ALL ABOUT ROUTES TO ISSUE EMPLOYEE STOCK OWNERSHIP PLAN

Table of Contents

ROUTES TO ISSUE ESOP (Employee stock ownership plan)

Under Companies Act, 2013, a company can issue ESOP to its employees through two modes, namely – Direct Route and Trust Route:

1. DIRECT ROUTE – Under direct route, the company directly grants the options to the employees. At the time of exercise, fresh equity shares are allotted to the eligible employees. Thus, the direct route is a one-to-one dealing between company and employees.

PROCEDURE FOR DIRECT ROUTE

- The board of directors of the company prepares the scheme of ESOP and passes a resolution for the same.

- The scheme is then proposed to the Remuneration Committee for their approval.

- Once the approval is received, the board shall call for a meeting of its shareholder.

- The meeting is convened and the scheme is proposed to all the shareholders. The notice supplied shall contain the details of the employees to whom the ESOP is granted and at what price.

- The shareholder shall approve the scheme by passing a special resolution.

- After successful approvals, the board issues a letter of offer to respective employees.

2. TRUST ROUTE – This route is gaining greater recognition in today’s world and is preferred by listed entities. Under this, the company creates a trust in the name of ESOP Trust, for the purpose of running the ESOP schemes. Employees interested in exercising the option to acquire the shares, would acquire it from the trust instead of from the company. The company shall first transfer the required shares in the name of trust using the secondary market or direct allotment and the trust will then issue the same to the exercising employees.

The trusts are funded by the company to purchase the requisite shares from the secondary market and when the employees pay the trust for taking up the share, the trust pays back the company. Also, whenever an employee wishes to sell the shares, the trust formed can take up such shares and by this the company can avoid transferring of shares to any unknown person.

CONDITIONS FOR TRUST ROUTE

- The creation of trust shall be done after a separate special resolution by the shareholders for the same.

- Where the company is listed on Stock Exchange in India, the trust can acquire the share of the company, only through the secondary market.

- In the case of an unlisted company, the trust can purchase the shares through the valuation done by an Independent Registered valuer.

- The total shares held by the trust shall not exceed 5%. of the aggregate of paid up capital and free reserves of the company, at any point of time.

PROCEDURE FOR THE TRUST ROUTE

- The board of directors of the company prepares the scheme of ESOP and passes a resolution for the same.

- The scheme is then proposed to the Remuneration Committee for their approval.

- Once the approval is received, the board shall call for a meeting of its shareholder.

- The meeting be convened and the scheme be proposed to all the shareholders and also a separate resolution be passed for creation of trust. The notice supplied shall contain the details of the employees to whom the ESOP is granted and at what price.

- The shareholder shall approve the scheme by passing a special resolution.

- After successful approvals, the board issues a letter of offer to respective employees.

- Then prepare the Trust Deed under the Indian Trusts Act for the proposed trust and register the same with the jurisdictional Sub-Registrar.

- File application for obtaining PAN for the Trust and Open Bank Account using the PAN obtained.

- Determine the number of shares and their value, required to be allotted to the Trust for subsequent transfer to the employees.

- Obtain Valuation Report from a Registered Valuer for the value of the Shares, in case the company is unlisted.

- Initiate the procedure to provide loan to the Trust, to purchase the required number of Shares at the predetermined price.

- Make the allotment of share to the trust.

- The trust will then transfer/sale the shares to the eligible employees respectively at the Exercise Price as determined in accordance with the ESOP Scheme

- On receipt of Exercise Price, the trust shall repay the loan back to the Company.

COMPLIANCES UNDER TRUST ROUTE

- APPOINTMENT OF TRUSTEES – The board can appoint any person as the trustee of the ESOP Trust, except for the following –

-

- Directors, Key Managerial Personnel of the company as well as their relatives.

- Directors, Key Managerial Personnel of the holding or subsidiary company of the concerned company.

- Any beneficial owner holding more than 10% of the paid-up share capital of the company.

- DISCLOSURES UNDER BOARD’S REPORT – on successful initiation of scheme, the company shall, specify the details of the ESOP scheme as per the provisions of the Companies Act, in its Board’s Report for the year in which the scheme is initiated.

- REGISTER OF ESOP – The company is also required to maintain a separate register in the name of Register of Employee Stock Options in Form no. SH.6 and shall enter the details pertaining to each ESOP granted.

ISSUES UNDER ESOPs

From the above information, we can very well make out that ESOPs are accompanied with complex rules and regulations. Companies require a proper administration system for providing stock ownership to the employees and in the event of failure, it may invite certain risk issues and penalties. Upon establishing ESOPs the company must have proper administration, staff, including third-party administration, legal costs, and trustees and be aware of the costs that will be incurred while providing this facility.

