Annual Return (FC-4) under the FCRA:

Table of Contents

Annual Return (FC-4) under FCRA 2010

FCRA Return Filling: The Foreign Contribution Regulation Act (FCRA) of 2010 is implemented by the government to make it legal for individuals and organizations registered in India to receive unauthorized grants and contributions from foreign businesses that are adverse for the country’s interests. Each entity receiving any contribution or hospitality from a foreign source will be required to obtain prior approval from the authorities governed by the act and will be required to register under the act’s requirements.

The Act also requires all NGO registered under the Act to file an annual return with Form FC-4 recognizing remittance received in the previous year to the MHA.

who is needed to file an Annual Return Under the FCRA?

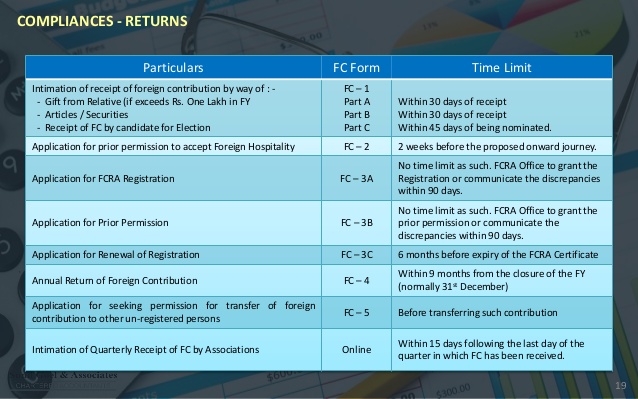

Any person, entity, or association receiving foreign remittances and opting for registration or “prior approval” for acceptance of such foreign remittances using form FC-2, FC-3A, or FC-3B is required to file an Annual return using Form FC-4 in accordance with Section 11 of the FCRA, 2010.

When is it necessary to file an annual return under the Foreign Contribution Regulation Act (FCRA), 2010?

All registered entities must file the return online within nine months of the year’s end of in each financial year, or by December 31st, For example: The annual return for the financial year 2020-21 must be filed by December 31, 2021.

The FCRA must be filed by every NGO who receives foreign contributions.

How do I file an annual return under the Foreign Contribution Regulation Act (FCRA), 2010?

Filling Annual returns by using form FC-4, can be completed online at the Ministry of Home Affairs’ official website. The following are the steps involved:

Stage 1: Go to https://fcraonline.nic.in/Home/Sample form.aspx?id=4 and fill out the form. and log in using your username and password. (If this is the first time you’ve received remittance, fill out the registration form.)

Stage 2: Complete the form by documenting all sources of monies/remittances received, as well as the purpose, usage of funds, and identifying information.

Stage 3: Either through DSC or by uploading the certified copy, get the declaration contained certified by a Chartered Accountant (CA).

Stage 4: As requested, upload any additional required papers.

Stage 5: Review the form before submitting it.

Stage 6: Pay the required fees according to the instructions.

Have you failed to file your Annual (FC-4) Return for the financial year 2019-20? Compound offence and reapply for registration!

- Has your NGO’s registration under the Foreign Contribution Regulation Act (FCRA), 2010 been cancelled because you failed to file your Annual Return in online Form FC-4 for the fiscal year 2019-20? If you answered yes, you have sixty days from the date of the Ministry of Home Affairs’ latest Notification, dated March 18, 2020, to reapply for registration, subject to online submission of any unfiled Annual Returns and payment of a penalty (Rs. 1,00,000/- or 5% of the foreign donation received during the period of non-submission, whichever is higher).

- The Ministry of Home Affairs (MHA) has cancelled several associations’ registrations under section 14 of the Foreign Contribution Regulation Act (FCRA) 2010 for failing to submit Annual Returns in online Form FC-4 for the Financial Year 2017-18, rendering these organizations ineligible for registration or prior permission for a period of three years from the date of cancellation.

- The Ministry of Home Affairs’ FCRA (Monitoring Unit) has published a notification dated March 18, 2020, providing defaulting associations a chance. The Notification is available at https://fcraonline.nic.in/home/PDF Doc/fc notice 18032020.pdf.

- Major causes for default: It appears from the notification that the main cause for these associations’ inability to submit returns on time was their reliance on accountants, chartered accountants, or consultants who were unaware of the FCRA’s severe compliance requirements.

- A real tragedy: This is, in our opinion, not an excuse offered by these NGO’s, but rather a very true and well-known fact. Chartered accountants do a detailed audit of these NGO’s and file returns with the charity commissioner/registrar of societies/companies, as well as income tax, well before Diwali (end of September), yet they wait till December to file FCRA returns. Why are we so perplexed?.

Penalties arise if an Annual Return is not filed on time under the Foreign Contribution Regulation Act (FCRA), 2010.

The act imposes the following penalties for failure to file an annual return on time:

- If filed within 90 days of the due date, you will receive 2% of the amount received or Rs 10,000, whichever is higher.

- If filed within 90 to 100 days of the due date, 3 percent of the amount received or Rs 25,000, whichever is higher.

- If more than 180 days have passed, 5% of the amount received, or Rs 50,000, whichever is larger, plus Rs 500 per day thereafter.

FAQ on FCRA Return

- Is the ‘cash basis’ method of accounting required by the FCRA?

- No, the FCRA does not compel you to use a specific accounting system. However, it does have specific reporting requirements that must be strictly followed. What documents must be filed on a yearly basis?

- Every organisation that accepts foreign contributions must file an annual return in Form FC-3 under rule 8(2) within 120 days of the year’s end.

- The following documents should be submitted in duplicate, including the chief functionary’s signature and the chartered accountant’s certification:

- Form FC-3;

- Balance Sheet and Statement of Receipt and Payment for all foreign contributions received and used throughout the year.

- Is it necessary to file an annual return even if the organisation receives no foreign contributions?

Even if an FCRA-registered organisation does not receive any foreign contributions, it must file nil returns. Form FC-3 must be filed every year if the organisation wishes to keep its registration valid. In press notes dated 09.01.1998, the Ministry of Home Affairs (FCRA division) specifically stated that even if no foreign contribution is received, the filing of a nil return is required. In the same press release, it was stated that failure to submit a return on time or providing false information would constitute a violation of the Act and would result in criminal penalties.

- Who should make the declaration and certify the annual return?

The FC-3 form must be signed by the organization’s Chief Functionary, and a certificate from a Chartered Accountant providing a brief summary of the FCRA funds movement and the opening and closing balances of FCRA Funds is also required.

The term “Chief Functionary” is not defined in either the FCRA Act or the Rules. Normally, the Chief Functionary should be interpreted as the organization’s head. Through a General Body/Governing Body resolution, the organisation may also designate any office bearer as the Chief Functionary for the purposes of filing FCRA returns, Forms, and so on.

- What does it mean if you don’t file your annual tax return on time?

The FC-3 filing deadline is not specified under the FCRA. It may be argued that if an NGO does not submit returns properly, it risks losing its FCRA registration, however if an NGO is unable to file FC-3 by July 31st, it should write a letter to the FCRA office explaining the reasons for the delay. In most cases, the FCRA will overlook such late filings.

-

What exactly is an annual report?

Annual report containing all of your activities and programmes.

- How much money do we have to show in the audit report?

You must demonstrate a minimum of six lacks expenditures (only last year).

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.