CBDT Extends Timeline of filling Form 10B, 10BB & ITR-7

Table of Contents

CBDT Extends Timeline of filling Form 10B, Form 10BB & ITR-7 AY 2023-24

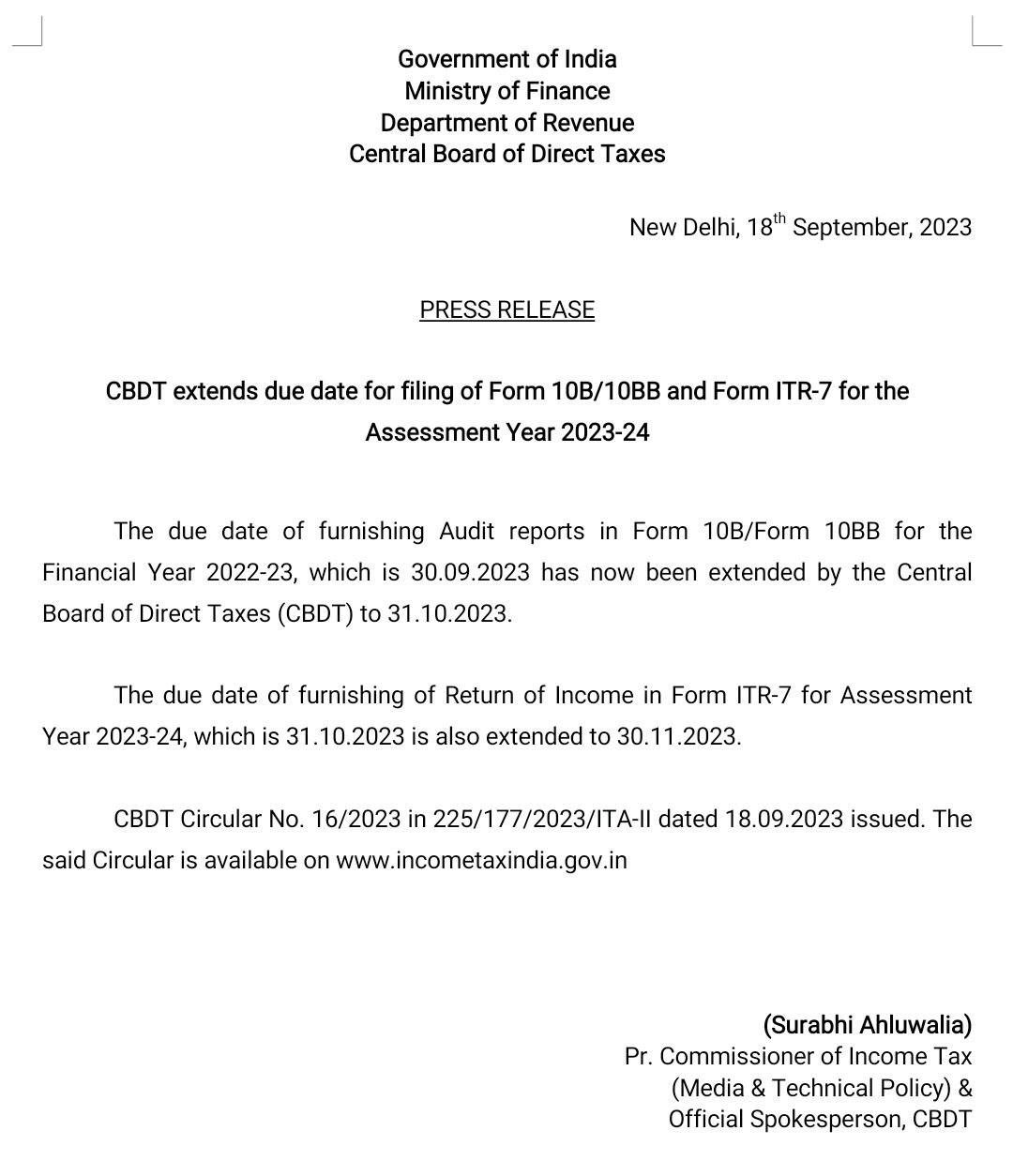

This Article is giving overview of the requirements for filling NGO Audit reports for Form 10B, Form 10BB, & nd ITR-7 for the AY 2023-24. The Central Board of Direct Taxes Extends due date of furnishing audit reports Deadlines for Form 10B, Form 10BB & ITR-7 Assessment Year 2023-24.

Central Board of Direct Taxes Circular No. 16 dated 18.09.2023 issued. The said Circular is available on incometaxindia.gov.in.

Income Tax Return -ITR-7 :

- Income Tax Return -ITR-7 is the ITR form used by entities, including trusts, that are required to file returns under various sections mentioned in the form. With ITR-7, NGO will required to attach the audit report (Form 10B or Form 10BB) and other necessary information and documents. It is also required that all the above ITR and Form are correctly filled in the ITR-7 form.

Audit Report for Institutions/ Trusts U/s 10(23C) & 80G(5)(vi)- Form 10BB:

- Income Tax Audit report prepared & signed by CA in practice under the Form 10BB is needed for institutions & trusts claiming Income tax exemptions U/s 10(23C) & 80G(5)(vi) which contain activities and compliance of the institution or trust.

Audit Report u/s 12A(b)in the Form 10B:

- Income Tax Act Form 10B is typically needed to be file by NGO that are registered u/s 12A(b) said NGO audit report prepared & Signed by a CA in practice that ensured that NGO’s income, expenditure, & activities for the relevant AY.

CBDT extends due date for filing of Form 10B/10BB for FY 2022-23 to 31.10.2023. Due date for furnishing of ITR in Form ITR-7 for the AY 2023-24 also extended to November. 30, 2023. Income Tax update & compliance formalities may change time to time, so NGO’s should consult a tax Expert for update on NGO guidelines & forms issued by the Income tax Dept.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.