Check list Documents required for Income Tax Return

Table of Contents

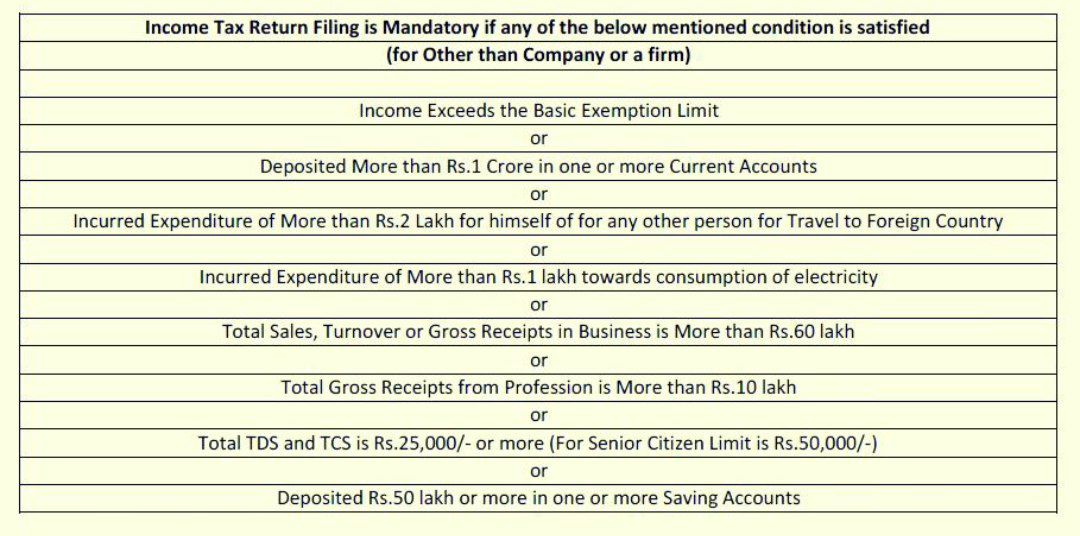

PROVISIONS FOR ITR FILING FOR THE AY

The following points be considered for the AY 2023-24 –

- The due date for filing ITR depends on the type of person along with the ITR form applicable to them. Also, whether audit is required or not, further varies the due date.

- Generally, the due date for most of the ITR forms is 31st July of the assessment year (AY). And relates to income earned during 1st April to 31st March of the previous year.

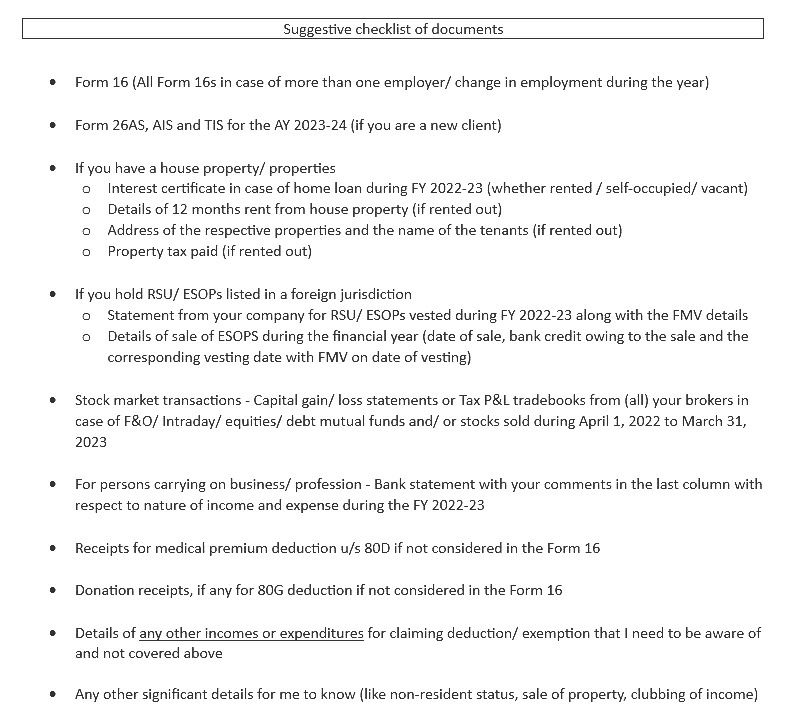

- FORM 26AS:It is the most important document required before filing ITR. It is also known as the annual consolidated statement, which contains all tax-related information of the taxpayer like the details of tax deducted at source, advance tax etc.

