All about updated Income Tax Return ITR-U U/S 139(8A)

Table of Contents

All about updated Income Tax Return ITR-U U/S 139(8A)

What is updated Income Tax Return ITR-U & how can submit it.

We can say that increase voluntary compliance by that person who pay tax to government. The government announced the concept of updated income tax return (ITR) in budget 2022. This concept in, section 139(8A) & section 140B were launched in the Income Tax Act, 1961. afterward, via a notification dated April 29, 2022, Central Board of Direct Taxes inserted Rule 12AC & notified form Income Tax Return ITR-U U/S 139 (8A), to provide some effect to the previously mentioned provision.

Describe Income Tax Return ITR-U U/S 139 (8A)

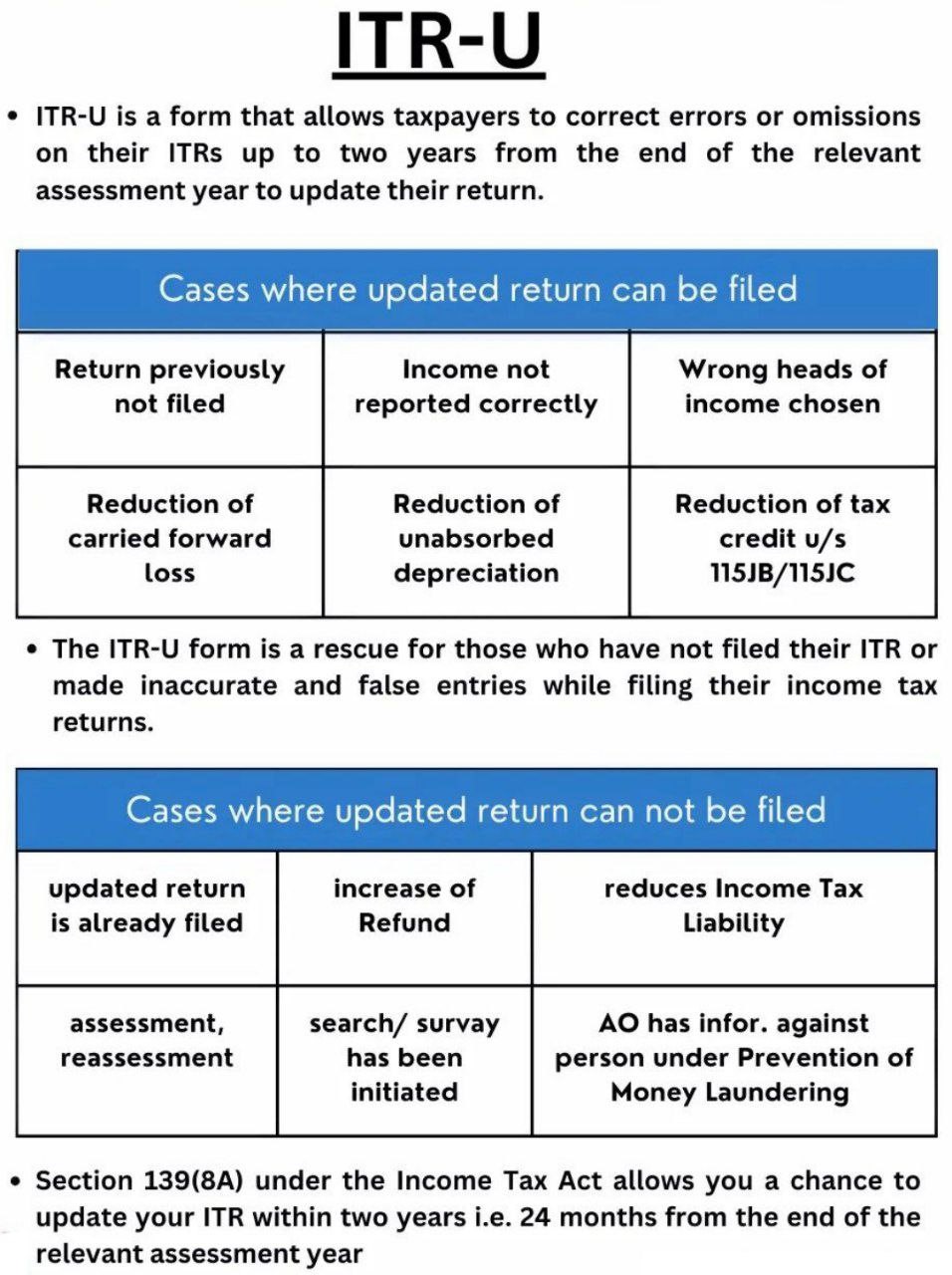

This was launched to allow an acceptable taxpayer to file or updated an income tax return, with particular timelines although paying some extra tax, interest & penalty, in an attempt to increase voluntary compliance & to ignore the penal outcome and further legal action if such kind of inclusion was later on find out by the tax authorities.

