MSME Payment Deductions & Budget 2023

Table of Contents

MSME Payment Deductions & Union Budget 2023: Demystifying Sec 43B

Income tax Sec 43B is a new income tax provision governing the deduction of certain amount sums when we are computing income tax liability. This change holds particular importance when it comes to payments made to MSMEs.

New Income tax Alert

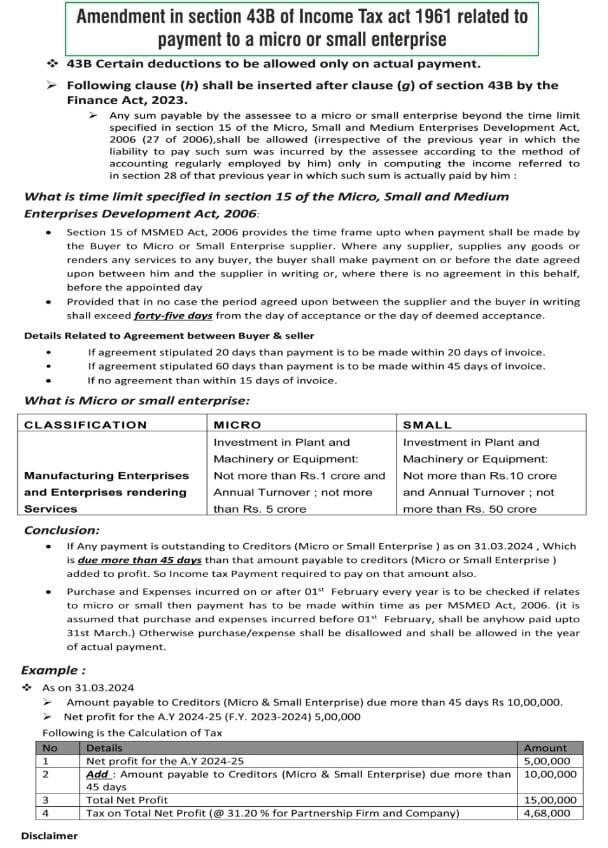

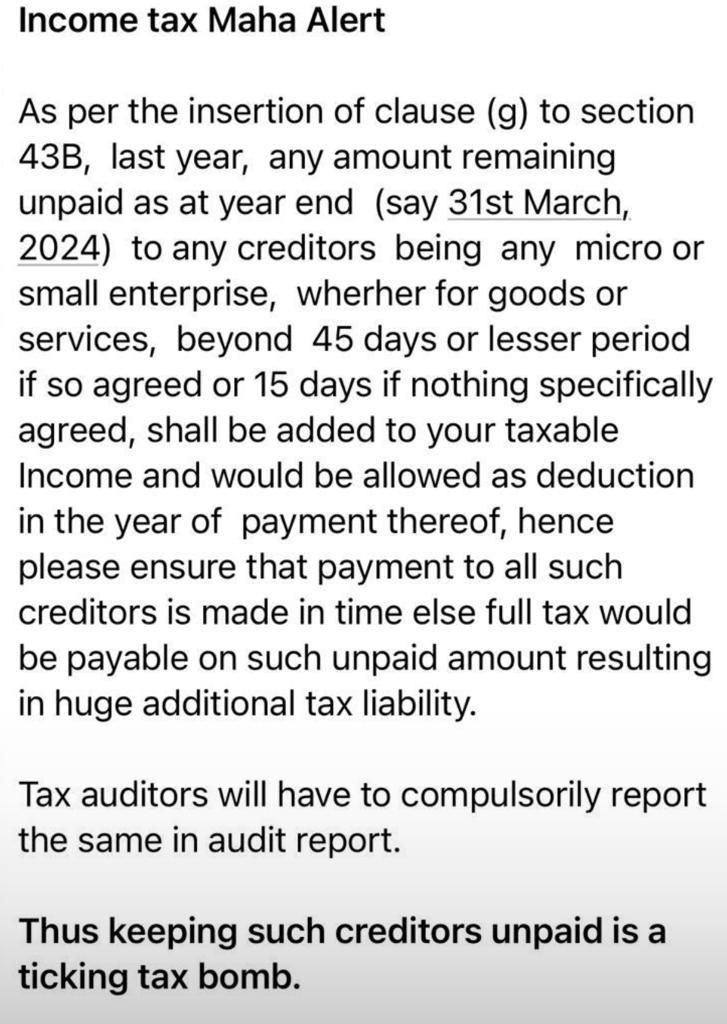

Income tax Section 43B- In the Union Budget 2023, a new Clause in the Income tax act “h” is added to Section 43B, effective from Financial Year 2023-24. This clause pertains to “Any sum payable by the income tax Assessee to a Micro or Small Enterprise beyond the time limit specified in Section 15 of the Micro, Small, and Medium Enterprise Development Act, 2006.” So that any amount remains unpaid on year end to creditors, being Micro, Small & Medium Enterprises, beyond forty-Five days or less, as agreed or Fifteen Days if no agmt, shall be added to taxable Income resulting in huge additional tax liability. Keeping such creditors unpaid is risky.