- It also reflects details of Annual Information Return (AIR), which is filed by different entities based on what an individual has invested or spent, mostly high-value transactions

- Such information be provided in Form 26AS latest by 31st May 2023. Thus, if filed by mid-June, the pre-filled returns & Form 26AS would not be updated on the tax department’s website and thus the taxpayer may not be able to file a tax return with correct information.

- Form 26AS also prefills the details pertaining to information uploaded by the diductors of TDS.

- Diductors is a person/entity who deducts the tax at the source on a specified payment made. Such TDS deducted be deposited with the Income Tax Department within a prescribed time limit.

- FORM 16: Form 16 contains the details pertaining to TDS deducted on salary paid to an employee. It is also known as the TDS (Tax Deducted at Source) certificate, provided by the employer after furnishing the information related to the taxes paid on behalf of the employee.

- The FORM 24Q: Such form is provided by the employer deducting tax under Section 192 of the Income Tax Act, 1961, at the time of paying salary to the employee. It contains the details of the salary paid and the TDS deducted from it and the same be submitted to the Income Tax Department on a quarterly basis.

- This form is constituted of 2 annexures namely– Annexure I and Annexure II. Annexure I contain the details about the deductor, challans, and deductees, name of the employee, PAN of the employee, date of payment/ credit, TDS Section code, TDS amount, the amount paid or credited, and education cess.

- Annexure-II consists of salary details like the total breakup of the salary and deductions to be claimed by the employee.

- FORM 26Q: It is used for filing TDS deducted on all the payments other than the salary. This form is to be submitted by the deductor after every quarter and is applicable for TDS u/s 193 and 194 of the Income Tax Act of 1961. Payments includes income on dividend securities, interest on securities, directors’ remuneration, professional fees, etc.

- The FORM 27Q: It is relevant for TDS deducted on payments made to non-resident Indians and foreigners and does not include salary income. It is basically a declaration by the NRI regarding the TDS deducted. Form 27Q shows the amount of TDS deducted on additional income such as interest, bonus, or any other sum owed to NRI or foreigners.

- FORM 27EQ: It is a quarterly statement for TCS deducted u/s 206C of the Income Tax Act of 1961. The same is submitted by the corporate deductors & collectors every quarter and it is mandatory to furnish TAN in this form.

- PRE-FILLED ITR FORM:As proposed in Budget 2020, the new ITR Forms will come with a software, which will pre-fill the details, pertaining to salary income, tax deducted at source, tax liability etc, which will further ease the compliance burden of taxpayers.

- Apart from this, Budget 2021, proposed to provide prefilled details of capital gains from listed securities, dividend income, and interest from banks, post office, etc, in the new TR forms.

- The prefilled information will also reflect in Form 26AS, which would be available in taxpayer’s account on IT portal.

- Due date for filing TDS return for the 4thquarter of the financial year 2020-21 has been extended to 30th June and for TCS return, the due date is 15th May .

Thus, it is advised by the department that, specifically for assessment year 2021-22, the taxpayers shall not file their income tax return before 15th June

