Is Self-Certification in GSTR-9C Really a Positive Thing?

Table of Contents

Self-certification in GSTR-9C vs. CA certification

What exactly is GSTR-9?

GST annual return GSTR 9C simplification

GSTR-9 is an annual return that must be filed by registered taxpayers with a preceding financial year turnover of more than Rs. 2 crores. Outward supplies, tax liabilities, input tax credit claimed, refund claimed, and tax paid within the financial year are all included. The deadline is the 31st of December of the year after the financial year in question. However, the following taxpayers are exempt from filing GSTR-9:

- Input Service Distributors

•Non-Resident Taxable Person

• Taxpayer under section 51 & 52 - Casual Taxable Person

What exactly is GSTR-9C?

Every registered person with an annual revenue of more than Rs. 5 crores is required to submit a copy of their audited financial statement and reconciliation statement in GTSR-9C. It’s essentially a GST audit. GSTR-9C is a statement of reconciliation between the statistics in the audited financial statements and the figures in the annual returns in GSTR-9 filed throughout the year, as required by the Income Tax Act. Any discrepancy is noted here, along with the reasons for the discrepancy. The Reconciliation Statement had to be validated until recently. However, it will now be filed on the basis of self-certification.

The Finance Act of 2021 implemented amendments to the CGST Act, eliminating the need to provide a CA-certified Reconciliation Statement in GSTR 9C.

Taxpayers are no longer obliged to have their Reconciliation Statement approved by a CA/CWA, thanks to the revisions.

Moreover, taxpayers with a revenue of up to Rs. 2 crores have the option of not filing GSTR 9. (Annual Return). These changes will take effect on August 1, 2021.

Prior to the foregoing modifications, taxpayers with a turnover of more than Rs. 5 crore had to file a Reconciliation Statement in GSTR 9C that was certified by a CA/CWA.

We attempt to explore the context and examine the ramifications of current changes in this piece.

On May 28, 2021, the 43rd GST council meeting was conducted, during which several key decisions were made, the majority of which were connected to granting relief for Covid and pandemic.

The GST annual return and reconciliation statement, often known as GST audit, was discussed in the aforesaid meeting.

In this regard council has recommended the following points:

“Simplification of Annual Return for Fiscal Year 2020-21:

- Amendments to sections 35 and 44 of the CGST Act to be announced by the Finance Act of 2021. This would make it easier for taxpayers to comply with the requirement to submit a reconciliation statement in FORM GSTR-9C, as they would be able to self-certify the statement rather than having it certified by chartered accountants. This adjustment will take effect for the Annual Return for Fiscal Year 2020-21.

- For taxpayers with an annual revenue of up to Rs 2 crore, submitting an annual return in FORM GSTR-9 / 9A would be optional in FY 2020-21.

- Taxpayers with an annual aggregate turnover of more than Rs 5 crore will be required to file a reconciliation statement in FORM GSTR-9C for FY 2020-21.”

As previously discussed, the Finance Act of 2021 eliminated Chartered Accountant certification of reconciliation statements in GSTR 9C, and the GST Council has now said that the same will apply to GSTR 9C for FY 2020-21.

As a result, the GSTR 9C for FY 2019-20 will be the final GSTR 9C certified by a Chartered Accountant. Although this will lessen CA’s responsibilities, the work will remain the same because the form has not been eliminated; only the certification has changed.

In addition, council has proposed that the annual return be simplified, and that the annual return turnover restrictions, which were previously announced for FY 2018-19 and 2019-20, be extended to FY 2020-21.

Why was it necessary to make these changes?

The GST Act has now been in effect for four years. Although there are numerous advantages to this new taxes system, there is a need to work actively to ease compliance.

Compliance must be simplified because it is an expensive endeavour in terms of money, time, and energy. Taxpayers are already required to file GSTR-1, GSTR-3B, and other forms on a monthly/quarterly basis, depending on the type of their business. They will have to spend a lot of money on it because professional services are required to manage compliance. There was widespread desire across industries to reduce the cost and time spent on this non-business chore.

