BASICS OF FCRA CERTIFICATE RENEWAL

Table of Contents

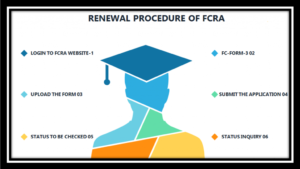

FCRA CERTIFICATE RENEWAL

- The certificate issued under the FCRA registration is valid for a period of up to 5 years starting from the date of granting of registration. In the earlier law, such a certificate was permanent in nature, but due to increasing cases of manipulation and fraud, FCRA, 2010 provided that such certificate be required to be renewed every 5 years.

- The entity requiring renewal of their FCRA registration is required to apply for renewal in Form FC-3C within 6 months before the expiry of the initial certificate.

- In case, the entity fails to comply with the above provision, their FCRA registration will be revoked and therefore they won’t be able to receive any foreign donations after the expiry of the certificate. Such an entity will again have to apply for fresh registration.

NOTE – For entities registered under FCRA, 1976, the Certificate of FCRA is valid till 30th April 2016. Thus, the entities applying for renewal of registration before 31st October 2015 i.e. 6 months before the last date of validity, their effective date of registration would be 1st May, 2016 and their 5 year period will start from this date only.

DOCUMENTS REQUIRED FOR FCRA RENEWAL OF CERTIFICATE

To get the certificate of FCRA registration renewed, the entity is required to apply in Form FC-3C and shall upload the following supporting documents namely –

- The signature of the Chief Functionary of the entity.

- The authorized seal of the entity.

- Entity’s original registration certificate.

- Their registered MOA/AOA/Trust Deed.

- Also, a self-certified copy of the registration.

INVESTIGATION UNDER FCRA ACT

Under FCRA Act, 2010, the department is having no authority to undertake any investigation at the time of renewal of the FCRA certificate, but they can conduct audits and inspections at any time, however, such investigation by the Central Government can be made only on providing a valid cause for such investigation.

However, the FCRA Amendment Act of 2020, enacted on September 29, 2020, gave the Central government full authority to make inquiries and satisfy itself as to Section 12(4) conformity prior to FCRA renewal. The need of authentication of the documents was acknowledged at the time of registration.

RENEWAL APPLICATION AFTER PRESCRIBED TIME

In case the entity was unable to apply for renewal by the deadline, its registration will be revoked. However, if sufficient cause for not submitting the renewal application is provided and the department is satisfied, they might be willing to overlook the delay. Thus, a pending application for renewal may be sent up to one year after the FCRA Certificate expires.

The renewal of the certificate will take place on retrospective effect, meaning that the new period of 5 years will start not when the renewal application is accepted, rather it will start from the day the last certificate got revoked/expired.

ANNUAL RETURN UNDER FCRA REGISTRATION

Entities after getting FCRA registration are required to file an annual return in Form FC-4 available on the FCRA portal. The entity is also required to provide the scanned copy of –

- Income statement of the entity during the previous year and the same be prepared as per the provisions applicable on them under the specified law.

- The balance sheet of the entity during the previous year, along with proper notes.

- International receipt statement of the account maintained wholly for the purpose of receiving foreign contribution.

- A complete statement of entity’s payments and expenditures during the previous year.

All these scanned copies be duly approved by a Chartered Accountant and the same be filed every year within the 9 months from the end of the previous year i.e., on and before 31st December that comes after the end of the current financial year.

CANCELLATION OF CERTIFICATE

The certificate under FCRA is granted after the complete verification of the details of the entity and its legality and qualification. Even after granting the FCRA registration, the department can cancel the registration of the entity. FCRA Registration canceled on the below ground.

- The entity has violated any provision of the Foreign Contribution (Regulation) Act, 2010.

- The entity fails to file their annual return by the deadline mentioned under the act.

- The entity is indulging in any activity of wrongdoing and such activity is validated by the officials.

- The entity is not utilizing the contributions obtained to achieve its objects specified at the time of FCRA registration.

KEY POINTS TO REMEMBER FCRA REGISTRATION & RENEWAL IN INDIA

- The entity must never combine domestic receipts with any international donation.

- Once applied for FCRA registration, the entity shall not change its decision.

- The entity should not use ATM or debit cards as the Foreign Contribution Bank usually does not have an ATM or debit card. Thus, if the entity is already having an ATM card, they should not make any cash payment through it.

- The entity shall not save or invest the Foreign Contribution money in any mutual fund or securities.

- The entity shall not use the foreign donation for any form of the personal or administrative function.

- The entity may not accept any foreign donation wherein their FCRA registration is on hold, canceled, or approval has not been given.

- The foreign contribution be received only in the foreign contribution account and no other income be received in that account.

- All the return required to be filed under Section 18 be filed on time.

FAQ ON FCRA REGISTRATION & RENEWAL IN INDIA

- What happens if the organization does not renew its FCRA registration online?

The current registration under the FCRA, 2010, will expire five years after the date of grant of registration. The association would have to reapply for registration in this case.

- What documents are required to update your registration?

-

- For renewal of registration,

- the association’s Memorandum of Association/ Trust Deed, and

- the association’s seal,

- the Chief Functionary’s signature,

- the association’s registration certificate,

- A self-certified copy of the registration must be uploaded.

- What is the process for re-registration?

Ngo that want to extend their registration certificate can do so online 6 months before it expires by completing Form FC-3.

- When does an organization that was granted FCRA registration in 1976 file for renewal?

Since the registration issued to associations under the revoked FCRA, 1976 is valid until April 30, 2016, those associations should have applied for renewal on or before October 31, 2015, 6 months before the authenticity ends. The renewed certificate will be valid for 5 years beginning May 1, 2016.

- Is it essential to keep the registration certificate up to date?

As per FCRA, 2010 section 16, an NGO that has been issued an FCRA certificate of registration u/s 12 must have it renewed within the 6th months of the FCRA certificate’s expiry date.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.