COMPLETE UNDERSTANDING EMPLOYEE STOCK OPTION PLAN

BRIEF INTRODUCTION

Employee Stock Option Plan, can be defined as a plan, which provides long-term benefits, to the employees of the company, in the form of an option to participate in the equity ownership of the company at an amount less than the fair market value of those shares. In short, a group of employees are identified by a company on the basis of their performance or pay scale, and such identified employees are provided with an option to take up, predefined lot of shares, at a predetermined price, which is at a discount to the FMV.

Table of Contents

BENEFITS FROM EMPLOYEE STOCK OPTION PLAN,

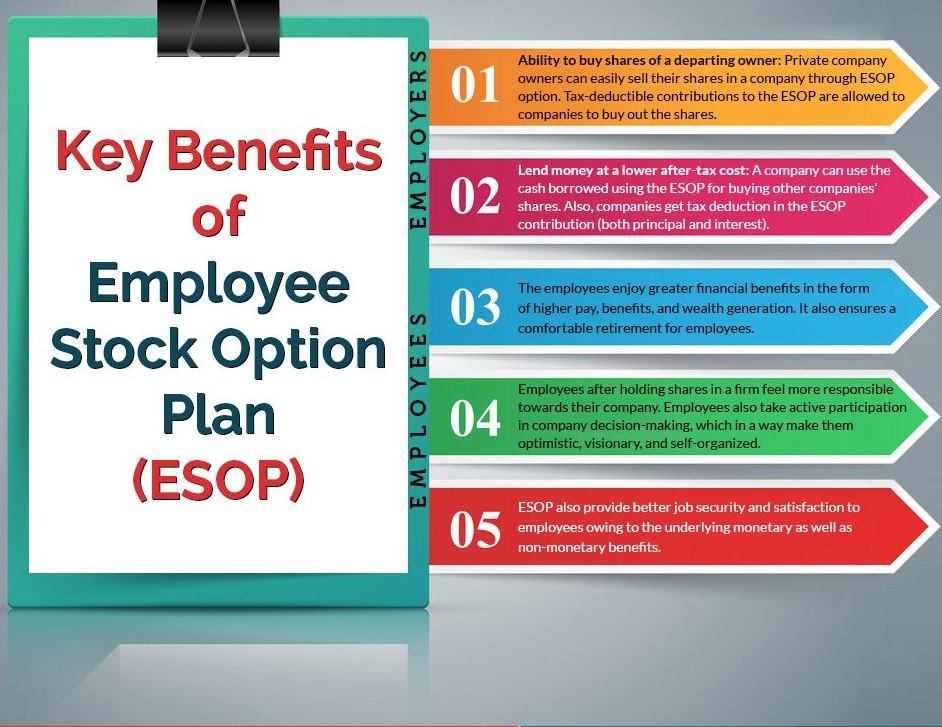

As we know, employees are the core asset of any Business. Thus, retention of the best is very important. ESOP was introduced, as the means of the most comprehensive and attractive tool for employee reward and retention. Through this process, the employees are offered stake in the ownership of the Company, which will thereby, results in boosting employee morale and loyalty towards the organization.

- MARKET FOR SHARES OF DEPARTING OWNER – Where any owner of a company wants to depart or leave the business, their holding in the companies, instead of transferring to some unknown person and also there is no guarantee that a buyer will be available. Thus, the company can use ESOP as a means of creating a ready market for their shares. By undertaking such an option, the company makes a tax-deductible cash contribution to the ESOP to buy out an owner’s shares.

- LOWER COST OF BORROWINGS – As discussed above, ESOPs is a tax-deductible cash contribution, to borrow money. The ESOP borrows cash from the company, and then uses it to buy company shares or shares of departing owners. Later, the company will make the tax-deductible contributions to the ESOP to repay the loan, thus having both principal and interest deductible from the profit.

- ADDITIONAL BENEFIT – A company can issue treasury shares under an ESOP, and deduct the value of shares taken up by employees, from their taxable income. Else, the company can contribute cash, and buy the share of departing public or private owners. In public companies, ESOP is used as a means of employee long term savings plan, which can account for about 5% of the plans and about 40% of the plan participants.