When we examine GSTR9 in this light, we can see that adjustments have been made in this direction. GSTR-9 is now only necessary for taxpayers with a turnover of more than Rs. 2 crores, whereas GSTR-9C is required for taxpayers with a turnover of more than Rs. 5 crores. The necessity for CA certification on the Reconciliation Statement was recently abolished, simplifying compliance.

On the 28th of May 2021, the 43rd GST Council met to consider various ways for combatting Covid and restoring enterprises. In addition, the council stated that Annual Filing should be made easier. It also proposed changing the CGST Act to facilitate the filing of GSTR-9C on a self-certification basis, which has now been adopted through notifications.

Although this is a positive step, it also has drawbacks that must be considered. This action is likely to bring compliance relief to a large number of taxpayers, but it will also increase the likelihood of intentional and unintentional misstatements / errors in annual files, necessitating higher departmental scrutiny and, as a result, increased enforcement burden.

On the other hand, it will provide a number of opportunities for litigation experts to manage their clients’ inspection notices and represent them in front of the department. As a result, the professional will have more opportunities to demonstrate their abilities and attract new clients.

As a result, it should be emphasised that the majority of taxpayers are unfamiliar with the requirements of annual files, necessitating expert assistance. We have yet to see whether the benefits of the move outweigh the drawbacks for various stakeholders.

What is the GSTR-9C form?

GSTR-9C is a declaration that reconciles the yearly GSTR-9 of a financial year with the taxpayer’s audited financial accounts. The registered taxpayer with a yearly turnover of exceeding Rs.2 crore must have his books audited by a Chartered Accountant/Cost Accountant. This ensures that a taxpayer’s self-assessment of taxes is accurate. A Chartered Accountant/Cost Accountant should write the reconciliation statement, which should then be filed by a taxpayer online or through a facilitation centre, together with a copy of the audited financial statements and the GSTR-9 form.

What are the sections of Form GSTR-9C that must be completed?

GSTR-9C is split into two sections:

Part A is the reconciliation statement, which is broken down into five sections:

Part I: The Fundamentals

The GSTIN, FY, legal name, and trading name are all need to be reported here. If a taxpayer is subject to an audit under any other law, he must likewise report it.

Part II: Conversion between the turnover shown in audited financial statements and the one reported in the Annual Return

There are four tables in this section.

Table 5: Reconciliation of gross turnover

| Table | Name | Details |

| A | Turnover (including exports) as per audited financial statements for the State / UT | The turnover (including exports) as per the audited financial statements should be reported here. The same should be derived GSTIN-wise, and not at a PAN level. |

| B | Unbilled revenue at the beginning of Financial Year | Any unbilled revenue at the beginning of the FY on which GST was payable during the current year, will be added to the turnover reported under A. |

| C | Unadjusted advances at the end of the Financial Year | Any advances at the end of the FY, on which GST has been paid but the revenue has not been recognised, will be added to the turnover reported under A. |

| D | Deemed supply as per Schedule I | Any deemed supply covered under Schedule I of the CGST Act will be added to the turnover reported under A Part, provided the same has not already been included in the turnover calculated in the audited financial statements. |

| E | Credit notes issued after the end of the financial year but reflected in the annual return | All the credit notes that were issued after the end of the Financial year but reflected in the annual return will be reduced from the turnover reported under A. |

| F | Trade discounts accounted for in the audited Annual Financial Statement but are not permissible under GST | All trade discounts that have been accounted for in the audited annual financial statement, on which GST was leviable, will be added to the turnover reported under A |

| G | Turnover from April 2017 to June 2017 | The pre-GST turnover for the period between April and June 2017 will be reduced from the turnover reported under A. |