SITUATION WHEN UPDATED INCOME TAX RETURN ITR-U UNDER SECTION 139 (8A) NOT ELIGIBLE TO FILE

Updated Income Tax Return U/s 139(8A) cannot be submitted in the following situation:

- In case an updated Income Tax Return reduces Tax Liability in the ITR Return submitted earlier

- In case Updated Income Tax Return results in the increase of Income Tax Refund

- In case an Updated Income Tax Return is already submitted.

- If an updated ITR return is the income tax return of loss

- In case income tax survey has been conducted U/s 133A

- If any proceeding of reassessment, assessment, re-computation or revision is pending or completed for that relevant year

- In case a search has been initiated U/s 132

- If the AO has information against such person under Black Money (Undisclosed Foreign Income and Asset) or PMLA Act & Benami Property Transactions Act or Imposition of Tax Act or Smugglers & Foreign Exchange Manipulators Act & same has been communicated to the assessee.

- In case Accounts books or any other documents are requisitioned U/s 132A.

- If the information for the relevant AY has been received under an agreement referred to in section 90A or section 90 in respect of such person and the same has been communicated to him prior to the date of furnishing of Income Tax Return under this subsection.

- Other CBDT Notified Persons

Who can file an Income Tax Return ITR-U U/S 139 (8A)?

Any person who has made of filed his Income tax return (Whether on time, belated return or revised return) or has not filed his Income tax return for an assessment year has an better option to file an Income Tax Return ITR-U U/S 139 (8A) just in 24 months from the ending of the appropriate assessment year to give it result in extra payment of tax to the government .means to say that an Income Tax Return ITR-U U/S 139 (8A) can’t be filed to claim a repayment of taxes.

