Company Name removal without filing of ROC Returns

Table of Contents

COMPANY NAME REMOVAL WITHOUT FILING OF ANNUAL RETURNS:

APPLICATION TOWARDS COMPANY NAME REMOVAL WITHOUT FILING OF ANNUAL ROC FILLING:

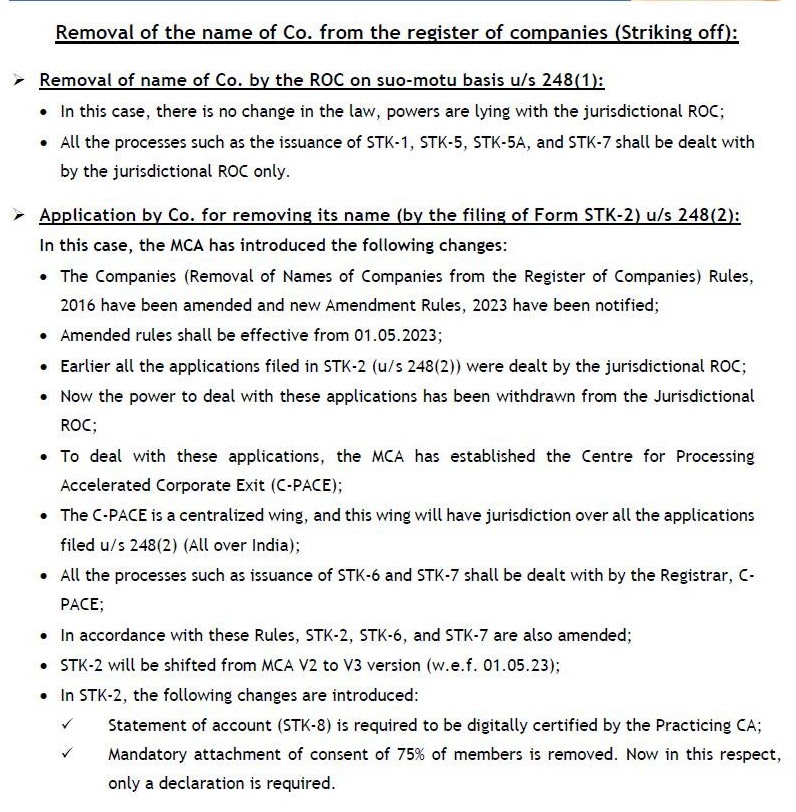

- Prior to the Register of Companies amendment, under Rule 4 (Removal of Names of Companies from the Register of Companies) Rules, 2016, it was mandatory for a company to file all of its pending Annual Returns, i.e. Form AOC-4, AOC-4 XBRL, and MGT-7, before filing an application in Form STK-2 for the removal of the company’s name from the Register of Companies.

- But according to the in Rule 4 of the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 (hereafter referred to as the principal rules), as amended by the ministry on May 10, 2019,

- A company may not file an application in Form No. STK-2 unless it has filed overdue returns in Form No. AOC-4 (Financial Statement) or AOC-4 XBRL, as applicable, and Form No. MGT-7 (Annual Return) up to the end of the financial year in which it CEASED TO CARRY ITS BUSINESS OPERATIONS.

- It means that a company is required to file its annual return for the year until it has conducted business; however, once the company has ceased operations, IT IS NOT REQUIRED TO FILE ITS ANNUAL PENDING RETURNS BEFORE GOING FOR DIRECT STRIKE OFF, and the company can go for direct strike off WITHOUT FILING OF ANNUAL RETURNS FOR THE YEAR IN WHICH THE COMPANY HAS NO BUSINESS.

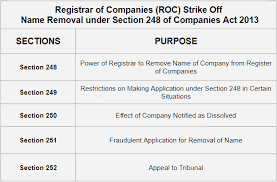

When company apply for the strike off to ROC voluntary?

- Voluntary removal of company’s name by itself U/s 248(2) read along with rule 4 of the companies (removal of names of companies from the register of companies) rules, 2016

- Without prejudice to the provisions of section 248(1), a company may, after extinguishing all its liabilities, by a special resolution or consent of 75%.

- Members in terms of paid-up share capital, file an application in the prescribed manner to the Registrar for removing the name of the company from the register of companies on all or any of the grounds specified in section 248(1) & the ROC shall, on receipt of such application, cause a public notice to be issued in the specified manner:

- Subject to that If the a company regulated under a special Act, approval of the regulatory body constituted or established under that Act shall also be obtained and enclosed with the application.

Documents required for strike-off for filing an application with ROC

Companies who are looking forwards strike-off must file an application to the ROC, which must attached the below mention documents:

- A statement of liabilities comprising of all liabilities & assets of the Company (in STK-8 not older than 30 days certified by a CA).

- statement concerning any pending litigations with respect to the company.

- An affidavit in Form STK 4 (by all directors of the company).

- Bank Closure Certificate

- Scan-Copy of CTC of Special Resolution (duly signed by every director of the company).

- If resolution is not passed consent of shareholders required to attach.

- Indemnity Bond duly notarized by all directors (in Form STK 3).

- Advertisement

Voluntary Strike Off/ Closure Services

We provide Voluntary Closure service for the companies/ LLP who have not filed Annual accounts and returns for previous financial years or since incorporation of the company/LLP or any other possible cases.

Who needs this Service and who can approach us for the above service?

- Company who has not filed Annual accounts & returns for previous financial years

- The Company who has some pending Charge satisfaction matters and looking to close the company

- Company who has any pending Director Dispute matter

- Any other matter in which the company wishes to file a closure application.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.