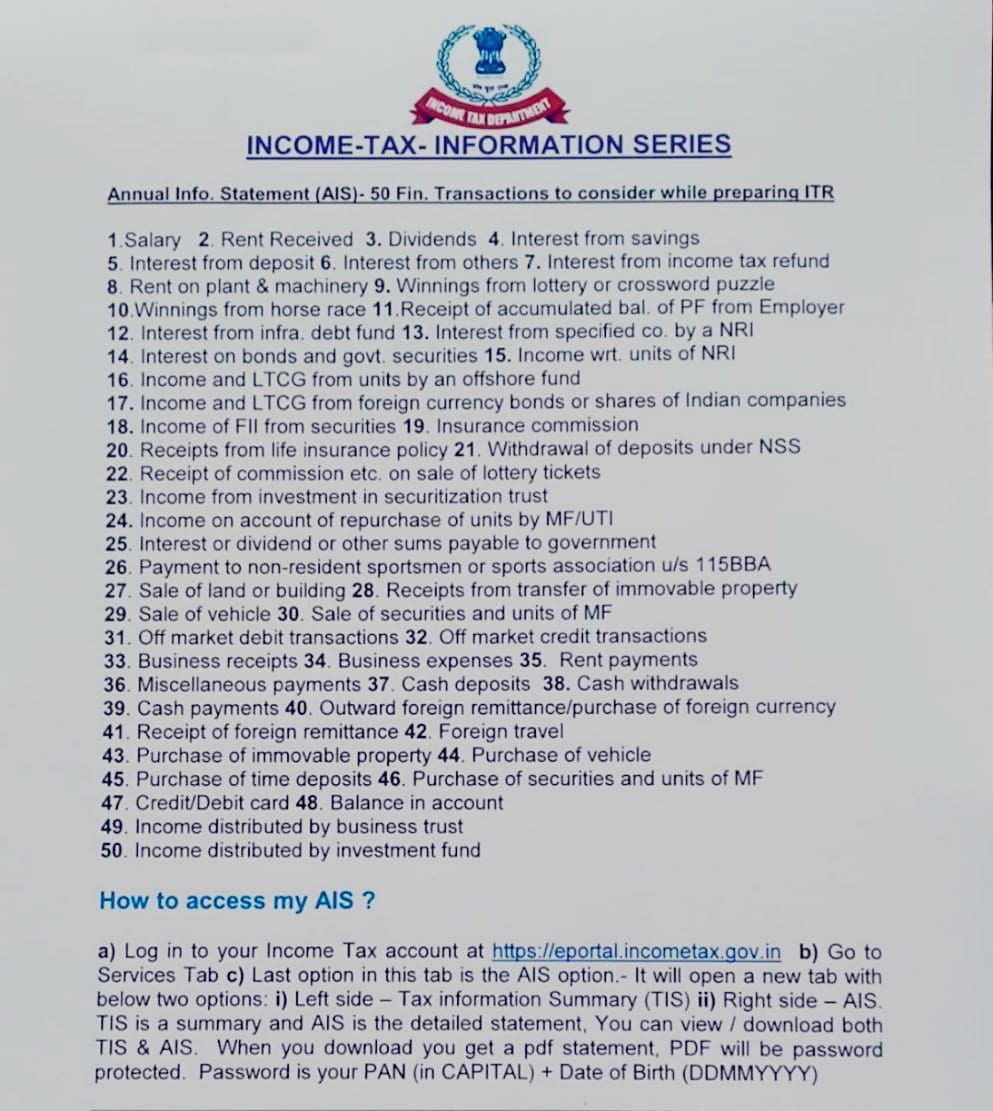

Latest 50 transactions Reporting by Annual Information Statement

- These are the 50 transactions which the Income tax department is doing data mining from various sources like banks, register office, etc… Kindly do not miss any such transaction in reporting while filing your Income tax Return or Goods and services Tax Return.

- Ensure you have reported all those 50 transactions without fail apart from your other transactions which might not covered in these 50. This shows the future approach of Income tax department, Goods and services Tax Authorities while reviewing the filed returns. Slowly- Slowly it will become a Artificial Intelligence based comparability’s and system throws the differences without assessing officers review. Be prepared from now on!

- Potential tax fraud cases can be found using artificial intelligence in auditing. Tax agencies are now using technologies based on machine learning, often known as “predictive modelling,” to identify situations that have characteristics that could indicate potential fraud.

- The accurate key data can then help for easy income tax payment and Income tax filing the tax returns & related Income tax assessment to the tax authorises.

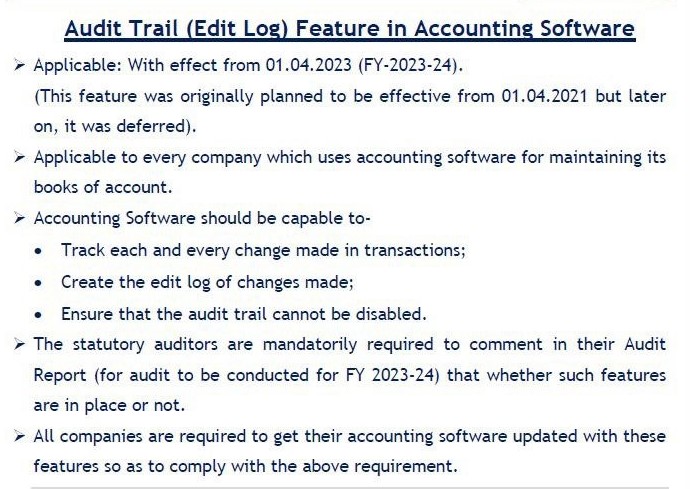

- Audit Trail Feature in the Accounting Software compulsory for Firm or Companies or Management or Auditors Responsibilities on compulsory Audit Trail (Accounting Software)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.