Income tax on Loss or Profit from Intraday share trading

Table of Contents

How to tax on Loss or Profit from Intraday share trading Income

- This has become a lot more trading on the stock market, and investors aren’t just restricted to those who engage in active share trading. Income tax is applicable to all income in India. Similar to this, every gain or loss from sharing shares is subject to income tax.

- Shares can be traded either on an intraday basis or in different ways on the stock market. Shares must be squared off in intraday trading on the same day, whether at a loss or a profit. In any other case, shares may be kept for a short while up to several years.

- This article will instruct you on how to calculate income tax on profits or losses from intraday trading:

Intraday Loss or profit is to be taxed under head Business Income or capital gain.

- this is common question arises in mind of trader is whether profit or loss from intraday share trading is taxed as Capital gain or business income.

- For Above Objective, we required to check the nature of income taxed under both heads.

Profit from Business or Profession (PGBP) Income

- Income from carrying out regular business activity are taxed under the PGBP head. Profit or loss arising from trading in stock-in-trade is taxable under head business income

capital gain Income.

- “Capital Asset” includes any kind of property held by the assessee, whether the same is connected with his business or not. However, capital asset does not include Stock-in-trade, consumable stores, raw material held for the purpose of business or profession. (Section 2(14))

- Stock in trade are the assets which are purchases for purpose of resale on a regular basis. If an asset if purchase for the purpose of holding it for long term then same can’t be classify as stock in trade.

How to Computation of Trading Activity Profit

- Income under business of Trading Activity is computing after deducting all expenses from revenue proceeds. In case of intraday trading, taxable income is Net Profit/Loss reduced by all ancillary expenses incurred such as Security Transaction tax, Commission etc.

Income Tax Audit Applicability

- Income Tax Assessee is needed to get his Income Tax audit completed, In Case Total gross receipts during the Last year more than Rs. 1 Cr. (Section 44AB of Income Tax Act)

- But, this Income threshold hold celling shall increased upto Rs. 10 Cr., In Case below requirements or conditions are fulfilled:

-

- Total of all received including received amount for turnover, sales or Total gross receipts during the Last year in cash does not more than 5 Percentage of Total receipts; &

- Total of all payments amount made including incurred for expenditure, in cash, does not more than 5 Percentage of said payment amount,

- If intra-day trading, no transaction is made in cash, so threshold limit of Rs. 10 Cr shall Applicability

- But, In Case Total gross receipts of Income Tax Assessee does not more than Rs. 2 Cr. then Income Tax Assessee may chose -”Presumptive Taxation” i.e. Section-44A. and required to pay income tax on profits presumptive computed basis, not less than 6 percentage of Total gross receipts. In such a case, Income Tax Assessee is not liable for Income Tax audits.

