Credit Note Disclosure in GSTR-9 Annual Return Filing

Table of Contents

Credit Note Disclosure in GSTR-9 Annual Return Filing

Under GST, suppliers of goods or services must issue a tax invoice for every taxable supply. However, when the taxable value of the supply decreases due to specific circumstances, the supplier is required to issue a credit note. This ensures proper adjustment of tax liability and helps maintain transparency in GST filings. This guide explains the concept of a credit note and the disclosure requirements for GSTR-9, the annual GST return.

What is a Credit Note?

A credit note is a document issued by a supplier to adjust or reduce the taxable value of goods or services originally invoiced. It serves as confirmation that the supplier has credited the buyer’s account in their records. This document is often issued when a reduction in the tax liability or adjustment in the invoice amount is required.

Why is a Credit Note Issued?

As per Section 34(1) of the CGST Act, credit notes are issued under these circumstances:

- Sales Returns: Due to quality issues, service rejection, or damaged goods.

- Overcharging: If the buyer is charged more than the agreed amount.

- Post-sale Discounts: Offering additional discounts after the sale.

- Quantity Variance: Delivered quantity is less than what was invoiced.

- Cancellation: Pending payments against invoices are canceled.

- Other Adjustments: Situations requiring invoice modification to reduce liability.

Key Features of a Credit Note

- Adjusts the original invoice and tax liability.

- Must be reported in the GSTR-1 return of the issuing month.

- Details appear in the recipient’s GSTR-2B and GSTR-2A.

- Helps suppliers avoid refunds by directly reducing the buyer’s payable amount.

Conditions for Issuing a Credit Note :

Must reference the original invoice number (optional under the new system). Should comply with time limits for declaration in GST returns.

Process of Issuing a Credit Note

- Scenario: A buyer raises a debit note for issues like defective goods.

- Action: The supplier acknowledges it by issuing a credit note.

- Result: Adjustments are made in the supplier’s and buyer’s accounts.

Time Limit to Issue a Credit Note

- Must be declared before:

- 30th September of the year following the supply year.

- The actual date of filing the annual return for that financial year.

Format of a Credit Note

A credit note must include:

- Supplier’s name, address, and GSTIN.

- Document type and unique serial number (up to 16 characters).

- Date of issue.

- Buyer’s details (name, address, GSTIN).

- Reference to the original invoice number.

- Taxable value, tax rate, and tax adjustment amount.

- Supplier’s or authorized representative’s signature.

Steps to Create a Credit Note

- Choose a template.

- Add the business logo.

- Include the date, unique credit note number, and invoice reference.

- Add supplier and buyer details, including GSTIN and place of supply.

- Save for records and future reference.

Disclosure Requirements in GSTR-9

Credit notes need to be accurately disclosed in GSTR-9, the annual GST return. Disclosure varies based on whether the recipient is a registered (B2B) or unregistered (B2C) person:

1. B2B Supplies (Registered Persons): Report credit notes under Table 4(I). Ensure alignment with outward taxable supplies and adjustments in tax liability.

2. B2C Supplies (Unregistered Persons): Separate disclosures are required for large and small B2C supplies:

-

- Large B2C Supplies (value per invoice > ₹2.5 lakh): Report under Table 5A for inter-state supplies.

- Other B2C Supplies (value per invoice ≤ ₹2.5 lakh): Disclose in:

- Table 5D (for inter-state supplies).

- Table 7 (for intra-state supplies).

Disclosure of Financial Credit Notes :

Financial Credit Notes (not linked to GST adjustments) do not require reporting in: GSTR-1, GSTR-3B, GSTR-9/9A. They may appear in GSTR-9C as part of reconciliation between books of accounts and GST returns.

Financial Credit Notes

- Financial credit notes are not subject to GST provisions.

- No reporting is required in GSTR-1, GSTR-3B, or GSTR-9/9A.

- However, they may be disclosed in GSTR-9C for reconciliation.

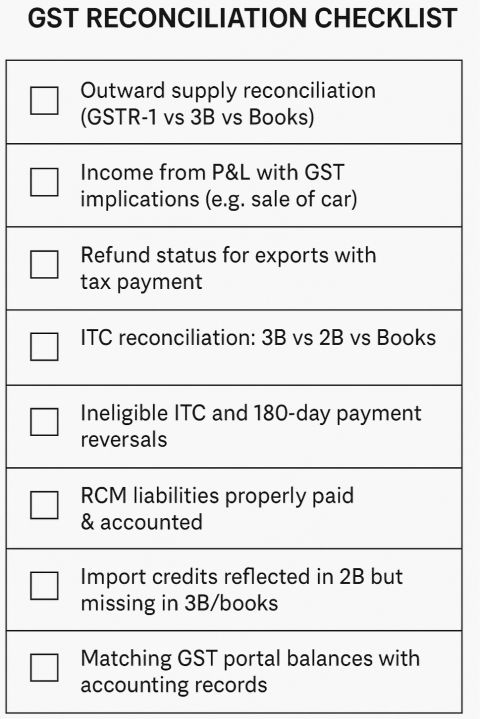

GSTR-9 Filing Season is Here!- GST Reconciliation Checklist

Quick Compliance & Value Addition Checklist for Professionals and Clients

As the annual GST return filing season begins, here’s a quick checklist to ensure accuracy, compliance, and peace of mind:

- Outward Supply Reconciliation : Compare GSTR-1 vs GSTR-3B vs Books to ensure all sales are correctly reported. Match GSTR-1, GSTR-3B, and books to ensure accurate sales reporting.

