Difference Between Repo Rate & Reverse Repo Rate

Table of Contents

WHAT IS THE DIFFERENCE BETWEEN REPO RATE AND REVERSE REPO RATE

BRIEF INTRODUCTION

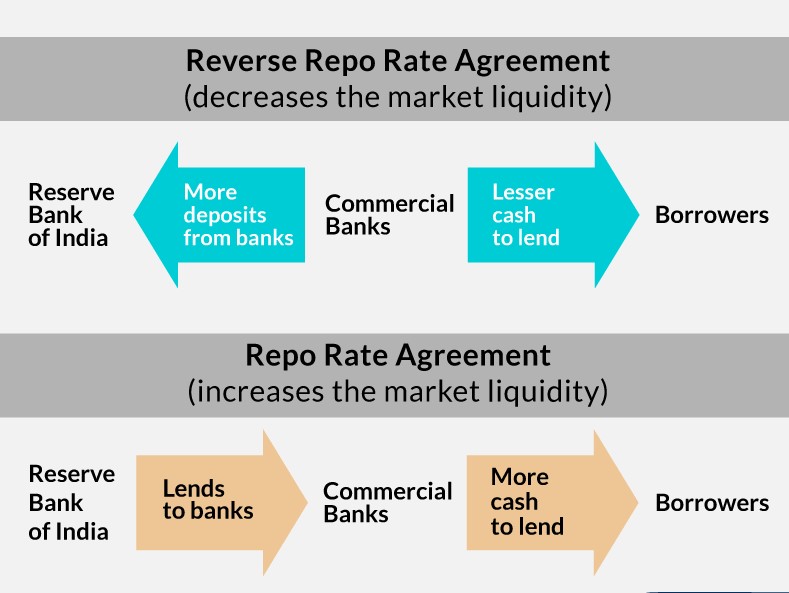

The two Liquidity Adjustment Facility with the Reserve Bank of India are – Repo Rate and Reverse Repo Rate. Repo Rate is basically the rate of interest which the RBI, i.e. Reserve Bank of India, charges for granting loans to commercial banks. On the other hand, Reverse Repo Rate is basically the rate of interest, which is provide to the commercial banks, for parking their excess money with the Reserve Bank of India.

Repo is an abbreviation, used for the term Repurchase Option Agreement. It’s a contract entered into between a customer and the seller of a debt instrument, wherein, the vendor makes a promise to repurchase the said instrument after a specified period of time. It requires the seller to repurchase securities at a comparatively higher price than the actual price on which it had been actually sold. So, the difference within the amounts paid by the customer of securities (at the time of buying) and therefore the seller of securities (at the time of repurchasing), is termed as repo rate. It helps the vendor of securities to raise short term funds.

In order to influence the short term interest levels, RBI tends to conduct Repo transactions only. The tool is employed to manage excess liquidity within the monetary system. Further, Repo/Reverse Repo transaction takes place between parties approved by the RBI which too within the securities approved by RBI, like Government of India and government Securities, Treasury Bills, FI Bonds, Corporate Bonds, PSU Bonds, etc.

These two rates are mainly accustomed to maintain the availability of money within the economy, i.e. to regulate by increase or decrease liquidity. The reserve bank of India revised the repo rate 4%. The reverse repo rate, on the opposite hand, has been revised at 3.35%. within the below-mentioned article, we’ve got highlighted the main differences between repo rate and reverse repo rate for your better understanding.

DIFFERENCE BETWEEN REPO RATE AND REVERSE REPO RATE

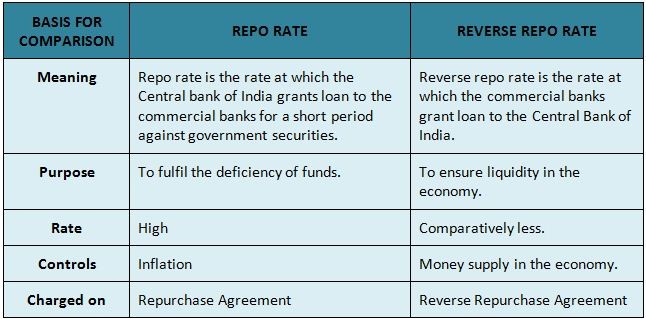

Some of the major differences between the Repo Rate and Reverse Repo Rate are as follows –