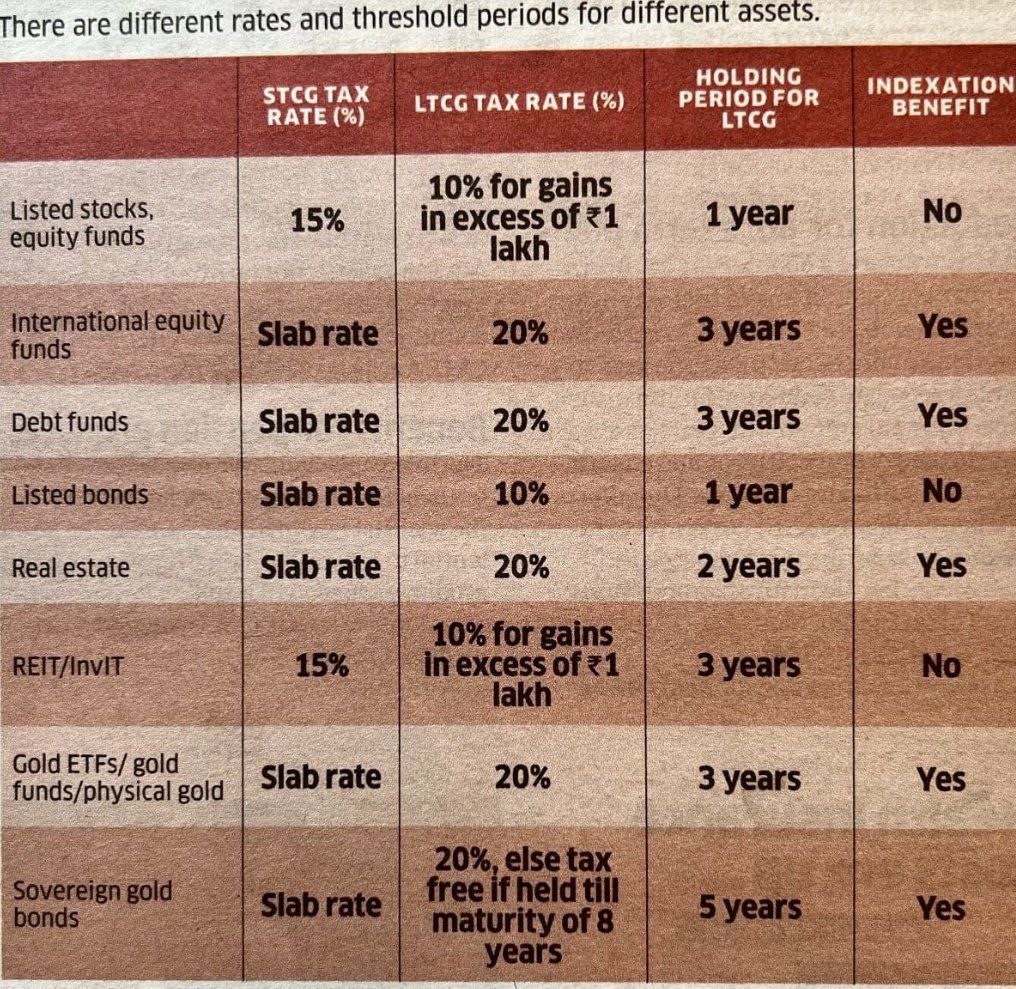

Capital Gain tax rate

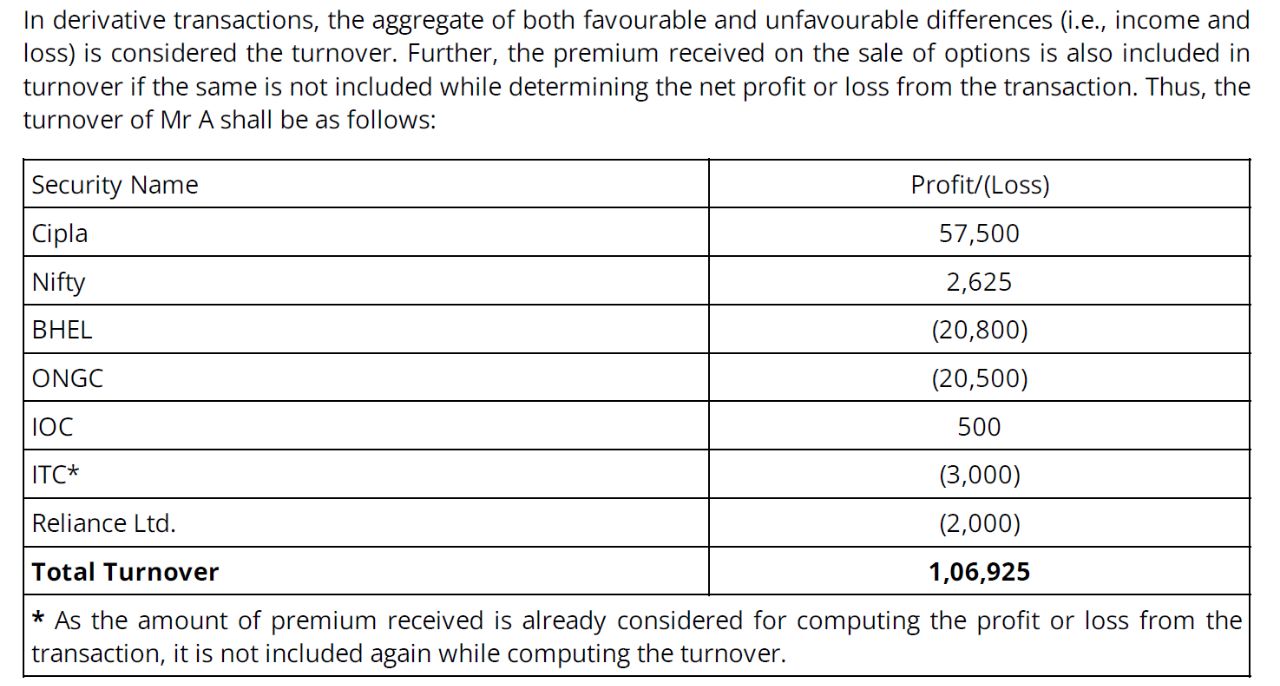

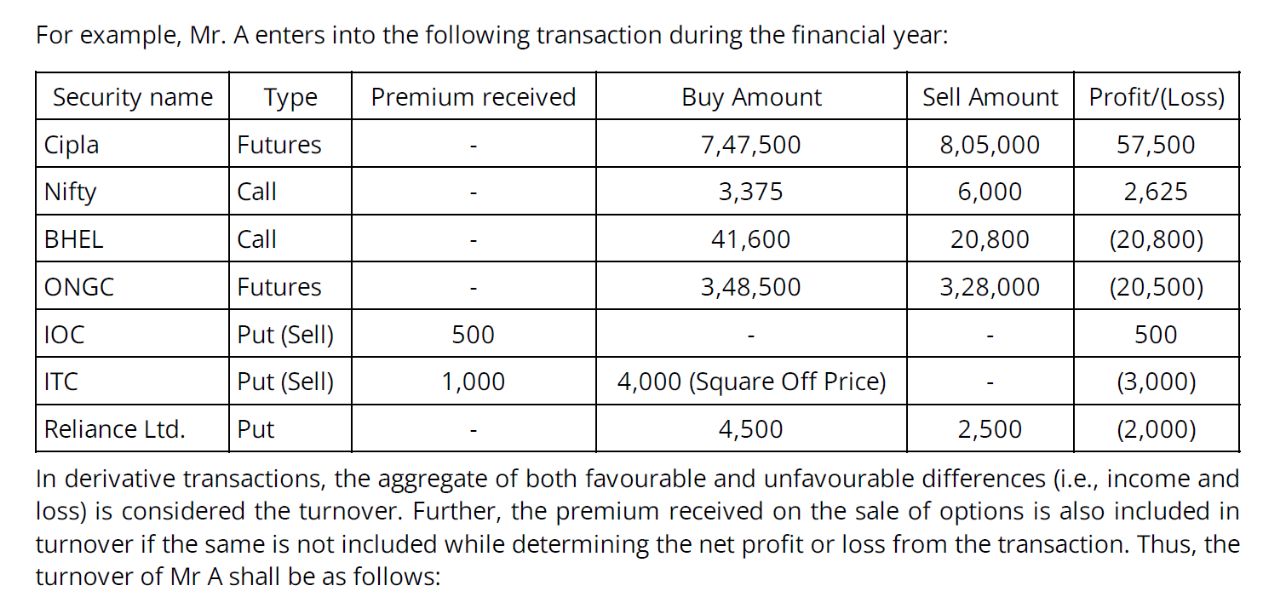

Intraday trading -Computation of Gross Receipts

- If intraday trading, turnover quantum, In case quite high as Intraday trader is needed to buy shares in specified lots.

- If intraday trading, Net position made in a day is considered for the computation of Total gross receipts. Both P & Loss are to be taken for the Gross receipts computation.

- For Example,

-

- Total Intraday trading Loss: Rs. 0.75 Cr

- Total-Intraday trading Profit: Rs. 1.55 Cr

- Total Gross receipt to check Income tax Audit applicability: Rs 2.30 Cr (1.55 Cr+ 0.75 Cr)

Set-off & C/F of Loss in case Intraday Trading

- Speculative business Loss can be carried forward for upcoming Four years subject to ITR filing with in the Timeline date.