- Income from P&L with GST Implications : Check for transactions like sale of fixed assets (e.g., car, machinery) that attract GST. Identify GST-applicable transactions like sale of assets (e.g., car).

- Refund Status Review : Verify export refund claims (with tax payment) and ensure they’re properly reflected. Confirm export refunds (with tax payment) are properly claimed and recorded.

- ITC Reconciliation : Match GSTR-3B vs GSTR-2B vs Books to confirm input tax credits are accurate and complete. Cross-check GSTR-3B, GSTR-2B, and books for correct input tax credit reporting.

- Identify Ineligible ITC & 180-Day Reversals : Reverse ITC where payments to vendors are pending beyond 180 days or where ineligible credits exist. Reverse ITC for unpaid vendor bills beyond 180 days and ineligible credits.

- Reverse Charge Mechanism (RCM) Liabilities : Ensure all RCM liabilities are paid and recorded correctly in the books. Taxpayer must ensure reverse charge liabilities are paid and reflected in accounts.

- Import Credits Validation : Cross-check import ITC appearing in 2B but missing in 3B or books, and reconcile accordingly. Reconcile import ITC shown in GSTR-2B but missing in GSTR-3B or books

- Match GST Portal Balances with Accounts : Verify cash, credit, and liability balances on the GST portal vs accounting records. Match portal balances (cash, credit, liability) with accounting records.

A thorough reconciliation today can save you from notices, reversals, and penalties tomorrow.

Conclusion

Credit notes play a critical role in ensuring accurate adjustments under GST. Suppliers should adhere to the guidelines and report them correctly to avoid discrepancies in GST filings. For assistance, consult tax experts to streamline your GST and income tax processes.

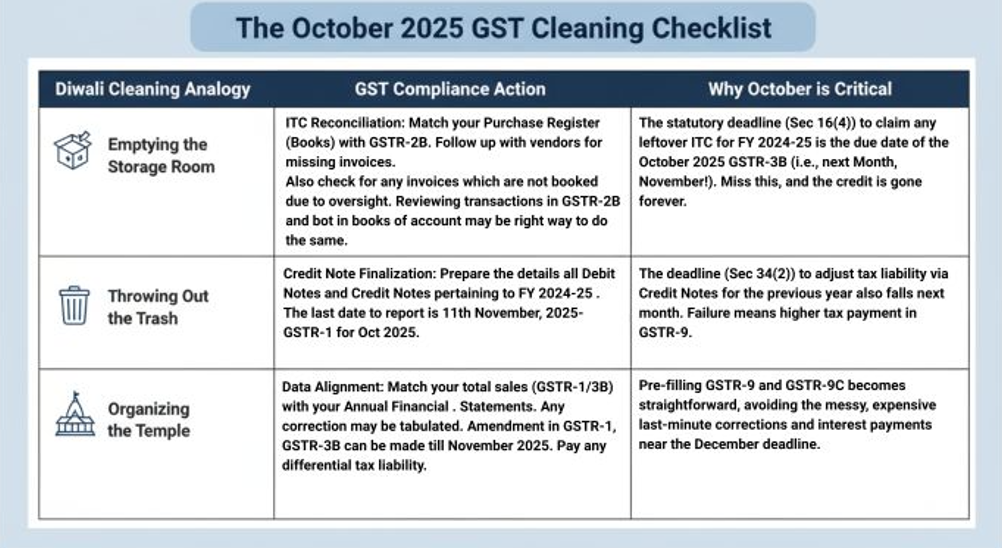

GSTR-9 & GSTR-9C Are Live! – 𝐓𝐢𝐦𝐞 𝐭𝐨 𝐒𝐭𝐚𝐫𝐭Taxpayer 𝐆𝐒𝐓 𝐃𝐢𝐰𝐚𝐥𝐢 𝐂𝐥𝐞𝐚𝐧𝐢𝐧𝐠

Looks like the Govt is nudging small taxpayers especially those with zero corrections in October GSTR-3B to file early this time. A smart move to distribute portal load and avoid the year-end rush we’ve seen in past cycles. Interestingly, annual return compliance has stayed below 60% for the last two years. & Early filing this time could help change that trend and make the filing season much smoother for everyone.

If your books are clean and October returns align. We needed File GSTR-9 & GSTR-9C early & Don’t wait till December to hit “Submit” We all know the Diwali tradition clearing out the old to welcome new prosperity. Taxpayer GST compliance deserves the same deep clean.

Why October Matters : October 2025 is the absolute must-do month for every registered business to finalize their books for FY 2024–25 Annual Return (GSTR-9/9C). The time limit for all major FY 2024–25 corrections in regular returns is tied to the October 2025 GSTR-3B, to be filed in November 2025. This makes October Taxpayer last window for:

- Input Tax Credit reconciliation

- Rectification of missed entries

- Adjustment of credit notes, debit notes, or mismatches

Start your GST deep clean now don’t let a simple reconciliation turn into a lost Input Tax Credit claim or penalty later. The earlier Taxpayer file GST return, the smoother company compliance journey will be.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.