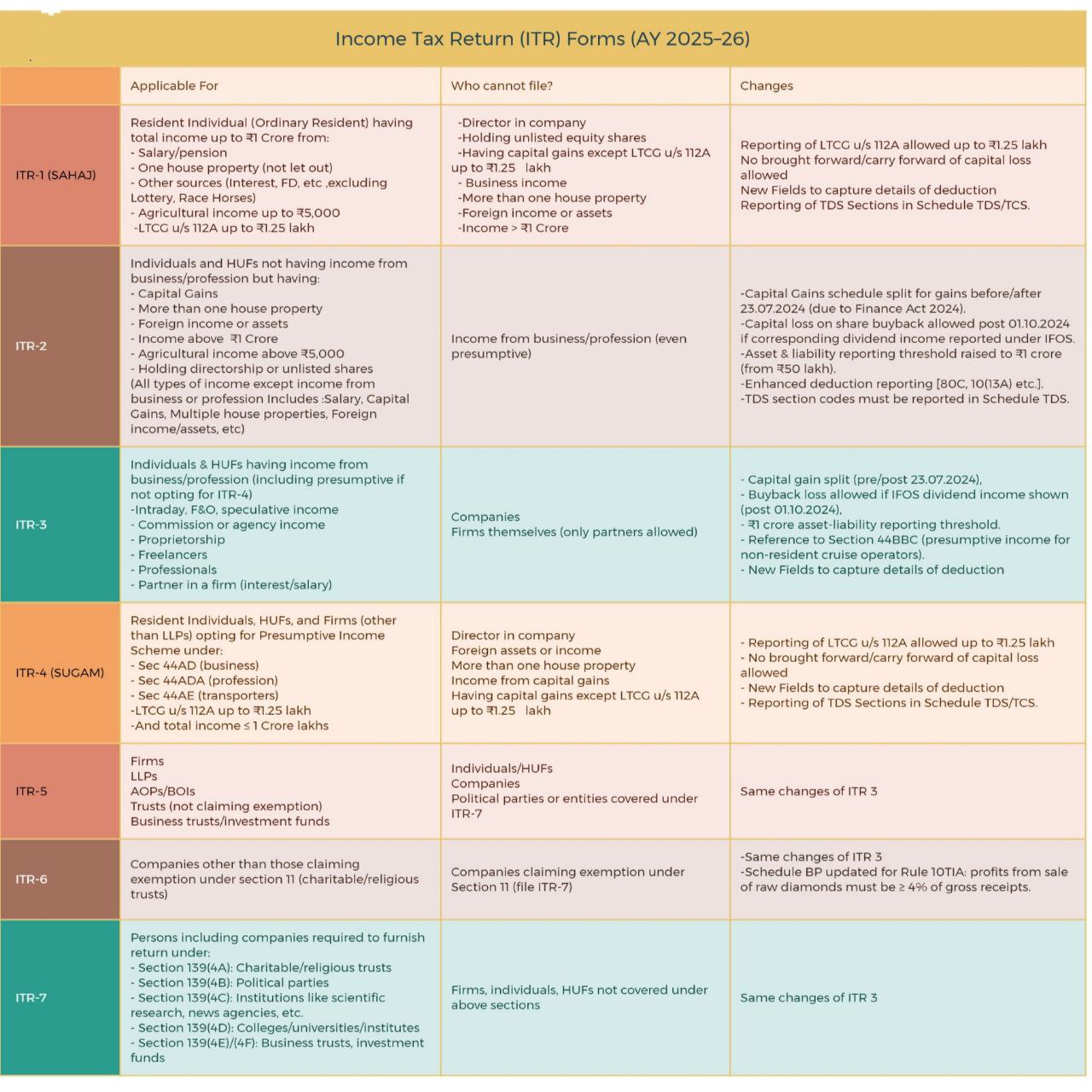

Highlights of Key changes in new ITR Forms 3, 4, 5, 6 & 7

Table of Contents

Highlights of Key changes in new ITR Forms 1,2 3, 4, 5, 6 and 7

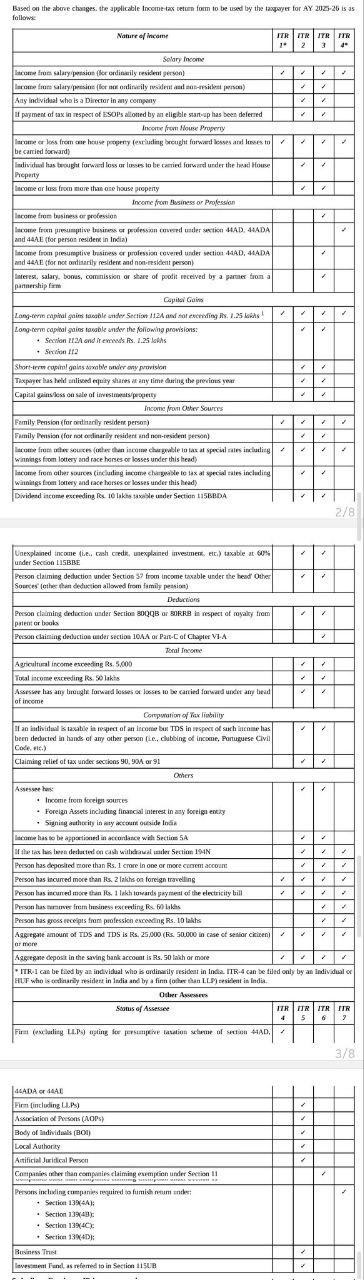

Summary of ITR Form Applicability – AY 2025–26

Salary Income

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Salary/Pension (Ord. Resident) | ✅ | ✅ | ✅ | ✅ |

| Salary/Pension (Not Ord. Resident/Non-Resident) | ❌ | ✅ | ✅ | ❌ |

| Director in a company | ❌ | ✅ | ✅ | ❌ |

| ESOP deferred tax (eligible startups) | ❌ | ✅ | ✅ | ❌ |

Income from House Property

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| One house (no carry forward loss) | ✅ | ✅ | ✅ | ✅ |

| Carry forward loss from HP | ❌ | ✅ | ✅ | ❌ |

| More than one house property | ❌ | ✅ | ✅ | ❌ |

Business/Profession Income

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Professional income (not presumptive) | ❌ | ❌ | ✅ | ❌ |

| Presumptive: Sec 44ADA (Resident professional) | ❌ | ❌ | ✅ | ✅ |

| Presumptive: Sec 44AD, 44AE (Ord. Resident only) | ❌ | ❌ | ✅ | ✅ |

| Commission, brokerage, etc. | ❌ | ❌ | ✅ | ❌ |

| Speculative income, F&O, betting, race horses | ❌ | ❌ | ✅ | ❌ |

Capital Gains

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| LTCG u/s 112A (above ₹1.25L) | ❌ | ✅ | ✅ | ❌ |

| LTCG (Other provisions) | ❌ | ✅ | ✅ | ❌ |

| STCG under 111A | ❌ | ✅ | ✅ | ❌ |

| STCG not under 111A | ❌ | ✅ | ✅ | ❌ |

| Capital gains from sale of property | ❌ | ✅ | ✅ | ❌ |

Income from Other Sources