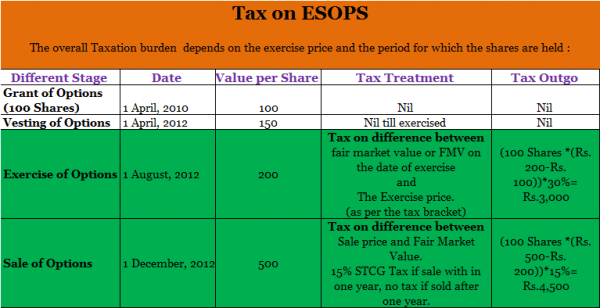

Taxation on ESOPs :

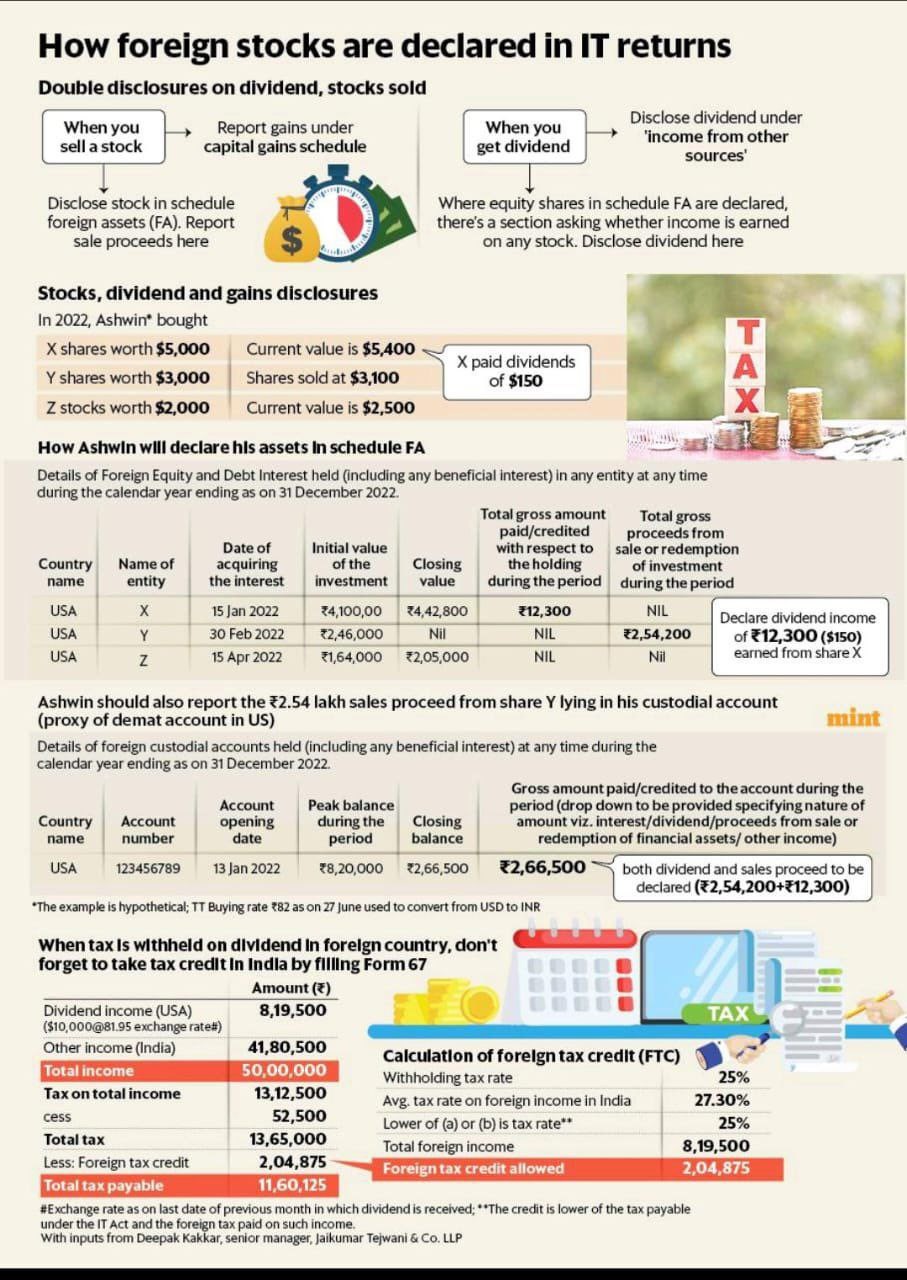

Taxation on long-term capital gains from Sale of Foreign Shares:

The LTCG Gains from the sale of foreign stocks are subject to a 20% tax rate, plus a surcharge, a health and education cess, and an indexation benefit on the cost.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.