| PARAMETERS | REPO RATE | REVERSE REPO RATE |

| MEANING | IT IS THE RATE OF INTEREST, AT WHICH RBI SANCTION LOAN TO COMMERCIAL BANKS, USING GOVERNMENT SECURITIES AS COLLATERAL. | REVERSE REPO RATE IS THE INTEREST OFFERED BY RBI TO BANKS WHO DEPOSIT FUNDS WITH THEM |

| RATE OF INTEREST | USUALLY HIGHER THAN THAT OF REVERSE REPO RATE | LOWER THAN THAT OF REPO RATE |

| OPERATIONAL MECHANISM | RBI ISSUES FUNDS TO COMMERCIAL BANKS, USING GOVERNMENT SECURITIES AS COLLATERAL. | COMMERCIAL BANKS DEPOSIT THEIR EXCESS FUNDS WITH RBI AND RECEIVE INTEREST ON THEIR DEPOSITS. |

| CONTROLS | INFLATION | MONEY SUPPLY IN THE ECONOMY. |

| PURPOSE | FULFILL THE SHORTFALL OF FUNDS. | ENSURE LIQUIDITY IN THE ECONOMY. |

| BORROWER’S OBJECTIVE | MANAGEMENT OF SHORT-TERM SHORTFALL OF FUNDS. | TO REDUCE OVERALL SUPPLY OF MONEY IN THE ECONOMY. |

| IMPACT OF HIGHER RATE | INCREASE IN COST OF BORROWING, HENCE MAKING LOANS EXPENSIVE. | DECREASE IN MONEY SUPPLY IN THE ECONOMY, AS COMMERCIAL BANKS TENDS TO PARK MORE SURPLUS FUNDS WITH RBI. |

| IMPACT OF LOWER RATE | DECREASE IN COST OF FUNDS, HENCE MAKING LOANS CHEAPER. | MONEY SUPPLY INCREASES IN THE ECONOMY AS BANKS LEND MORE AND REDUCE THEIR DEPOSITS WITH CENTRAL BANK |

| CHARGED ON | REPO RATE IS CHARGED ON REPURCHASE AGREEMENT | REVERSE REPO RATE IS CHARGED ON REVERSE REPURCHASE AGREEMENT |

| CURRENT RATE | 4% | 3.35% |

REPO RATE

As mentioned above, repo rate is an interest rate at which the RBI grants funds to commercial banks for short-term against government securities. in such a case, a repurchasing agreement is signed by both parties, stating that the securities are repurchased at a pre-determined price at a given date. It helps the RBI to manage the money supply, liquidity, and inflation within the economy. As of August 2021, the repo rate is about at 4%.

FEATURES

- It is the interest are at which, RBI lends money to commercial banks, in order to cover up their short-term deficiency of funds.

- Banks also borrow money in the case of an emergency or to comply with the norms of CRR or SLR requirements.

- It could be a tool to regulate inflation and liquidity and, regulate the money supply within the economy.

- RBI makes increases or decreases the Repo Rate considering the macroeconomic factors.

REVERSE REPO RATE

Reverse repo rate is the interest offered by the RBI to commercial banks who deposit funds with them. as an example, when banks generate excess funds, they are advised to deposit it with RBI and earn interest on the same. thus, it is another financial tool employed by the RBI to manage funds within the economy. Reverse repo rate stands @ 3.35% as of August 2021.

FEATURES

- Banks deposit their surplus money with the RBI and earn interest for it.

- Considering the macroeconomic forces, RBI increases or decreases the rate.

FAQs on Repo Rate and Reverse Repo Rate

- Is reverse repo rate more than the repo rate?

No, reverse repo rate is often under repo rate. Currently, the reverse repo rate is 3.35%, while repo rate is 4%.

- What is the reason, for reverse repo rate being less than the repo rate?

Reverse repo rate is under the repo rate because RBI cannot pay higher interest on deposits than charging interest on loans. This is often to facilitate income from RBI to commercial banks, which successively will increase the purchasing power of the market.

- What happens when reverse repo rate decreases?

In case the reverse repo rate decreases, commercial banks tend to reduce their deposits with RBI, and therefore use the surplus funds in lending to their customer, in order to earn higher interest. This ends up in increasing purchase power and cash inflow within the economy.

- What is the reverse repo rate at present?

Reverse repo rate stands at 3.35% as of August 2021.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.