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Family Pension (Ord. Resident) | ✅ | ✅ | ✅ | ✅ |

| Family Pension (Non-Resident/Not Ord. Res.) | ❌ | ✅ | ✅ | ❌ |

| Lottery, gambling, etc. | ❌ | ✅ | ✅ | ❌ |

| Other special rate income | ❌ | ✅ | ✅ | ❌ |

| Dividend > ₹10L under 115BBDA | ❌ | ✅ | ✅ | ❌ |

Unexplained Income / Deductions

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Unexplained credit, taxed @60% (115BBE) | ❌ | ✅ | ✅ | ❌ |

| Deduction under 57 (other than family pension) | ❌ | ✅ | ✅ | ❌ |

| 80QQB, 80RRB royalty deduction | ❌ | ✅ | ✅ | ❌ |

| 10AA (SEZ Unit) deduction | ❌ | ✅ | ✅ | ❌ |

Agriculture / Tax Limit

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Agri. income > ₹5,000 | ❌ | ✅ | ✅ | ❌ |

| Income > ₹1 crore (non-business) | ❌ | ✅ | ✅ | ❌ |

Tax Filings and Compliance

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Disclose > ₹1L electricity bill | ✅ | ✅ | ✅ | ✅ |

| Deposit > ₹1Cr in current account | ✅ | ✅ | ✅ | ✅ |

| Expenditure > ₹2L foreign travel | ✅ | ✅ | ✅ | ✅ |

| Professional income > ₹50L | ❌ | ❌ | ✅ | ❌ |

Foreign Income / Assets

| Nature | ITR-1 | ITR-2 | ITR-3 | ITR-4 |

|---|---|---|---|---|

| Foreign income/assets/signing authority | ❌ | ✅ | ✅ | ❌ |

| Section 5A apportionment (Goa/Portuguese civil code) | ❌ | ✅ | ✅ | ❌ |

Other Assessments

-

Firms (other than LLPs) under presumptive scheme → ✅ in ITR-4

-

LLPs, AOPs, BOIs, Trusts, Local Authorities, Artificial Juridical Persons → ❌ in ITR-1 to ITR-4

-

Institutions under Sec 11, 139(4A–4F) → File ITR-7

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.