DISADVANTAGES FROM EMPLOYEE STOCK OPTION PLAN

- OBLIGATION FOR THE COMPANY – The providing ESOP to its employees, are put under an obligation to issue the required securities on the exercise date. ESOP does not help the company in any other way, except for providing some amount of liquidity and also some tax advantage as well. Otherwise, it is just like issuing normal stocks. This can make options riskier than normal stocks.

- UNCERTAINTY OF FUNDS – There is a greater insecurity of liquidity, as the funds will come only when the employees exercise their respective options. Thus, the amount is uncertain till the date of the exercise and the liquidity benefits with ESOPs is highly uncertain.

- IMPROPER VALUATION NORMS – As per the Companies Act, 2013, it is still unclear about various guidelines related to the valuation and accounting procedure for ESOPs in a company.

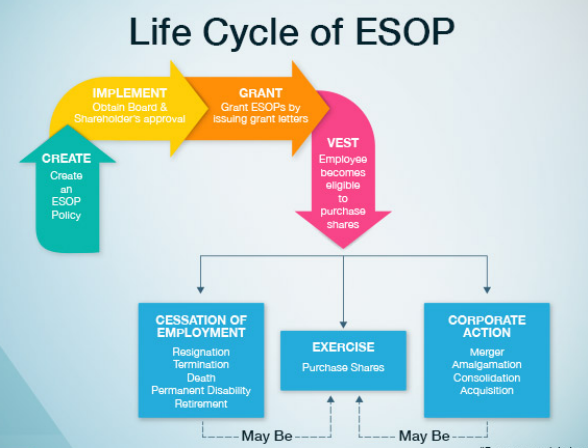

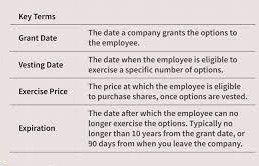

LIFE-CYCLE OF ESOP

TAXABILITY UNDER EMPLOYEE STOCK OPTION PLAN

The Section 17(2)(vi) of the Income Tax Act, 1961, defines perquisites as the value of any specified security or sweat equity shares allotted or transferred, directly or indirectly, by the employer, or any other former employer, to its employees, either free of cost or at concessional rate.

- In the above definition, specified security means the securities as defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and, includes securities issued under the plan of ESOP.

- In order to calculate the gain on such ESOP, the value of the specified security or sweat equity shares shall be taken as the fair market value of these securities, as on the date on which the option is exercised by the concerned employee. The gain shall be such FMV, as reduced by the amount actually paid or recovered from the employees.

TAXATION ON TWO STAGES

1. As discussed above, the securities issued under ESOP, comes under the definition of perquisite and thus, the same be taxed in the hands of employees as perquisite.

- TAXABLE VALUE OF PERQUISITE – The value of such perquisite shall be – (FMV on the date of exercise per share – Exercise price per share) x number of options exercised.

- For example, Company XYZ provided its employee Mr. A, with an option to take up 5000 shares of the company under the scheme of ESOP. The FMV on the date of exercise is Rs 150 per share and the Mr. A can take up these shares at Rs 75 per share.

- Thus, the amount of perquisite will be (150-75) *5000 = Rs 37500. This amount of Rs 37500 will be included in the salary of Mr. A, in the year, the shares are allotted to him. Also, the employer is required to deduct TDS on such an amount of perquisite.

- Also, where the employee is unable to pay TDS, many companies provide an option to sell some shares from the total shares to be allotted to the employee. Such sale of shares will amount to transfer of shares by the employee and capital gain provision will be welcomed. Such transfers always account for short term capital gain, as they are transferred just when they are allotted. For calculating the capital gain on such a transfer, the cost of acquisition shall be the FMV on the date of exercise.

2. Second stage of taxation comes, when the employee decides to sell some or all the shares after the lock in period. Whenever these securities are sold, capital gain or loss is accounted for in such transactions. Different tax rates are applicable on capital gain, based on the type of security and most importantly, its holding period.

