NEW VS OLD TAX REGIME AFTER BUDGET 2023

Table of Contents

TAX REGIME AFTER BUDGET 2023

Major Direct tax proposals (from speech)

1. Rollout of next gen ITR form

2. New limit for 44AD & ADA : 3 crore & 75 Lacs

3. Expense deduction to MSME to be allowed on payment basis

4. New cooperatives manufacturing tax @ 15% if upto 31.03.24

5. Higher loan limit /cash deposit Rs 2 lacs for PAC society –

6. Startups:

a) Date of incorporation for. startup extended to 31.03.24

b) Extension of Carry forwards of losses 7 yrs in case of change in shareholders

7. Selective scrutiny + More CIT to dispose off small appeals

8. Extension of tax benefits for IFSC

9. Personal Income tax

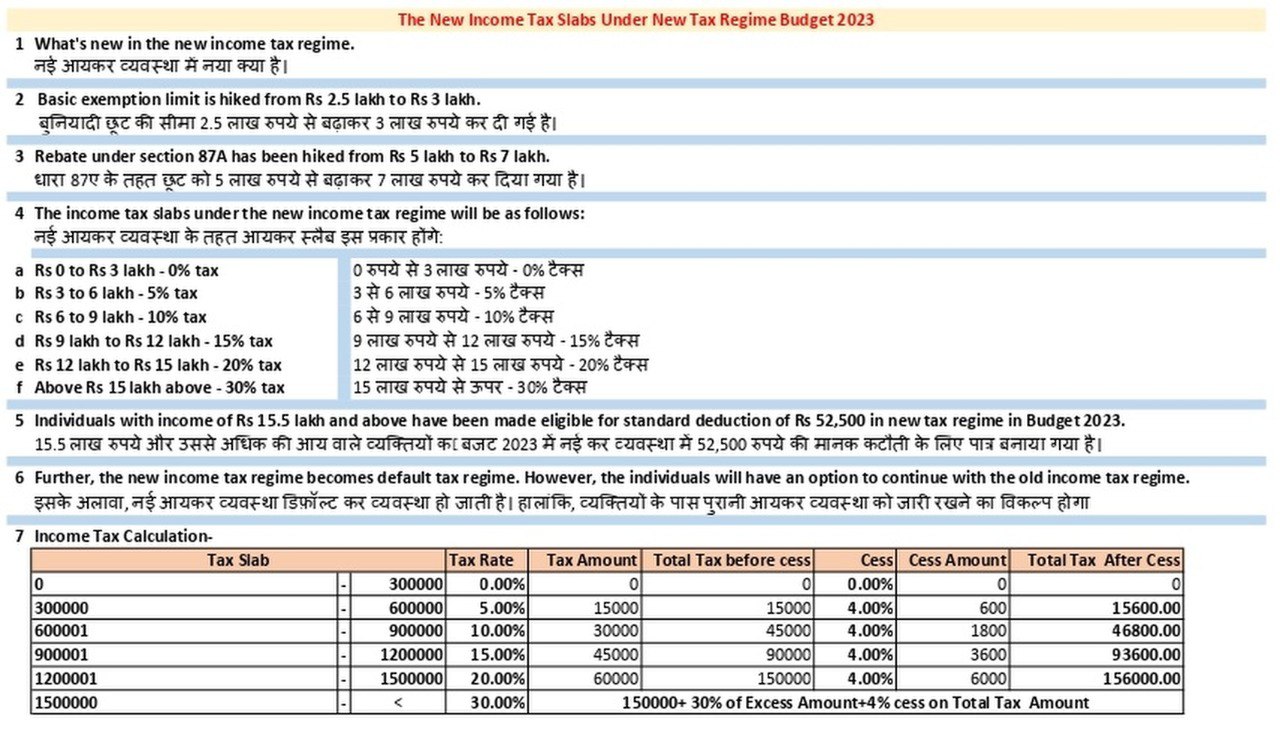

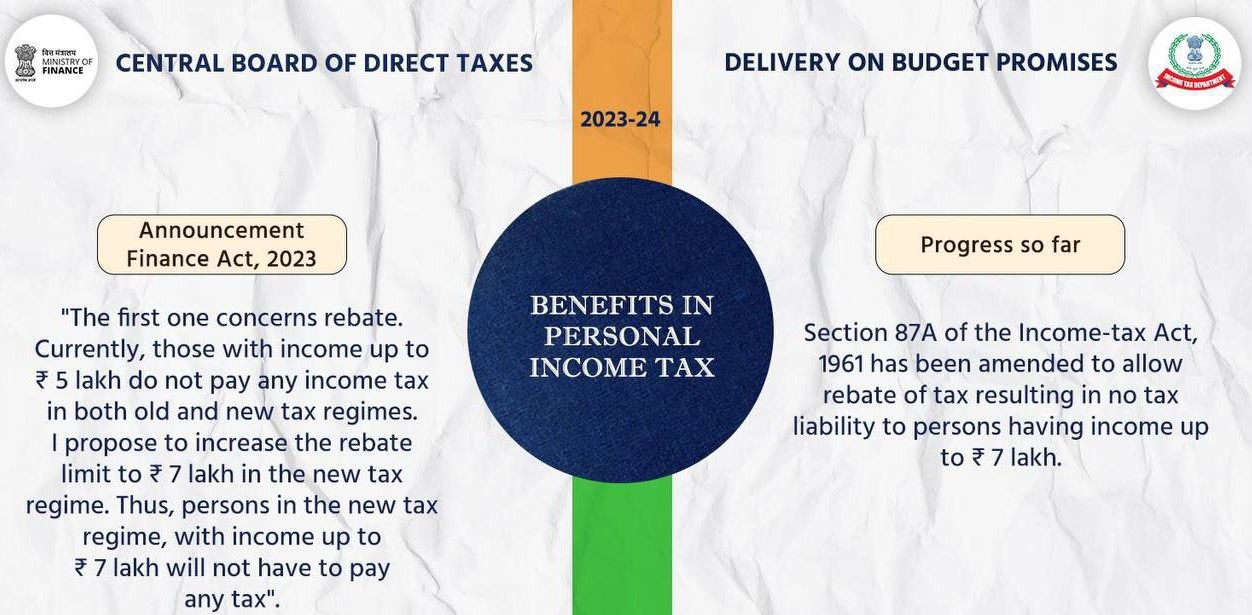

a) Tax rebate limit extended to 7 lacs (new regime)

