FAQ on FCRA Registration with prior permission

FAQ on FCRA Registration with prior permission

Q.: What is the right approach to get Prior Permission?

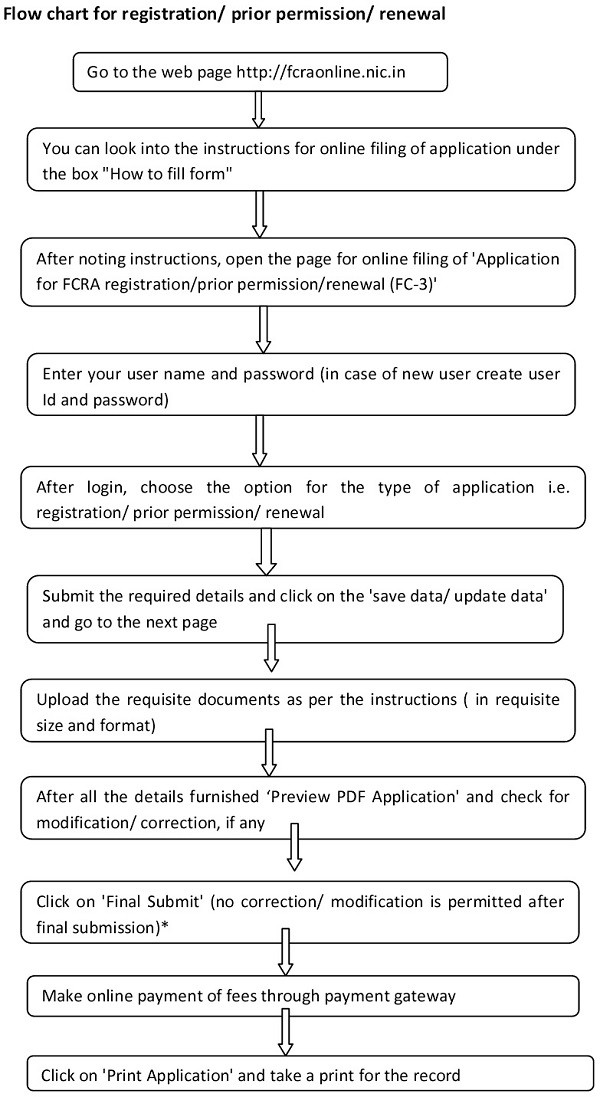

The procedure for obtaining Prior Permission is quite similar to the one for registering. An applicant must fill out and submit a Form 3B together with the necessary papers to receive Prior Permission from the Ministry of Home Affairs. The concerned NGO must submit information on its registration, mission, and goals, as well as a separate bank account to receive donations. It is proposed that an application be required to explain how they intend to use the proposed foreign funding and how it will help them achieve their goals. Moreover, this is always a good idea to provide a description of an Applicant’s previous activities, as well as the specifics of the transactions demonstrating expenditure and funding/donations obtained in previous years. Finally, the application must be accompanied by a Rs 5,000/- statutory fee.

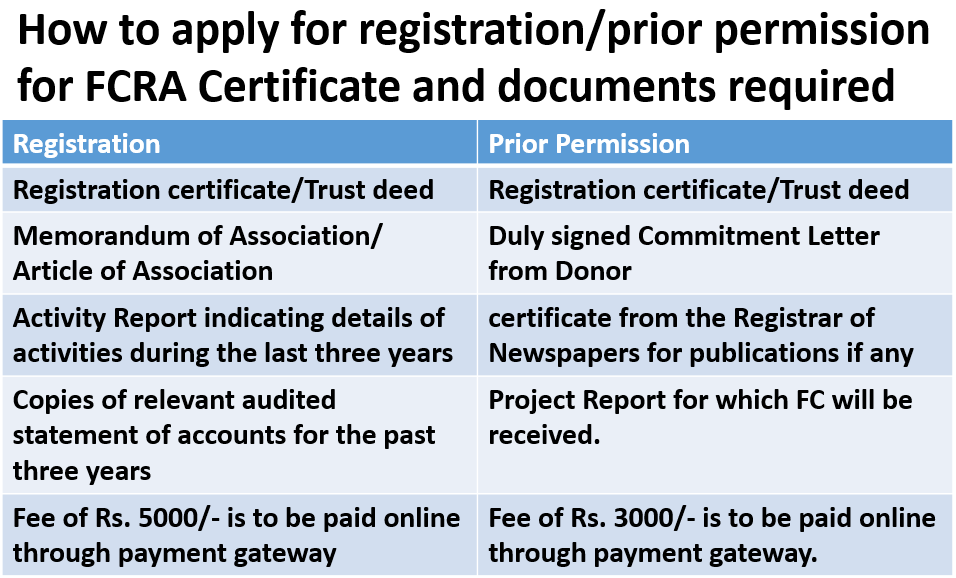

Documents required for FCRA Under Prior Permission

- MOA AND AOA

- Certificate of Registration; and

- Confirmation from the donor and agreement; and

- Report qua the said Funding.

