Why needed to register a private limited company?

Table of Contents

Company Registration- Online Company Registration In India

-

- Under Chapter-II of the act, along with the [Rules] of the Companies (Incorporation) Rules, 2014 and the Companies Act, 2013 lays down the rules for the incorporation of both public and private companies.

- A company that wishes to be incorporated as a Private Company must have a minimum paid-up capital of Rs. 1,00,000 and at least two directors and for Public Company it must have a minimum paid-up capital of Rs. 5,00,000 and at least 7 directors. Types of Company structures in India you can register as bellows

- One Person company

- Limited Liabilities Partnership

- Public Limited Company

- Private Limited Company

| Company type | Ideal for | Tax advantages | Legal compliances |

| Limited Liability Partnership | Service-oriented businesses or businesses that have low investment needs | Benefit on depreciation | Business tax returns to be filed ROC returns to be filed |

| One Person Company | Sole owners looking to limit their liability | Tax holiday for first 3 years under Startup India Higher benefits on depreciation No tax on dividend distribution | Business returns to be filed Limited ROC compliance |

| Private Limited Company | Businesses that have a high turnover | Tax holiday for first 3 years under Startup India Higher benefits on depreciation | Business tax returns to be filed ROC returns to be filed An audit is mandatory |

| Public Limited Company | Businesses with a high turnover | Tax exemptions under | Business tax returns to be filed. Mandatory Audits |

Key Points to Consider Before Choosing Types of Business

- It is important to carefully select your business structure because it will directly affect your income tax returns. When registering your company, keep in mind that each business model has distinctive levels of compliance that must be met.

- A sole proprietor, for example, is only required to file an income tax return. A company, on the other hand, must file an income tax return as well as annual returns with the registrar of companies.

- Account books of a company must be audited annually. Following these legal requirements necessitates the hiring of auditors, accountants, and tax filing specialists. Therefore, when considering the registration of the company, it is important to select a proper business structure.

- An entrepreneur must have a clear understanding of the types of legal compliances with which he or she is willing to deal.

How do you choose a business structure before applying for company registration in India?

- Ownership/Partnership:

- A-One Person company would be ideal for you if you were a single person who owned the entire initial investment for your enterprise. On the other hand, a limited liability company (LLP) or a private limited company would suit you best if your business has two or more proprietors and is actively seeking investment from other parties.

- Initial Investment:

- If you would first spend less on a single owner or a HUF or Partnership, it would be a good idea. You can choose a One Person Company, LLP, or Private Limited Company if you are certain that you will be able to recover the setup and enforcement costs.

- Liability:

- The liability of business structures such as a sole proprietorship, a HUF, or a partnership company is unlimited. This assumes that in the event of a loan default, the whole loan amount will be recovered from the members or partners in a profit-sharing ratio. Personal properties are at risk in these situations.

- Companies and LLPs, on the other hand, have a limited liability provision. This ensures that each member’s liability is limited to the amount of their investment or the value of the shares they own.

- Income Tax Rate:

- The income tax rates for a single owner and a HUF are the standard diminishing rate. The business earnings are clubbed with the other Individual’s income for a sole proprietorship.

- However, a tax rate of 30% is applicable for other entities such as partnerships and companies.

- Money from Investors:

- If your business structure is not registered, it is difficult to make investments. When it comes to investment, entities such as LLP and Private Limited Company are trusted. Select the right structure, seek the expert’s advice and register with the right guidance.

Benefits of Company Registration:

- Legal Entity:

- A company is a legal entity that reflects reality. It is an artificial individual that has been created by law and is separate from its directors and shareholders. The word “legal person” refers to an entity being recognized by law. by law.

- It has the ability to sue and be sued in its own right. An enterprise holds its own rights, bears its own liabilities, and manages its own lawsuits. A company gains its own personality when it is incorporated.

- As a company can possess its property, and incur debts, it has a broader legal capacity, so that the individual company members are not responsible to the creditors of the company for debts.

- Perpetual succession:

- The term “perpetual succession” refers to the company’s ability to continue or endure continuously. It denotes the continued existence of a corporation or company until it is legally dissolved.

- Perpetual succession is an important consideration as It is a separate legal entity that is unaffected by the death or resignation of any of its members, as previously mentioned. Whatever changes occur, such as composition, executives, employees, or shareholders, nothing will be able to impact its existence; once incorporated, it will continue to operate in accordance with the Companies Act.

- Limited Liability:

- Limited Liability is a legal obligation to repay a limited number of debts. The members’ liability for the company’s debts is limited, i.e., to the face value of the share purchased by them.

- The terms and conditions may differ when the members have contractually agreed to unlimited liabilities. These are known as unlimited companies

- Shares transferability:

- The number of shares in a company is limited by the number of shares purchased. It can be transferred to another person by a shareholder.

- Shares can be transferred to whomever the shareholder wishes. The buyer of shares would be given a signed copy of the share transfer form as well as share certification.

- There are no technical restrictions on the transfer of shares in a public limited company. As a result, a shareholder can transfer his shares to whoever he wants.

- A public limited company’s securities or other interests are freely transferable. However, any securities transfer contract or agreement is enforceable in the form of a contract.

- In the case of private limited companies, the law allows them to place restrictions on the transfer of their shares. There is no such thing as a complete ban on shares.