- So, Loss incurred from Intraday trading can be carried forward to the upcoming Four years only if ITR return is submitted with in Timeline date.

- Moreover, Speculative Business Loss can be Set-off only against Speculative Business income. So, intraday losses can be Set-off against speculative income only.

- But, if Income tax assessee Choose for a new tax Income tax regime, they cannot adjust them against business incomes or carry forward these losses.

Tax rates apply on Intraday trading income.

- Intraday trading Income or Profit earned is added to other incomes of the Income tax assessee & income tax will be payable as per normal Income tax slab rates apply to the Income tax assessee. His kind of intraday trading earning will not chargeable to any special Income tax rate.

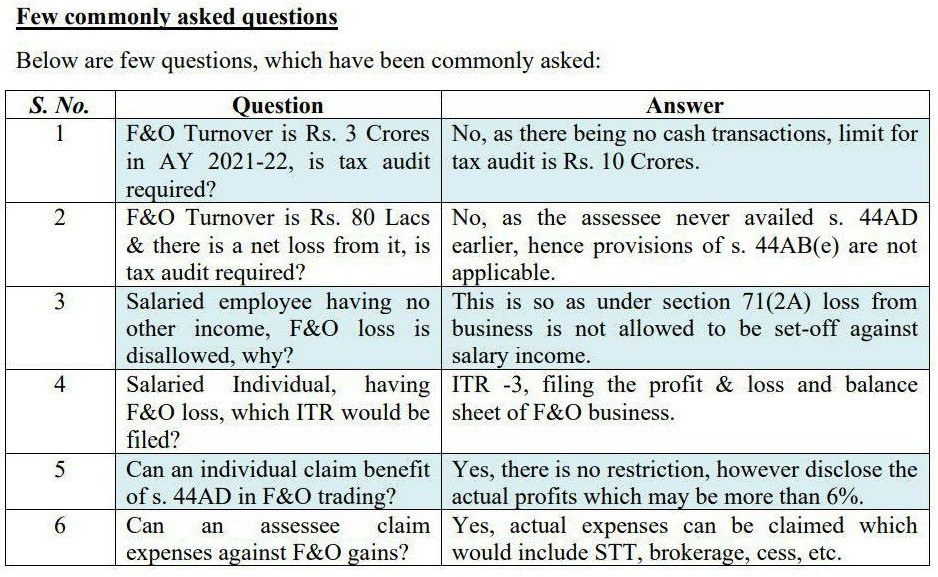

FAQ on F&O or Intraday trading income

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.