- Affidavits from an Applicant’s Chief Functionaries, certifying, among other things, that all of the information submitted is truthful and correct to the best of their knowledge. It should be noted that the aforementioned affidavits must be attested by a Notary or a Class 1 Magistrates.

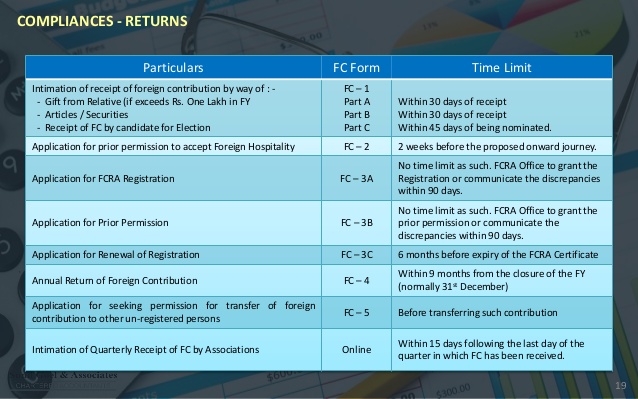

The preceding paragraphs, on the other hand, clarify the entire process and the requirements that must be satisfied when applying for registration or Prior Permission. However, the above material is not exhaustive, and the competent Authority may, if necessary, request further information from an Applicant. Finally, after applying for registration or Prior Permission, as the case may be, an applicant must include the information in its annual returns.

Q. : Can political parties accept foreign donations?

The FCRA expressly prohibits political parties from receiving foreign funds. Under no circumstances may political parties receive foreign funds. They cannot apply for registration or for prior permission on a case-by-case basis.

Q.: What will the FCRA Registration fees be?

An application for prior permission is supposed to be followed by a charge of Rs. 1000/-, whereas an application for registration is supposed to be accompanied by a charge of Rs. 2000/-. Hence, total amount is 3000/-.

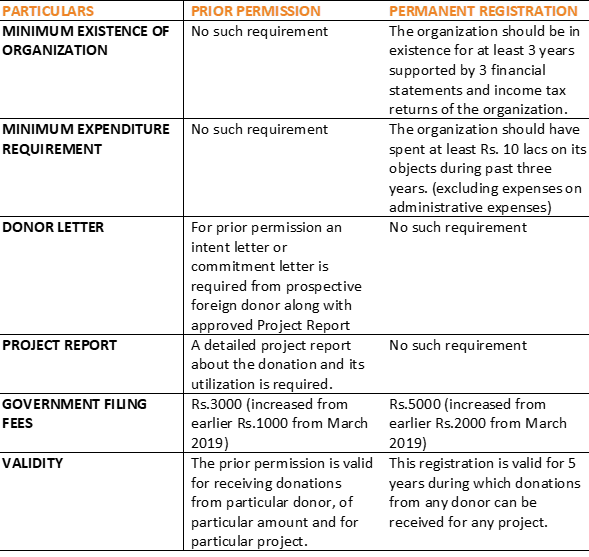

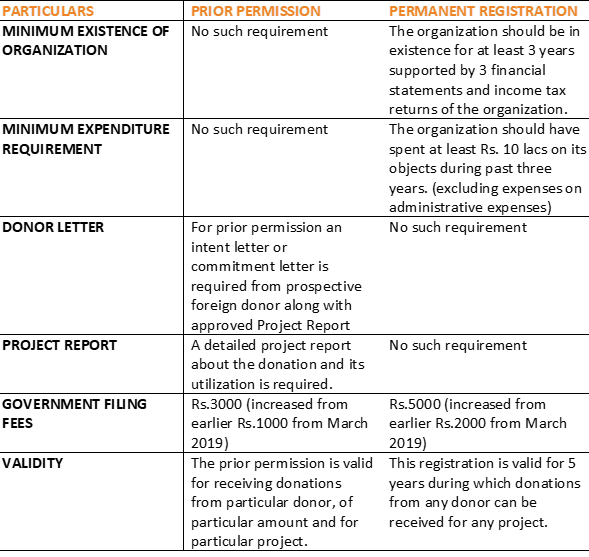

Q.: What is difference between prior permission & permanent FCRA Registration?

Q.: Can a political organisation accept foreign contributions and register with the FCRA?

