GST & Income Tax Restrictions on Cash Transactions

Table of Contents

GST and Income Tax Restrictions on Cash Transactions

- One must be cautious when engaging in any high-value cash transaction because the Income Tax Department has become extremely vigilant about cash transactions.

- First, we must define High Value + Cash Transaction.

- High-value transactions involve substantial sums of money.

- First, we must understand the provisions of Income Tax and GST pertaining to Cash Transactions.

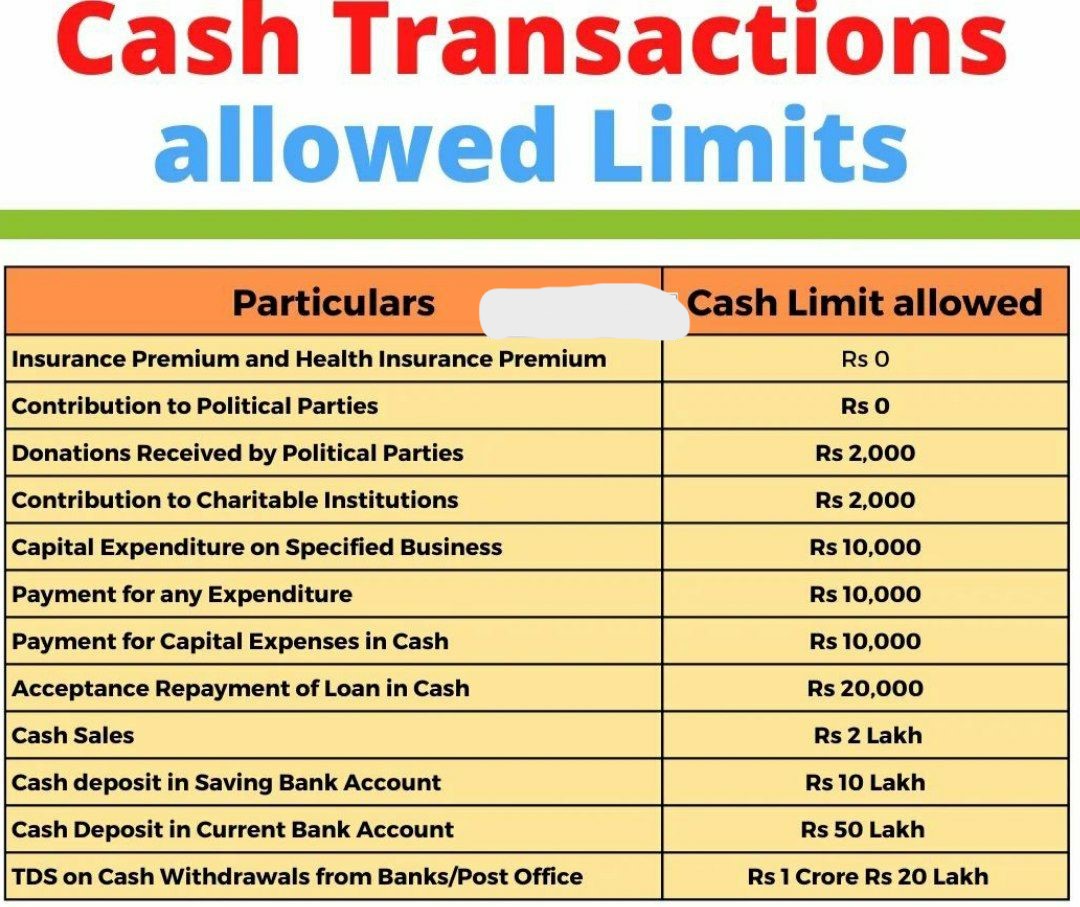

There is no provision in GST that restricts cash transactions, but in Income Tax, we have the following list of transactions that are restricted.

List of cash transaction restrictions under income tax law, one by one: –

- Section 269T :- This section limits cash repayment of any loan, deposit, or specified sum to Rs. 20000/- or more.

- Section 269ST :- Cash transaction restrictions :- The section was introduced by the Finance Act, 2017, and it prohibits a person from receiving an amount of Rs. 2 lakh or more.

- From a single person over the course of a day or,

- In the consists of a single transaction or,

- In the case of transactions involving a single event or occasion from an individual.

- Aside from an account payee cheque/draft or the use of an electronic clearing system via a bank account.

- Note: The above cash transaction limit applies to the receiver, not the payer. For the purposes of this Section, bearer cheques and self-cheques will also be considered CASH.

- Section 269SS :- This section prohibits accepting any loan, deposit, or specified sum in cash unless the total amount (including previous deposits) is Rs. 20,000/- or more.

