Online utility of Traces(TDS), income tax, GST, ESI, PF

Table of Contents

Online utility of Traces(TDS), income tax, GST, ESI, PF

What is Gst Login portal page?

Gst Login Page:

http://www.gst.gov.in is the official Goods and Services tax website, widely known as the GSTN portal/ GST Portal, which facilitates many kinds of services for GST taxpayers, that is start from taking GST Registration, traversing via GST Return filing, GST Refund application filling, and GST registration cancellation application etc.

How to view my company information from MCA Master Data service?

MCA allows you to look at the your company master data by just entering the company’s CIN. The master data of any LLP or company can be found at the website below.

http://www.mca.gov.in/mcafoportal/viewCompanyMasterData.do

Employee Provident Fund Login Portal:

PF Portal makes available a lot of its services online. It is useful to both Employer & Employee. Employee Provident Fund office also assists the Central Board in administering a mandatory contributory PF Scheme, an Insurance Scheme and a Pension Scheme for the workforce engaged in the organized sector in India.

https://unifiedportal-emp.epfindia.gov.in/epfo/

ESI Portal Login

Employee State Insurance is a health insurance scheme and self-financing social security for Indian Employee managed by ESIC under the Employee State Insurance Act 1948. Under this scheme, employees earning up to Rs. 21,000 per month should contribute 1.75% towards Employee State Insurance while the employer contributes 4.75% which shall be deposited with the Govt within 15 days from the end of the respective month.

Employee State Insurance corporation is providing a wide range of services using online mode via its portal. Below is the link to Employee State Insurance Portal.

http://www.esic.in/employeeportal/login.aspx

Traces (Tax Deduction, Reconciliation, Analysis and Correction Enabling System) Portal Login:

This is the official website of CPC(Tax deduction at source), Department of Revenue, Ministry of Finance, Government of India.

Centralized Processing Cell (Tax deduction at source ) is a technology-driven transformation initiative for TDS administration that provides a comprehensive solution through its portal TRACES. The Portal has been developed under the National E-Governance Plan of the Govt.

Below online enabled services are available on this portal:

- Registration for taxpayers and tax-deductors.

- Electronic filing of Tax deduction at source Statements – Original and Corrections

- View Statement Processing Status and TDS Defaults

- View Tax Credit Statement (26AS) of taxpayers

- Digital Tax deduction at source Certificates – Forms 16/16A/16B in reconciliation with 26AS

- Justification Report for details of TDS Defaults

- Consolidated File for submitting corrections to the Tax deduction at source Statements

- Total Tax deduction at source Compliance Report for Tax-Deductor PAN with multiple associated Tax Deduction and Collection Account Number

- E -TDS Statement Corrections

- Secured integration with corporate Tax-deductors

- Tax deduction at source Refunds

https://www.tdscpc.gov.in/app/login.xhtml

How to check Tax deducted at source Challan Paid?

Challan Status Enquiry for Tax Payers:

Using this feature, taxpayers can track the status of their challans deposited in banks online.

This offers two type of TDS searches:

- a) Challan Identification Number (CIN) based view:

On entering Challan Identification Number (CIN) i.e. details such as BSR Code of Collecting Branch, Challan Tender Date & Challan Serial No.) and amount (optional)

The taxpayer can view the following details:

BSR Code, Date of Deposit, Challan Serial Number, Major Head Code with description, TAN/PAN, Name of Tax Payer, Received by TIN on (i.e. date of receipt by TIN)

– Confirmation that the amount entered is correct (if the amount is entered)

- b) Tax Deduction and Collection Account Number (TAN) based view:

By providing TAN & TDS Challan Tender Date range for a specified financial year, the Income tax taxpayer can view the below details:

CIN No, Major Head Code with description, Nature of Payment, Minor Head Code

In case income tax taxpayer enters the amount against a CIN, the system will confirm whether it matches with the details of the amount uploaded by the bank or not.

https://tin.tin.nsdl.com/oltas/servlet/TanSearch

How to check TDS Challan Paid status:-

Challan Status Enquiry for Tax Payers : Taxpayers can track the status of their challans deposited in banks online with the help of this provided feature.

There have two type of searches available –

1st CIN based view, &

CIN based view:-

On entering Challan Identification Number (CIN i.e. details such as BSR Code of Collecting Branch, Challan Tender Date & Challan Serial No.) and amount (optional)

The taxpayer can view the following details:

BSR Code, Date of Deposit, Challan Serial Number, Major Head Code with description, TAN/PAN, Name of Tax Payer, Received by TIN on (i.e. date of receipt by TIN)

– Confirmation that the amount entered is correct (if the amount is entered)

2nd TAN based view.

How to make the application for a TAN Online?

Tax Deduction Account Number (TAN) can be applied through both offline and online mode. If a person want to apply for TAN through online mode he/she have to application in FORM NO. 49B.

Link of FORM NO. 49B:-

https://tin.tin.nsdl.com/tan/form49B.html

How to Apply for a Pan Online?

Nowadays, PAN (PERMANENT ACCOUNT NUMBER) can be applied online from anywhere. Applying for PAN is a simple and easy process in which the require data must be filled online & after filling correct detail once the form is submitted, some mandatorily document which require should be sent at the NSDL Center as specified. Later, in case of any changes or correction that can also be made online through service portal.

