MRL most effective tool of defense for Auditor?

Table of Contents

Is Management representation letter is an effective tool of Deference for Statutory Auditor?

What is management representation letter ?

- A client may provide a written management representation to the auditor as part of the audit evidences. To prevent misunderstandings about management’s responsibility for the financial accounts, it serves to document management’s representations made during the audit.

- The primary goal of a Management Representation Letter on a variety of topics is to draw attention to such topics so that management can particularly address them in greater depth than would otherwise be possible.

- Statutory auditor must be aware of the limitations of management representations as audit evidence, though.

- The auditor is still responsible for their duties even after receiving a Management Representation Letter. He has to do the audit with professionally.

Why MRL is play important for Chartered Accountants or auditor ?

- The letter essentially says that all of the data given is true and that all relevant data has been shared with the auditors. This letter is used by the auditors as audit proof.

- If it turns out that some aspects of the audited financial statements do not accurately reflect the financial results, financial position, or cash flows of the company, the letter also puts some of the burden on management.

- Due to this, the auditor’s remarks in the letter include a wide range of topics, covering any circumstance in which management errors could result in the publication of false or misleading financial statements.

- We should make ensure that a practicing chartered Accountants of obtaining MRL from Chartered Accountants Clients. In the Existing controlled, regulatory & punitive audit environment, it may work as safety Armor for all of Chartered Accountants, in the hour of requirements.

We have a readymade solution for chartered Accountants & only a Cell-phone call away.

Let’s wear & carry it all the time, while performing any attest function.

Now, the big question is

- ‘How effectively to be articulated’& ‘at what point of time Chartered accountants should be presented to the Company Mgt’.

- ‘What all it should contain’,

- ‘How should it look like’,

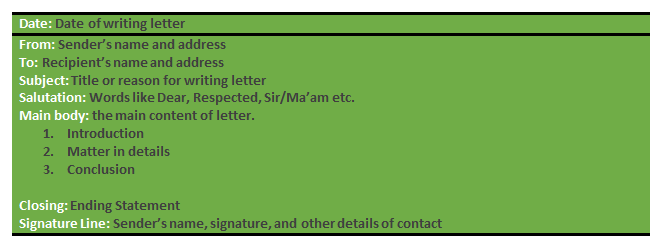

Sample copy of MRL letter are attached here under:

Management representation letter(MRL)

At times, you may not find enough time to create such a document and it gets ignored due to other persisting commitments.

Basic benefit of Management Representation Letter are as follows include:

The main objective of a Management Representation Letter on a variety of points is to draw attention to such important points, So that management can specifically address them in greater depth than would otherwise be feasible.

- Acceptance of primary responsibility by Client & confirmation thereof.

- Immediate support to face adversities/ hardships from regulatory bodies (Enforcement Directorate, National Financial Reporting Authority, Central Bureau of Investigation, Economic Offences Wing, Nationalised or private MNC Banks, Serious Fraud Investigation Office, The Institute of Chartered Accountants of India Disciplinary Action and others).

- Complete of Quality Review and Peer Review needs.

- Standards on Auditing Compliance by the auditors.

At what time Written Representation to be given.

Auditor has to take MRL before completion of auditing assignment:

- MRL must cover for all FS & period’s referred to in Audit report.

- Date of MRL shall be before date of statutory or other auditor’s report on the FS.

Whom to I obtain written representations from?

- Management with adequate responsibility for the financial statements & knowledge of the relevant issues must provide written representations upon request from the auditor.

- In some circumstances, written representations may also be sought from someone with specific knowledge pertaining to the subjects covered by the written representations, such as

- staff engineers who may be in charge of and have expertise in environmental liability measurements.

- Internal counsel who could offer details necessary for legal claim provisions.

Entity Auditor to be take care following Factors for the purpose of MRL

- MRL must Includes basic matters covered in all the terms of audit engagement provide to them.

- Management Representation Letter is given by the person from whom the auditor wants the Representation.

- Management Representation Letter must be provided to entity auditor on or before the date of completion of audit report.

This Standard on Auditing (SA) 580 provide an format as illustrative for purpose of MRL, However that must be amended to suit the company audit needs time to time.

Following are the List of standard of Auditing Containing needs of Written Representations

- Audit Documentation – SA 230

- Auditor’s Responsibility relating to fraud in an Audit of Financial Statements SA 250 – Consideration of Laws and Regulations in an Audit of Financial Statements – SA 240

- Communication with the those charged with Governance SA 450 – Evaluation of Misstatements Identified during Audit – SA 260

- The Audit Evidence- Specific Considerations for Selected Items- SA 501

- Auditing Accounting Estimates, Including Fair Value Accounting Estimates and Related Disclosures – Sa540

- The Related Parties – SA 550

- Going Concern – SA 570

Popular Articles related to Tax Audit :

- KEY POINTS ON ANNUAL FILINGS TO ROC

- challenges faced by-CA Firms in India

- Overview of Tax Audit

- Tax Audit Check List

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.