- Section 269SU (W.E.F. 01-11-2019):- In addition for other electronic modes of payment, where any such person provides the payment facility, in case of total sales, turnover and gross receipt of a company in the preceding year is more than 50 crore Rupees, every person carrying on business shall provide the facility to accept payment by electronic method as prescribed, in addition to facility for other electronic modes. The common commissioner may impose a penalty of 5000 per day for infringement of the terms of Section 269SU, during which such failure continues following an announcement of an exhibition cause.

- √ Incentive Provisions

- √ Section 44AB –

- Every person,-

- Business Carrying, if its entire sales, turnover or gross receipts, as

- the case may be, in business exceeds or exceeds 1 crore rupees in any previous year.”

- The following proviso shall be inserted throughFinance Act 2020e.f. A/Y 2021-22:-

- “Provided, in case of a person whose –

- The aggregate of all amounts received in cash during the previous year, including amounts received for sales, turnover, or gross receipts, does not exceed 5% of the said amount, and

- During the preceding year, the total of all cash payments, including expenditures, does not exceed 5% of the total payment,

- This clause would be construed as if the words “one crore” had been replaced with “five crore rupees”

- Section 44AD (presumptive Taxation) :- Normally, an eligible assessee who operates an eligible business subject to the rules of section 44AD must disclose net profit at 8% of turnover/gross revenues (up to turnover of 2 crore rupees). However, with effect from April 1, 2017, a proviso was added to provide for a reduced presumptive tax of 6% instead of 8% in respect of the amount of turnover or gross revenues received via account payee check or any other means provided therein.

- Sections 43CA, 50C and 56:- Real-estate-related transactions. :- The laws above provide that the consideration for the transfer of any immovable property cannot be less than the stamp value determined by the stamp valuation authority. However, where the transaction is the consequence of a previously completed agreement, the value as per the agreement may be used if any advance payment was made through account payee check or any other specified means.

Compliances in respect of cash Transactions

- Section 285BA – Section 285BA read with Rule 114E makes it mandatory for certain individuals to report information of cash receipts/deposits in excess of Rs. 200000/-..

- Section 194N (w.e.f. 01-09-2019) – Every person, from,-

a) A post office or

b) A banking, or

c) A co-operative society that engages in the banking business,

who is responsible for paying any sum, or aggregate of sums, in cash, in excess of 1 crore to any person from one or more accounts maintained by the recipient with it during the previous year shall deduct an amount equal to 2% of the sum exceeding one crore rupees as income tax at the time of payment of such sum.

- Section 80D:- If a health insurance premium or medical expense for the assessee, his parents, or dependent family members is paid in cash, no deduction from gross total income is allowed.

- Section 80G :- If a donation exceeds Rs. 2000/- in cash, no deduction is allowed.

- Section 80GGA :- If a donation for scientific research or rural development exceeds Rs. 10,000/-, it is not tax deductible.

- Section 80GGB :- If paid in cash, an Indian Company’s contribution to any political party or electoral trust is NOT deductible.

- Section 80GGC :- If paid in cash, a contribution made by anyone other than an Indian company to any political party or electoral trust is NOT deductible.

- Section 80JJAA :- This Provision allows for a deduction of 30% of additional employee costs incurred in the course of such business in the previous year for the previous 3 assessment years, including the AY relevant to the PY in which such employment is provided. The deduction is subject to the conditions specified in the section, as well as the payment being made in any mode other than cash.

- Section 13A : – There should be no donation in cash to political parties that exceeds Rs. 2000/-.

- Section 35AD :- In case of cash beyond the value of Rs. 10000/-, the capital expense covered by U/S 35AD should NOT be permitted as deductions.

- Section 36 :- Section 36(1) (ib) sets up a deduction limit on the employer’s premium amount paid in cash for his employees’ health insurance.

- Section 40A (3) and 40A (3A) :- In order to deduct income from business and profession, payments or aggregates made to a person on a day other than a cheque payer or a demand drafts, or use of an electronic clearing system through a bank account exceeding Rs. 10 000/ – are NOT allowed for the purpose of calculating incomes on a business and vocational basis.

- For transportation charges this limit is expanded to Rs. 35,000/-. The Rule 6DD of the Revenue Tax Rules provides for few exceptions.

- Crux – NO PENALITY but expenses shall be DISALLOWED

Section 40A (3A) provides for the claim of any amount as expenditure in any specific year and for any future year the payment of cash in excess of Rs. 10000/- (transport charge of Rs. 35000/-) shall be made. The same applies to the revenue of the next year.

- Section 43(1) :- When an assessee spends more than Rs. 10,000 on assets that are not purchased through banking channels, the cost of the asset is not included in the cost of the asset, which means that DEPRECIATION is not allowed on that cost.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.