Discrepancy in GST E-way Bill: No GST Penalty will be Levey

Table of Contents

Discrepancy in GST E-way Bill: No Penalty under GST law will be Levey

- The origination as well as termination of the goods in question was in State of Madhya Pradesh meaning thereby the authorities are of the view that the goods were not to be unloaded in the State of UP or any intention to avoid tax.

- But, mainly on the ground of some small technical fault for not carrying the GST E-waybill e-way bill, Penalty ought not to have been levied in the absence of any discrepancy in document accompanying the goods.

- So it can be concluded that Small Technical Fault for Not Carrying Goods and Services Tax E-Way Bill’ & in the matter of Allahabad High Court in the case of JK Cement Ltd – Penalty Set-Aside By Allahabad High Court In Absence Of Any Other Discrepancies. (Allahabad High Court in the case of JK Cement Ltd)

With reference to Discrepancy in GST E-way Bill :

- Penalties under GST law can be levied for various reasons, including non-compliance with E-way bill rules. If there is a discrepancy in the E-way bill, such as incorrect information or non-issuance of a valid E-way bill when required, it can lead to penalties under GST law.

- The penalties under GST can vary depending on the nature of the violation. These penalties are meant to ensure that businesses comply with the GST regulations and do not engage in tax evasion or fraud.

- To ensure compliance with GST Tax requirements, it’s critical to identify & resolve any GST discrepancies in an E-way bill as soon as possible. Minor errors, but might not always incur GST fines or penalty, particularly if they were made unintentionally and could be fixed right away.

- GST E-way bill is a document needed for the movement of goods from one place to another, especially for the transportation of goods valued at more than a specified threshold. It is generated electronically on the GST portal to track the movement of goods and ensure tax compliance.

Here are some key points to consider while dealing in discrepancy in Goods and Services Tax E-way Bill:

- Timely required GST E-waybill Correction: In case any e-way bill GST discrepancy is identified, Then It is important to rectify it as soon as possible. GST tax Dept provide a window for correction without imposing penalties in case e-way bill GST discrepancy done promptly.

- Nature of GST E-waybill Discrepancy: The nature and extent of the discrepancy matter. Minor errors like typographical mistakes in the vehicle number or slight variations in the invoice amount may not attract penalties.

- Communicate the GST E-waybill discrepancy on timely manner: It’s a good practice to communicate the GST E-waybill discrepancy & Business Origination intent to correct it to the GST Tax authorities. e-way bill GST Transparency can sometimes help in avoiding GST penalties.

- GST related record Keeping: requirement of maintain proper records of all GST transactions, including E-way bills, invoices, & Corrections made. Good record-keeping can help demonstrate your compliance efforts.

- Intent intentional or unintentional GST discrepancy -: Goods and Services Tax authorities often consider whether the e-way bill GST discrepancy was intentional or unintentional. If it was an honest mistake, Business Origination might have a better chance of avoiding GST penalties.