Check list Documents required for Income Tax Return

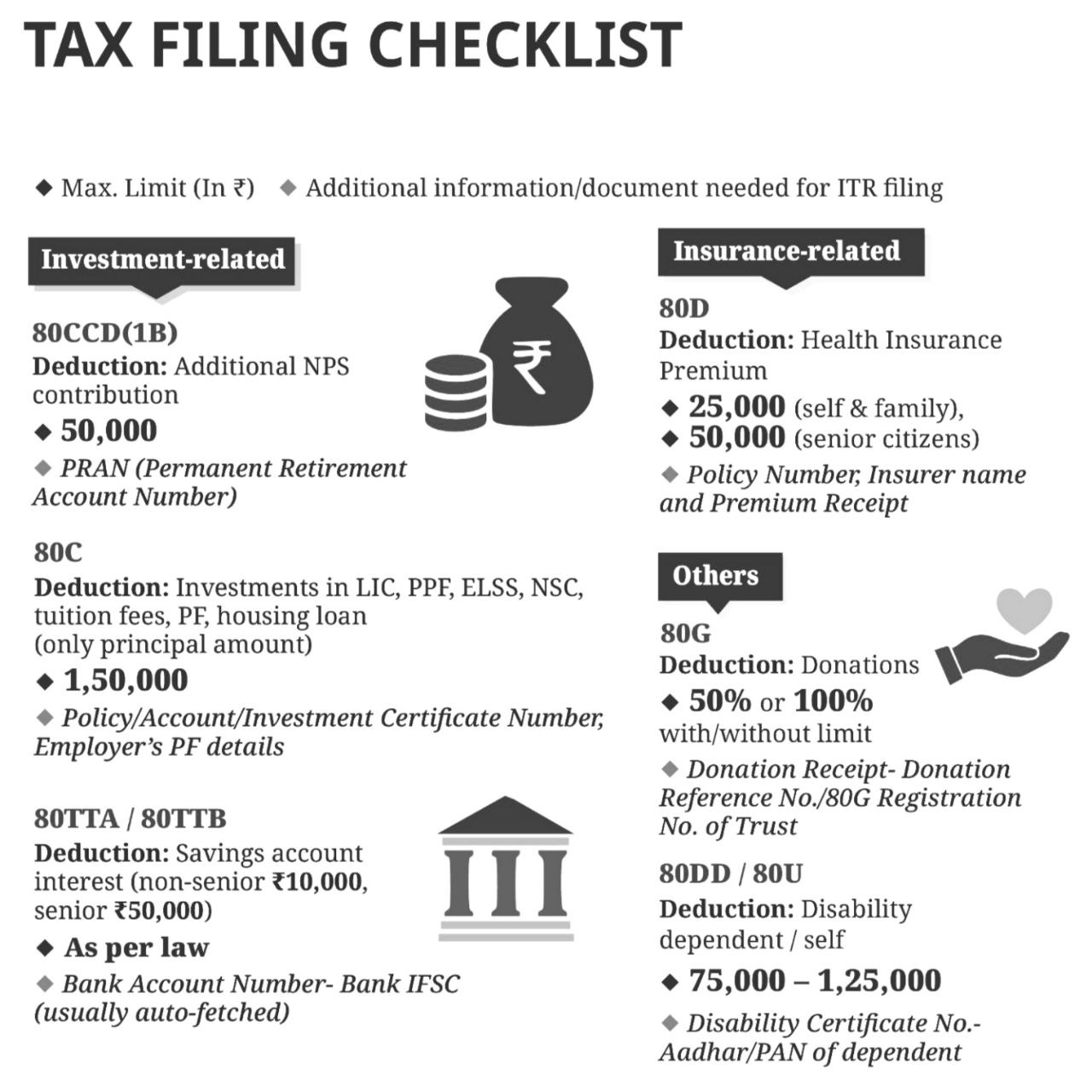

TAX FILING CHECKLIST

Investment-related Deductions

- Section 80CCD(1B) – Additional NPS Contribution

- Limit: INR 50,000

- Required: PRAN (Permanent Retirement Account Number)

- Section 80C – Investments like LIC, PPF, ELSS, NSC, Tuition Fees, PF, Housing Loan (Principal)

- Limit: INR 1,50,000

- Required: Policy/Account/Investment Certificate Number, Employer’s PF details

- Section 80TTA / 80TTB – Savings Account Interest

- Limit: INR 10,000 (non-senior), ₹50,000 (senior citizens)

- Required: Bank Account Number, IFSC (usually auto-fetched)

Insurance-related Deductions

- Section 80D – Health Insurance Premium

- Limit: INR 25,000 (self & family), ₹50,000 (senior citizens)

- Required: Policy Number, Insurer Name, Premium Receipt

Other Deductions

- Section 80G – Donations

- Limit: 50% or 100% depending on donation type

- Required: Donation Receipt, Donation Reference No., 80G Registration No. of Trust

- Section 80DD / 80U – Disability (Dependent/Self)

- Limit: INR 75,000 to INR 1,25,000

- Required: Disability Certificate No., Aadhar/PAN of dependent

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.