| H | Unbilled revenue at the end of the financial year | Any unbilled revenue recorded during the FY, which has accrued but not liable to GST in the same FY, will be reduced from the turnover reported under A. |

| I | Unadjusted Advances at the beginning of the financial year | All advances at the beginning of the financial year, on which GST has not been paid but the same recognised as revenue in the audited financial statements, will be reduced from the turnover reported under A. |

| J | Credit notes accounted for in the audited annual financial statement but are not permissible under GST | All credit notes that have been accounted for in the audited annual financial statements, but are not allowable under the CGST Act, will be added to the turnover reported under A. |

| K | Adjustments on account of supply of goods by SEZ units to DTA Units | Any adjustments on account of supply of goods by SEZ units to DTA units (where the DTA units have filed bills of entry) will be reduced from the turnover reported under A. |

| L | Turnover for the period under composition scheme | The turnover for the period under the Composition Scheme (for those taxpayers who have opted out during the year), should be reduced from the turnover reported under A. |

| M | Adjustments in turnover under section 15 and rules thereunder | Any differences arise between the turnover declared in the annual return and the audited annual financial statements, due to the principles of valuation under section 15 of the CGST Act, should be added/reduced from the turnover reported under A. |

| N | Turnover adjustments due to foreign exchange fluctuations | Any adjustments in turnover due to foreign exchange fluctuations should be added/reduced from the turnover reported under A. |

| O | Turnover adjustments due to reasons not listed above | Any other adjustments in turnover for reasons not listed above should be added/reduced from the turnover reported under A |

| P | Annual turnover after adjustments as above | It will be auto-populated based on the above additions and reductions. |

| Q | Turnover as declared in Annual Return (GSTR-9) | Turnover declared in GSTR-9 is to be reported here. |

| R | Un-Reconciled turnover (Q – P) | It will be the difference between P and Q. |

Table 6: A taxpayer can give reasons for the non-reconciliation between the turnover declared in the annual return and the audited annual financial statements here.

Table 7: Reconciliation of taxable turnover

| Table | Name | Details |

| A | Annual turnover after adjustments (from 5P above) | It will be auto-populated from Table 5P above. |

| B | Value of Exempted, Nil Rated, Non-GST supplies, No-Supply turnover | The value of exempted, nil rated, non-GST supplies, and no-supply turnover should be reported here (net of credit/debit notes and amendments, if any). |

| C | Zero-rated supplies without payment of tax | The value of supplies which are zero-rated (including supplies to SEZs) and for which no tax was paid should be reported here (net of credit/debit notes and amendments, if any). |

| D | Supplies on which tax is to be paid by the recipient on reverse charge basis | The Value of supplies for which tax is to be paid by the recipient under reverse charge should be reported here (net of credit/debit notes and amendments, if any). |

| E | Taxable turnover as per adjustments above (A-B-C-D) | It is (A-B-C-D). |

| F | Taxable turnover as per liability declared in Annual Return (GSTR9) | The taxable turnover with regard to the liability listed in the annual return GSTR-9 (Tables 4N to 4G and Tables 10-11). |

| G | Unreconciled taxable turnover (F-E) | It will be the difference (F – E). |

Table 8: A taxpayer can give reasons for un-reconciled taxable turnover in Table 7G over here.

Part III: Reconciliation of taxes paid

This part consists of three tables –

Table 9: Reconciliation of taxes paid

| Table | Name | Details |

| A-O | Rates of taxes | Under Tables A-O, one needs to report taxable values, central, state tax, integrated tax and cess value for each tax rate (5%, 12%, 18%, 28%, 3%, .25% and .10%). If the tax is paid under reverse charge mechanism, the same needs to be reported as a separate line item under rows marked RC. Interest, late fees and penalties should also be reported. |

| P | Total amount to be paid as per tables above | It is a sum total of A to O. |

| Q | Total amount paid as declared in Annual Return (GSTR 9) | Amount of tax paid as reported in GSTR-9 should be reported here. |

| R | Unreconciled payment of amount | It is a difference between P and Q |

Table 10: A taxpayer can give reasons for any un-reconciled amount of tax in Table 9R here.

