CBDT Issue clarification New Tax Regime u/s 115BAC

Table of Contents

CBDT Issue Clarification on Section 115 BAC

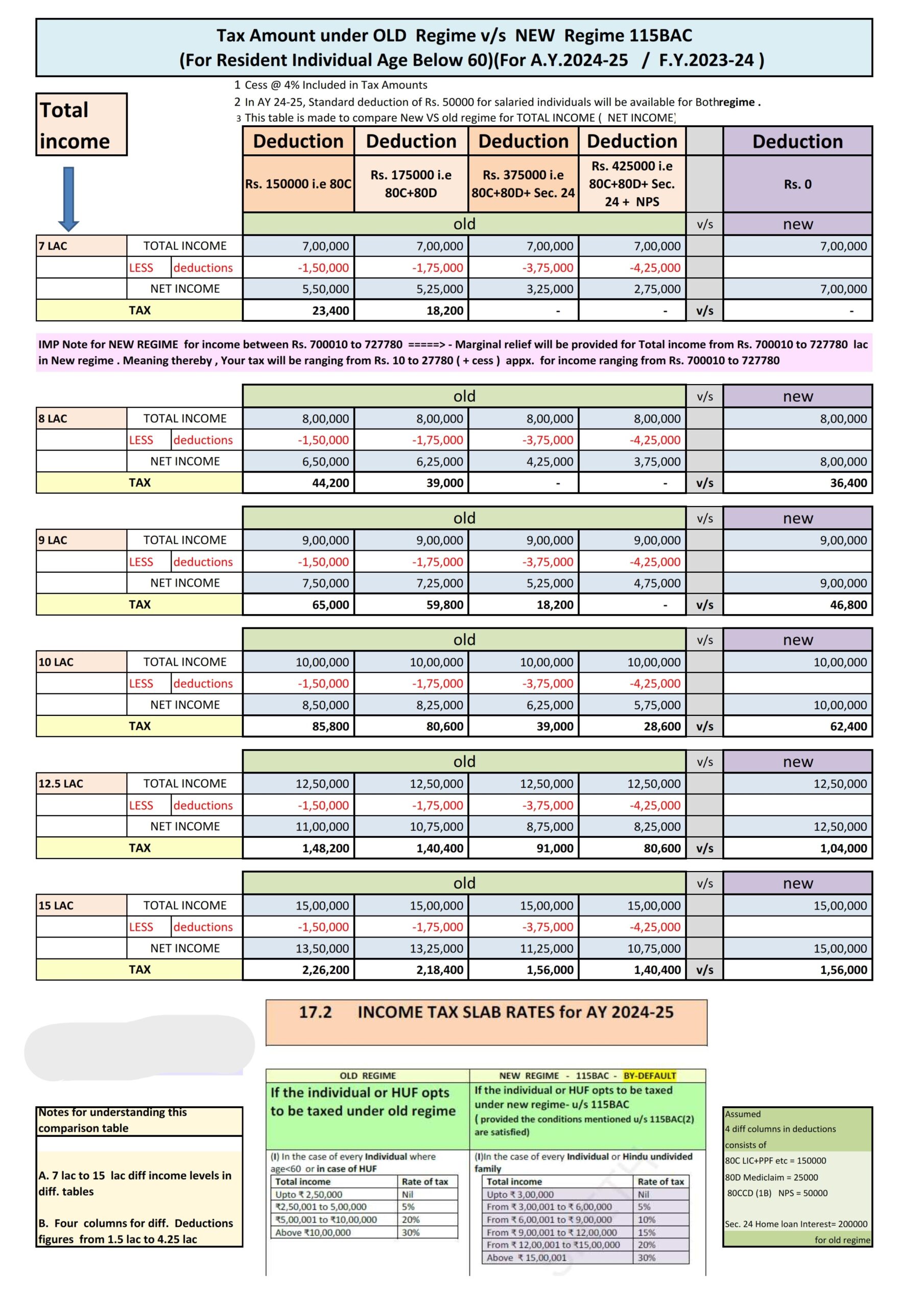

The Finance Act 2020 introduced Section 115BAC in the Income Tax Act, offering individuals and Hindu Undivided Families (HUFs) the option to be taxed under a new concessional tax regime. This new section permits taxpayers to choose between the old tax regime and the new concessional rates, provided they forego certain exemptions and deductions. Below are the detailed conditions and the exemptions/deductions not claimable under the new tax regime.