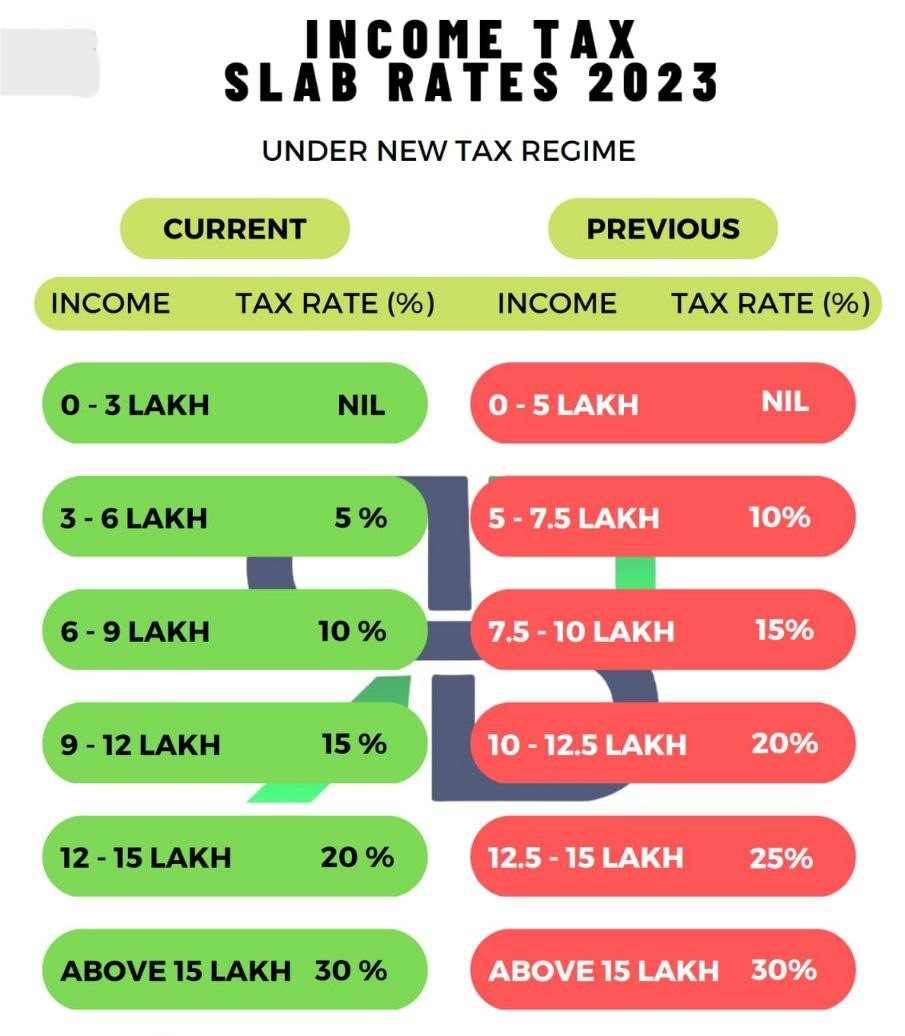

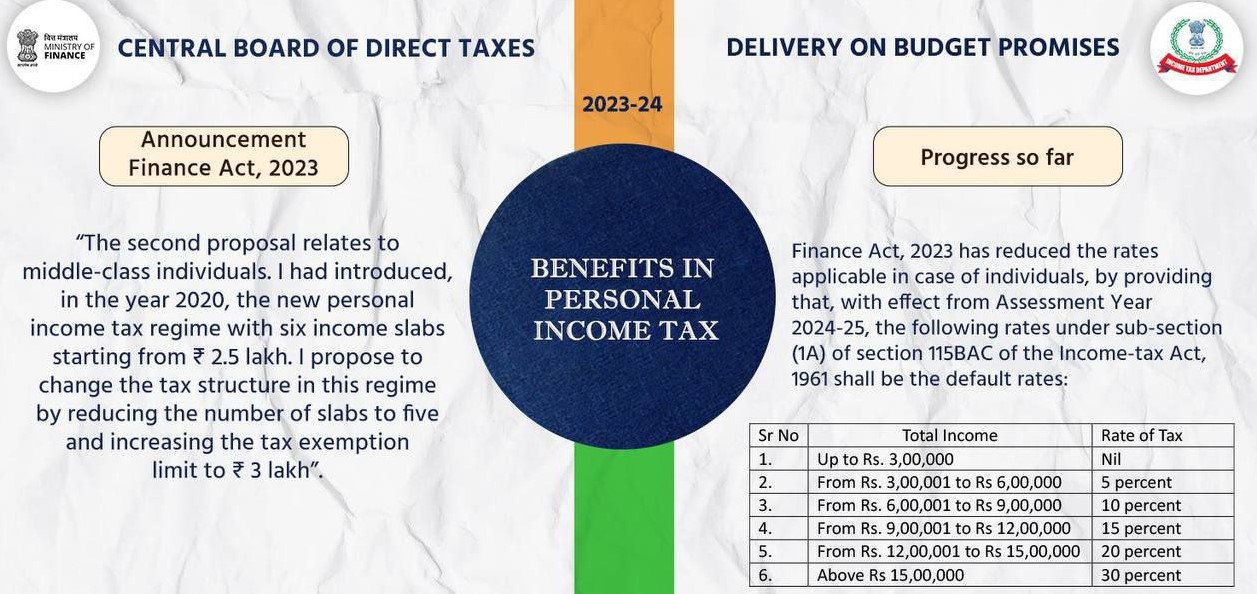

b) change in tax slabs & new tax rates

0-3 L : Nil

3-6 L : 5%

