Govt is not considering levying GST on UPI TR’s Over Rs. 2k

Official Fact Check: No 18% GST on UPI Transactions Above INR 2,000

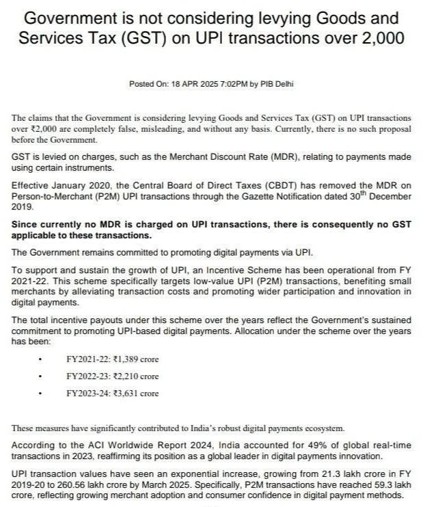

Official statement from the Ministry of Finance, Government of India, clarifying that the government is NOT considering levying GST on UPI transactions over INR 2k . This clarification firmly debunks any misinformation regarding the imposition of GST on UPI transactions and reinforces the government’s stance on supporting and expanding the digital payment ecosystem. The ministry reiterated the government’s commitment to promoting digital payments and noted a significant increase in UPI usage. UPI transaction values surged from INR 21.3 lakh crore in financial year 2019-20 to INR 260.6 lakh crore by March 2025, reflecting growing public trust and merchant adoption. Key Highlights from the Statement (dated 18 April 2025):

No GST on UPI transactions over ₹2,000: The claims suggesting the imposition of GST are false, misleading, and baseless. Currently, there is no such proposal before the government.

The Claim : Recent media reports and viral social media posts have claimed that the Union Government plans to impose an 18% GST on UPI transactions exceeding INR 2,000. A widely circulated article titled “GST on UPI payments or Transactions Above Rs 2000? What Experts Argue,” published on April 18, 2025, contributed to the speculation.

The Truth: The claim is misleading and speculative. There is no official proposal or plan by the Government of India, the Ministry of Finance, or the GST Council to impose GST on UPI transaction values over ₹2,000.

What is currently taxed in UPI?

No Merchant Discount Rate = No GST: GST is levied on charges like the Merchant Discount Rate. Since MDR has been removed for person-to-merchant UPI transactions since January 2020, there is no GST applicable on these transactions. Since currently no MDR is charged on UPI transactions, there is consequently no GST applicable to these transactions,” the ministry stated.

UPI transactions are generally free for users. MDR is not applicable to standard UPI transactions. If GST is levied at all, it is on intermediary services (e.g., payment aggregators) and not on the transaction amount itself.

Government’s Commitment to Digital Payments: An incentive scheme has been operational since financial year 2021-22 to support low-value P2M UPI transactions. Yearly allocations:

-

-

- FY2021-22: ₹1,389 crore

- FY2022-23: ₹2,210 crore

- FY2023-24: ₹3,631 crore

-

This demonstrates the government’s ability to maintain strong indirect tax revenues without burdening digital payment users.

Impact on Digital Economy: As per ACI Worldwide Report 2024, India accounted for 49% of global real-time transactions in 2023. UPI transactions have grown from ₹21.3 lakh crore (financial year 2019-20) to ₹260.56 lakh crore (financial year 2024-25). P2M transactions reached ₹59.3 lakh crore, reflecting high adoption and confidence.

Conclusion: The viral claim that 18% GST will be charged on UPI payments above INR 2k is false. It originated from a speculative article and was taken out of context. No such proposal exists, and the government has firmly denied any such plan. UPI transactions remain tax-free for users, reflecting India’s ongoing push toward a digital-first economy.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.