Key points for Considerations for purpose of Section 43B of income Tax amendment:

It’s imperative to grasp many main points with reference Section 43B in the Income tax amendment 2023:

-

Definition Micro & Small Enterprises:

-

- Small Enterprises must also satisfy two conditions: Turnover less than or equal to 50 Cr & Investment in P&M less than or equal to 10 Cr..

- Micro Enterprises must meet two criteria: Sale less than or equal to 5 Cr Investment in P&M less than or equal to 1 Cr.

-

Medium Enterprises Excluded:

-

- Notably, this clause does not cover Medium Enterprises.

-

Proviso for Filing Return U/S 139(1) Not Applicable:

-

- The income tax provision allowing deductions if payments are made within the time line date for filing returns u/s 139(1) does not apply in this case.

-

Payment Time Limits According to the Micro, Small, and Medium Enterprise Development Act, 2006:

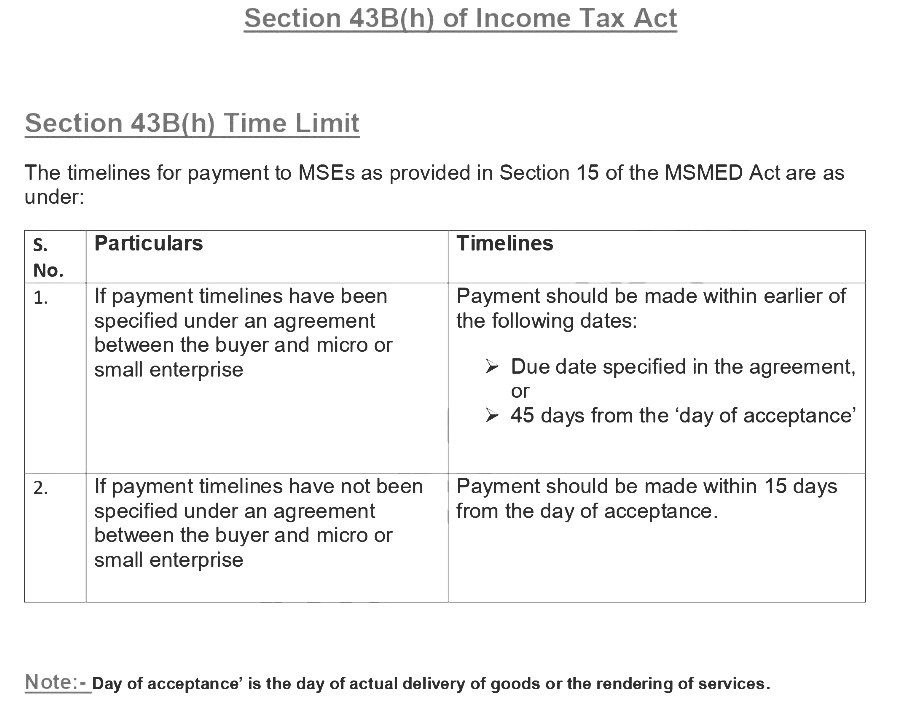

– According to Sec 15 of the Micro, Small, and Medium Enterprise Development Act, 2006, the purchaser must make payments for the supply of services & goods within:

-

- The appointed day in the absence of an MSME Agreement, where the appointed day is day following expiry of 15 days from acceptance or deemed acceptance.

- Date agreed upon in case of a written agreement, which must not exceed 45 days from acceptance.

-

Date of Acceptance & Deemed Acceptance:

-

- Deemed Acceptance occurs when NOC are raised within 15 days of delivery.

- Date of Acceptance refers to the actual delivery of goods or services.

Final analysis on section 43B(H)

- In the final analysis, for efficient financial planning and tax strategies, it is essential to remain aware about Section 43B, the definitions of Micro and Small Enterprises, and the payment schedules specified in the Micro, Small, and Medium Enterprise Development Act, 2006. This information can have a big impact on a company’s financial efficiency and compliance in the ever-changing Micro, Small, and Medium Enterprise payments market.

- MSME has always been suffering from long outstanding dues from the OEs. In order to provide certain reliefs to the MSMEs, the Finance Act, 2023 has made certain amendments in the Income-tax Act, 1961 which are applicable w.e.f. 01/04/2023.

- These amendments provide for; In the case of any assessee, if he fails to pay the outstanding dues payable to a MSME within the time provided in the Purchase Order (Not exceeding 45 days) or within the time provided in the MSME Act (15 days) from the date it become due, such outstanding shall be deemed to be the income of the assessee and tax shall be computed accordingly.

- In case MSME outstanding payment dues is pending for more than 15 days as on 31-03-2024, Income tax Assessee will not get advantages of income tax exemption from expenditure. In this, a written agreement of 45 days can also be made to extend more than 15 days for outstanding payment.

Provisions related to creditor payment-

– 180 days in GST (Reversal of ITC availed)

– 15 / 45 days to Micro & Small Ent. (Disallowance u/s 43B in Income Tax) (Interest under MSMED act)

– Companies Act (Ageing in Financial Statement Notes) (Half yearly MSME 1 form with MCA)

While these amendments are blessing in disguise for the supplier MSME, at the same time it may turn into a curse for the buyer

Revised definition of MSME w.e.f 1.4.2025

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.