Eligibility Criteria for the New Tax Regime under Section 115BAC

Individuals and HUFs with income other than from profession or business. Taxpayers can exercise this option along with their income tax return filed under Section 139(1) for each year. Tax is computed without specified exemptions, deductions, set-off of losses, and additional depreciation.

Conditions for Income Calculation under the New Tax Regime:

- Losses: Calculation without offsetting any losses from previous assessment years resulting from the above deductions or from house property.

- Perquisites/Allowances: Exclusion of any perquisites or allowances related deductions.

- Additional Depreciation: No additional depreciation as per Clause (iia) of Section 32.

- Exclusion of Deductions/Exemptions:

- All deductions under Chapter VI-A, except sections 80CCD and 80JJAA.

- Deductions specified in Sections 35, 35AD, 35CCC.

- Deduction under Clause (iia) of Section 57.

- Deductions specified in Section 24(b).

- Exemptions under clauses (5), (13A), (14), (17), (32) of Sections 10, 10AA, 16.

- Deductions under Sections 32(1), 32AD, 33AB, 33ABA.

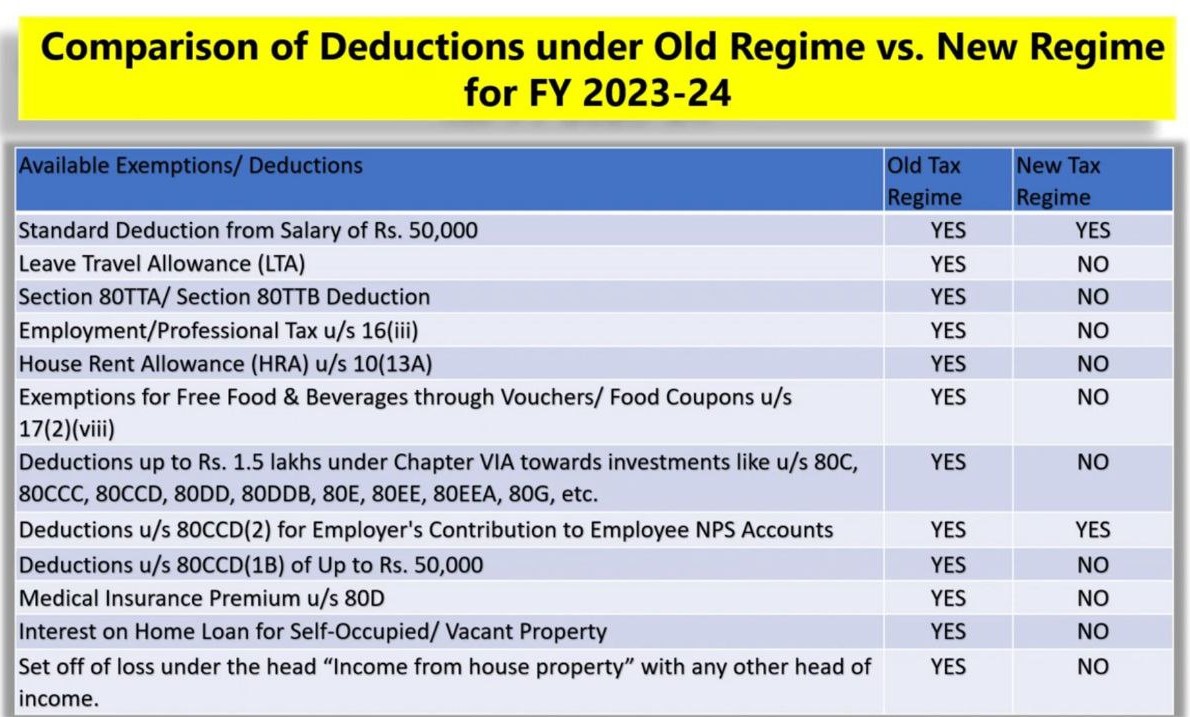

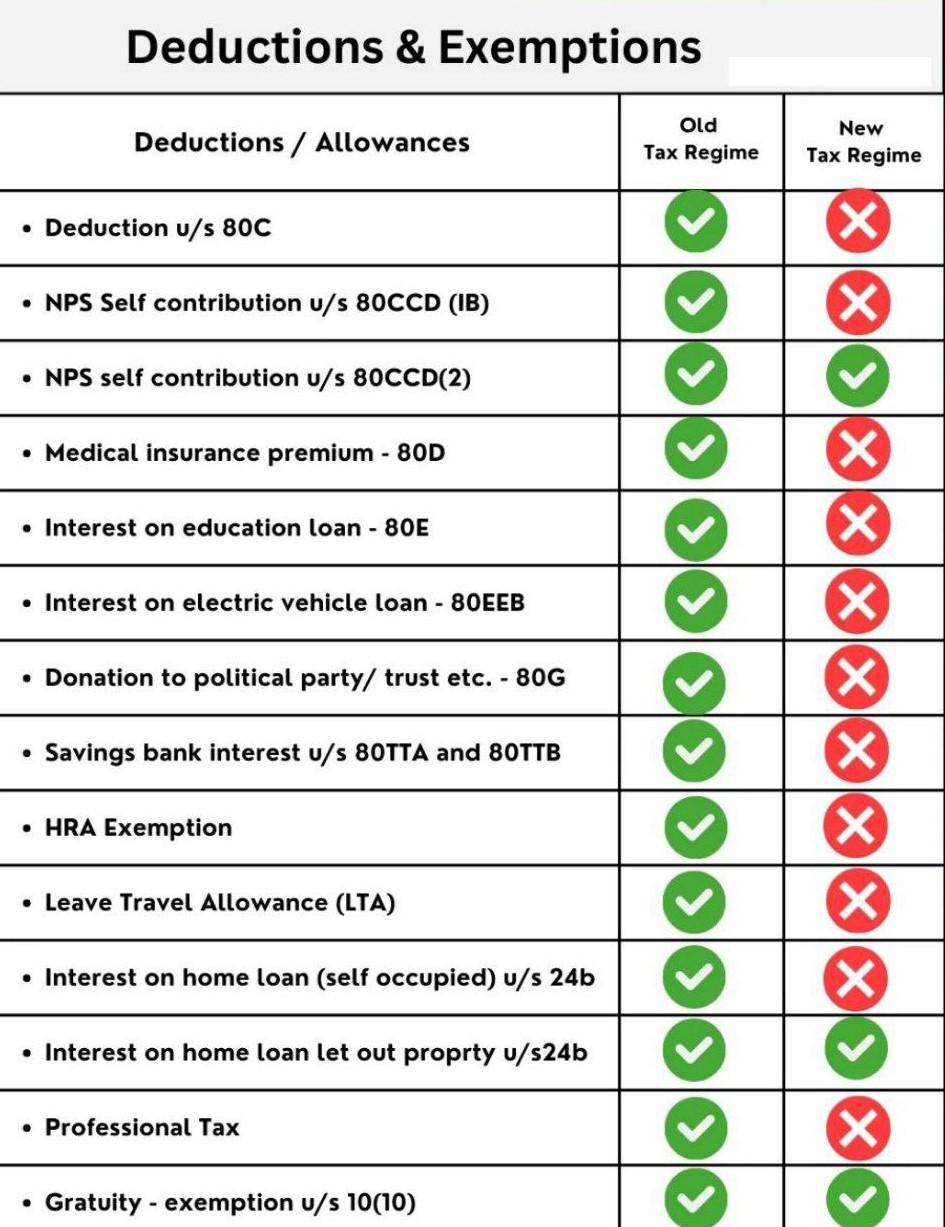

Major Deductions and Exemptions Not Claimable:

- Under Chapter VI-A:

- Section 80TTA/80TTB.

- Section 80C, 80D, 80E, etc. (except 80CCD(2) and 80JJAA).

- Section 80G, 80GGA, 80GGC (donations).

- Salaries:

- Professional tax and entertainment allowance.

- Leave Travel Allowance (LTA).

- House Rent Allowance (HRA).

- Allowances to MPs/MLAs.

- Minor child income allowance.

- Helper allowance.

- Children education allowance.

- Special allowances under Section 10(14).

- Perquisites and other allowances.