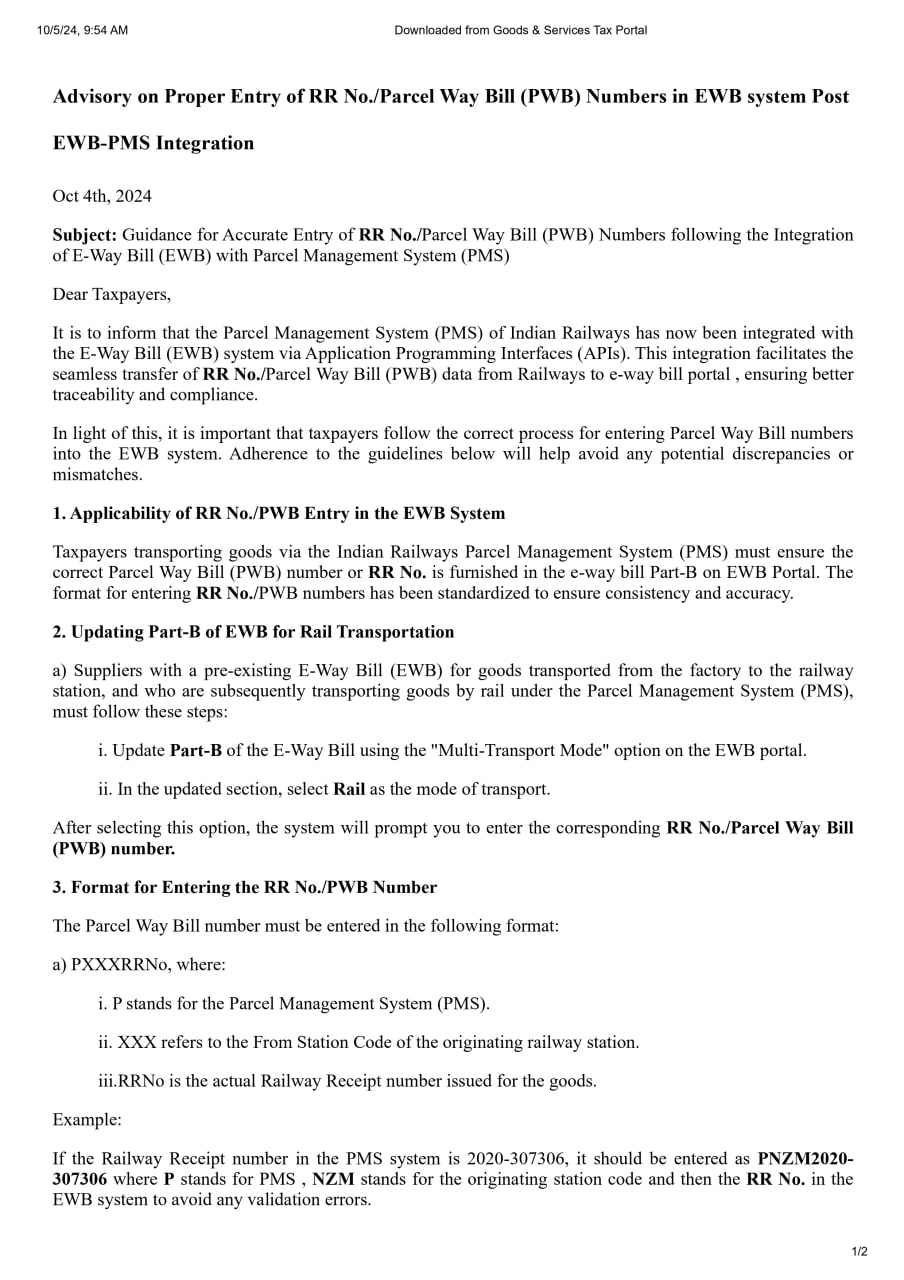

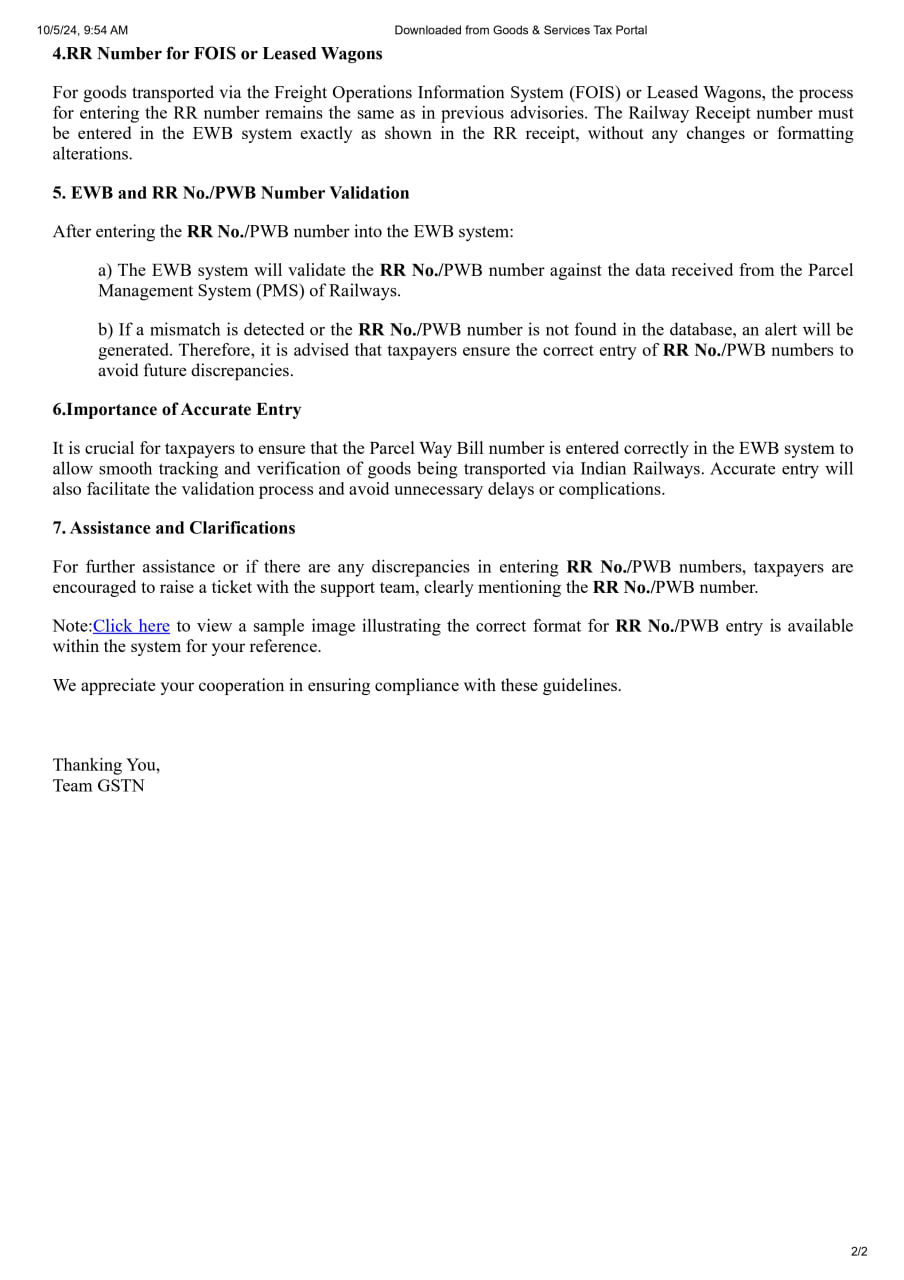

Advisory on Proper Entry of RR No./Parcel Way Bill (PWB) Numbers in EWB system Post EWB-PMS