Table 11: Any amount which is payable due to reasons specified under Table 6, 8 and 10 above shall be reported here.

Part IV: Reconciliation of ITC

This part consists of five tables –

Table 12: Reconciliation of the net input tax credit (ITC)

| Table | Name | Details |

| A | ITC availed as per audited Annual Financial Statement for the State/ UT | ITC is availed as per audited financial statements for the should be reported here. In case of multiple GSTIN’s under the same PAN, an entity should internally derive at ITC for individual GSTIN’s for reporting. |

| B | ITC booked in earlier Financial Years claimed in current Financial Year | Any ITC booked in the earlier FY but availed in the current FY should be reported here. For e.g., any transitional credit of earlier years reported in the current year should be reported here. |

| C | ITC booked in current Financial Year to be claimed in subsequent Financial Years | Any ITC booked in the current FY but not credited to the ITC ledger should be reported here. |

| D | ITC availed as per audited financial statements or books of account | It is a sum total of A, B, and C above. |

| E | ITC claimed in Annual Return (GSTR9) | Net ITC as declared in Table 7J of GSTR-9 should be reported here. |

| F | Unreconciled ITC | It is a difference of 12D and 12E above. |

Table 13: Reasons for unreconciled ITC in Table 12F should be provided here.

Table 14: Reconciliation of ITC declared in GSTR-9 with the ITC availed on expenses as per audited financial statement or Books.

| A-Q | Expenses | Various sub-heads of general expenses are mentioned in these Tables. A taxpayer needs to declare respective ITC against each head. He can also add/delete any expense head as per applicability. |

| R | Total amount of eligible ITC availed | It is a sum total of A-Q above. |

| S | ITC claimed in Annual Return (GSTR9) | Net ITC as declared in Table 7J of GSTR-9 should be reported here. |

| T | Un-reconciled ITC | It is a difference of 14R and 14S above. |

Table 15: The reasons for the discrepancy between the ITC claimed on the various expenses shown in Table 14R and the ITC claimed in Table 14S will be listed below.

Table 16: Any sum due as a result of the causes listed in Tables 13 and 15 must be stated here.

Part V: Recommendation of the auditor about increased liability due to non-reconciliation

The auditor’s suggestions are included in this section. Recommendations can be made in the following areas:

Additional responsibility incurred by a taxpayer as a result of non-reconciliation of turnover or ITC.

Any costs for supplies that are not covered by the annual return.

Erroneous refund claim that should be returned to the government.

Any other outstanding debts must be settled.

Note: At the end of the GSTR-9C return form, taxpayers can use FORM DRC-03 to make payment for any excess liability declared in the form. In FORM DRC-03, the taxpayer must pick ‘Reconciliation Statement’ from the dropdown menu. Only the electronic cash ledger can be used to pay such a debt.

Part B is the certification section. A Chartered Accountant or a Cost Accountant must certify Form GSTR-9C. He should either use a DSC or an Aadhaar-based signature technique to authenticate the return.

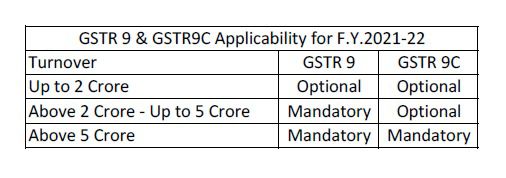

GSTR 9 and GSTR -9C applicability for FY 2021-22.

- GSTR-9 and GSTR-9C for the FY 2021-22 are available on the GST Portal for filing

- GSTR-9C & GSTR-9 Applicability for F.Y.2021-22 given below

- Due Date to File GSTR-9 & GSTR-9C is 31/12/2022

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.