6L-9L : 10%

9L-12L: 15%

12-15 L : 20%

15L +: 30%

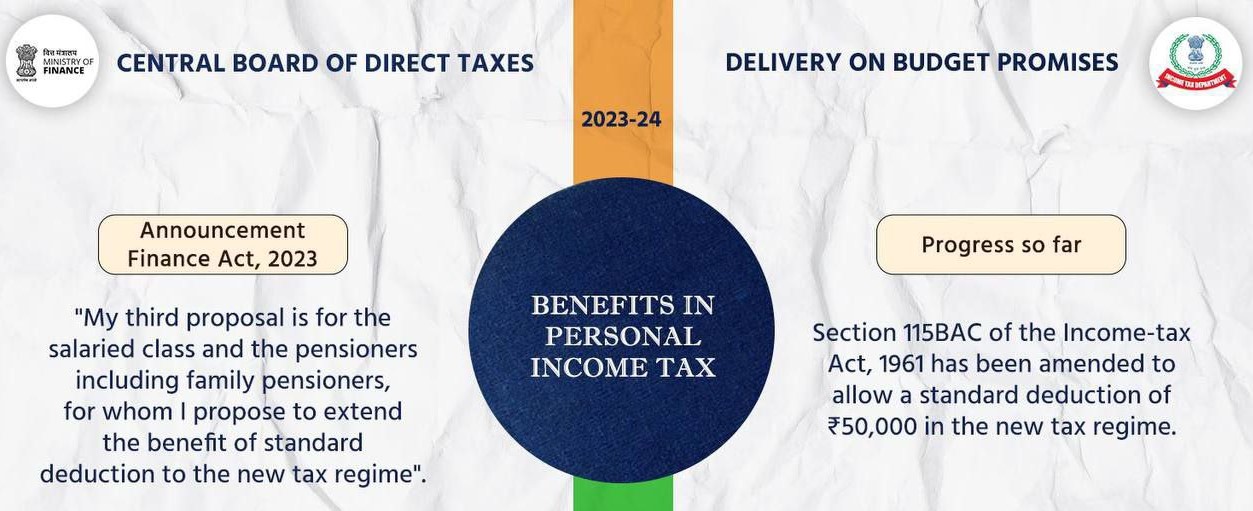

c) Salaried class & pensioners(incl family pensioners) :