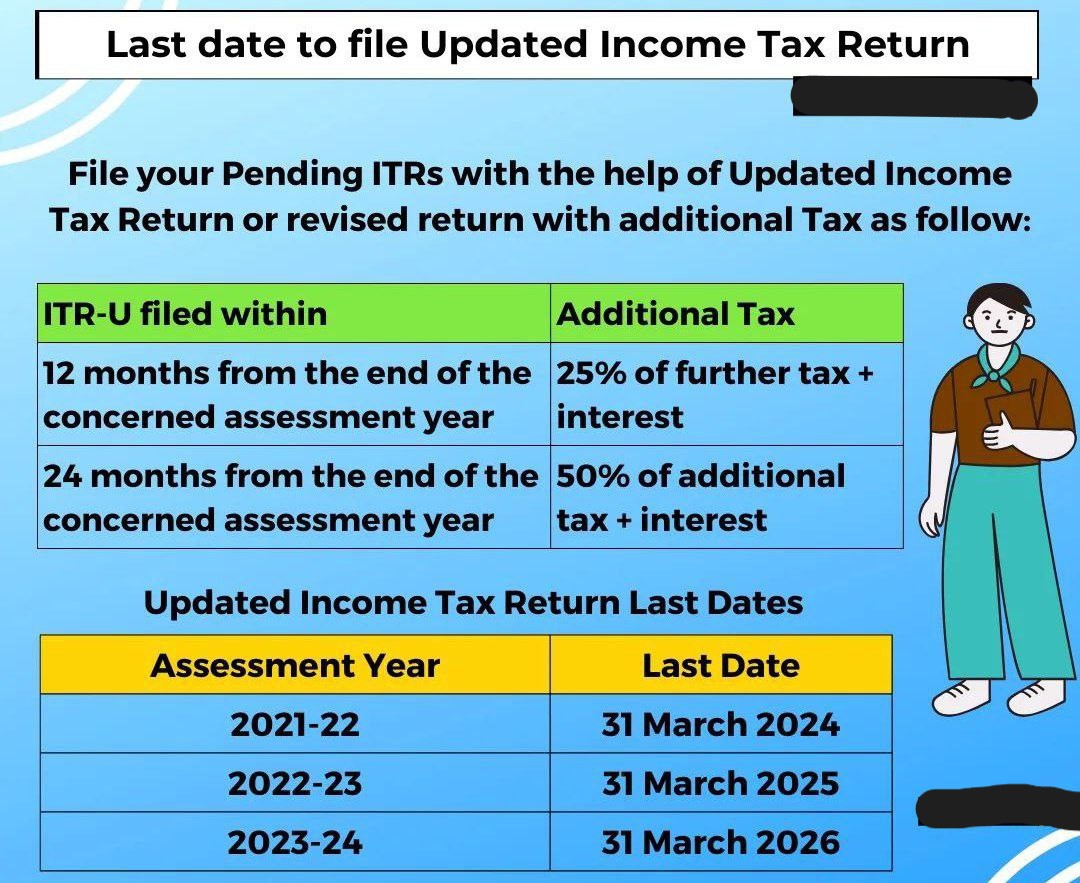

Recently, an updated return in Form of updated Tax Return can be filed for financial year 2020-21 (AY 2021-22) up to March 31, 2024 & for FY 2021-22 (AY 2022-23) up to March 31, 2025.

If a taxpayer has any omissions, errors, or incorrect information in his prior income return, he is entitled to file an updated return under Section 139 (8A) regardless of whether he has provided an original return, revised return, or belated return.

SITUATION WHEN UPDATED INCOME TAX RETURN ITR-U U/S 139 (8A) ELIGIBLE TO FILE

ITR -U required to be file in the situation like income tax return previously not filed; Reduction of carried forward loss; Reduction of unabsorbed depreciation; Reduction of tax credit under section 115JB/ 115JC; Wrong rate of tax; Income not reported correctly; Wrong heads of income chosen; Others

To give an example, if a person who pay the tax has filed Income tax return for financial Year 2021-22 & it has come to my attention that specified income has not been reported in the authentic /belated return was not filed then, the updated return can be filed by march 31, 2025.same as for financial year 2022-23, in case of that person who pay tax solitary that who is acceptable to file an updated return, like as return can be filed until March 31, 2026 just as an original return or a belated return is not filed. Updated income tax Return (ITR) can be filed in following situation:

- Income tax Return previously not submitted

- To Reduction of unabsorbed depreciation in the ITR.

- Reduction of carried forward loss in the original income tax Return

- When Wrong heads of income chosen in last income tax Return

- To Reduction of tax credit under section 115JB or 115JC

- Wrong rate of tax taken in income tax Return

- In case Taxpayer Income not reported correctly in last ITR

How to calculate tax on updated income tax return ITR-U

In case Income tax return was not submitted earlier:

Where the no of Income tax return has been submitted by the taxpayer, then before submit the updated return, the taxpayer have to pay the tax due together with interest & late filing fee payable, for the later in filing return &/of prepayment of tax, along with the extra tax applicable on filing of the updated income tax return ITR-U. The payment of tax is calculated after taking into account of the following points :

– The amount of advance tax (already paid)

– Any relief of tax claimed under various sections of the Income Tax Act

– Any-Tax deducted at source TDS/ Tax Collected at Source

– Any Alternative Minimum Tax credit/ Minimum Alternate Tax credit

Such updated income tax return shall also be accompanied by proof of payment of such tax, additional tax, interest & Late filing fee u/s 234F.

Is there an updated income tax return ITR-U penalty?

- Penalties are always imposed for late filing. If the return is filed within a year of the end of the relevant assessment year, an extra 25% of the tax and interest due on the income missing to be reported will be required to be paid.

- If the return is filed within two years of the relevant assessment year and after one year, the penalty is increased to 50% of the additional tax and interest that is owed.

Late fee for Belated ITR👇👇👇

- No Late Fee if Gross Total Income (GTI) upto ₹2,50,000

- Late Fee is ₹1,000 if GTI above ₹2,50,000

- Late-Fee is ₹5,000 if TOTAL Income above ₹5,00,000

- Last date for filing of updated returns (ITR-U) for A.Y. 2021-22 (i.e. for F.Y. 2020-21) is 31.03.2024

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.