Comparison between Revised, Belated & Updated Return

Table of Contents

Basic Comparison between Revised, Belated, and Updated Return

Revised Return – Section 139(5)

A revised return is filed when a taxpayer has already filed an original or belated return and later discovers any mistake, omission, or wrong statement (income missed, wrong head, incorrect deductions, etc.).

Time limit for Revised Return – Section 139(5), like example (AY 2022-23) : Up to 31 December 2022, or before completion of assessment, whichever is earlier.

Key points related to Revised Return – Section 139(5) : Revised Return – Section 139(5) Can revise any number of times within the time limit. Revised Return – Section 139(5) Change of ITR form is allowed. Revised Return – Section 139(5) if no penalty for bona fide mistakes. In case of a revised return, Section 139(5) Interest U/s 234B & 234C will be recomputed, if applicable. The original return must be verified before filing a revised return. If the original return was filed manually, it cannot be revised electronically. Such cases are extremely rare now, as almost all returns are e-filed.

Belated Return – Section 139(4)

What is Belated Return – Section 139(4)?

A Belated Return is filed when a taxpayer misses the original due date U/s 139(1). For AY 2022-23: Original due date: 31 July 2022 and Belated return period: 1 August 2022 to 31 December 2022

In case of a belated return, Section 139(4) and the late filing fee—Section 234F—are applicable.

- INR 5,000 if total income is greater than INR 5 lakh

- INR 1,000 if total income ≤ INR 5 lakh

When no late fee applies if income is below the basic exemption limit and taxpayers are not mandatorily required to file a return. Then no late fee is payable, even if filed after the due date.

Limitations under Belated Return under Section 139(4) : Under the Belated Return—Section 139(4), certain losses cannot be carried forward (e.g., business loss, capital loss). However, earlier, belated returns under Section 139(4) could not be revised, but now they can be revised within the allowed time.

