Mandatory filing of Income Tax Return AY 2022-23

Table of Contents

Mandatory filing of Income Tax Return AY 2022-23

India’s population is more than 136 crores, but only around 8 crore people pay income tax. This means that the taxpayers constitute only about 5.8 percent of the total Indian public. A lot of people do not file an income tax return (ITR) generally because of one prime excuse – their income is under the basic exemption limit. However, according to the taxation rules, several persons are mandatorily required to file an income tax return if they have incurred high value financial transactions with potential tax liabilities. The Indian Government has made some changes in the rules regarding ITR filing. According to the new Rule 12AB notified by CBDT, a person will have to file an ITR even if their income in a financial year is under the basic exemption limit.

The Indian government has implemented the non-filers monitoring system (NMS) to identify such persons that may be required to file an ITR. Failure to file an ITR in case a person has potential tax liabilities can lead to penalties along with serious criminal charges. This article intends to guide the readers about the new changes regarding the mandatory ITR filing.

In India, majority of people do not file Income tax return as their income is below basic exemption limit. Population of India is 136 crores, however only 5.8% of the total population file ITR. But Taxation rules has made it compulsory for people to file ITR if they engage in high value transaction that may have tax liabilities.

The new rules suggest that, a person will have to file ITR if they engage in transactions that may attract tax liabilities, even if their Income is below the exemption limit. A new system i.e non-filers monitoring system is implemented to find such persons. In case such person is found, who is engaging in such transaction but not filing ITR can be charged with criminal charges.

You will find all the relevant information regarding the new rule in this article:

What were the old rules for ITR filing (mandatory)?

Following is the list of people who were mandatory to file ITR, even if income is less than basic exemption limit under section 139 of Finance Act 2019:

- If in current account, there is a deposit of more than 1 crore.

- If the expenditure on foreign travel is more than 2 lakhs.

- If the expenditure on electricity consumption is more than 1 lakh.

New rules for mandatory ITR filing

It has been made clear by CBIT; under what conditions it is compulsory to file ITR. the new rules will be applicable for FY- 2021-22.

- If the Total sales/turnover/gross receipts of a business are more than Rs 60 lakh during the previous year.

- Gross receipts of a professional are over Rs 10 lakh during the previous year.

- Total TDS/TCS during a financial year is Rs 25,000 or more (in the case of senior citizens, the applicable limit is Rs 50,000)

- Total deposits in saving bank account are Rs 50 lakh or more during the previous year.

It is to be noted that even in cases where TDS/TCS is less than the limit mentioned below, the person shall file ITR in order to avoid any charges as NMS system will identify such person beforehand.

Let’s also discuss some other cases where ITR filing is mandatory

- If the gross total income of a person in any financial exceeds the basic exemption limit. The GTI is to be considered

- A Company and firm including LLP is mandatorily required to file an ITR irrespective of their income levels.

- In order to claim income tax return

- In order to carry forward the loss

- return if a person is a resident individual of India and has an asset or financial interest in a business located outside India.

- If you are a resident of India as well as a signing authority in a foreign account.

- In case they receive income derived from property held by a trust for religious or charitable purposes/ a political party/ research institution/ news agency/ education/medical institution/ trade union/ a hospital/ infrastructure debt fund/ any authority/ body or trust.

- In case of a foreign company getting treaty benefits on any transaction in India.

- To obtain loan or visa application.

How to file an ITR?

ITR is filed online through income tax portal. In case of any doubt or query it is best to consult a Chartered Accountant. There are CAs available in India that provide several services apart from filing income tax.

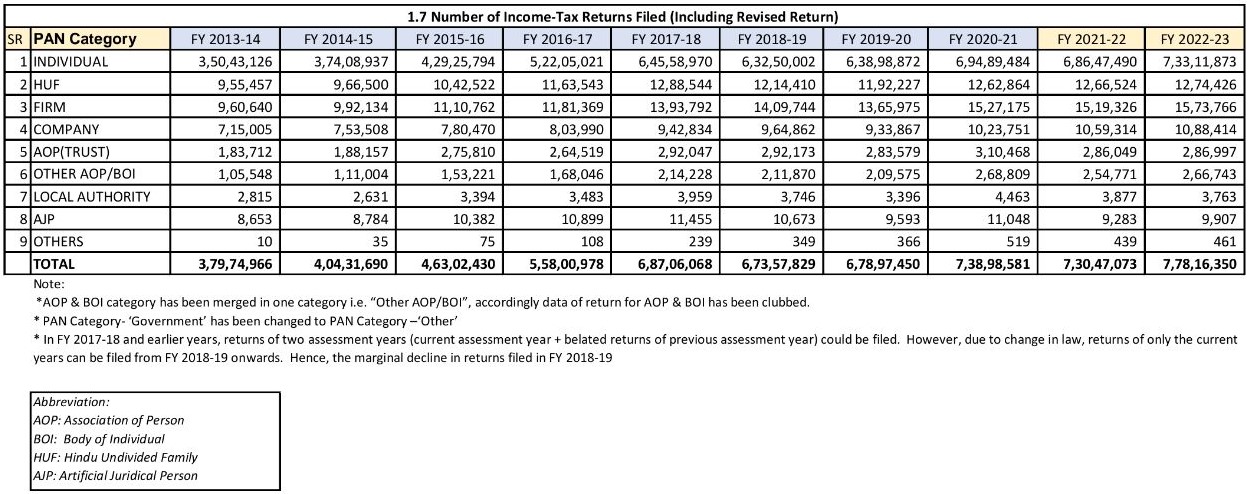

No of ITR’s Filed (Including Revised Return) for the Financial Year 2013-14 to Financial Year 2022-23

Conclusion

The new rules are stricter which make it compulsory to file ITR for persons engaging in high value transactions. The new rules will undoubtedly increase the number of income tax returns filed in India, ultimately leading to more transparency in economy.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.