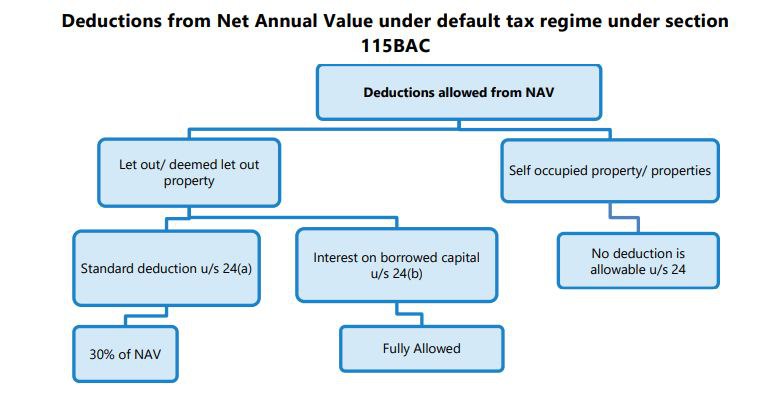

- House Property:

- Interest on housing loan on self-occupied or vacant property (Section 24).

- Others:

- Additional depreciation under Section 32(1)(iia).

- Deductions under Sections 32AD, 33AB, 33ABA.

- Deductions for donations or expenditure on scientific research under Sections 35(2AA), 35(1)(ii), (iia), (iii).

- Employee’s contribution to NPS.

- Donation to political parties/trusts.

Loss from house property has become noteworthy under the default (new) regime!

Exemptions and Deductions Available Under the New Regime:

- Transport Allowance: For specially-abled persons.

- Conveyance Allowance: For conveyance expenditure as part of employment.

- Travel Compensation: For travel on tour or transfer.

- Daily Allowance: For charges incurred due to absence from regular place of duty.

- Perquisites: For official purposes.

- Voluntary Retirement Benefits: Section 10(10C).

- Gratuity: Section 10(10).

- Leave Encashment: Section 10(10AA).

- Interest on Home Loan: On let-out property (Section 24).

- Gifts: Up to Rs 50,000.

- Employer’s NPS Contribution: Section 80CCD(2).

- Additional Employee Cost Deduction: Section 80JJA.

- Standard Deduction: Rs 50,000 from FY 2023-24.

- Family Pension Income Deduction: Section 57(iia).

- Agniveer Corpus Fund: Deduction under Section 80CCH(2).

CBDT Issue clarification New Tax Regime u/s 115BAC -Circular No. C1 of 2020

The Ministry of Finance issued a press release to clarify erroneous information about the new tax regime. It is clarified that the new regime under Section 115BAC(1A) was implemented in the Finance Act 2023, and no further changes have occurred since April 1, 2024.

As a default regime, this regime applies to individuals other than businesses and firms beginning with the fiscal year 2023-24 (Assessment Year 2024-25). The new tax regime has drastically lower tax rates. However, many exemptions and deductions (other than the standard deduction of Rs. 50,000 from salary and Rs. 15,000 from family pension) are no longer accessible, as they were in the previous system.

Although the new tax regime is the default, taxpayers are free to choose the tax system that they believe is most beneficial to them. The option to opt out of the new tax regime is accessible until the filing of the return for fiscal year 2024-25. Eligible individuals with no company income will be able to choose the regime for each fiscal year. Consequently, taxpayers can select a new tax regime in one fiscal year and an old one in the one that follows, or vice versa.

The CBDT issued Circular No. C1 of 2020, clarifying the following:

- Once an employee has intimated the choice of the new tax regime for a financial year, it cannot be altered for TDS purposes during that year.

- For taxpayers with business income, once the new regime is chosen, it applies to all subsequent years unless specific conditions are met to change it.

- Impact on Withholding Taxes from Salary : Employers must now consider the employee’s choice between the old and new tax regimes for accurate TDS calculation.

- Employer’s Role:

- Employers are required to compute TDS based on the employee’s intimation regarding the new tax regime.

- The employee’s intimation to the employer does not constitute a formal exercise of the option under Section 115BAC(5); the final decision can differ when filing the income tax return.

- Intimation by Employee:

- Employees must inform their employers each year if they opt for the new tax regime under Section 115BAC.

- If an employee fails to provide such intimation, the employer will compute TDS based on the old tax regime.

Common ITR Issues & FAQ’s For Filing Return For AY 2024-25

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.