- Owning Property:

- A company can invest, hold, take benefits, and sell property under its own name. A shareholder isn’t really allowed to compensation the company’s property because they are not the company’s owners.

- A shareholder strictly does have an interest in the company arising from the company’s articles of association, measuring a sum for liability.

- The shareholder is really not entitled to the benefits of the company’s profits. It is, however, obligated by the contract outlined in the articles of association. As a result, the company’s property is not the individual member’s property.

- Can sue and be sued:

- A person can file a lawsuit in his or her own name. Similarly, a company, as an independent legal entity, could take legal action against another person in its own name.

- This includes a change in the company’s name, mergers, and demergers.

- Dual Relationship:

- Any individual member could enter into an agreement or contract with the company. It is possible for a person to take over the company’s operations while still working for the company.

- As a result, an individual can be a shareholder, creditor, director, and employee of the company all at the same time.

- Borrowing Capacity:

- Companies have the option of borrowing money. They have the authority to issue and accept public debentures. The company also invites banking or other financial institutions to also provide additional financial assistance.

- Equity raising:

- The only type of legal entity that can assist promoters in raising equity funding from Angel Investors, Private Equity Firms, and the Stock Exchange is a company.

- For raising equity funds from Angel Investors and Private Equity Investors, a private limited company would suffice. A Limited Company, on the other hand, would be required for the listing or allotment of shares to more than 200 shareholders.

Process of Registration of a company

- Digital Signature Certificate (DSC):

Digital signatures are needed to file forms on the MCA portal since the company’s registration system is entirely online. Both proposed directors and memorandum and articles of association subscribers must submit a DSC.

- Director Identification Number (DIN):

Anyone who wishes to be a director in an organization must obtain a Director Identification Number (DIN). In the company registration form, the proposed director’s DIN, as well as his or her name and proof of address, must be included.

- Registration on the MCA Portal:

The SPICe+ form shall be completed and presented on the MCA portal to apply for company registration. The company director must register on the MCA portal to fill out the SPICe+ form and submit documents. The director can log in after registration and gain access to the services of the MCA portal which include e-form submissions and public document viewing.

- Certificate of Incorporation:

The Registrar of Companies shall examine the application once the registration request is filed and submitted together with the documents requested. The certificate of incorporation of the Company will be issued after verification of the application.

List of required documents for Company Registration

The list of documents required for Company Registration in India are as follows:

- Address Proof: Electricity Bill or Bank Account Statement or Latest Telephone Bill

- A recent copy of an electricity bill, a property tax receipt, or a water bill is required.

- Identity Proof: Diving license/passport or Pan Card or Aadhaar card.

- Original copy of ROC’s formal letter related to the availability of the Company name.

- DIN

- DSC

- SPICe+ form

Note: Identify Proof and Address proof must submit by all Directors and Shareholders.

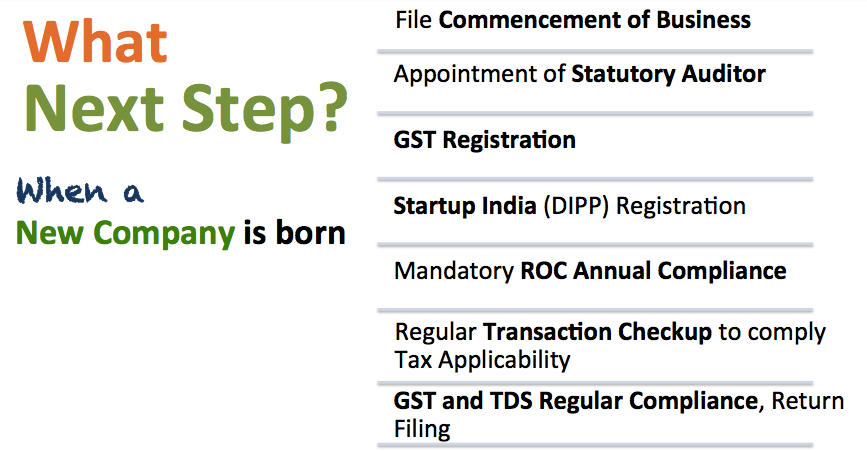

Compliances to be followed by the Company

- Once a company is registered, it must stick to certain Compliance on an annual basis.

- The company must adapt to regulations, Compliances such as the requirement to name its first auditor within 30 days of incorporation at the first meeting of the board of directors.

- During the calendar year, every company must have a minimum of four board meetings at predetermined intervals. Each financial year, it must prepare and file a profit and loss account, annual return, and balance sheet, as well as an auditor’s report, with the Registrar of Companies by the due date.

- Every company is required to keep certain statutory records.

- For any information/queries, you can contact us. Our team of professional experts can provide all the assistance in registration of Company in India for Indian residents and as well as a foreign company. With the experience, we have gained and learn from several years with hundreds of clients who have started their successful business ventures in all parts of India and as well in Foreign Countries. We can assure you the best services at the most competitive rates. Our business consulting services spans from the starting of a company or business till that business becomes a successful enterprise in India.

- Legal and various types of document works are involved in starting a business in India other than approvals from the Government of India.

- We can assist you in registering your company in India along with getting vital documents and approvals from the government

- For any information/queries, you can contact us. Our team of professional experts can provide all the assistance related to Company Registration.

- Website- Click here

Email id- info@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.