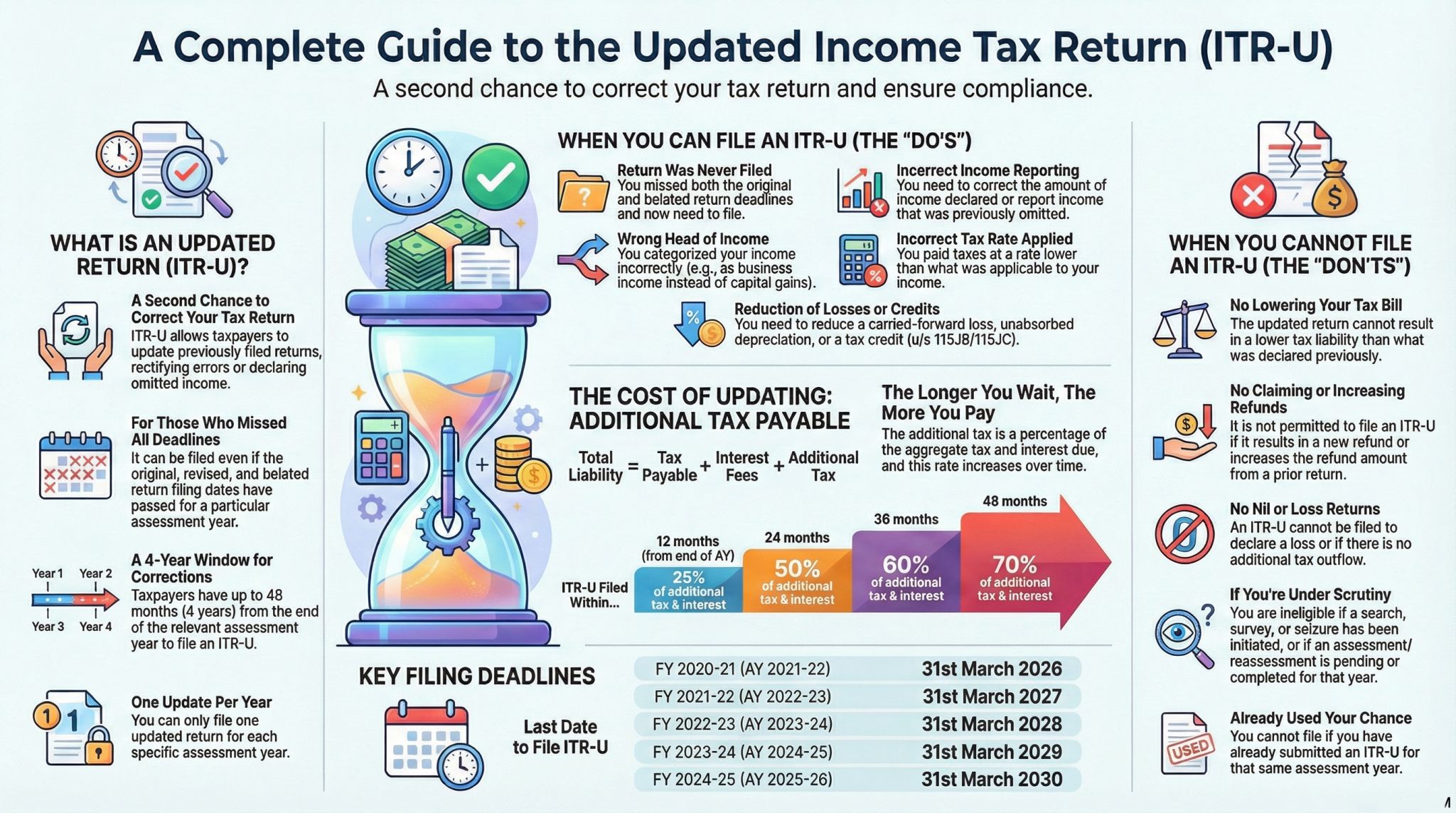

Updated Return – Section 139(8A)

What is ITR -U (Updated Return) – Section 139(8A)?

ITR-U (Updated Return) – Section 139(8A) Introduced by the Finance Act, 2022, the updated return allows taxpayers to file or update returns even after the time limit for belated/revised returns, subject to conditions.

Time limit for ITR-U (Updated Return) – Section 139(8A): Updated Return – Section 139(8A) can be filed within 24 months from the end of the relevant assessment year.

ITR-U (Updated Return)—Section 139(8A) Applicable years can be understood via example.

- FY 2019-20 : AY 2020-21

- FY 2020-21 : AY 2021-22

- FY 2021-22 : AY 2022-23

In case of an updated return, Section 139(8A) Additional tax payable

| Timing of filing Updated Return | Additional Amount |

| Within 12 months | 25% of tax and interest |

| After 12 months (up to 24 months) | 50% of tax and interest |

This is over and above normal tax and interest.

Situation where an updated return is NOT allowed—to reduce income, To declare or increase loss, To claim/refund more tax, To set off additional losses & If assessment, search, or prosecution proceedings have started

Separate form, i.e., filed using ITR-U (Updated Return), ITR-U (Updated Return) is mandatory to select reason for updating (missed income, wrong head, wrong tax rate, etc.)

Basic Comparison between Revised, Belated and ITR-U (Updated Return)

| Particulars | Revised Return | Belated Return | Updated Return |

|---|---|---|---|

| Section | 139(5) | 139(4) | 139(8A) |

| Filed When | Error in filed return | Missed original due date | Late correction / disclosure |

| Time Limit (AY 2022-23) | Up to 31-12-2022 | Up to 31-12-2022 | Up to 24 months from end of AY |

| Penalty | No | INR 234F late fee | 25% / 50% additional tax |

| Loss Carry Forward | Allowed | Limited | Not allowed |

| Separate ITR Form | No | No | Yes (ITR-U) |

| Can Reduce Income? | Yes | Yes | No |

Summary in Simple Terms

- Income Tax Revised Return: Best option if you made a mistake in your original return. No penalty, can reduce income, and losses can be carried forward. Revised Return is Correct mistakes (best option, no penalty)

- If filling the Belated Return: Filed after the due date but before the end of the assessment year. A late fee applies, and loss carryforward is restricted. Belated Return is a missed deadline (late fee applies)

- ITR -U (Updated Return): Last chance to disclose missed income within 24 months. Cannot reduce income or claim losses. Comes with a heavy cost (25% or 50% additional tax). The updated return is last opportunity to disclose income (costly but compliant)

ABout IFCCL

IFCCL offers end‑to‑end income tax return filing and specialised cross‑border tax support for individuals and businesses with global financial interests. As a trusted partner for expatriates, IFCCL provides comprehensive NRI taxation solutions, including NRI income tax filing and advisory services, NRI tax services, and expert assistance for NRI income tax filing in India. With a dedicated team of specialists, we serve clients as an experienced NRI income tax consultant, delivering structured and compliant NRI taxation services in India that address residency rules, foreign asset reporting, and India‑source income taxability.

We also offer in-depth Double Taxation Avoidance advisory, helping NRIs lawfully eliminate double taxation under DTAA provisions. As a seasoned FEMA compliance consultant, IFCCL supports clients in managing cross‑border investments, property transactions, and banking requirements. Our tailored foreign remittance tax advisory ensures clarity on LRS rules, repatriation, and tax liabilities on outward remittances.

For investors and property owners, IFCCL provides accurate NRI capital gains tax filing and overseas income taxation help, ensuring full compliance with both Indian and foreign tax regimes. Recognised as an expert CA for NRI taxation, we also extend strategic corporate tax advisory and personalised guidance to minimise liabilities and ensure seamless compliance across jurisdictions. With IFCCL as your trusted income tax consultant, NRIs receive reliable, expert‑driven solutions for every aspect of India‑related tax management. Contact us at 9555 555 480 or Singh@carajput.com/singh@caindelhindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.