Standard deduction extended

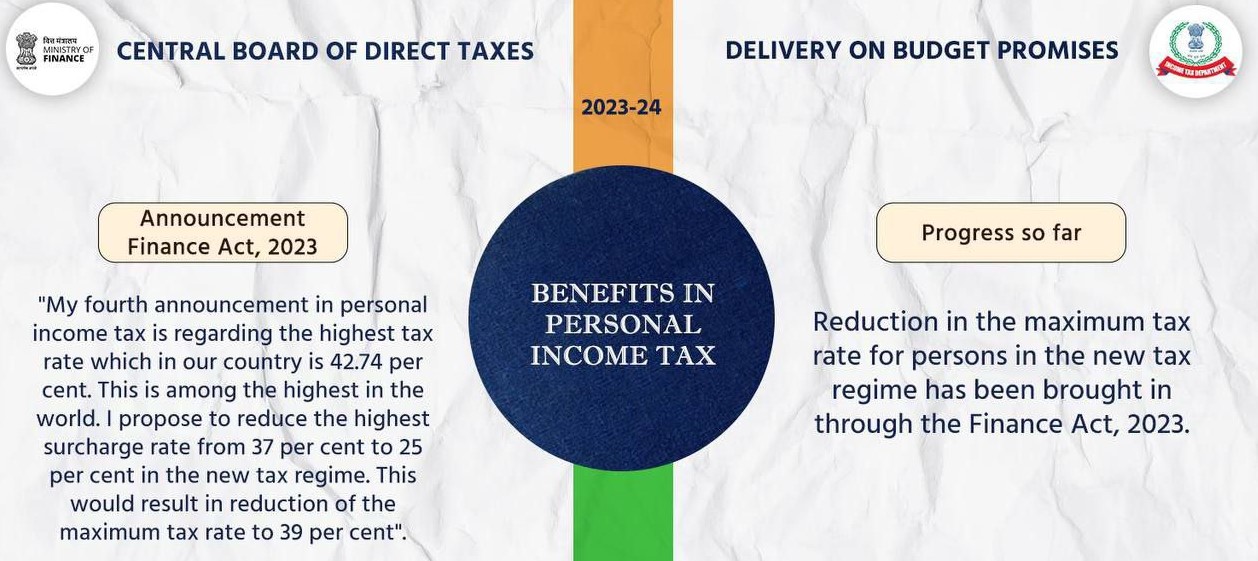

d) Highest surcharge reduced from 37% to 25%

Now MMTR : 39%

e) Leave encashment exemption (pvt) increased from 3Lacs to 25 Lacs

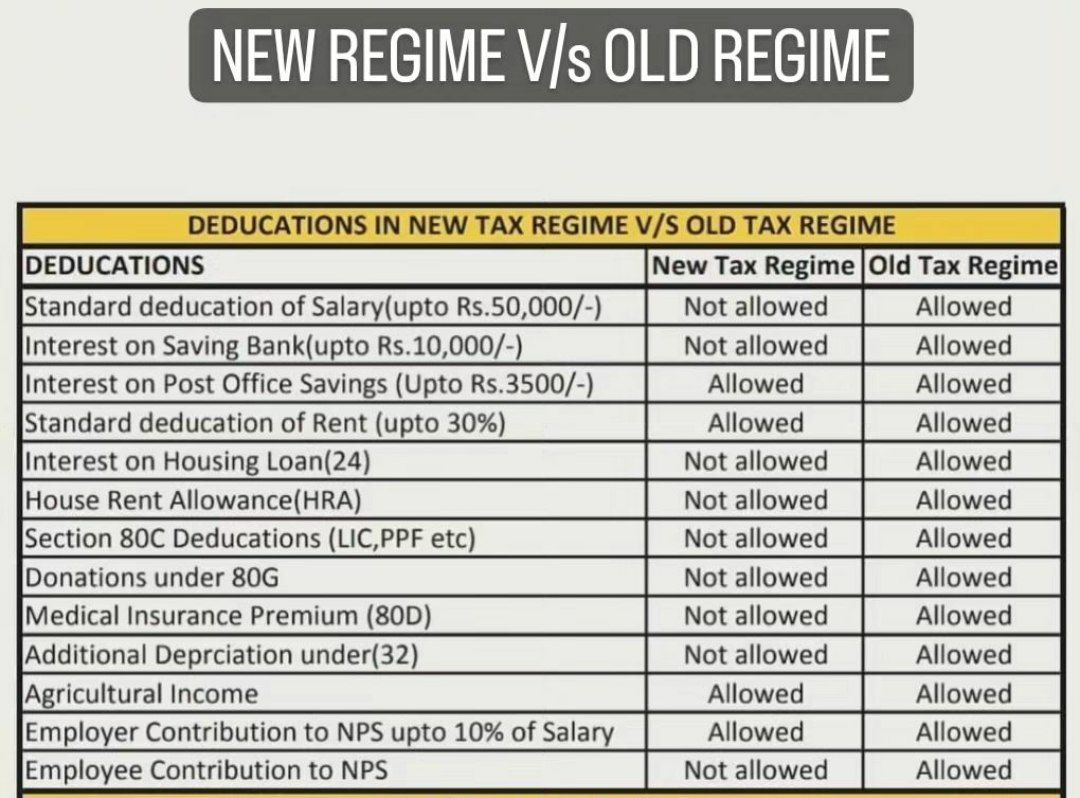

f) New tax regime is now default tax regime -Old tax regime will continue

NEW VS OLD TAX REGIME AFTER BUDGET 2023

Increase in tax rebate: U/s 87A rebate limit has been increased from INR 12,500/- to INR 25,000/- in the new income tax mechanism/regime.