Political organisations are not eligible for FCRA registration. Such organisations, however, may apply for prior permission on a case-by-case basis. A political organisation is one that is associated with or close to political parties. The Central Government has released a list of organisations that are classified as political organisations.

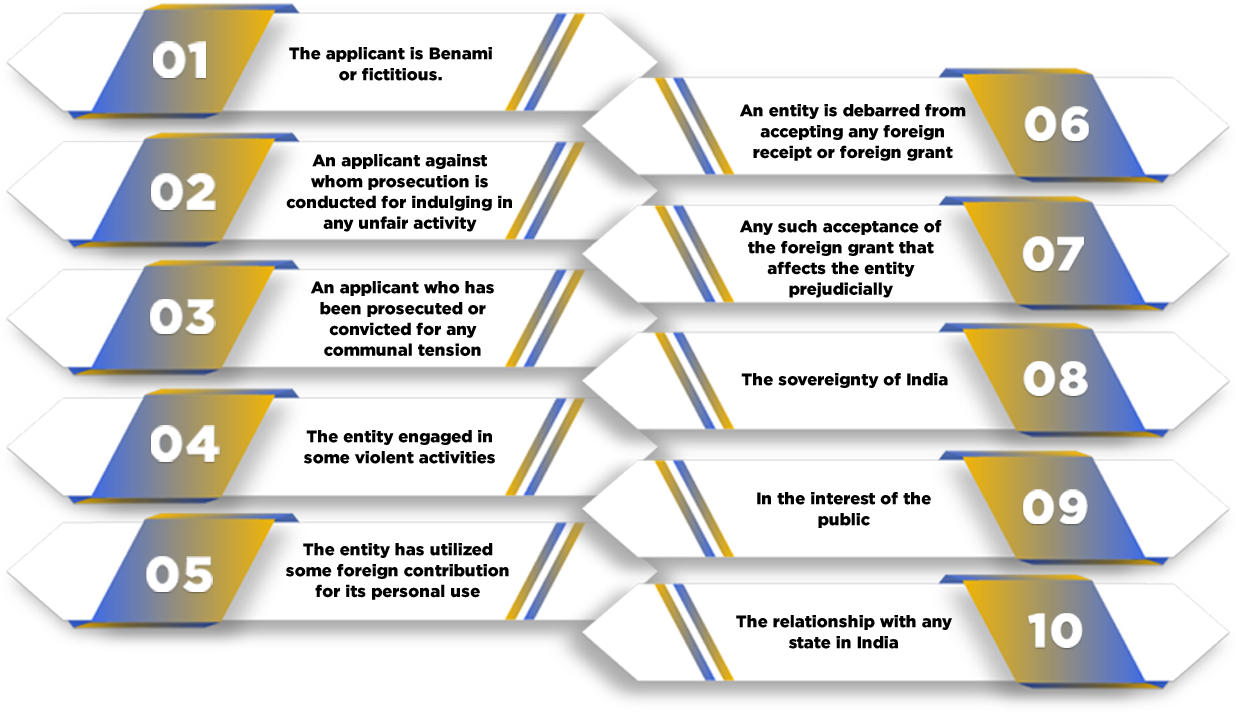

Q.: Who are Non eligible for FCRA Registration ?

Q.: Is it possible to collect foreign contributions before registering with the FCRA?

-

- With prior permission from the FCRA department, an association or organisation can receive foreign contributions even if it is not registered. Only two conditions apply to receiving foreign finances and materials:

- The organisation has gained permanent registration from the FCRA department.

- On a case-by-case basis, the association or organisation seeks prior approval from the FCRA department

Q.: What is the time limit for applying for prior permission?

An application for prior permission in Form FC-1A can be made at any time after an organization’s legal formation. However, a written commitment (Letter of Intent) from the donors is required.

Q.: Is there a deadline for granting prior permission?

A prior permission application should be processed by the FCRA department in no more than 120 days.

Q.: What happens if the application is not disposed of within 120 days?

- If the prior permission is not provided within the necessary time period, the applicant might presume that the prior permission has been given, according to the provisions of Section 11. Even in the lack of any explicit message from the FCRA department, the deeming provision gives the applicant organisation an automatic right to receive foreign contributions.

- Before invoking the deeming provisions, the recipient organisation should wait a reasonable amount of time after the end of the 120-day period to ensure that interaction is not in postal transit.

The procedure for obtaining registration or prior approval is not overly complicated. However, there are a few practical intricacies in filing and submitting the aforementioned forms and documentation that make compliance with the aforementioned standards challenging for organisations. As a result, it’s a good idea to hire a lawyer or a CA/CS

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.