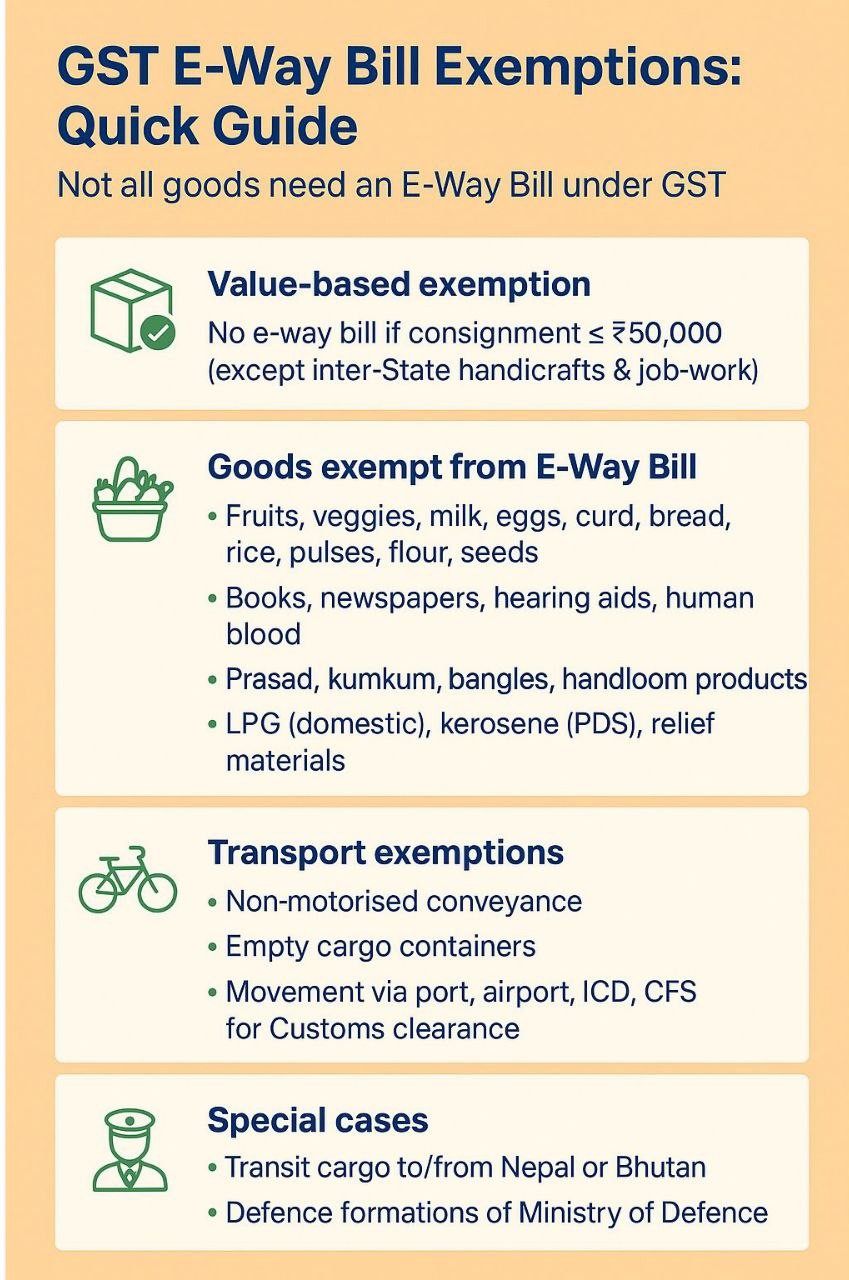

GST E-Way Bill Exemptions: Quick Guide

Under Rule 138 of the CGST Rules, an e-Way Bill is normally required for movement of goods valued above ₹50,000. However, several exemptions exist where generation of an e-Way Bill is not mandatory.

1. Exemption Based on Nature of Goods

No e-Way Bill is required for transport of goods listed in Annexure to Rule 138(14) of the CGST Rules, such as:

| Exempt Goods | Examples / Remarks |

|---|---|

| Unprocessed agricultural produce | Fresh fruits, vegetables, cereals, pulses, rice, wheat, paddy, jaggery, milk, curd, meat, fish, eggs etc. |

| Natural products | Charcoal, firewood, clay, stones, sand, salt etc. |

| Live animals and plants | Cattle, poultry, trees, saplings, flowers etc. |

| Currency, used personal effects, newspapers, judicial documents | Excluded as non-goods or non-commercial movements. |

Note: Full list available in Rule 138(14) read with Notifications No. 12/2018 & 15/2018 – Central Tax.

2. Exemption Based on Mode or Type of Movement

| Situation / Movement Type | Exemption Explanation |

|---|---|

| Goods transported under Customs control | Imports/exports from ICD, CFS, or port to customs station. |

| Goods transported from customs port/airport/land customs station to ICD or CFS | Covered under customs supervision. |

| Movement within notified area of a city or municipality | Intracity transport as notified by State Governments (subject to state-specific rules). |

| Movement for weighment up to 20 km | Between business place and weighbridge — with delivery challan. |

| Goods transported by non-motorized conveyance | E.g. handcart, cycle, animal cart — no e-Way Bill needed. |

| Goods transported by defence formations under Ministry of Defence | Fully exempt. |

| Empty cargo containers | No e-Way Bill required. |

| Goods transported for job work within same state under ₹50,000 value | Not mandatory, though may be voluntarily generated. |

3. Exemption Based on Value or Type of Consignment

| Condition | E-Way Bill Requirement |

|---|---|

| Value of goods ≤ ₹50,000 | Not required (except for specific notified goods). |

| Movement of exempt goods only | Not required. |

| Movement of personal household goods (non-business use) | Not required. |

| Movement by unregistered person to a registered recipient | Required to be generated by recipient, if value > ₹50,000. |

4. Exemption for Government and Special Entities

| Entity / Category | E-Way Bill Status |

|---|---|

| Ministry of Defence consignments | Exempt |

| Local authorities transporting municipal waste | Exempt |

| Transport of goods by Government or statutory body for non-commercial purpose | Exempt |

5. State-Specific Relaxations

Some states have additional or partial relaxations for Intra-State movement below specified distance (e.g. within 10–20 km radius). & Intra-city movement of specified goods (e.g. Delhi, Maharashtra, Gujarat). Always verify respective State GST notifications.

6. Key Compliance Tips

If value exceeds ₹50,000, generate e-Way Bill even for stock transfer or branch transfer. Ensure Part B (vehicle details) is updated before movement begins. Maintain delivery challans and supporting documents for exempted movements. Transporters must carry documentary proof of exemption if stopped for inspection.

Summary Snapshot

| Category | E-Way Bill Requirement |

|---|---|

| Exempt goods (agricultural/natural/personal) | No |

| Non-motorized transport | No |

| Value ≤ ₹50,000 | No |

| Customs-controlled goods | No |

| Defence consignments | No |

| Regular taxable goods > ₹50,000 | Yes |

We will staying informed about updates & changes in tax laws is essential to maintain compliance & avoid potential Goods and Services Tax penalties in the future.

In the world of Goods and Service taxation, where repeatedly biased decisions are coming, having a reliable partner like India Financial Consultancy Corporation Pvt Ltd can make all the difference. IFCCL commitment is to protect our client from safeguard your rights, unfairness, & also ensure that Clints remain compliant, no matter how complex the current situation is.

To learn more about how India Financial Consultancy Corporation Pvt Ltd can assist you, please don’t hesitate to contact us. We’re here to support you on clints taxation compliance journey.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.