New income tax mechanism/regime becomes default: The new income tax mechanism/regime has been made default regime. That is, while filing an ITR, it will by default show the new income tax mechanism/regime. If you want to go with the old the income tax mechanism/regime, Income taxpayer will have to select it manually.

Standard deduction of INR 50,000/-: upto the earlier past year, an pensioners or employees paying tax used to get income tax deductions of INR 50,000/- only under old income tax mechanism. From current year, pensioners & employees who choose New income tax mechanism/regime will also get a INR 50,000/- standard deduction under the income tax.

Tax exemption limit in the new income tax mechanism/regime.: The tax exemption limit has been increased in the new tax regime. People adopting the new tax system will get tax exemption on income of up to INR 3,00,000/-, which till now was available only up to INR 2,50,000/-. That means tax exemption on additional INR 50,000/- will be available from this year.

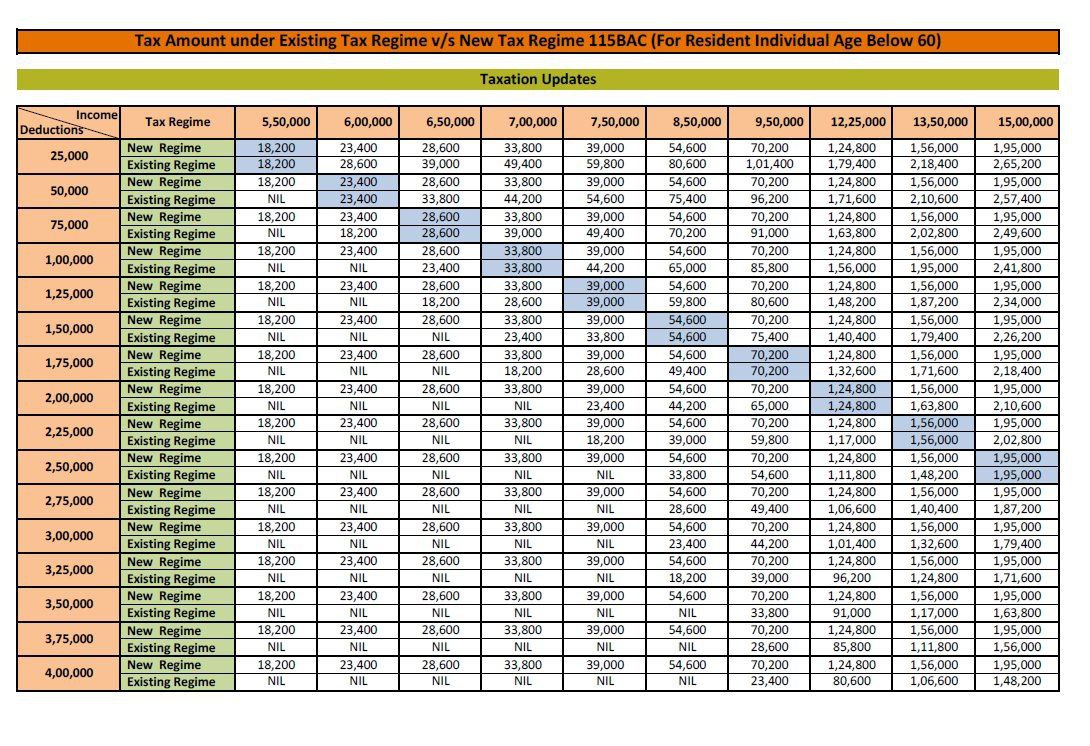

For diff salaried incomes

Assumption- 80C investment 1.5 lac ( even other than Home loan) and 80D Mediclaim 25000 is claimed

conclusions

- New regime is default setting- You have to file form for opt old one

- For ppl having NO housing loan – New regime is beneficial – It doesn’t make diff whether You are paying 80C+80D full

- Business ppl will have slight higher tax than above working as they wont get standard deduction of 50000