With the help of below link online application can be made for PAN on NSDL website :-

https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

How to Check Income Tax Refund Status?

The refund originated on processing of ITR (Income-Tax Returns) by the CPC- Bangalore or Assessing officers are transmitted to the , CMP Branch, SBI or Mumbai (refund Banker) on the very next day of the processing for additional distribution to the taxpayers.

Refund could be sent in two defined mode:-

NECS / RTGS: To permit credit of refund straight to the bank account , then Taxpayers bank account no. (which of at least ten digits),Bank branch’s MICR (Magnetic ink character recognition) CODE & correct mentioned address is mandatory.

Paper Cheque: Correct address & Bank Account No. is mandatory.

Amount of the tax can be seen by taxpayer after 10 days of their refund which has been sent by the Assessing Officer to their refund banker , just by entering correct ‘Assessment Year’ & ‘PAN’ (PERMANENT ACCOUNT NUMBER) detail.

https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

Where to Login for Filing ITR?

Online Income tax E-filing Portal – This is the official portal of Ministry of Finance, Income Tax Dept, Govt of India. Above said E-filing Portal has been developed as a Mission Mode Project under National E-Governance Plan. Aim of this income tax portal is to give one window access to income tax-related services for national citizens and related stakeholders.

https://portal.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html?lang=eng

How to Pay Income Tax Online?

Online tax payment Facility, where the income tax taxpayer can submit online challan & fil it challan through the Internet. The income tax taxpayer must have a bank account with the selected bank’s Debit card/ Net-banking.

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Telangana Commercial Taxes Website:

The Commercial Taxes Department is a pioneer in the use of information technology to offer fair and equitable tax administration. The majority of the Department’s critical functions are now available online. Key Dealer services such as Commercial Taxes Registration, returns & registrations are also available online. Key Online Dealer services are as follows:

- E-Registration (PT registrations & VAT registrations for Liquor & Petrol)

- E-waybill

- E-Payment

- E-Return

https://www.tgct.gov.in/tgportal/

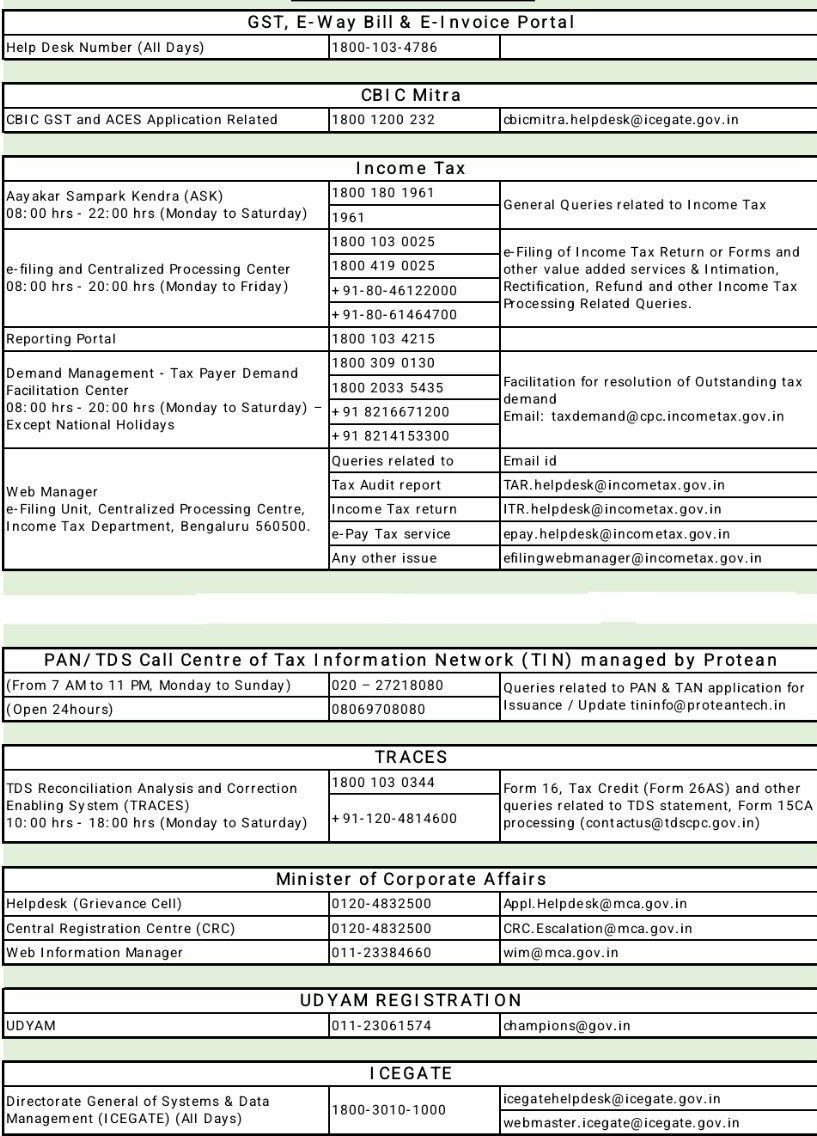

Useful Taxation support help line No and email address of tax authorities

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.