EFFECTS OF MERGER OF PSB ON ITS CUSTOMERS

Table of Contents

What is Customer effect of PSU Bank merger

INTRODUCTION

If customers have an account in one amongst the merging bank accounts, they will expect these changes post-merger:

-

Change In Account Details

The consolidation of banks means the customers will get a replacement account number, customer id, and IFSC codes. for example, if the customers have an account in Andhra Bank and Corporation bank, the 2 bank accounts will merge into one after the consolidation and that they are going to be allotted one account number and id.

Important Thing to Remember: To receive the official information about the change in account details, all the personal information like email address, signaling, address must be updated with the bank.

-

Submission Of Details To Third-Party

The new account numbers and id means you have got to update your financial details to 3rd parties like the income tax department, insurance companies and mutual funds also. This update is required to debit/ credit various bills and charges.

Important Thing to Remember: the customers must not forget to clear all the post-dated cheques and electronic clearing services. they need to issue new electronic clearing services (ECS) mandate post inquiry from banks and third parties. they can’t use existing balance cheque leaves and checkbooks beyond 12 months.

-

Internet Banking Facilities

The customers may have to face the close up of the net banking facilities of the merging banks, reckoning on the policies of anchor banks. They must, however, not panic as one of the foremost significant plus points of the merger is advancement in technology, which essentially means they will get access to better technological platforms.

Important Thing to Remember: the customers must be prudent while accessing the web site of anchor banks and wary that they’re not redirected to any phishing webpages.

-

Services And Charges Of The Bank

The bank charges for deposits and borrowing may additionally change eventually after the merger. However, if the customer has taken a loan, then the rate of interest of the loans won’t be changed unless it’s renewed.

Important Thing to Remember: the customers must keep a watch on the interest rates and costs and charges of the anchor bank. These charges of the bank might not be immediately changed after the merger but will surely come into effect eventually.

-

Credit/Debit Cards

It is also expected that the customers will need to exchange the Credit / debit card of the merging bank with the cards of anchor banks. While the old card might be used for the interim period, they may, however, need to get replaced at some stage.

-

Shutdown Of Local Branches And ATMs

There is also a possibility that some of the ATMs of the merging banks be close up. With the close up of those ATMs, other benefits like locker facilities shall also not be available with the customers.

CHECKLIST TOWARDS PSB MERGER NECESSITIES

- Do not panic.

- Know about the new bank.

- Keep track of upcoming changes.

- To avoid any check bounce, leave some amount in old accounts.

- Negotiate with the new bank.

Advantage of PSU Bank Merger :

- The Government has made an attempt to ensure that substantially weaker banks are not knocked out of the market due to poor loans/NPAs by merging them with stronger banks. Because the same borrower has taken loans from several banks, the legal and other ancillary costs will be reduced by merging the banks.

- Because the merged bank will benefit from synergies, a large client base will help the banks to be profitable. Better business portfolios, asset quality, market capitalization, risk appetite, and risk management strategies will be available to the amalgamated institutions.

Economies of scale and lower operating costs will benefit the amalgamated banks. - Business After the merger, banks will be in a stronger position to fund large projects that they previously couldn’t afford on their own, making the funding process for those projects faster and easier.

- With fewer institutions to manage, the RBI will be able to impose the banking norms used in other economies, bringing Indian banks up to par with banks with a global presence.

- Merging banks will allow them to pool resources and employ them more effectively and efficiently. Branch rationalisation, responsibilities, and functions will be reduced as a result of the mergers. However, FM has stated that there will be no layoffs and that staff will solely gain from the mergers.

Mergers of Public Sector Banks: A Synergistic Approach

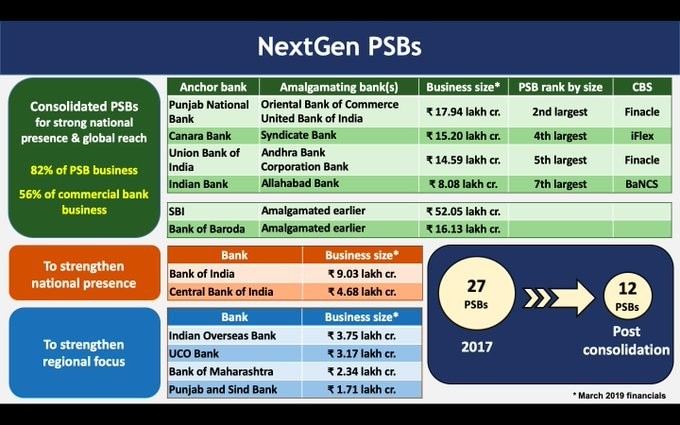

Mergers of PSUs reduce the number of PSUs from 27 to 12. This has a positive influence on the Banking Books of Accounts. The amalgamated Banks will only perform profitable lending based on the consortium. Banking efficiency will improve, and prior NPAs may be securitized with new refinancing under the Merged PSUs. In addition, the Basel Accord III-based requirement of maintaining capital to risk-weighted assets of public sector undertakings will be followed, resulting in increased profitability for Bank NIFTY on the equity stock market (NSE).

CONCLUSION

- It’s expected that the PSB merger will foster the financial growth of public sector banks, making them competent enough to stay pace with the worldwide banks. During this process, customers may experience a number of the teething experiences; however, to avoid any such hassle, they must not panic and keep a detailed watch on the changes post-merger.

- The government has taken several efforts for the welfare of the country at regular intervals. Some of these produce immediate results, while others produce results after a period of time. The outcome of this massive merger is a contentious subject, and the future will determine the merger’s fate. Currently, the COVID-19 pandemic has halted the whole economy and plunged the country into disarray. Let us band together and combat this evil together by staying at home.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.