- For ppl having housing loan – Always Old regime is beneficial

Changes in personal tax via Finance Act 2023

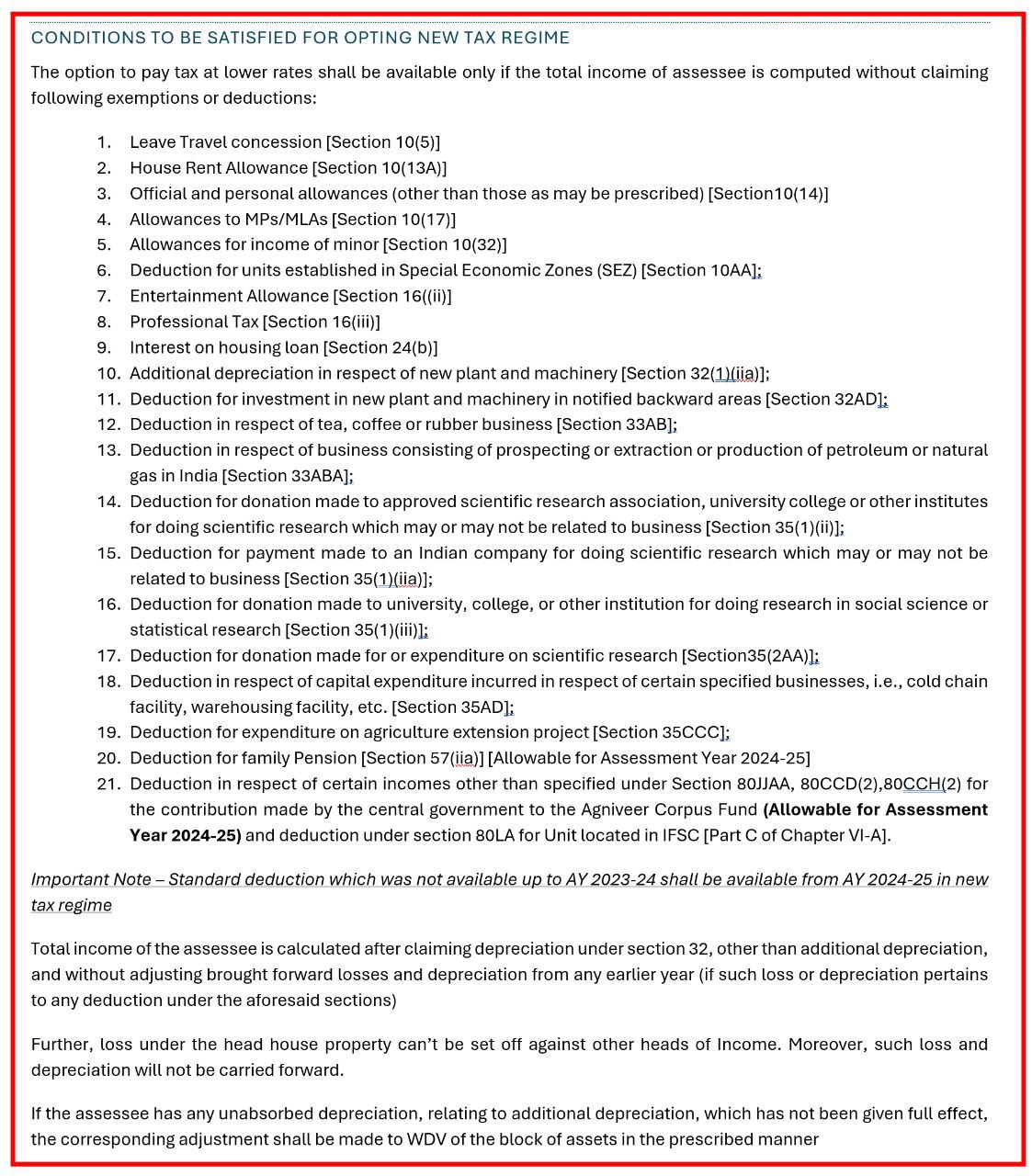

Conditions to optin for New Tax Regime in Assessment Year 2024-25

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.