TYPE OF SHARES |

HOLDING PERIOD |

TYPE OF CAPITAL GAIN |

RATE OF TAX |

| LISTED | UPTO 12 MONTHS | SHORT TERM | 15% U/S/ 111A |

| MORE THAN 12 MONTHS | LONG TERM | 10% IN EXCESS OF Rs 1 LAKH U/S 112A | |

| UNLISTED | UPTO 24 MONTHS | SHORT TERM | NORMAL SLAB RATE |

| MORE THAN 24 MONTHS | LONG TERM | 20% U/S 112 |

TAXATION AFTER BUDGET 2020

As discussed in the above part, ESOP is a perquisite in the hands of employees of the company and the same is subjected to income tax (30%+) on the full value of perquisite less the price paid for it. But for start-up, such an option is quite a great source of fund, if we exclude the aspects of tax and compliance. Thus, in order to benefit the start-up to come up with a great number, amendments were made in the Budget in 2020. As a result, a slew of measures was undertaken by the Government of India, for the benefit of the Indian start-up sector. The Government decided to defer the payment of income tax on ESOPs from the time of exercise of ESOPs. Under the new provisions, the tax liability for start-ups arises within 14 days from the earlier of the following –

- Date after the expiry of 48 months from the end of the PY in which ESOP is exercised/allotted.

- Date when such shares have been transferred or sold by the employee.

- Date from which the employee ceases to be an employee of the ESOP issuing company.

Budget also deferred the liability of the employer to deduct TDS on the ESOP by start-ups.

ELIGIBILITY FOR ABOVE RELAXATION

- The start-up was incorporated on and after 1st April, 2016 and before 1st April, 2021.

- And the annual turnover of such a start-up does not exceed Rs 25 crores during any of the previous years.

- Also, the business be in receipt of a certificate of eligible start-up issued by the Inter-Ministerial Board of certification as notified in the Official Gazette by the Central Government.

Such a system of deferring tax payment on ESOPs will help start-ups gain high-quality employees. Deferring of tax means that the employee is relieved from the burden of paying tax when the shares are allotted. Hence, they will pay tax at the time of selling the exercised shares and the tax can be paid from the proceeds of such sale. Also, the time period of 48 months from the end of the assessment year when the ESOPs were exercised, for selling the share, is a pretty good time and also the share will become long term capital assets, thus the tax rate will also be less. Also, in case the employee wishes to leave the company, the company can take up these shares and the same be taxed at that time, which will indeed help the company from retaining its own shares.

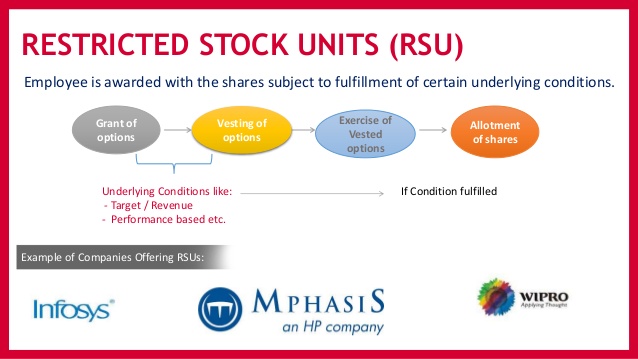

RESTRICTED STOCK UNITS(RSU) IN INDIA

RSU are Restricted Stock Units that are provided by foreign companies to their employees as a means of compensation for their worthy service to their business. RSU is taxable in India and is considered just like ESOPs.

- Since RSUs are issued by foreign companies, the same shall not be listed on any recognised stock exchange in India. Thus, no STT (Security Transaction Tax) shall be paid in relation to such stocks.

- Such securities shall be termed as short-term capital assets, where the period of holding is up to 24 months. When they are transferred, Short-term capital gains arise and the same is taxed at the employee’s normal income tax slab rates.

- In case, RSUs are held for a period exceeding 24 months, they are termed as long-term capital assets. When they are transferred, long term capital gain arises and the same is taxed @ 20% along with indexation benefit.

In case the assessee has already paid some tax in respect of such RSUs, he can claim credit of same in India, at the time of filing their annual return, provided such country is in DTAA agreement with India and such agreement allows the assessee to take the credit in India.

CONCLUSION

Concluding the above article, it can be made out that ESOP is a great way to build the foundation of financial freedom and retirement. As a means of motivation, ESOP makes the employees more inclined to work towards the goal of the company. They feel pride and could connect with the company, when provided with the ownership of the company and thus, ESOP turns to be a measure of success for a company.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.