CWA, CS, & CA are now come under purview of PMLA

Cost and work accountants, company secretaries, & Chartered accountants are now come under purview of PMLA.

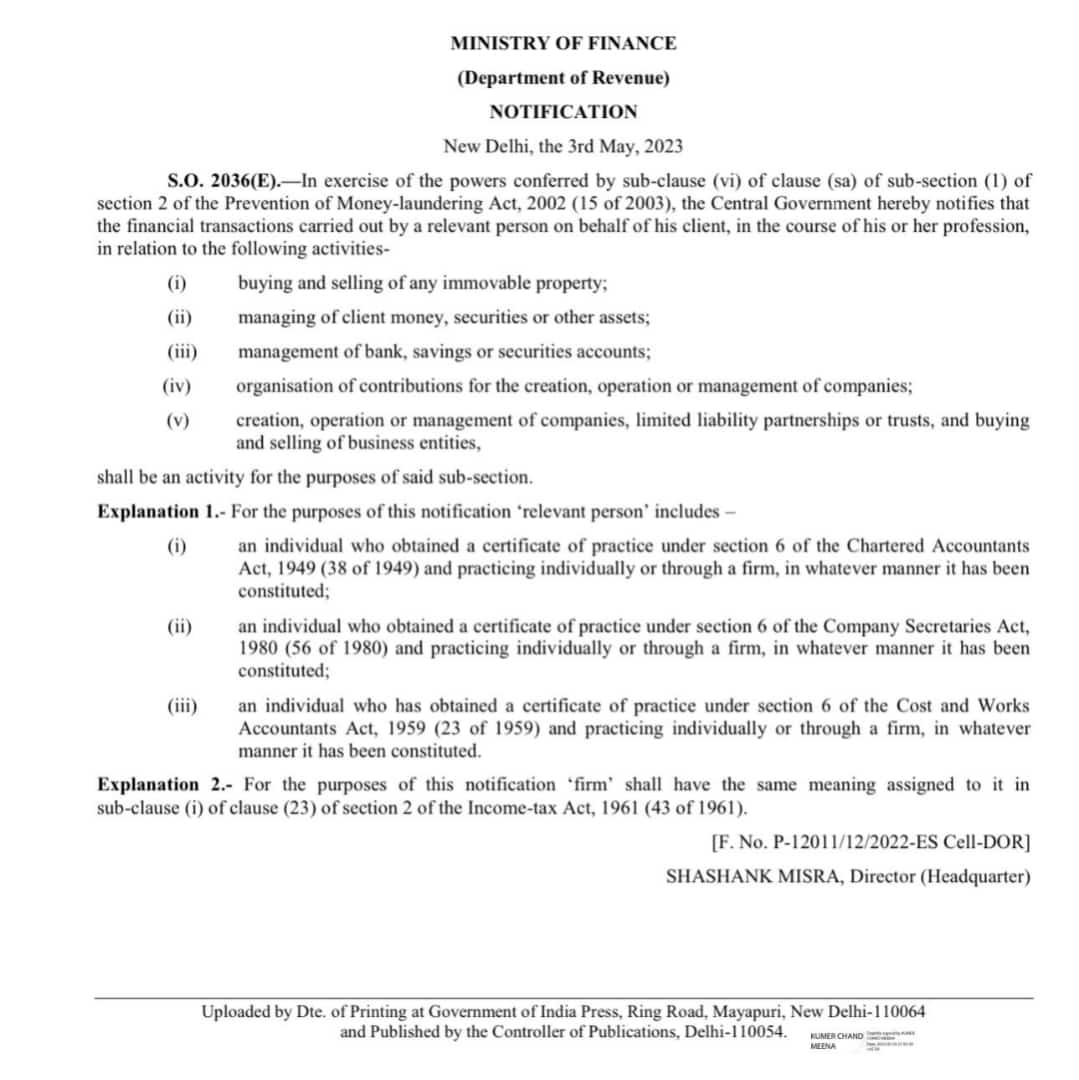

- Cost and work accountants, company secretaries, and Chartered accountants who undertake financial transactions on behalf of their clients are now subject to the Prevention of Money Laundering Act.

- In accordance to the Ministry of Finance, the following activities by the aforementioned professionals will fall under the purview of the Prevention of Money Laundering Act: buying and selling immovable property, managing client securities/assets/money, managing saving/bank or securities accounts, establishing and operating LLP/trusts/companies, buying and selling business entities on behalf of their clients.

- Ministry of Finance dated May 3, has been issued in a notification mentioned here under :

- The expansion of the scope of money laundering law i.e Prevention of Money Laundering Act aims to increase the process of due diligence and corporate governance performed by practising professionals like CWA, CS, & CA, as well as to combat the threat of money laundering and similar kind of malicious Acts.

- New Delhi based practicing Chartered Accountants Mr. Swatantra Kumar singh, the above notification is a little ambiguous because professionals can do due diligence and the Prevention of Money Laundering Act will only be enforced when personal involvement in any crime is discovered. Furthermore, professionals are expected to follow the responsibilities outlined in the applicable law.

- But, Mr. Swatantra Kumar Singh stated that the action will help to reduce such professionals’ involvement in the formation and operation of shell businesses, which causes losses to the government’s coffers. Overall, he believes it is a good technique for combating money laundering.

- Last year, the government recommended disciplinary action against 400 chartered accountants and company secretaries for their suspected role in incorporating shell businesses in violation of norms and guidelines.

- There is little doubt that the government’s relationship with these specialists can be strained at times, as the government has recently accused them of assisting clients in evading taxes and worse. However, industry has argued that as long as it comes within the scope of the legislation, they cannot be held accountable.

- The reality of course, in the case of smaller firms, this level of involvement may be their main selling point, whereas larger firms earn huge fees for ‘consulting’ work by opening up such channels.

- However, as every tax payer will tell you, the most obvious and common sense choice of more straightforward tax regimes with transparent processes keeps evading everyone’s notice.

- Perhaps it is because these restrictions keep an army of accountants in business and busy. One hopes that, at some point, we will reconsider this approach as well, rather than aiming to criminalise more and more activities, including genuine mistakes.

Goods and Services Tax Act violations will be booked as Prevention of Money Laundering Act offence

For details related contact us India Financial Consultancy Corporation Pvt Ltd, a team of Expert CA CS in Delhi. or email singh@caindelhiindia.com, or call on 9555 555 480,

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.